Определение трейдинга

Трейдинг – это процесс купли-продажи активов с целью получения прибыли. Активами могут быть валюты, акции, крипта, облигации, фьючерсы, опционы и другие финансовые инструменты. На первый взгляд, деятельность трейдеров и инвесторов может показаться схожей: они оба приобретают активы с целью получения прибыли. Однако трейдеры – это люди или компании, занимающиеся активной куплей-продажей финансовых инструментов, они совершают множество сделок за короткий период и стремятся извлечь выгоду из краткосрочных колебаний рынка. Трейдеры не заинтересованы в хранении активов, лишь на возможности заработка на изменении котировок. Например, трейдер покупает BTC за 32000$ и продает за 32200$, заработок трейдера от такой сделки составляет 200$.

Инвесторы, с другой стороны, более ориентированы на долгосрочные перспективы. Они приобретают активы с намерением удерживать их в течение длительного времени. Например, инвестор покупает BTC за 32000$, а продает за 40000$ через несколько месяцев. Заработок инвестора составляет 8000$.

Краткая история трейдинга

Может показаться, что трейдинг – это современная профессия, которая получила свое развитие совсем недавно, хотя на самом деле это не так. Трейдинг существует уже много веков. Первые предпосылки трейдинга встречаются в древних китайских и индийских источниках. Торговля золотом, шерстью, солью имела место задолго до появления денег. Появление денег упростило процесс трейдинга. В эпоху Возрождения появились первые биржи, где трейдеры могли торговать друг с другом. Одной из первых бирж считается Венецианская биржа, основанная в 13 веке.

Первые ценные бумаги на бирже появились в Голландии благодаря так называемым “менялам” – пионерам брокерского дела. Они выполняли функции банкиров, обеспечивая обмен валюты: принимали ее в одном месте и выдавали клиентам в другом, взимая свой процент. Внутренние записи “менял” приравнивались к официальным документам, служа гарантом сделок.

С течением времени, в 14-15 веке, количество “менял” стало настолько велико, что начали проводить вексельные ярмарки. Это привело к появлению первых векселей – ценных бумаг, предусматривающих отсрочку платежа или оплату в заранее оговоренный срок. В 16 веке центр биржевой торговли переместился в Лондон. Томас Грешем, впечатленный опытом в Голландии, решил построить в Лондоне специальное здание для торговцев. Так появилось место, где они могли проводить финансовые операции, заключать сделки и вести переговоры. Именно там возникло первое профессиональное сообщество брокеров.

Две биржи, находящиеся в Амстердаме и Лондоне, не только стали основой бирж, которые мы знаем сейчас, но и придумали множество терминов, которые используются по сей день. Именно там были впервые использованы термины "быки" (участники рынка, играющие на повышение, словно бык вздергивает противника на рога) и "медведи" (играющие на понижение, словно медведь, который давит своим весом). Биржи Амстердама и Лондона трансформировали финансовые рынки, обеспечив переход от торговли деньгами к ценным бумагам.

В 1771 году была основана Венская фондовая биржа, специализирующаяся на торговле государственными ценными бумагами.

Следующие десятилетия были отмечены стремительным распространением бирж по всему миру: в 1790 году в Филадельфии была создана первая Американская биржа, вскоре последовала биржа в Нью-Йорке.

В 1878 году появилась Токийская биржа, закрепив тенденцию к глобальному распространению финансовых рынков. Индустриальная революция привела к расширению предприятий, и биржи стали центрами торговли акциями и облигациями. В это время также активно начали использоваться фьючерсы и опционы.

С развитием технологий в 20 веке, особенно с появлением интернета, трейдинг стал доступен для широкой публики. Интернет-трейдинг изменил динамику финансовых рынков, предоставив инвесторам прямой доступ к мировым биржам. Теперь люди могли торговать ценными бумагами, валютами и другими активами не выходя из дома. Это сделало рынки более открытыми и конкурентоспособными, давая возможность как институциональным трейдерам, так и отдельным инвесторам участвовать в мировой финансовой игре.

С появлением BTC в 2009 году криптовалюты и децентрализованные рынки предоставили новые возможности для трейдинга, предлагая альтернативные формы активов и способы обмена без посредников – централизованные и децентрализованные платформы. Именно в эти годы трейдинг стал доступен еще более широкой аудитории.

Типы рынков

Финансовые рынки можно классифицировать по различным критериям. Наиболее распространенная классификация основана на характере торгуемых активов. По этому критерию можно выделить следующие типы рынков:

- Товарные рынки – это рынки, на которых торгуются товары, такие как зерно, нефть, золото и другие сырьевые товары.

- Валютные рынки – рынки, на которых торгуются валюты.

- Фондовые рынки – рынки, на которых торгуются ценные бумаги (акции и облигации).

- Рынки деривативов – рынки, на которых торгуются производные финансовые инструменты (фьючерсы, опционы).

- Рынки криптовалют – рынок цифровых активов (Bitcoin, Ethereum и т.д.).

Товарные рынки являются одними из самых древних финансовых рынков. На них торгуются различные товары, такие как зерно, нефть, золото и другие сырьевые товары. Товарные рынки играют важную роль в мировой экономике, поскольку они обеспечивают торговлю и распределение товаров по всему миру.

Валютные рынки являются крупнейшими финансовыми рынками в мире. На них торгуются валюты (доллар США, евро, фунт стерлингов и другие). Такие рынки обеспечивают обмен валют и торговлю между странами.

Фондовые рынки являются рынками, на которых торгуются ценные бумаги. Ценные бумаги представляют собой долевое участие в собственности компании или долг компании. Фондовые рынки обеспечивают финансирование компаний и частных инвесторов.

Рынки деривативов являются рынками, на которых торгуются производные финансовые инструменты – это финансовые инструменты, стоимость которых зависит от стоимости другого актива, такого как товар, валюта или фондовый индекс.

Рынки криптовалют – представляет собой относительно новую сферу финансов, основанную на технологии блокчейн. Криптовалютные рынки появились в 2009 году с созданием BTC. С тех пор они быстро выросли и стали одним из самых динамичных и быстрорастущих сегментов финансовых рынков.

Основные виды трейдинга

Существует несколько ключевых подходов в трейдинге: дневная торговля, скальпинг, свинг-трейдинг и позиционная торговля. Они различаются не только стратегиями, но и активностью трейдера на рынке. Активный режим торговли подразумевает постоянное взаимодействие с рынком, выполнение большого числа операций и оперативное принятие решений на основе текущей ситуации. В пассивном режиме трейдер предпочитает менее частые сделки, реже изменяет свою позицию и фокусируется на более долгосрочных перспективах, стремясь извлечь прибыль из долгосрочных трендов и тенденций рынка.

Рассмотрим подробнее каждый из видов трейдинга.

Дневная торговля – это стратегия торговли, при которой трейдер открывает и закрывает свои позиции в течение одного торгового дня. Основная идея заключается в том, чтобы извлечь прибыль из краткосрочных изменений цен активов, не оставляя открытых позиций на следующий день. Этот вид трейдинга требует внимательного мониторинга рынка и быстрых реакций.

Преимущества интрадей торговли:

- Быстрые результаты: поскольку позиции удерживаются лишь на короткое время, дневные трейдеры могут быстро увидеть результаты своих решений.

- Снижение рисков: дневные трейдеры закрывают свои позиции в конце каждого торгового дня, избегая рисков, связанных с внерабочими событиями, такими как новости или изменения цен во время ночных перерывов, плюс ко всему таким трейдерам не важны долгосрочные колебания цен.

Недостатки интрадей торговли:

- Эмоциональное напряжение: быстрые изменения цен и необходимость принятия решений в реальном времени могут вызвать стресс и эмоциональное напряжение у трейдера.

- Беспрерывный мониторинг: интрадей трейдинг требует от трейдера постоянного мониторинга рынка в течение торгового дня, что может быть трудно совместить с другими обязанностями.

Скальпинг – это краткосрочная стратегия, при которой трейдер заключает множество быстрых сделок в течение дня, пытаясь извлечь прибыль из малых ценовых изменений. Такие операции обычно длительностью от нескольких секунд до нескольких минут. Цель скальпера – извлечь небольшую прибыль из каждой сделки, примерно в пределах нескольких пунктов или процентов.

Преимущества скальпинга:

- Быстрая прибыль: скальперы стремятся извлекать небольшие прибыли из краткосрочных движений рынка, что позволяет им быстро накапливать результативные сделки.

- Минимизация риска: короткие временные рамки сделок уменьшают время, в течение которого рынок может развернуться в неблагоприятном направлении.

- Не требует глубокого анализа рынка: в отличие от более долгосрочных стратегий, важно лишь то, как ведет себя актив здесь и сейчас.

Недостатки скальпинга:

- Высокий уровень стресса: скальпинг требует быстрого принятия решений и реакции на мгновенные изменения на рынке – это может повышать уровень стресса у трейдера.

- Скальпинг для продвинутых: стратегия является сложной и требует быстрого принятия решений на основе краткосрочных изменений. Новички, еще не обладающие достаточным опытом и пониманием рынка, могут столкнуться с трудностями в успешной реализации этой стратегии.

- Комиссии: открывая множество сделок, трейдер каждый раз платит комиссии платформам. Он получает небольшую прибыль, но при этом все время должен отдавать процент бирже.

Свинг-трейдинг – это стратегия, при которой трейдер удерживает свои позиции на рынке в течение нескольких дней до нескольких недель. В отличие от дневного трейдинга, свинг-трейдеры не стремятся извлечь прибыль из краткосрочных колебаний, а ориентируются на более продолжительные движения цен. Эта стратегия предоставляет трейдерам больше гибкости и времени для принятия решений, что делает ее более подходящей для тех, кто не может следить за рынком в течение всего дня.

Преимущества свинг-трейдинга:

- Распоряжение временем: свинг-трейдинг не требует постоянного мониторинга рынка, что позволяет трейдерам заниматься чем-то кроме мониторинга рынка 24/7.

- Меньший уровень стресса: поскольку свинг-трейдеры ориентированы на более длительные тренды, у них нет необходимости реагировать на краткосрочные колебания рынка. Это может снизить уровень стресса и позволить трейдерам принимать более взвешенные решения.

- Потенциал для крупных движений: такие трейдеры охотятся за более значительными трендами, что может привести к более крупным прибылям при успешных сделках.

Недостатки свинг-трейдинга:

- Противостояние моменту: в некоторых случаях стратегия свинг-трейдинга может противостоять текущему тренду или моменту, что может снизить эффективность в сравнении с более краткосрочными методами торговли.

- Зависимость от рыночных трендов: поскольку свинг-трейдеры ориентированы на длительные тренды, их прибыльность напрямую зависит от наличия стабильных рыночных движений. В периоды бокового тренда или непредсказуемости рынка стратегия может оказаться менее эффективной.

- Негибкость: в случае резких и неожиданных событий на рынке свинг-трейдеры могут испытывать трудности и не мочь отреагировать на них так же быстро как, например, интрадей трейдеры.

- Длительность сделки: свинг-трейдеры могут ждать закрытие своей сделки неделями.

Позиционная торговля – это стратегия трейдинга, при которой трейдер удерживает свою позицию в течение длительного времени, измеряемого в месяцах. В отличие от более коротких стратегий, позиционная торговля ориентирована на долгосрочные тенденции рынка. Трейдер, применяющий позиционную стратегию, рассматривает фундаментальные факторы, такие как экономические показатели, политические события и структурные изменения в отраслях, чтобы определить перспективы актива на долгосрочно. Затем он открывает позицию, ожидая, что эти факторы приведут к значительному изменению цены актива.

Преимущества позиционной торговли:

- Извлечение максимальной прибыли: позиционные трейдеры стремятся воспользоваться долгосрочными движениями цен, что позволяет им максимизировать потенциальную прибыль.

- Меньшая активность: позиционная торговля не требует постоянного отслеживания рынка и многократных сделок, что снижает уровень стресса и обеспечивает более спокойный торговый опыт.

- Меньшие комиссии: за счет меньшего числа сделок позиционные трейдеры могут сэкономить на комиссиях.

- Меньше воздействия эмоций: позиционная торговля часто освобождает трейдера от соблазна реагировать на краткосрочные колебания рынка, что помогает избежать эмоциональных решений.

Недостатки позиционной торговли:

- Больший период ожидания: позиционная торговля требует терпения, так как для реализации прибыли требуется значительное время. Это может быть неудобно для тех, кто ищет быстрые результаты.

- Больше опыта и знаний: позиционная торговля требует больше опыта и знаний, чем другие виды трейдинга. Трейдер должен уметь анализировать фундаментальные и технические факторы, чтобы принимать обоснованные решения о покупке или продаже активов.

Таким образом, трейдинг подходит всем, кто хочет его освоить, просто следует выделить для себя наиболее подходящую стратегию и следовать ей. Рынки дают возможность заработать каждому, важным является лишь определение наиболее подходящего подхода именно для вас.

Как стать трейдером?

Путь у каждого трейдера свой, однако следующие шаги проходит каждый желающий зарабатывать на разнице котировок активов:

Выбор рынка. Первое с чем вы столкнетесь – это выбор рынка, на котором вы хотите торговать: фондовый, форекс (валютный) рынок, крипторынок и другие. Трейдер, торгующий на фондовой бирже, отличается от трейдера, торгующего криптовалютой. Если у вас ограниченный бюджет, начать с крипторынка может быть наилучшим вариантом, поскольку начать торговать криптой можно и со 100$ на балансе, торговать акциями с таким бюджетом может быть значительно сложнее.

Выбор зависит от ваших интересов, финансовых возможностей и степени готовности к риску. Однако на самом деле вы можете не ограничивать себя одним рынком: если вам интересен и форекс, и крипто, например, то вы можете быть участником сразу нескольких рынков. После выбора рынка вы сможете более детально изучить его особенности и приступить к следующему этапу – выбору торговой платформы.

Выбор платформы. После того как вы определились с рынком, следующим важным шагом станет выбор торговой платформы. Это торговая площадка, на которой вы будете открывать свои сделки. На рынке существует множество торговых платформ, и выбор зависит от ваших предпочтений. Для Форекса, например, популярными платформами являются MetaTrader 4 и MetaTrader 5.

Для торговли криптовалютой можно выбрать биржу WhiteBIT, например. Важно удостовериться, что выбранная вами платформа надежна, обеспечивает быстрый доступ к рынку и предоставляет необходимые аналитические инструменты. Можно также изучить комиссии, которые взимает та или иная биржа за открытие/закрытие сделки, поскольку они могут отличаться в зависимости от платформы.

Обучение. После того как вы определились с рынком и выбрали платформу, наступает время изучения основ трейдинга. Обучение играет ключевую роль в формировании успешного трейдера, поскольку без знаний трейдинг превращается в гемблинг. Исследуйте рынок, изучайте торговые стратегии и основы анализа. Существует множество источников, книг и ресурсов, которые помогут вам углубить свои знания.

Кроме того, очень важно оказаться в правильном окружении опытных трейдеров – двигаться вместе с комьюнити всегда намного проще, чем самостоятельно, поскольку так вы сможете избежать дорогих ошибок. Cryptology предлагают всем начинающим трейдерам пройти абсолютно бесплатный курс Base Camp – там вы научитесь основам функционирования рынков и работе на них, а также получите базовые знания торговли и начнете разрабатывать свою собственную торговую стратегию. Помните, что трейдинг – это постоянный процесс обучения, и успешные трейдеры всегда остаются в теме, следят за новостями и аналитикой рынка.

Составление торговой стратегии и ведение торгового журнала. Торговая стратегия – это ваш четкий план действий на рынке. Она включает в себя ваши цели, риски, методы анализа и конкретные шаги для принятия решений. Создание стратегии требует внимательного анализа рынка, определения вашего стиля торговли (например, дневная торговля, свинг-трейдинг и т.д.) и установки четких правил для входа, выхода и управления рисками. Это документ, который будет направлять вас в ходе торговли и помогать соблюдать дисциплину. Составив стратегию, вы получаете каркас для вашего трейдинга, который поможет вам оставаться целенаправленным в любых рыночных условиях.

Кроме того, крайне важным является ведение торгового журнала – документа, в который трейдер вносит все свои сделки и описывает причины их открытия и результаты. Торговый журнал позволяет трейдеру анализировать свои предыдущие сделки. Разбор прошлых торговых операций помогает выявить сильные и слабые стороны своей торговой стратегии. Анализ прошлых сделок позволяет понять, что привело к убыткам, и избежать повторения таких ошибок в будущем. Кроме того, торговый журнал также позволяет трейдеру оценивать свои результаты и отслеживать свой прогресс со временем. Это помогает понять, насколько успешно применение той или иной стратегии и какие изменения необходимо внести для улучшения результатов.

Первые шаги в торговле. Перед тем как вложить реальные деньги, рекомендуется отточить свои навыки с помощью торговли на "бумаге" или демо-счете. Демо-счет – это площадка или встроенная в реальную биржу функция, которая позволяет вам торговать на реальных рыночных условиях, но без риска потери реальных средств. Это отличный способ проверить свои стратегии, улучшить свои навыки и привыкнуть к психологии торговли без финансового давления.

Однако долго останавливаться на демо-счете тоже не рекомендуется: намного более эффективным будет попробовать свои навыки на реальных деньгах, начиная с небольшого депозита или на демо-счете. Только реальная торговля позволяет трейдеру получить практический опыт работы с реальными рыночными условиями. Кроме того, трейдеры, работающие с реальными деньгами, более внимательно следят за управлением рисками и учатся принимать ответственные решения о размере позиций и стоп-лоссах. Торговля с реальными деньгами также создает эмоциональную и психологическую нагрузку, которая недоступна на демо-счетах. Это позволяет трейдеру более точно оценить свои реакции на рыночные изменения и эмоциональные стрессы, что является важной частью психологии трейдера – подробнее о психологической составляющей трейдинга можете узнать в этом материале.

Еще одним важным шагом является проведение бектестов – тестирование торговой стратегии на исторических данных для оценки ее эффективности и прибыльности. Во время бектеста трейдер изучает исторические данные ценовых движений на рынке и применяет свою торговую стратегию к этим данным. Затем он анализирует результаты, чтобы оценить, как стратегия себя ведет в различных условиях рынка, и делает выводы об ее эффективности.

Переход к осознанной торговле. После успешной отработки своих навыков на демо-счете или небольшом депозите настало время перейти к осознанной торговле полным объемом. Всегда помните о контроле рисков, начинать можете с меньших сумм и постепенно увеличивать объемы сделок по мере роста вашего опыта и уверенности.

Кроме того, обязательно продолжайте учиться: начинайте с основ в нашем Base Camp, в котором мы поделимся с вами опытом и проверенными знаниями, мы готовы провести вас с нуля к углубленным знаниям, чтобы вы поняли, как работают рынки, как не терять, а главное – как получать прибыль.

Инструменты трейдера

Открывать сделки на “а-бум” или исключительно по чьей-то рекомендации совершенно не рекомендуется, каждый трейдер смотрит на рынок субъективно, именно поэтому сделка, открытая другим трейдером может не подойти вам, поскольку вы можете смотреть на рынок по-другому. Для того чтобы определиться с тем, какую позицию и когда вы хотите открыть, следует использовать следующие инструменты:

Аналитическая площадка. Одной из наиболее распространенных для построения своего BIAS (предубеждения) относительно ситуации на рынке площадок является TradingView. TradingView – это веб-платформа для анализа финансовых рынков. Она предоставляет широкий набор инструментов для технического анализа, создания графиков, анализа данных, и обмена мнениями с другими трейдерами. TradingView позволяет пользователям создавать и публиковать графики с различными финансовыми инструментами, применять технические индикаторы, а также следить за новостями и аналитикой рынка. Именно на этой платформе вы можете нанести на график все ваши мысли с помощью инструментов, которые там представлены. TradingView предлагает множественные графики, которые работают с использованием данных в режиме реального времени, более 100 индикаторов и более 50 интеллектуальных инструментов рисования (и нет, не таких, как в Paint), оповещения о движениях цены и много всего другого. Эта платформа является обязательной для использования для каждого трейдера, который хочет преуспеть в данном деле.

Платформа TradingView

Экономический календарь. Экономический календарь является неотъемлемым инструментом для трейдера, предоставляя информацию о предстоящих событиях, которые могут повлиять на рынок. Здесь отображаются ключевые экономические показатели, новости и события, такие как решения центральных банков, отчеты о занятости, данные по инфляции и другие факторы, способные вызвать колебания на финансовых рынках. Следить за экономическим календарем помогает трейдерам адаптировать свои стратегии к ожидаемым изменениям и минимизировать риски.

Пример экономического календаря (платформа ForexFactory)

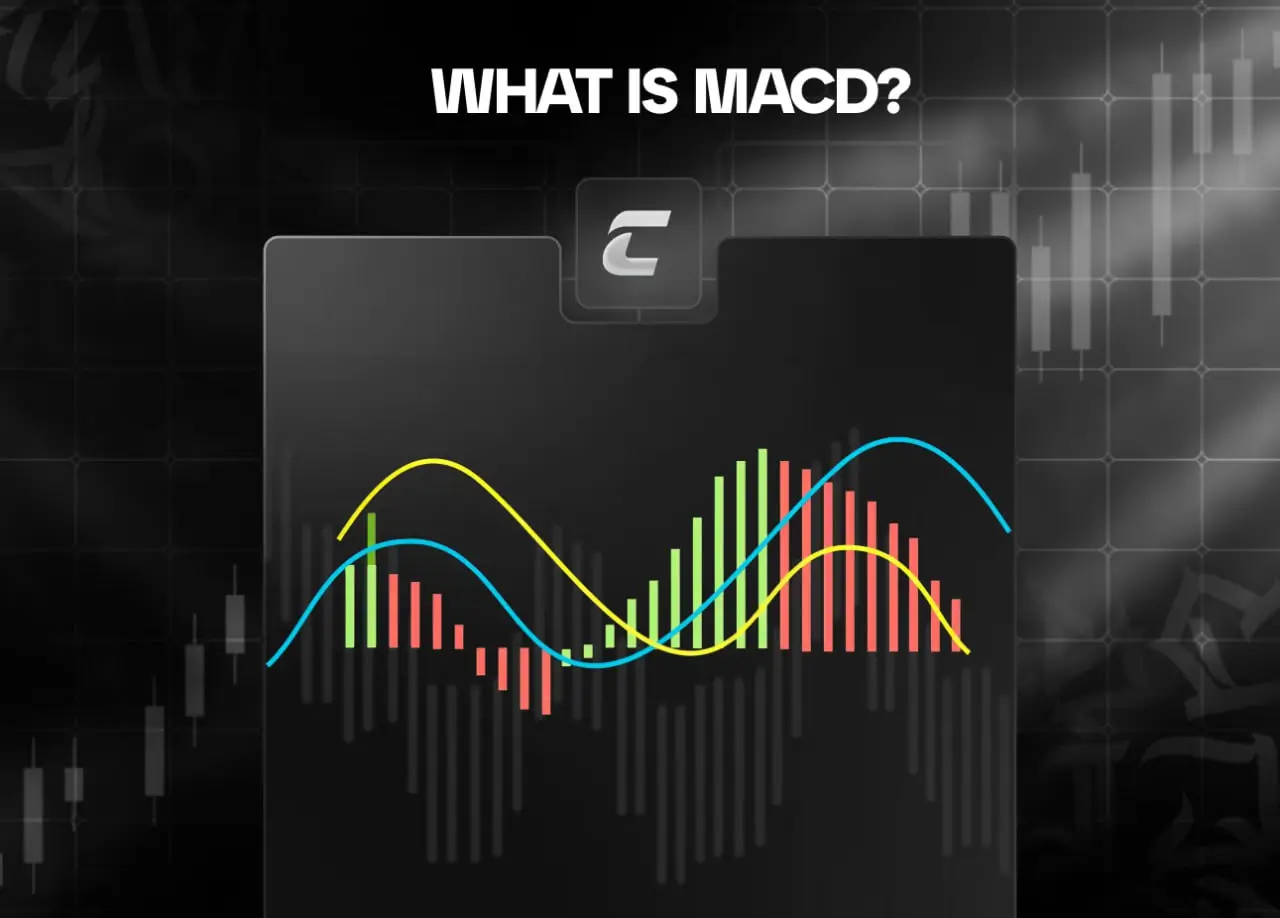

Индикаторы. Индикаторы – это важный компонент арсенала трейдера, предоставляющий дополнительную информацию о движении цен и объемах торгов. Они помогают выявлять тренды, периоды перекупленности или перепроданности актива, а также другие ключевые моменты на рынке. Наиболее популярными индикаторами являются скользящие средние, индикатор относительной силы, стохастический осциллятор, RSI и многие другие. Индикаторы – это вспомогательные инструменты для трейдера, они могут быть частью стратегии, однако это необязательно. Наша команда разработала собственные индикаторы, которые помогают трейдерам сэкономить время при анализе.

Новости. Новостные источники являются очень важным инструментом. Различные финансовые новости, экономические события, регулирование и анонсы компаний могут существенно повлиять на рынок. Трейдеры используют новостные порталы, чтобы оставаться в курсе событий, которые могут повлиять на их торговые решения. Например, как только компания Tesla выпустила новость о том, что они теперь принимают оплату в BTC, цена на актив моментально выросла.

Объемы торгов. Объемы торгов – еще один важный инструмент для трейдера. Они отражают количество активов, купленных или проданных за определенный период времени. Анализ объемов помогает оценить силу или слабость текущего тренда, а также определить потенциальные точки разворота рынка. Некоторые трейдеры используют объемы для подтверждения сигналов других индикаторов и принятия решений о входе или выходе из сделок.

Это далеко не весь список инструментов, которые могут помочь трейдеру в прогнозировании цен, однако они – являются ключевыми.

Психология трейдинга

Психология, риск-менеджмент и только потом анализ графиков – такой порядок ключевых составляющих для успешного трейдинга. Здесь психология выступает в роли регулятора эмоций, позволяя трейдеру сохранять хладнокровие и анализировать ситуацию обдуманно. Страх и жадность – ключевые эмоции, которые прослеживаются на финансовых рынках.

Помните Стэнфордский зефирный эксперимент? Где дети оставались один на один с зефиром и обещанием получить дополнительный, если удержатся от первого. Большинство детей, конечно же, не устояло перед соблазном и съело зефир. Это напоминает то, как новички в трейдинге, поддавшись первой прибыли, закрывают сделку, не терпя до достижения целевого уровня. Это, в сущности, поведение детей в эксперименте. Когда появляется потенциальный убыток, начинаются другие паттерны. Новички надеяться на то, что рынок изменится в их пользу, и оставляют убыток расти. Это как будто ожидание, что зефир, который уже в рту, вдруг превратится в два. Эксперимент намекает на важность тренировки себя действовать вопреки инстинктам и эмоциям, что в трейдинге часто означает резкое изменение своего мышления и стратегий.

Страх, в свою очередь, может “парализовать” и заставить пропустить выгодные возможности из-за опасений потерь. С другой стороны, жадность может манить к высоким рискам и приводить к неразумным решениям в поиске быстрой прибыли. Эти эмоции часто взаимосвязаны, создавая цикл, который влияет на принятие решений трейдера. Страх усиливается потерями, а жадность может возникнуть после успешных сделок. Важно научиться управлять этими эмоциями, чтобы сохранить хладнокровие в любой рыночной ситуации. Психология трейдера и торговли напрямую влияет на вашу результативность и успех на рынке.

Управление рисками

Можно первоклассно читать рынки, но если вы не научитесь риск-менеджменту – потеряете все.

Риск-менеджмент – это ключевой инструмент, обеспечивающий финансовую безопасность трейдера, предотвращающий катастрофические потери и поддерживающий эмоциональную стабильность.

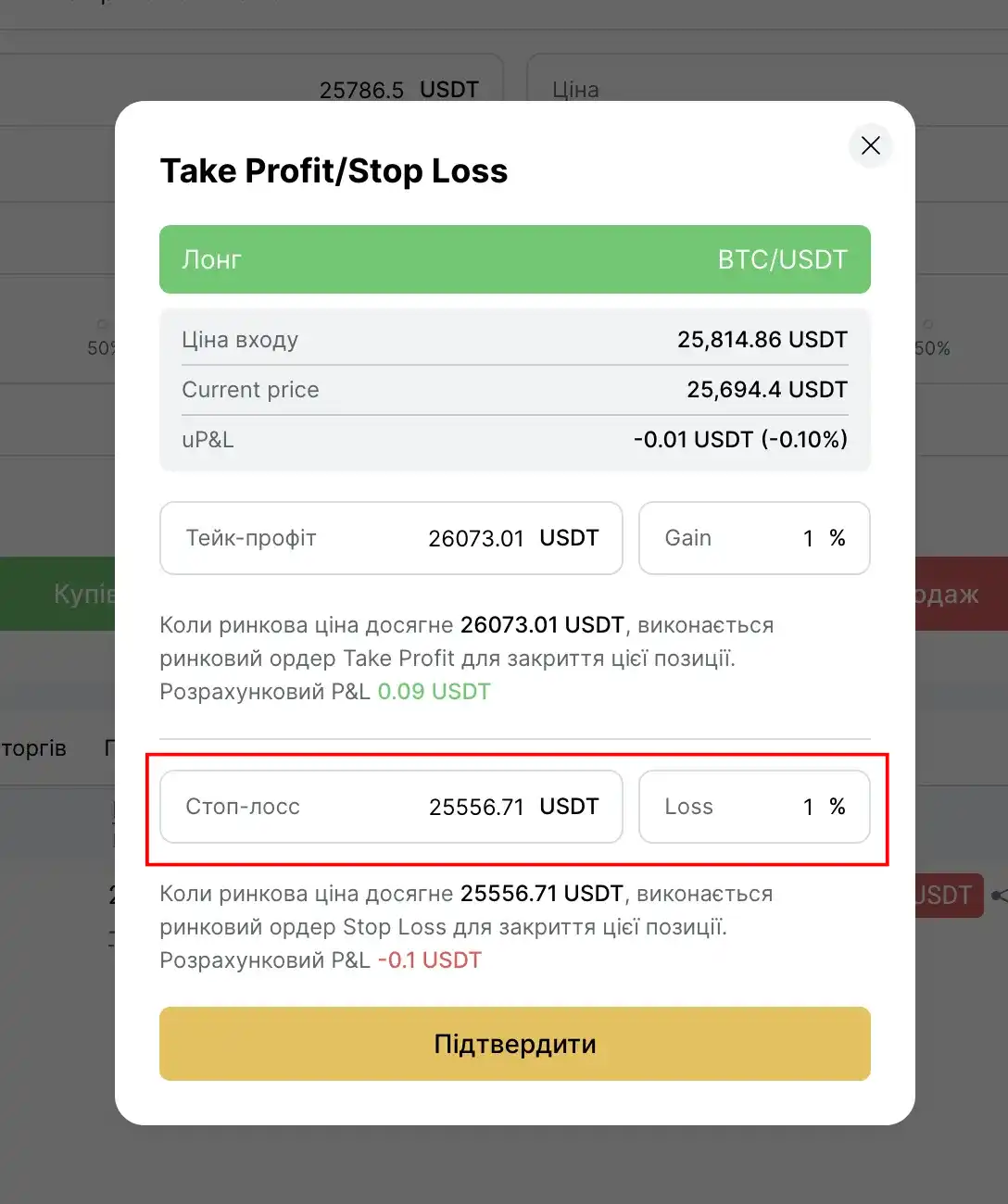

Путем определения четких пределов потерь и стратегий управления рисками трейдеры создают прочный фундамент для успешной торговли, где рациональные решения превалируют над эмоциональными реакциями, обеспечивая долгосрочную стабильность и эффективное управление соотношением "риск/прибыль". Для того чтобы не потерять весь капитал или его значительную часть при удержании сделок, следует использовать стоп-лоссы.

Стоп-лосс – это механизм в трейдинге, предназначенный для минимизации потерь трейдера. Это предварительно установленный уровень цены, при достижении которого открытая позиция автоматически закрывается, предотвращая дальнейшие убытки. Стоп-лосс является очень важным элементом стратегии управления рисками, позволяя трейдеру контролировать свои потери в случае неблагоприятных рыночных движений. Этот инструмент призван защитить капитал и обеспечить баланс между риском и потенциальной прибылью, делая торговлю более стабильной и предсказуемой.

Установка стоп-лосса на бирже WhiteBIT.

Определение максимального уровня риска на каждую сделку является важной частью риск-менеджмента. Это означает, что трейдер определяет максимальную сумму, которую он готов потерять в случае неудачной сделки. Например, если у трейдера есть капитал в размере $10,000, и он устанавливает максимальный риск на сделку в 2%, то максимальная потеря на одной сделке не превысит $200. Именно для этого и используется стоп-лосс.

Важным в риск-менеджменте также является использование фиксированных процентов капитала для торговли: трейдер решает торговать определенным процентом своего капитала в каждой сделке. Например, если у него есть $10,000, и он устанавливает фиксированный процент на уровне 3%, то размер каждой сделки будет $300. Эта стратегия помогает более равномерно распределить риск при разных объемах капитала. В зависимости от актива, рыночных условий, уверенности трейдера в сетапе этот процент может меняться.

С чего начать свой путь в мире трейдинга?

Очень важным в начале своей карьеры трейдера является попасть в правильную среду. Опытные трейдера из комьюнити помогут вам минимизировать возможные ошибки и повысить шансы на успех без набивания собственных шишек. Кроме того, следует включиться в информационное пространство, поскольку просто смотреть на чарты недостаточно, очень важно быть в “теме” постоянно.

Сначала это может казаться сложным, вы можете напоминать себе следить за новостями, отчетами и событиями, но уже через несколько месяцев вы не сможете вспомнить как это: проснуться и не посмотреть первым делом на котировки активов или почитать новости из мира финансов.

Мы предлагаем вам облегчить свой путь в мире трейдинга и начать его с нашего Base Camp – это бесплатный мини-курс по трейдингу для начинающих. На Base Camp мы предоставляем вам доступ к проверенным знаниям и опыту наших экспертов. В рамках Base Camp вы получите доступ к 5 бесплатным видеоурокам, 2 практическим трансляциям для отработки полученных знаний, а также возможность задать вопросы в рамках Q&A сессии с Костей Кудо, опытным трейдером и преподавателем. Base Camp – это ваш стартер пак знаний и инструментов для успешного развития в этой области.

Трейдинг для начинающих: рекомендации команды CRYPTOLOGY KEY

Рынки дают возможности заработать каждый день. Трейдинг – это возможность работать на себя из любой точки мира, однако для достижения успеха в трейдинге очень важно следовать нескольким ключевым рекомендациям.

Во-первых, начните с обучения. Погрузитесь в основы рынка, изучите различные стратегии и освойте терминологию. Трейдинг без знаний – азартная игра, в которой сегодня можно заработать 500$, а завтра – потерять весь депозит.

Во-вторых, определите свои финансовые цели и риски. Соблюдение риск-менеджмента – ключевой пункт для успешной торговли, работа без стоп-лосса и открытие сделок “на всю котлету” – прямой путь к потерям. Попрактикуйтесь на демо-счете перед входом в реальные торги – это поможет вам освоить психологию рынка без риска потерь, отточить навыки и проверить эффективность торговой стратегии.

Кроме того, если вы только начинаете, мы рекомендуем стартовать с небольших сумм и постепенно увеличивать объемы сделок по мере приобретения опыта. Еще один важный момент: не позволяйте эмоциям влиять на ваши решения, будьте терпеливы и последовательны в своем подходе.

Успешный трейдинг требует времени и усилий для освоения, но с правильным подходом и обучением, вы сможете развивать свои навыки и достигнете успеха. Если вы хотите узнать больше о том, как играть и выигрывать на бирже, получить инструменты и наставничество опытных трейдеров, школа трейдинга Cryptology приглашает вас начать путь вместе!

Что такое трейдинг?

Трейдинг и инвестиции – одно и то же?

Какие существуют виды трейдинга?

Почему важна психология трейдинга?

Что такое риск-менеджмент?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!