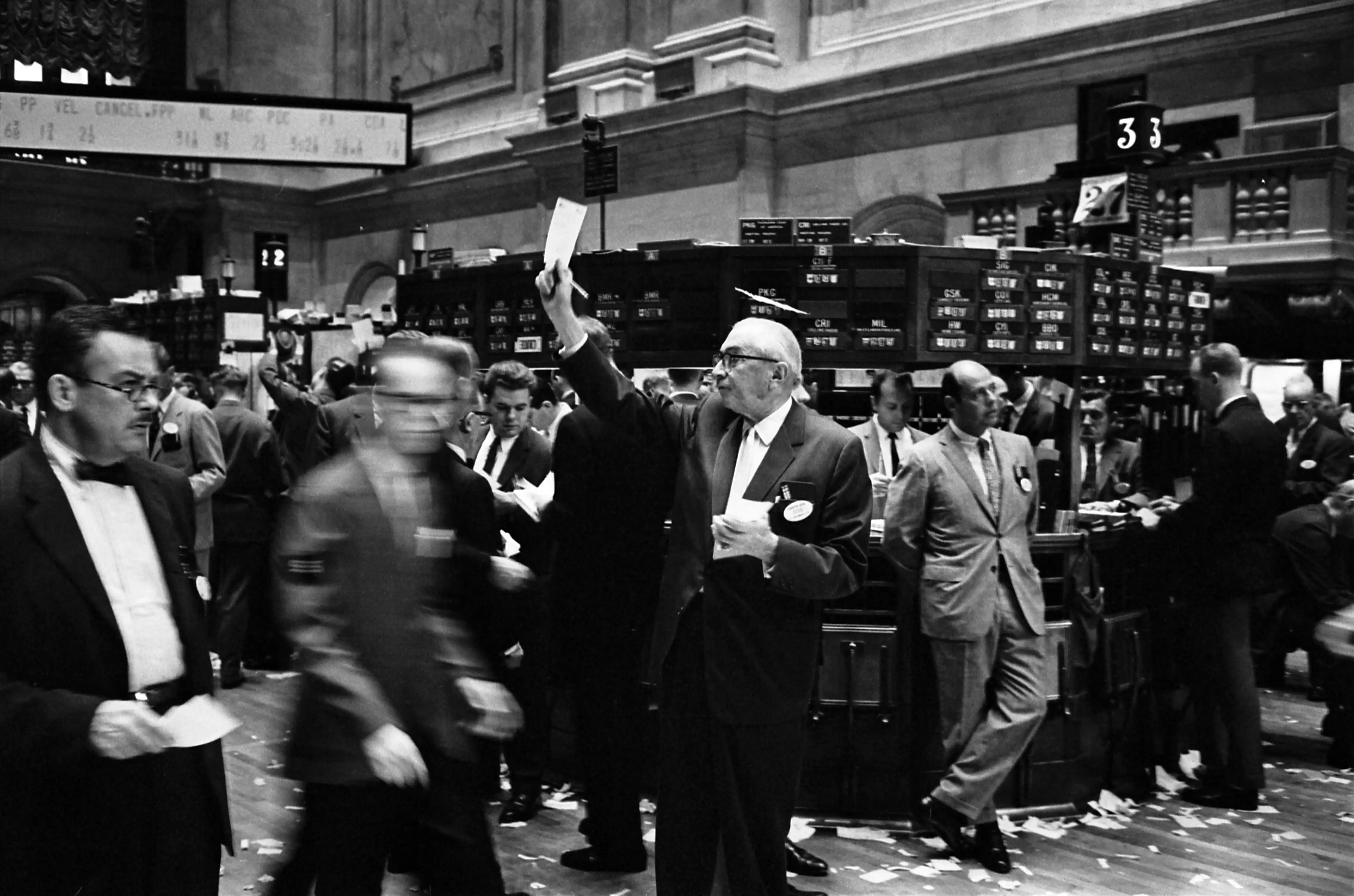

Жизнь – это игра чисел, баланс активов и пассивов, сила, которая подстегивает погоню за счастьем, за успехом. Точно также работает в мире финансов, где каждый доллар имеет значение – биржи являются основным двигателем этого мира.

Что такое биржа?

Биржа – организатор торговли, где происходят покупка и продажа активов, таких как акции, облигации, опционы и другие. Биржи существуют уже несколько веков и они оказали огромное влияние на развитие мировой экономики.

Затем, прямиком из уже далекого 2009 года, в эту вечную игру входит новый игрок – криптовалюты. И по мере того, как они набирают обороты, возникает необходимость в площадках для их обмена. Вот тут-то и появляются криптобиржи.

Криптобиржа – это такая же биржа, но для торговли криптовалютами. Они позволяют пользователям купить, продать и обменять криптовалюты, такие как Bitcoin, Ethereum и многие другие.

Все это происходит в режиме реального времени, и также как и на традиционных биржах, цены устанавливаются на основе предложения и спроса в реальном времени. Однако криптобиржи отличаются от традиционных бирж множеством особенностей, включая использование технологии блокчейна, цифровых кошельков и других инновационных технологий.

Теперь перейдем к следующему термину в нашем путешествии – централизованные биржи CEX.

CEX (Centralized Exchanges): что такое централизованные биржи

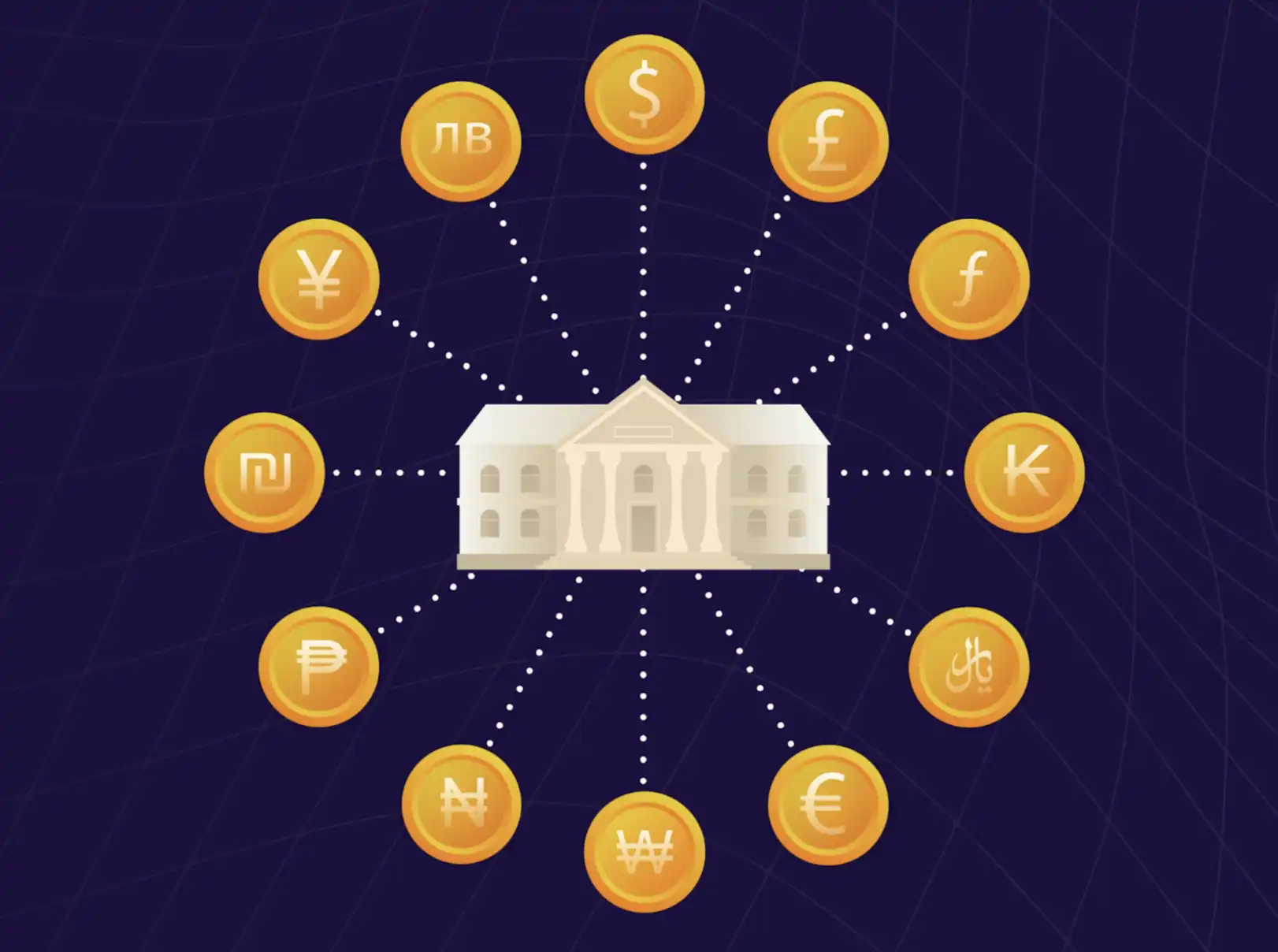

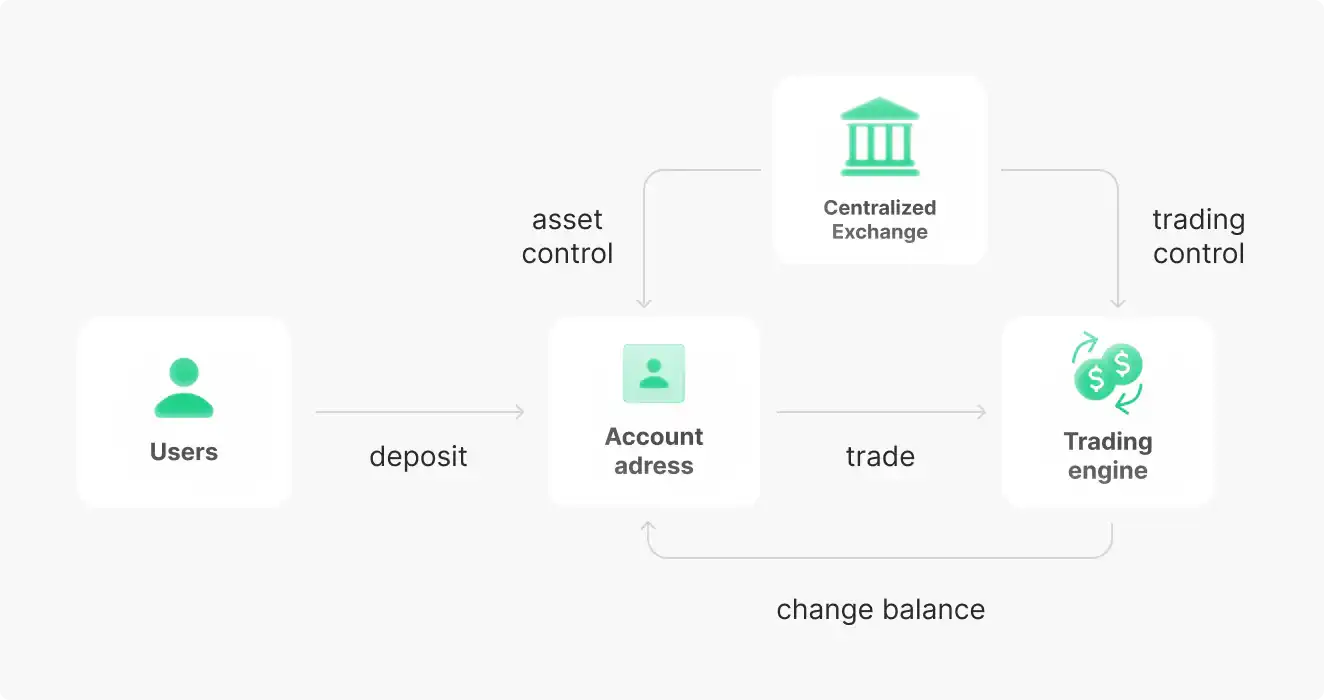

CEX (Centralized Exchange) – это централизованная криптовалютная биржа. Она принадлежит и управляется централизованной организацией, обычно это компания. CEX биржи были первыми типом криптобирж, и они по-прежнему остаются наиболее популярными. На CEX пользователи создают аккаунты и совершают торговые операции на платформе, которая действует как посредник между покупателями и продавцами.

На CEX бирже пользователи могут покупать, продавать, обменивать и хранить криптовалюты. Биржи предлагают широкий выбор криптовалют, а также фиатных валют, таких как доллар США, евро, гривна и так далее.

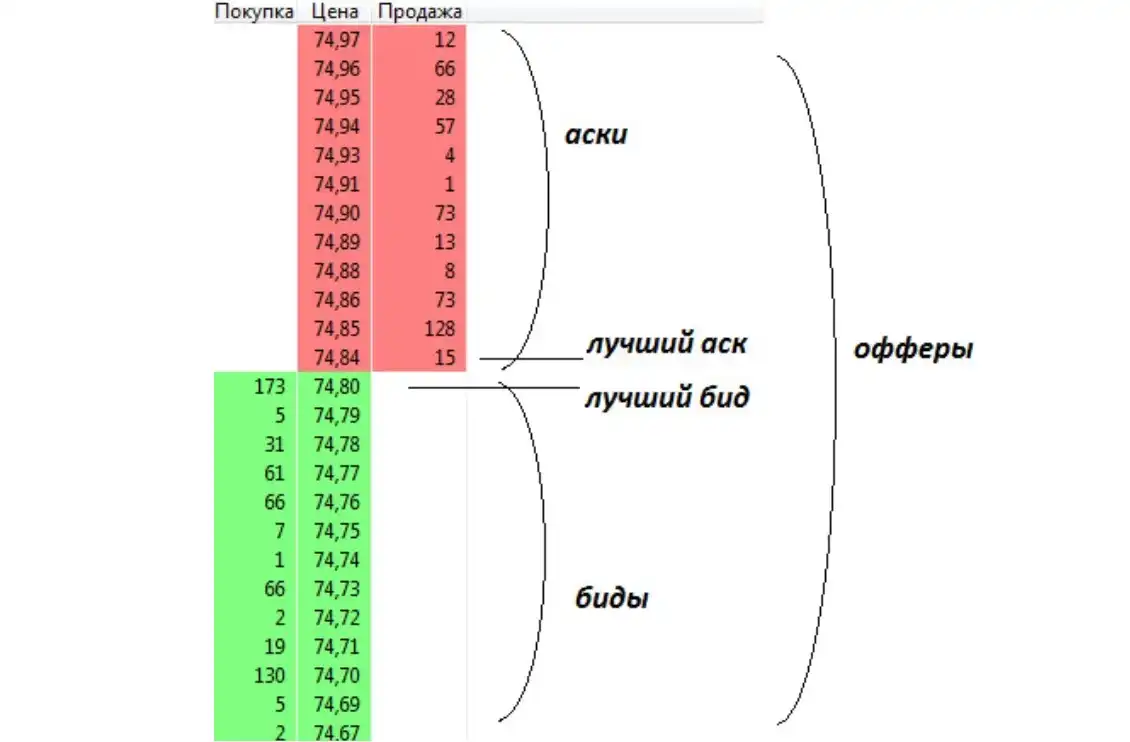

На таких биржах торговля осуществляется через биржевой стакан, представляющий собой таблицу заявок на покупку и продажу криптовалют. Этот стакан собирает все заказы на торговлю активами платформы.

Определение стоимости активов происходит на основе взаимодействия спроса и предложения на рынке.

Когда пользователи не могут достичь согласия по цене актива (когда нет совпадения между ценами, по которым хотят купить и продать), в процесс вступает маркетмейкер. Это может быть крупный игрок или сама биржа, играющие роль посредника. Маркетмейкер обеспечивает ликвидность биржи, обеспечивая постоянство торговой активности. Без его участия сделки могли бы занимать гораздо больше времени.

Как работают централизованные криптовалютные биржи?

Если разобраться, работа CEX бирж довольно проста. Вам просто нужно создать аккаунт, подтвердить свою личность (в большинстве случаев), пополнить баланс криптовалютой или фиатными деньгами и начать торговать.

CEX биржи управляют всеми входящими и исходящими транзакциями, включая хранение активов пользователей. Это может упростить процесс торговли для новичков, но также вносит элемент риска, связанный с хранением активов на бирже.

CEX – это просто и удобно, но из-за них теряется сама идея децентрализации. В CEX вы вводите деньги напрямую на биржу, а это значит, что ваши средства принадлежат биржевому кошельку, который просто закреплен за вами, но фактическим владельцем является биржа. Закинув деньги на CEX биржу вы далее совершаете операции внутри биржи. При этом, например, чтобы совершить вывод стейблкоинов с биржи в той или иной сети, например TRX, вам не нужно иметь нативный токен (TRX) для оплаты комиссии, комиссия снимется в том же стейблкоине: биржа в таком случае оплачивает комиссии в нативных токенах со своих кошельков.

Преимущества и недостатки при работе с централизованными биржами

Централизованные биржи криптовалют (CEX), несмотря на все идеалы децентрализации, которые воплощают криптовалюты, стали популярными из-за ряда уникальных преимуществ.

Преимущества использования CEX:

- Простота и удобство: CEX выделяются своей простотой использования, и даже новичок легко освоит то, как они работают. Регистрация, KYC-проверка, внесение средств – и вперед, можно торговать криптовалютами. Здесь нет необходимости управлять своими ключами, разбираться в тонкостях кошельков или изучать сложности криптотранзакций.

- Широкий функционал: централизованные биржи предоставляют обширный функционал, различающийся в зависимости от их масштаба. Даже самые простые позволяют совершать сделки с криптовалютными парами, например, BTC/ETH. Большие платформы расширяют возможности, включая торговые пары фиат/крипто, а также множество дополнительных инструментов: маржинальная торговля, стейкинг, фарминг, деривативы, криптокарты и даже участие в аирдропах или IEO.

- Регулирование: CEX различаются по степени регулирования. Некоторые платформы активно добиваются соответствия местным законам и требованиям, получая лицензии и проходя KYC-проверку. Здесь требуется верификация личных и банковских данных, но чем больше информации предоставляет пользователь, тем больше у него возможностей. Например, лимиты на ввод и вывод средств.

- Ликвидность: благодаря большому числу участников и активной торговле, централизованные биржи часто обладают высокой ликвидностью, что обеспечивает быстрое выполнение ордеров.

- Клиентская поддержка: большинства CEX предоставляют службы клиентской поддержки, что облегчает решение вопросов и проблем пользователей. Пользователь всегда может связаться с поддержкой для решения вопросов.

Недостатки использования CEX:

- Централизация: CEX биржи управляются централизованной организацией, что может быть проблемой для тех, кто ценит децентрализацию криптовалют. Например, централизованная биржа может заблокировать аккаунт пользователя или приостановить торговлю определенными криптовалютами по каким-то причинам.

- Комиссии: CEX биржи обычно взимают комиссии за транзакции, что может снизить прибыльность торговли. Комиссии могут варьироваться в зависимости от биржи, типа транзакции и объема торговли.

- Регулирование: с одной стороны регулирование является преимуществом, но с другой это может ограничить их возможности, такие как возможность предлагать определенные функции или работать в определенных странах.

CEX биржи являются удобным и безопасным способом для покупки, продажи и обмена криптовалютами. Однако они также имеют ряд недостатков, таких как централизация, комиссии и регулирование. При выборе CEX биржи важно учитывать свои потребности и предпочтения. Если вы ищете биржу с широким выбором криптовалют, высокой ликвидностью и удобным интерфейсом, то CEX биржа может быть хорошим вариантом для вас. Однако если вы цените децентрализацию и низкие комиссии, то вам следует рассмотреть возможность использования DEX биржи.

Примеры централизованных бирж

Whitebit – одна из крупнейших централизованных бирж криптовалют в Европе. Биржа предлагает широкий выбор функций и инструментов, которые делают ее удобным и безопасным местом для торговли криптовалютами. Whitebit поддерживает стейкинг и предоставляет возможность участия в листинге новых токенов. Whitebit активно развивается и привлекает внимание сообщества криптотрейдеров.

Bybit является популярной централизованной биржей, специализирующейся в торговле криптовалютными деривативами, в частности, фьючерсами и перпетуальными контрактами. Биржа предлагает высокую ликвидность и низкие комиссии, что делает её привлекательной для трейдеров. Bybit также известна своими инновационными продуктами и активным вовлечением в общество трейдеров.

OKX является одной из крупнейших бирж по объему торгов и предоставляет разнообразные продукты, включая торговлю на спотовом рынке и фьючерсы. Опции для участия в стейкинге и децентрализованных финансах расширяют возможности трейдеров на платформе.

Binance – одна из наиболее известных и популярных централизованных бирж в мире криптовалют. Ее преимущества включают в себя высокую ликвидность и обширный выбор торговых пар. Платформа предоставляет разнообразные инструменты, такие как маржинальная торговля и фьючерсы. Кроме того, Binance Launchpad предоставляет возможность участвовать в инвестициях в новые проекты.

Как выбрать CEX биржу?

Выбор правильной CEX биржи зависит от ваших индивидуальных нужд и требований. Вот некоторые факторы, которые стоит учитывать:

- Репутация: изучите отзывы и исследования о различных биржах, чтобы узнать о их репутации. Это может помочь определить, насколько надежной является биржа.

- Безопасность: узнайте, какие меры безопасности применяются биржей. Отсутствие базовых мер, таких как двухфакторная аутентификация, может быть негативным фактором.

- Услуги: оцените услуги и функции, которые предлагает биржа. Если вам нужны определенные торговые инструменты или вы хотите торговать определенными криптовалютами, убедитесь, что выбранная биржа может предложить это.

Индустрия криптовалют продолжает развиваться и с ней развиваются и CEX биржи. Вместе с этим появляются новые возможности и вызовы. Независимо от того, являетесь ли вы новичком в криптовалютах или опытным трейдером, важно всегда оставаться в курсе последних новостей и тенденций в этом быстро меняющемся мире.

DEX (Decentralized Exchanges): что такое децентрализованные биржи

Децентрализованные биржи (DEX) представляют собой платформы для торговли криптовалютами, которые работают на основе технологии блокчейн и не имеют центрального управления. В отличие от централизованных бирж (CEX), где биржа управляет пользователями и их средствами, DEX стремятся к децентрализации и обеспечивают более прямое участие пользователей в процессе торговли.

DEX не имеют центрального сервера или организации, контролирующей все торговые операции. Вместо этого они базируются на блокчейне, где участники могут проводить торговые операции напрямую с использованием смарт-контрактов.

Проще говоря, DEX биржа – это лишь платформа, которая соединяет напрямую продавцов и покупателей, а они в свою очередь уже обмениваются активами между собой. При этом, например, чтобы совершить транзакцию на такой бирже в той или иной сети, например TRX, вам, в отличии от CEX бирж, нужно иметь нативный токен (TRX) для оплаты комиссии на своем кошельке, подключенном к бирже, в противном случае вы не сможете совершить транзакцию.

Кроме того, пользователи DEX имеют полный контроль над своими частными ключами и средствами, так как они хранятся в их собственных кошельках. Это повышает уровень безопасности и предотвращает централизованную угрозу взлома.

В какой-то степени выбор между централизованными и децентрализованными биржами подобен выбору между безопасностью и свободой.

Централизованные биржи обеспечивают высокую скорость транзакций, удобство использования и дополнительные услуги, такие как торговля с плечом, стейкинг и даже возможность займа и кредитования. Они являются "односторонними дверями" для новых пользователей криптовалют, предлагая удобные способы покупки криптовалют за фиатные деньги. С другой стороны, децентрализованные биржи предоставляют пользователям полный контроль над их активами и личной информацией. Идея децентрализованных бирж возникла из желания создать платформу для торговли криптовалютами, которая была бы в соответствии с идеологией децентрализации, лежащей в основе большинства криптовалют. Это было реакцией на уязвимости централизованных платформ, таких как риск взлома, мошенничество со стороны операторов биржи и необходимость передачи полного контроля над своими активами третьей стороне.

Преимущества и недостатки при работе с децентрализованными биржами

DEX имеют ряд уникальных особенностей, которые отличают их от централизованных бирж:

- Децентрализация: DEX биржи не управляются централизованной организацией, что делает их более устойчивыми к взломам и кражам.

- Анонимность: DEX часто обеспечивают более высокий уровень анонимности, поскольку они не требуют предоставления личных данных или прохождения KYC-проверки для торговли. Запросы на верификацию KYC/AML стали неотъемлемой частью многих бирж. Биржи требуют от пользователей подтверждение личности перед началом работы на бирже. Для некоторых людей – это проблема, поскольку речи о конфиденциальности просто не идет в таком случае. При этом, если вы не верифицируете свой аккаунт, вам не будут доступны некоторые функции. Что делать, если не удается предоставить требуемые документы? А что, если переживать о возможной утечке конфиденциальной информации? Вот где DEX и выигрывают, как настоящие стражи конфиденциальности. Децентрализованные биржи доступны для всех, вам не нужно беспокоиться о проверке личности. Все, что требуется для старта – это криптовалютный кошелек.

- Безопасность: DEX биржи используют смарт-контракты для автоматизации торговли, что снижает риски для пользователей.

- Возможность покупки “редких” активов: на децентрализованных биржах (DEX) пользователи имеют уникальную возможность приобретения активов, которых часто нет на централизованных биржах (CEX). Это происходит благодаря тому, что DEX позволяют торговать сразу с кошелька к кошельку, обеспечивая доступ к более широкому спектру токенов и криптовалют. DEX, не имея центральной инстанции, дают возможность торговать с различными токенами, включая те, которые могут быть новыми или не такими популярными просто с помощью поиска монет по ее контракту.

- Возможности для DeFi: одним из важных преимуществ децентрализованных бирж (DEX) является их тесная интеграция с миром децентрализованных финансов (DeFi). DEX обеспечивают прямой доступ к разнообразным продуктам DeFi, таким как ликвидностьные пулы, стейкинг, фарминг и децентрализованные кредиты. Кроме этого, DEX часто становятся местом первичного листинга для новых токенов, связанных с DeFi проектами, что дает пользователям возможность участвовать в раннем этапе развития проектов.

- Контроль: пользователи имеют полный контроль над своими средствами на DEX бирже.

- Низкие комиссии: DEX биржи обычно взимают более низкие комиссии, чем централизованные биржи.

- Отсутствие ограничений по географии: DEX предоставляют глобальный доступ к торговле, и пользователи могут участвовать в них из любой точки мира.

- Резистентность к цензуре: в отличие от централизованных платформ, DEX трудно заблокировать или цензурировать, что делает их доступными для пользователей во всем мире.

Недостатки использования DEX:

- Ликвидность: одним из основных недостатков DEX бирж является их низкая ликвидность. Это означает, что пользователям может быть сложнее купить или продать криптовалюты по справедливой цене. Ликвидность DEX бирж зависит от количества пользователей, которые предоставляют свои средства в качестве обеспечения для создания ликвидности. Если на бирже мало пользователей, то ликвидность будет низкой.

- Сложность использования для новичков: для новичков использование DEX может быть сложным из-за особенностей работы с кошельками, смарт-контрактами и отсутствия привычных интерфейсов, к которым они привыкли на централизованных биржах.

- Ограниченный функционал: некоторые DEX могут предоставлять ограниченный набор функций по сравнению с централизованными биржами. Это может включать в себя отсутствие маржинальной торговли или дополнительных инструментов.

- Возможность утери ключей: пользователи несут ответственность за безопасное хранение своих частных ключей. В случае их утери или компрометации, средства могут быть утрачены без возможности восстановления.

- Отсутствие клиентской поддержки: одним из недостатков децентрализованных бирж (DEX) является отсутствие традиционной клиентской поддержки, которую мы привыкли видеть на централизованных биржах (CEX). На CEX пользователи могут обратиться за помощью по вопросам технической поддержки, уточнению информации или решению проблем. Однако на DEX, поскольку отсутствует централизованная организация, предоставляющая услуги поддержки, пользователи могут столкнуться с тем, что не имеют прямого и немедленного доступа к профессиональной помощи. Ответы на вопросы могут потребовать самостоятельного исследования или обращения к сообществу, что может занять больше времени и требовать большего усилия.

Если вы ищете биржу с высоким уровнем безопасности и децентрализации, то DEX биржа может быть хорошим вариантом для вас. Однако если вы ищете биржу с высокой ликвидностью и удобным интерфейсом, то вам следует рассмотреть возможность использования централизованной биржи.

Примеры децентрализованных бирж

Рассмотрим примеры наиболее известных децентрализованных бирж:

Uniswap – это крупнейшая децентрализованная биржа, которая работает на блокчейне Ethereum. Она занимает около 40% всего рынка криптовалют. У биржи достаточно простой интерфейсом и широкий выбор активов. Кроме того, пользователи могут создавать свои собственные пулы ликвидности и мгновенно обменивать криптовалюты. Uniswap также интегрирована с сотнями DeFi-площадок, что позволяет пользователям выводить средства в любой момент и управлять биржей с помощью нативного токена UNI.

SushiSwap – это форк Uniswap, который также работает на блокчейне Ethereum. Главная особенность SushiSwap – это то, что поставщики ликвидности получают вознаграждение в виде токена SUSHI.

dYdX – гибридная биржа, сочетающая элементы централизации и децентрализации. Эта биржа направлена на то, чтобы предложить пользователям свободу и прозрачность, характерные для децентрализованных систем, а также работу со смарт-контрактами. При этом она интегрирует некоторые функции централизованных бирж, например, книгу ордеров.

PancakeSwap – данная биржа работает на блокчейне BNB Chain. Биржа позволяет торговать токенами формата BEP-20. Благодаря тому, что PancakeSwap работает на BNB Chain, она предлагает более быстрые транзакции и низкие комиссии. На бирже также проходят лотереи для пользователей каждые 6 часов.

1inch – это децентрализованная биржа, которая работает на блокчейне Ethereum. Биржа также предоставляет доступ к DeFi-агрегатору. Это означает, что 1inch собирает данные о других DEX и активах на них и предлагает пользователю наиболее выгодные пути проведения сделок.

Какой тип биржи лучше подходит для разных целей: мнение команды CRYPTOLOGY KEY

Окончательный выбор между децентрализованными и централизованными биржами зависит от ваших индивидуальных требований и предпочтений. Если вы ищете лучшую скорость, удобство использования и доступность, а также цените возможность торговать широким спектром криптовалют и использовать дополнительные услуги, то CEX, вероятно, будет лучшим выбором.

Однако, если вы очень цените свою приватность и не хотите доверять свои средства третьей стороне, или если вы хотите торговать криптовалютами, которые не поддерживаются на традиционных биржах, DEX может быть вашим выбором.

В принципе выбор торговой платформы зависит и от того, являетесь ли вы новичком или опытным трейдером, а также от ваших целей. Для новичков в криптотрейдинге централизованные биржи (CEX) – лучший вариант. Они просты в использовании и предлагают широкий спектр функций и инструментов. Кроме того, в случае возникновения проблем пользователи могут обратиться в службу поддержки за помощью. Однако централизованные биржи хранят ваши активы, что может привести к риску взлома или кражи. Более опытные трейдеры часто выбирают децентрализованные биржи, которые обеспечивают более высокий уровень безопасности, поскольку они не хранят ваши активы. Децентрализованные биржи (DEX) лучше подходят для опытных трейдеров или тех, кто хочет инвестировать в новые проекты с низкой рыночной капитализацией.

Некоторые трейдеры и инвесторы предпочитают использовать и CEX, и DEX в зависимости от конкретной ситуации, так что вы не обязаны ограничиваться только одним типом биржи. Главное, помните о безопасности и всегда храните свои активы в безопасном месте.

Как DEX, так и CEX играют важную роль в экосистеме криптовалют. Оба типа бирж служат различным потребностям и предлагают большие преимущества. Важно помнить, что технология все еще развивается и мы можем ожидать новых и улучшенных решений в обеих категориях в ближайшем будущем.

Что такое централизованные биржи (CEX)?

Что такое децентрализованные биржи (DEX)?

Какие биржи лучше подходят для новичка?

Какие биржи лучше подходят для покупки активов с низкой капитализацией?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!