Лимитный ордер, или как его еще называют - “лимитка”, - это детальная заявка, которую трейдер подает на биржу, устанавливая максимальную или минимальную цену, по которой он готов купить или продажу актив. Это как ставка в аукционе, где участник указывает цену, которую он готов заплатить за предмет. Но в случае с биржей, этот ордер остается активным до тех пор, пока условия не будут удовлетворены, или пока трейдер сам не отменит его.

Как работает лимитный ордер?

При подаче лимитного ордера, трейдер указывает не только цену, по которой он готов купить или продать криптовалюту, но и количество активов, которое он желает приобрести или отчуждать. Когда рыночная цена соответствует цене, указанной в ордере, биржа автоматически запускает процесс исполнения ордера, обеспечивая трейдеру сделку по его желаемой цене - или даже лучше, если возможно.

Используя лимитные ордера, трейдеры могут приобретать криптовалюту по цене ниже рыночной или продавать ее по цене выше рыночной. Это обеспечивает им больший контроль над своими сделками и позволяет получать более выгодные условия на рынке.

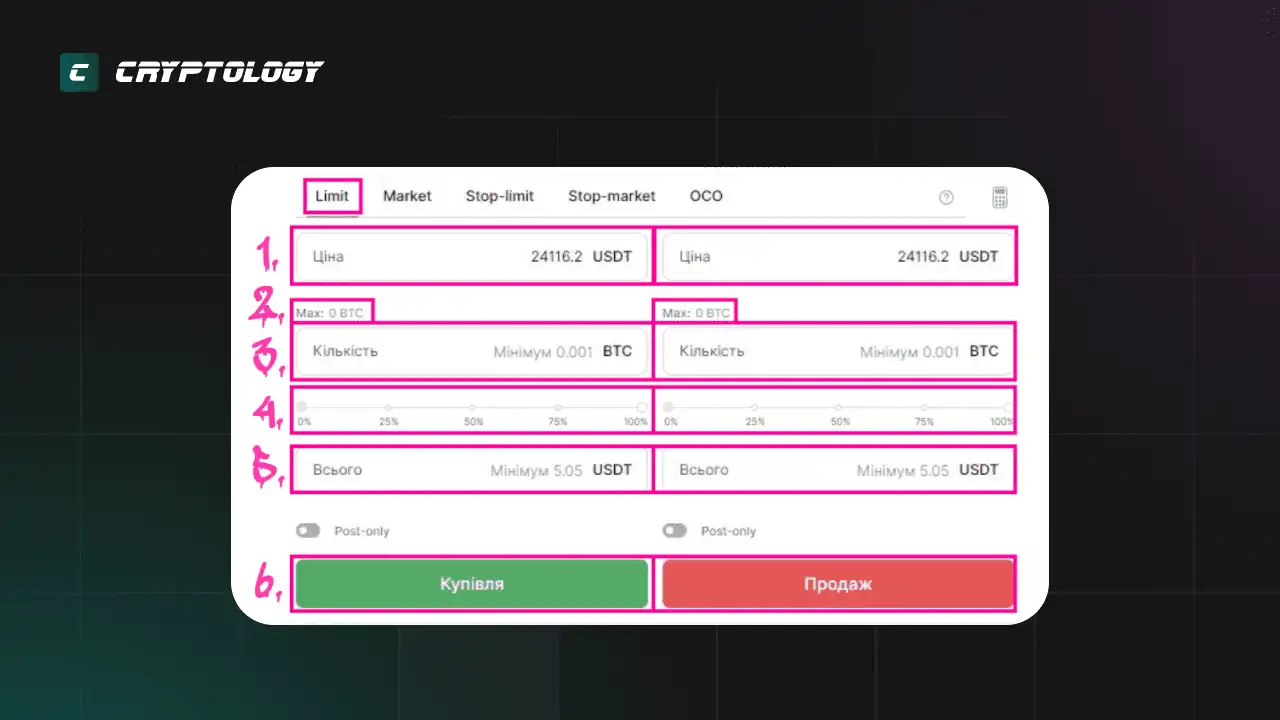

Применение лимитного ордера на примере терминала WhiteBit

- Цена лимитного ордера: Здесь устанавливается цена, при достижении которой будет исполнен ордер.

- Баланс торгового аккаунта: Здесь показан ваш баланс в выбранной вами торговой паре.

- Количество актива: Здесь указывается количество активов, которые вы планируете купить или продать.

- Количество актива (ползунок): Это другой способ указать объем активов для покупки или продажи, но вместо абсолютного числа вы указываете процент от вашего текущего баланса.

- Количество денег: Здесь указывается сумма, которую вы планируете потратить на покупку актива (при покупке), или сумма, которую вы получите при продаже указанного объема активов (при продаже).

- Кнопка “Покупка/продажа”: При нажатии на эту кнопку, ваш ордер направляется в книгу ордеров, ожидая своей очереди на исполнение.

Разновидности лимитных ордеров

Криптобиржи предлагают трейдерам несколько типов лимитных ордеров, каждый из которых имеет свои особенности:

- Лимитный ордер на покупку (buy limit order): В данном случае трейдер задает ценовой лимит, по достижении которого он желает приобрести криптовалюту.

- Лимитный ордер на продажу (sell limit order): Здесь трейдер устанавливает ценовую границу, при которой он готов продать криптовалюту.

- Стоп-лимитный ордер (stop limit order): Это особый тип лимитного ордера, который активируется только после того, как цена достигает заданного уровня. Этот ордер состоит из двух частей: stop price и limit price.

Чем отличаются рыночный и лимитный ордера?

Существует ряд ключевых различий между лимитными и рыночными ордерами, основанных на их исполнении и гарантиях:

- Лимитный ордер: Трейдер заранее задаёт определённую цену, по которой он желает купить или продать криптовалюту. Такой ордер гарантирует исполнение по этой или более выгодной цене, но не обещает моментальное исполнение.

- Рыночный ордер: Этот ордер подразумевает мгновенную покупку или продажу криптовалюты по текущей рыночной цене. Такой ордер обеспечивает немедленное исполнение, но не гарантирует конкретной цены исполнения.

Таким образом, основная разница между лимитными и рыночными ордерами заключается в балансе между гарантией исполнения и контролем над ценой исполнения.

Использование лимитных ордеров в трейдинге

Лимитные ордеры — это важный элемент стратегии трейдинга, предлагающий трейдерам больший контроль над их позициями на рынке криптовалют и других активов.

Стратегия "входа в рынок": Трейдер устанавливает лимитный ордер на покупку криптовалюты по цене ниже текущей рыночной. Если цена достигает указанного уровня, ордер автоматически исполняется, позволяя трейдеру войти в рынок с выгодой.

Стратегия "выхода из рынка": Трейдер устанавливает лимитный ордер на продажу криптовалюты по цене, выше текущей рыночной. При достижении этой цены ордер исполняется, трейдер продает свою криптовалюту с прибылью и выходит из рынка на выгодных условиях.

Трейдеры также используют лимитные ордеры как средство защиты от неблагоприятных ценовых колебаний. Если трейдер опасается резкого падения цены на криптовалюту, он может установить лимитный ордер на продажу ниже своей входной цены. В случае существенного падения цены, этот ордер будет исполнен, что поможет минимизировать потери.

Лимитный ордер: преимущества использования

Лимитные ордера обладают целым рядом преимуществ по отношению к другим типам ордеров на криптовалютных биржах:

- Оптимальные цены: Лимитные ордера позволяют трейдеру указать конкретную цену, по которой он намерен приобрести или продать криптовалюту. Таким образом, они могут помочь трейдеру получить более выгодную цену, в сравнении с рыночными ордерами.

- Полный контроль: Лимитные ордера предоставляют трейдеру полный контроль над ценой сделки. Он может выбрать оптимальный уровень цены для максимизации прибыли или минимизации потерь.

- Гибкость: Лимитные ордера предоставляют трейдеру гибкость в управлении его позициями на рынке. Трейдер может установить лимитный ордер на продажу для защиты своей позиции, или лимитный ордер на покупку для входа на рынок на более выгодных условиях.

- Избежание "проскальзывания": Лимитные ордера помогают избежать проскальзывания, когда сделка совершается по цене, отличающейся от указанной. Если трейдер использует рыночный ордер, цена может измениться во время обработки ордера, что может привести к нежелательным потерям. Лимитный ордер, наоборот, гарантирует исполнение сделки по указанной цене.

- Низкие комиссии: Некоторые криптобиржи предлагают сниженные комиссии за лимитные ордера, что делает их более выгодными для трейдеров.

В целом, лимитные ордера предлагают трейдеру более выгодные условия, чем другие типы ордеров, и позволяют ему более эффективно управлять своими позициями на рынке.

Недостатки использования лимитных ордеров

Несмотря на множество преимуществ, у лимитных ордеров есть и некоторые недостатки:

- Негарантированное исполнение: Лимитный ордер не обеспечивает гарантированное исполнение сделки. Если цена не достигает указанного уровня, ордер останется невыполненным, и трейдеру придется или изменить цену ордера, или отменить его и установить новый.

- Упущенные возможности: Если цена быстро меняется, лимитный ордер может пропустить возможность для сделки, так как цена может не достигнуть указанного уровня.

- Риск потери: Если трейдер устанавливает слишком агрессивную цену для лимитного ордера, сделка может не быть выполнена, что может привести к потере прибыли или даже к убыткам.

Лимитный ордер: вывод и мнение команды Cryptology KEY

Лимитный ордер на криптобирже – это мощный инструмент для трейдеров, который позволяет контролировать цену покупки или продажи криптовалюты. Он позволяет трейдеру точно определить желаемую цену для сделки, защищает его капитал и устанавливает конкретные цели для прибыли. Использование лимитных ордеров является важным элементом эффективной торговли на криптобирже.

Важно отметить, что лимитный ордер - это эффективный инструмент в профессиональных руках, но также это и риски в руках неопытных трейдеров. Новички часто совершают ошибки при работе с лимитными ордерами, забывая выставить stop-loss или отменить ордер, если торговая идея больше не актуальна.

Подобный вид ордеров имеет явные преимущества, но не каждый трейдер их использует, ведь всё зависит от индивидуальной торговой системы каждого трейдера.

Если вы хотите научиться использовать лимитные ордера для эффективной торговли на криптобирже – запишитесь на обучение трейдингу криптовалют в школе трейдинга Cryptology Key.

Что такое лимитный ордер?

Стоит ли использовать лимитные ордера?

Можно ли потерять деньги на лимитном ордере?

Является ли лимитный ордер более безопасным, чем рыночный?

Могу ли я отменить лимитный ордер?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!