Биржа Nasdaq

Биржа Nasdaq появилась в 1971 году, когда национальная ассоциация дилеров по ценным бумагам NASD зарегистрировала компьютерную систему Nasdaq. Nasdaq расшифровывается как National Association of Securities Dealers Automated Quotations – служба автоматизированных котировок Национальной ассоциации дилеров по ценным бумагам. Биржа начинала как электронная доска котировок. Самое интересное, что изначально торговать через нее было невозможно, однако открытые котировки снижали биржевой спред, что было удобно для инвесторов. Кроме этого была возможность видеть объемы торгов. Вскоре функционал торговли был успешно реализован, и Nasdaq превратилась в полноценную биржу. Всего через десять лет после создания, в 1981 году, на Nasdaq было проторговано 37% американских ценных бумаг, что составило 21 миллиард акций.

Nasdaq считается биржей с самой высокой технологичностью. Она в принципе была основана как альтернатива традиционным биржам. В 80-е годы многие трейдеры вели сделки по телефону, но в 1987 году, в период биржевого кризиса, брокеры могли просто не снимать трубки телефонов. Чтобы решить эту проблему, Nasdaq преобразили в полностью электронную торговую систему. Инвесторы смогли размещать заказы на покупку или продажу акций через брокерские компании. Именно поэтому она стала популярной среди технологических компаний и новых стартапов, предпочитающих ее инновационный и децентрализованный подход к торговле. По сути биржа Nasdaq доказала, что для успешного функционирования не нужно помещение.

На данный момент на бирже торгуются акции более 3000 компаний, включая такие известные компании, как Apple, Microsoft, Amazon и Tesla. Биржа NASDAQ проводит около 1,8 миллиарда сделок ежедневно, что превышает объем сделок любой другой фондовой биржи в Соединенных Штатах.

Топ 20 акций на Nasdaq

Кроме акций, на бирже можно купить ETF, облигации и производные финансовые инструменты на товары, валютные пары и даже криптовалюту. Если вы подумали, что это все исключительно американские компании, то это совсем не так. На бирже можно найти акции компаний из более, чем 50 стран мира, например: Samsung (SSNLF) – южнокорейская компания электроники, Adidas (ADDYY) – немецкая компания, которая занимается производством спортивной одежды и обуви.

Кроме того, Nasdaq также является публичной компанией, акции которой торгуются на этой бирже.

Индексы

Индексы Nasdaq Composite (IXIC) и Nasdaq 100 – это два известных индекса, используемых для отслеживания производительности различных компаний, торгующих на бирже Nasdaq.

Nasdaq Composite (IXIC): этот индекс был создан вместе с открытием биржи в 1971 году. Он представляет собой общую картину производительности всех компаний, включая технологические, биотехнологические и другие, котирующиеся на бирже Nasdaq. Nasdaq Composite включает в себя тысячи компаний и широко используется для отслеживания общего тренда на технологических и других рынках.

Nasdaq 100: этот индекс ориентирован на более крупные и ликвидные компании на бирже Nasdaq. Nasdaq 100 исключает компании финансового сектора и включает в себя сто крупнейших компаний, таких как Apple, Amazon, Microsoft, Adobe, Cisco, Facebook и другие. Этот индекс часто используется для оценки производительности крупных технологических компаний.

Компании из потребительского сектора занимают 24% этого индекса и включают в себя предприятия, занимающиеся гостиничным и ресторанным бизнесом, торговлей, а также предоставляющие туристические услуги – речь о таких компаниях как Starbucks, Amazon и Costco. Инновационные медицинские компании составляют 11% индекса.

Часы работы Nasdaq

Торговая сессия на бирже Nasdaq разделена на две части:

- Pre-market – с 4:00 до 9:30 по восточному поясному времени (11:00 до 16:30 по киевскому летнему времени). В это время инвесторы могут размещать заказы на покупку или продажу акций, но они не исполняются до начала основной торговой сессии.

- Основная торговая сессия (regular session) – с 9:30 до 16:00 по восточному поясному времени (16:30 до 23:00 по киевскому летнему времени). В это время исполняются все заказы на покупку или продажу акций.

- Post-market – с 16:00 до 20:00 по восточному поясному времени (23:00 до 03:00 по киевскому летнему времени). Это период торговли активами, который происходит после закрытия стандартной торговой сессии. В этот временной промежуток инвесторы и трейдеры могут продолжать совершать сделки, но крайне не рекомендуется это делать, ведь в это время рынок переходит в фазу очень низкой ликвидность. Спред в это время кратно увеличивается, что можно очень негативно отразиться на ваших сделках. В основном трейдеры и инвесторы используют лимитные ордеры для работы в это время, но и они не всегда исполняются.

Важно упомянуть, что данные часы работы могут смещаться на час из-за перевода времени.

Биржа NYSE

Биржа Нью-Йорка (NYSE), также известная как Нью-Йорская фондовая биржа, является одной из крупнейших и старейших фондовых бирж в мире. Она расположена в Нью-Йорке и служит площадкой для торговли множеством ценных бумаг, включая акции крупных компаний. NYSE имеет долгую историю, начиная с 1792 года. В отличии от Nasdaq, у этой биржи есть помещение, она находится по адресу Уолл-Стрит, 11, и ее площадь составляет приблизительно 1500 кв.м.

Биржа была основана 17 мая 1792 года, когда 24 брокера и коммерсанта под руководством финансиста и банкира Уолл-стрит, подписали соглашение “Buttonwood Agreement" (“Соглашение под платаном”). Этот документ стал основой для создания финансового сообщества, которое занималось обменом ценных бумаг.

В 19 веке NYSE стала стремительно расти, становясь центром торговли акциями многих промышленных компаний, включая железнодорожные и нефтяные. Кроме этого, в 1878 году была внедрена телефонная связь, благодаря которой коммуницировать с брокером стало еще проще.

В 1920-х годах NYSE внедрила технологические инновации, такие как электричество и тикер-тейп, упрощая и ускоряя процессы торговли. Тикер-тейп представлял собой систему отображения актуальных ценных бумаг на бирже. Эта инновация позволила брокерам и трейдерам получать мгновенную информацию о текущих котировках и объемах торгов, что ускорило принятие решений.

В 1934 году Комиссия по ценным бумагам и биржам (SEC) зарегистрировала New York Stock Exchange (NYSE) как национальную фондовую биржу. Это признание укрепило статус NYSE в качестве ключевого участника финансовых рынков США.

В 1950 году NYSE внедрила радио AMEX, транслирующее котировки, движения рыночных индексов и другую важную информацию. Это радио было способом привлечения еще большего числа клиентов, предоставляя им доступ к актуальным данным о рынке. За следующие 10 лет общая ценность акций на бирже возросла с $12 до $23 миллиардов.

В 1975 году New York Stock Exchange (NYSE) перешла из коммерческой структуры в некоммерческую организацию. Этот важный шаг был сделан с целью повышения прозрачности и эффективности торговли, а также для обеспечения более справедливых условий для всех участников рынка. Статус некоммерческой организации подчеркивает прежде всего обязательство биржи перед обществом и инвесторами, а не максимизацию прибыли для акционеров.

В 2006 году NYSE объединилась с Archipelago Exchange (Arca), электронной биржей. Благодаря этому слиянию ценные бумаги биржи стали более доступными инвесторам. Теперь на бирже можно было торговать онлайн, однако, интересно, что в период пандемии COVID-19 в марте 2020 года, когда торговый зал New York Stock Exchange (NYSE) столкнулся с временным закрытием из-за введения карантинных мер, бирже пришлось полностью перейти на электронные торги, и это при том, что на тот момент около 18% от общего объема торгов на NYSE осуществлялось на торговом зале. Это был ответ на изменяющиеся условия и требования, подчеркивающий гибкость и адаптивность финансовых институтов в сложных ситуациях.

На бирже NYSE торгуются акции более 2800 компаний. Ежедневный объем торгов акциями на бирже NYSE составляет в среднем около 1,46 миллиарда акций. Это составляет около 25% от общего объема торгов акциями на всех биржах США.

Топ 20 акций на NYSE

Индексы

В 1966 году Нью-Йоркская фондовая биржа представила составной индекс.

Индекс NYSE Composite (^NYA) – это фондовый индекс, который отслеживает стоимость всех акций, торгуемых на бирже NYSE. В индекс входят акции более 2800 компаний, включая как американские, так и не американские компании. Индекс включает как крупные корпорации, так и меньшие компании, предоставляя инвесторам более полное представление о состоянии рынка.

Индекс NYSE Composite является одним из самых популярных фондовых индексов в мире. Индексы, такие как NYSE Composite Index, предоставляют инвесторам информацию о текущем состоянии рынка. Обновляются они ежедневно.

Часы работы NYSE

Биржа NYSE работает с понедельника по пятницу, с 9:30 до 16:00 по восточному поясному времени (EST). Это означает, что в Киеве биржа работает с 16:30 до 23:00 по киевскому времени (EET).

Торговая сессия на бирже NYSE разделена на две части:

- Ранее открытие (pre-market) – с 4:00 до 9:30 по восточному поясному времени (11:00 до 16:30 по киевскому летнему времени). В это время инвесторы могут размещать заказы на покупку или продажу акций, но они не исполняются до начала основной торговой сессии.

- Основная торговая сессия (regular session) – с 9:30 до 16:00 по восточному поясному времени (16:30 до 23:00 по киевскому летнему времени). В это время исполняются все заказы на покупку или продажу акций.

- Extended Hours (Post-market): с 16:00 до 20:00 по восточному поясному времени (23:00 до 03:00 по киевскому летнему времени). Это период послебиржевой торговли, который начинается сразу после окончания основной торговой сессии. Важно отметить, что пост-маркетная торговля обычно характеризуется меньшей ликвидностью по сравнению с обычными торговыми часами, поэтому торговать в это время не рекомендуется.

Данные часы работы могут смещаться на час из-за перевода времени.

Требования к размещению на Nasdaq

Требования к размещению на бирже Nasdaq зависят от того, на какой площадке биржи компания хочет разместить свои акции. На бирже Nasdaq существуют три площадки:

- Nasdaq Global Select Market (ранее Nasdaq Global Market) – это самая престижная площадка биржи, на которой торгуются акции крупнейших компаний США и мира. Требования к листингу на этой площадке самые строгие.

- Nasdaq Global Market – это площадка для компаний, которые соответствуют менее строгим требованиям, чем для листинга на Nasdaq Global Select Market.

- Nasdaq Capital Market – это площадка для небольших компаний, которые соответствуют еще менее строгим требованиям, чем для листинга на Nasdaq Capital Market.

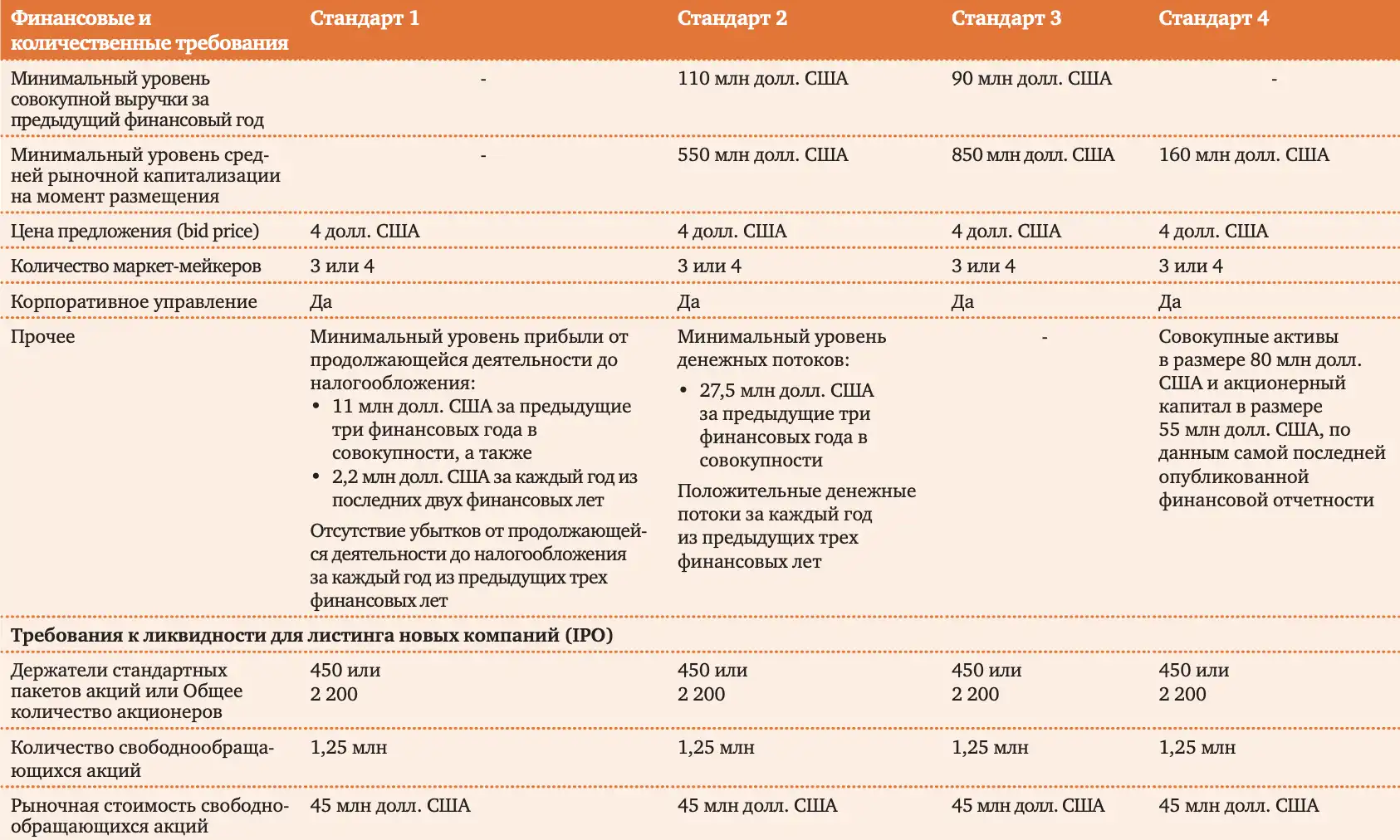

Nasdaq Global Select Market: для того, чтобы компания могла разместить свои акции на данной площадке, она должна соответствовать всем критериям одного из 4 стандартов.

Nasdaq Global Market: для того, чтобы компания могла разместить свои акции на данной площадке, она должна соответствовать всем критериям одного из 4 стандартов.

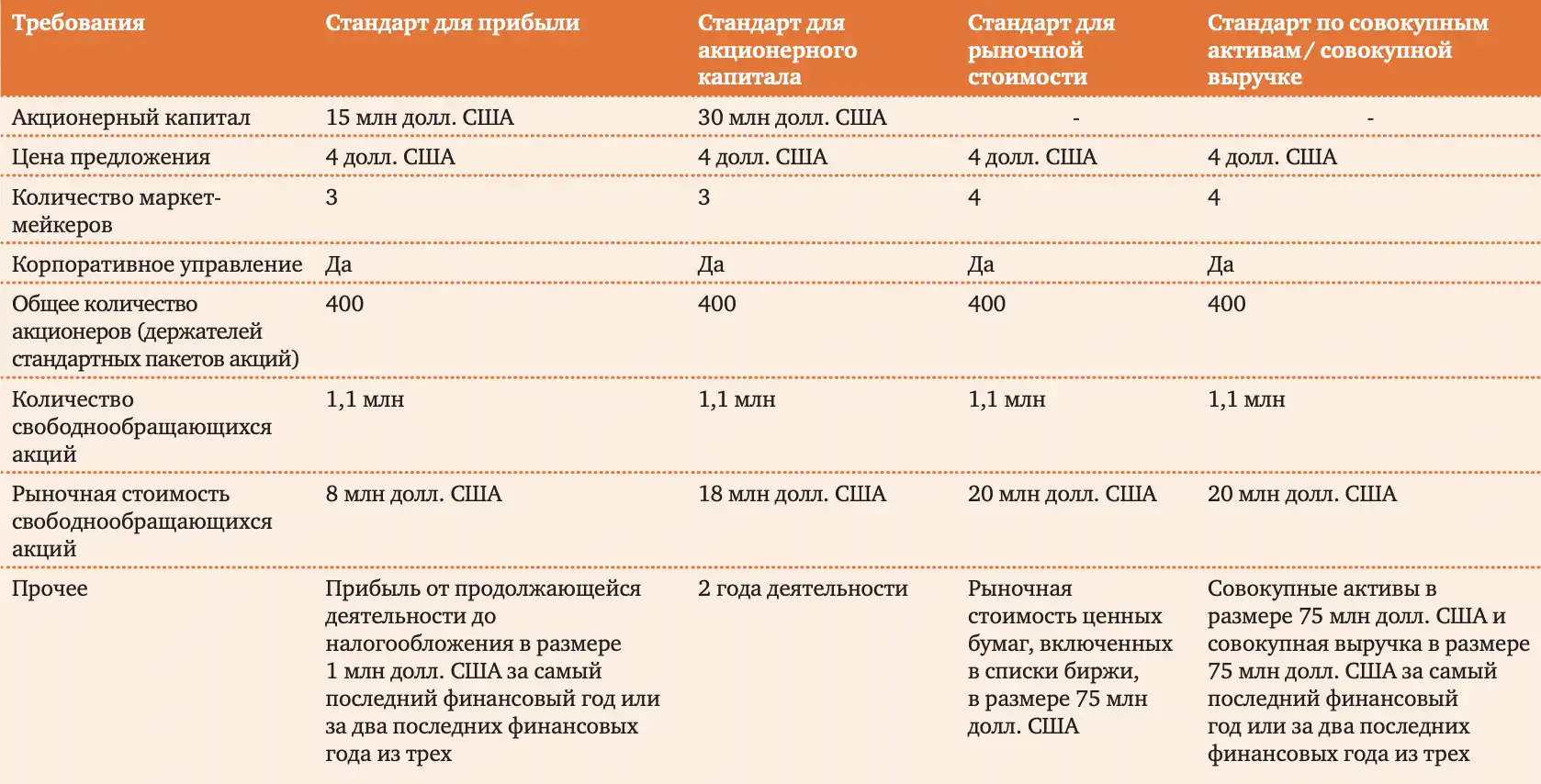

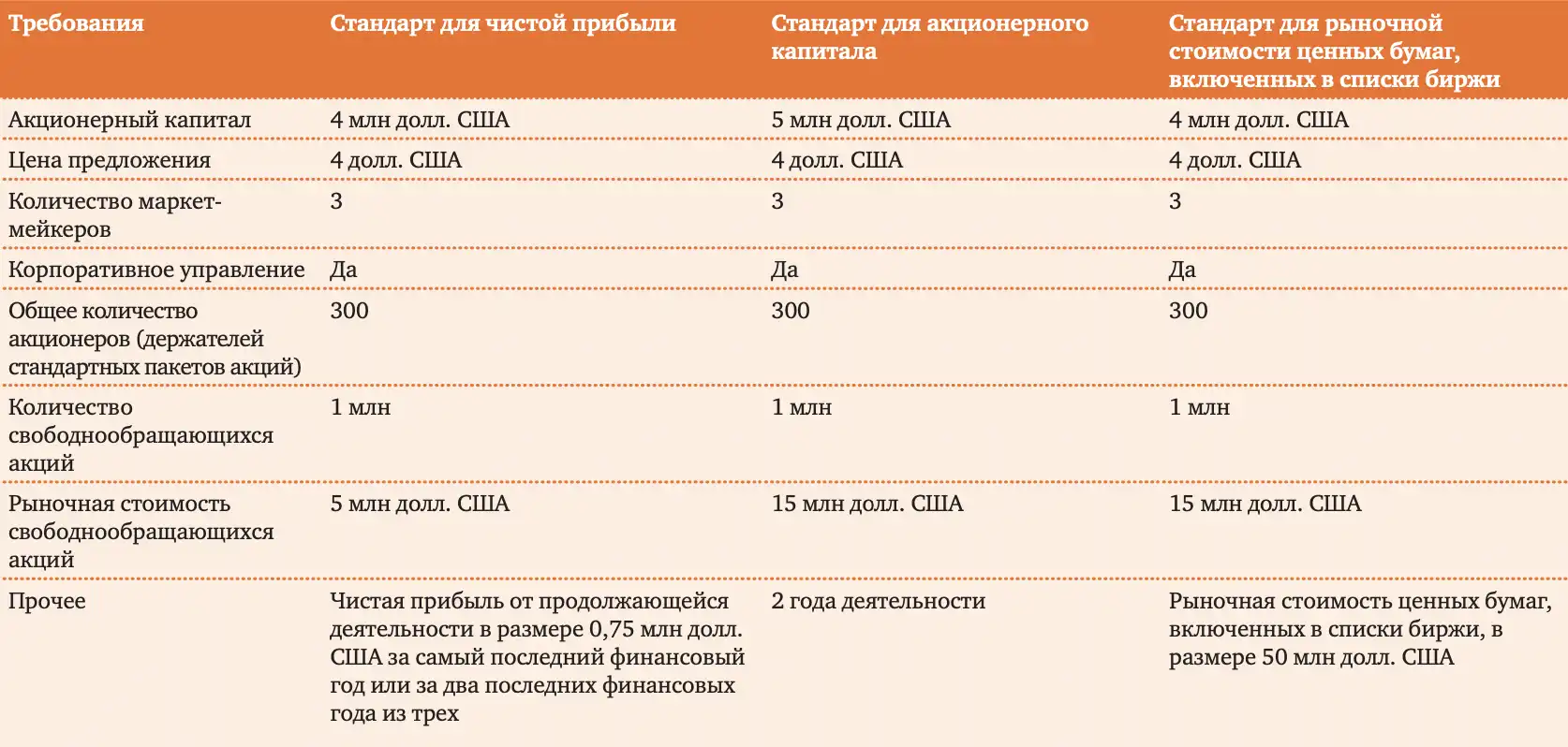

Nasdaq Capital Market: для того, чтобы компания могла разместить свои акции на данной площадке, она должна соответствовать всем критериям одного из 4 стандартов.

Требования к размещению на NYSE

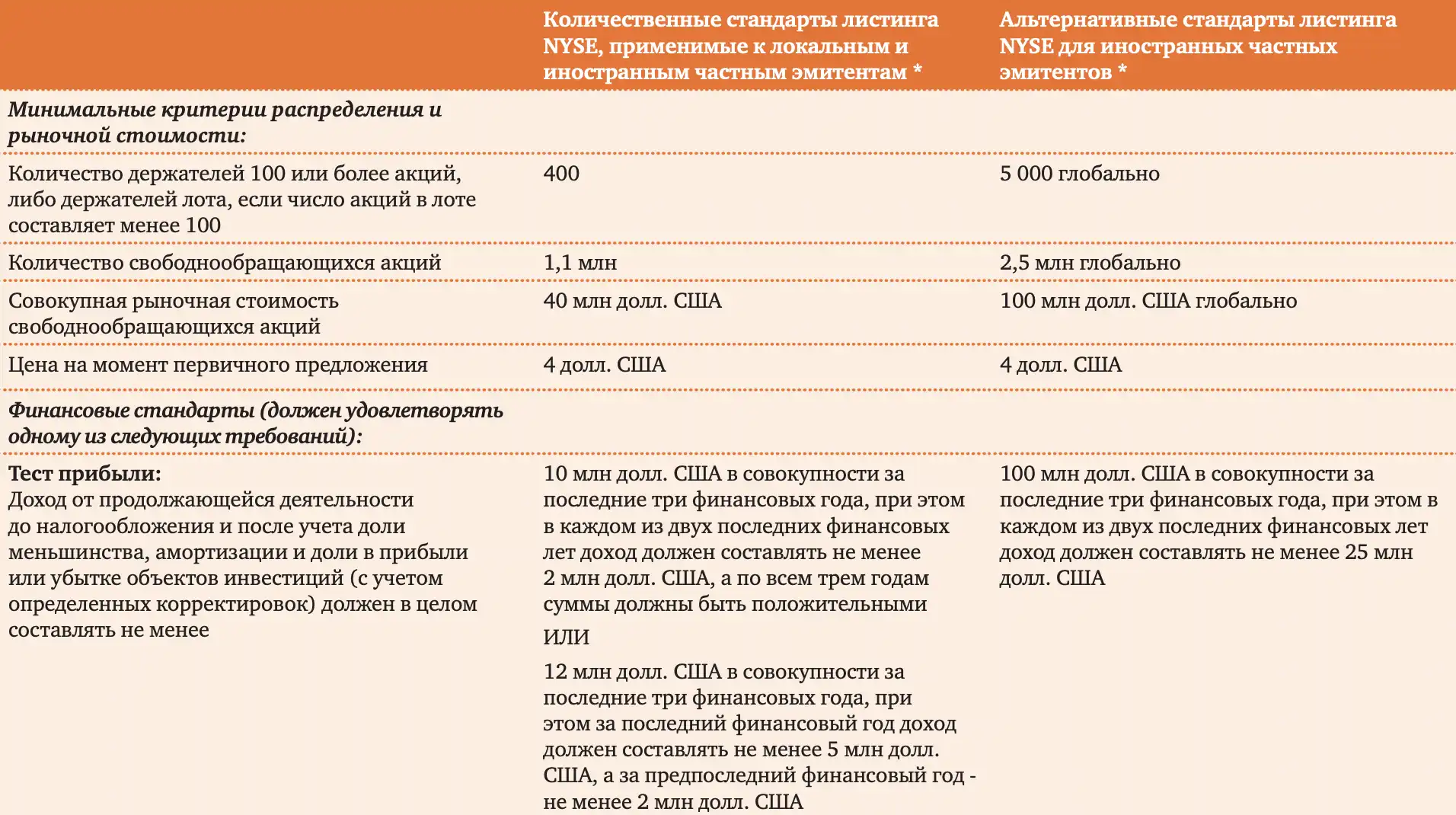

Иностранный частный эмитент на Нью-Йоркской фондовой бирже (NYSE) может выбирать между стандартами листинга, применяемыми к локальным эмитентам, и альтернативными стандартами для иностранных частных эмитентов. Альтернативные стандарты листинга, ориентированные на глобальное распределение акций иностранных компаний, обязательны лишь в случае, если акции этой компании торгуются и пользуются ликвидностью за пределами США.

Любой эмитент, будь то локальный или иностранный частный, обязан соответствовать установленным минимальным критериям в отношении распределения и рыночной стоимости, а также выбрать один из финансовых стандартов.

Где листинг престижнее?

Очень важное отличие двух бирж в их позиционировании и восприятии компаниями:

На NYSE преимущественно продаются акции традиционных крупных компаний, так называемые “голубые фишки”, в то время как NASDAQ предоставляет площадку для инновационных и технологических предприятий. Одной из причин такого положения дел является стоимость листинга на биржах, поскольку для того, чтобы компания могла появиться на них, нужно не только соответствовать требованиям, но и купить “входной билет”. NASDAQ дает доступ к бирже с более низкими стартовыми затратами, составляющими $55,000–$80,000, по сравнению с более высокими стоимостями от $150,000 до $295,000 на NYSE.

Кроме того, требования NYSE включают в себя поддержание внутреннего аудита и соблюдение правил корпоративного управления. В отличие от этого, на NASDAQ такие обязательства отсутствуют, что делает эту биржу более привлекательной для стартапов. Важно отметить, несмотря на более высокую цену листинга, компании на NASDAQ не следует считать менее ценными – они просто выбирают среду, способствующую быстрому росту, даже при повышенной волатильности.

Ликвидность и волатильность: Nasdaq vs. NYSE

Биржа Nasdaq обычно считается более ликвидной, чем биржа NYSE. Это связано с несколькими факторами. В первую очередь, так считается из-за того, что на Nasdaq торгуются акции более 3000 компаний. Получается, что на бирже Nasdaq просто больше спектр выбора, то есть биржа считается более ликвидной вероятно из-за того, что там есть больше активов, которые могут показывать повышенную волатильность.

Например, на Nasdaq торгуются акции NVIDIA – огромной и очень ликвидной и волатильной компании. Еще одним примером может быть Meta – еще одна волатильная и огромная компания. Соответственно это и влияет на то, что Nasdaq немного ликвиднее NYSE. Помимо этого, на бирже Nasdaq преобладают электронные торги, в то время как на бирже NYSE по-прежнему используются традиционные методы торговли, такие как открытое аукционное предложение. Электронные торги обеспечивают более высокую ликвидность, чем традиционные методы торговли, поскольку они позволяют инвесторам быстро и легко размещать заказы на покупку или продажу акций.

Биржа Nasdaq также считается и более волатильной, чем биржа NYSE. Так происходит, поскольку на Nasdaq доминируют технологические компании, которые, как правило, более волатильны, чем компании других отраслей. Плюс ко всему на бирже Nasdaq более широко используются опционы, чем на бирже NYSE.

Опционы представляют собой финансовые контракты, дающие инвестору право (но не обязанность) купить или продать актив по определенной цене в определенный момент в будущем. Опционы – это как договоры о том, что вы можете купить или продать что-то по фиксированной цене в будущем. Они дают вам выбор, но вы не обязаны это делать. Например, опция на покупку позволяет вам купить актив (например, акции) по заранее установленной цене, если захотите. Такие спекуляции могут способствовать увеличению волатильности на биржах.

Преимущества и недостатки Nasdaq

Преимущества Nasdaq

- Высокая ликвидность. Nasdaq является одной из самых ликвидных фондовых бирж в мире. Это означает, что акции легко купить или продать по справедливой цене.

- Широкий охват. На Nasdaq торгуются акции компаний из различных отраслей и стран. Это дает инвесторам широкий выбор для инвестирования.

- Электронные торги. Nasdaq использует электронные торги, которые обеспечивают более высокую скорость и эффективность торгов, чем традиционные методы торговли.

- Прозрачность. Nasdaq имеет строгие требования к раскрытию информации, которые обеспечивают прозрачность для инвесторов.

Недостатки Nasdaq

- Высокая волатильность. Nasdaq считается более волатильной биржей, чем другие биржи. Для трейдеров этот пункт будет скорее преимуществом, а не недостатком, поскольку там, где выше волатильность, там и больше движений, на которых можно заработать. Однако, для инвесторов это не такой большой плюс, так как цены на акции могут колебаться достаточно сильно.

- Меньший престиж. В сравнении с NYSE, Nasdaq может иметь меньший престиж из-за своего профиля, ориентированного на технологический сектор и стартапы.

- Отсутствие торгового зала: Nasdaq в отличие от NYSE не имеет традиционного торгового зала с аукционами, что может снизить некоторые традиционные аспекты биржевой торговли.

Преимущества и недостатки NYSE

Преимущества NYSE

- Высокая капитализация. NYSE является крупнейшей фондовой биржей в мире по рыночной капитализации. Это означает, что на бирже торгуются акции крупнейших компаний в мире.

- Традиционный статус. NYSE имеет более чем 200-летнюю историю, что делает ее одной из старейших и наиболее уважаемых фондовых бирж в мире.

- Строгие требования к листингу. NYSE имеет строгие требования к листингу, которые обеспечивают защиту инвесторов.

Недостатки NYSE

- Ликвидность. NYSE считается менее ликвидной биржей, чем Nasdaq. Это означает, что акции могут быть труднее купить или продать по справедливой цене.

- Более низкие темпы роста. NYSE торгует акциями компаний из более традиционных отраслей, которые, как правило, имеют более низкие темпы роста, чем технологические компании, которые доминируют на Nasdaq.

- В сравнении с Nasdaq, NYSE может иметь более устойчивые и менее подверженные колебаниям курсы акций, что может не привлекать трейдеров, ищущих более высокую волатильность и потенциальную прибыль.

Nasdaq vs NYSE: что лучше? Мнение команды CRYPTOLOGY KEY

Nasdaq и NYSE – две известные на весь мир биржи, каждая со своими особенностями. Nasdaq обычно ассоциируется с чем-то более современным, как минимум, по той причине, что она изначально была основана как альтернатива традиционным биржам, запущенная как электронная торговая система. Она привлекательна для стартапов, поскольку предлагает более простой и экономичный способ размещения акций по сравнению с NYSE.

С другой стороны, NYSE считается более традиционной. Она все еще сохраняет традиционные торги в зале (это также придает ей особую атмосферу и статус). Размещение на NYSE часто воспринимается как более престижное, особенно для крупных, устоявшихся компаний. Это связано с историей и репутацией NYSE, которая длительное время считалась ведущей мировой фондовой биржей.

Однако выбор между Nasdaq и NYSE зависит от конкретных целей и стратегий компаний или инвесторов. Nasdaq привлекает инновационные и технологические компании, в то время как NYSE привлекает традиционные индустриальные гиганты. Также важно учитывать различия в структуре и правилах торговли на этих биржах. Nasdaq использует систему маркет-мейкеров для поддержки торгов, тогда как NYSE применяет гибридную модель, включающую как флор-трейдеров, так и электронную торговлю.

Важным моментом является то, что только белый бизнес, который подчиняется законодательству и регулятору может претендовать на листинг на таких крупных биржах. Перед листингом на бирже компанию проверяют по всем аспектам, связанным с оплатой налогов (в том числе проверяется, все ли сотрудники официально трудоустроены). Кстати, это одна из главных причин, почему на бирже торгуются акции Coinbase, но на ней нет Binance.

Nasdaq и NYSE предлагают разные возможности и опыт для компаний и инвесторов. Выбор между ними зависит от множества факторов, включая размер компании, отрасль, корпоративную стратегию и требования к листингу. Обе биржи играют ключевую роль на глобальном финансовом рынке, и нельзя однозначно сказать, что одна лучше другой – они просто разные.

Что такое Nasdaq?

Какие собственные индексы существуют на бирже Nasdaq?

Что такое NYSE?

Какие собственные индексы существуют на бирже NYSE?

Какая биржа престижнее?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!