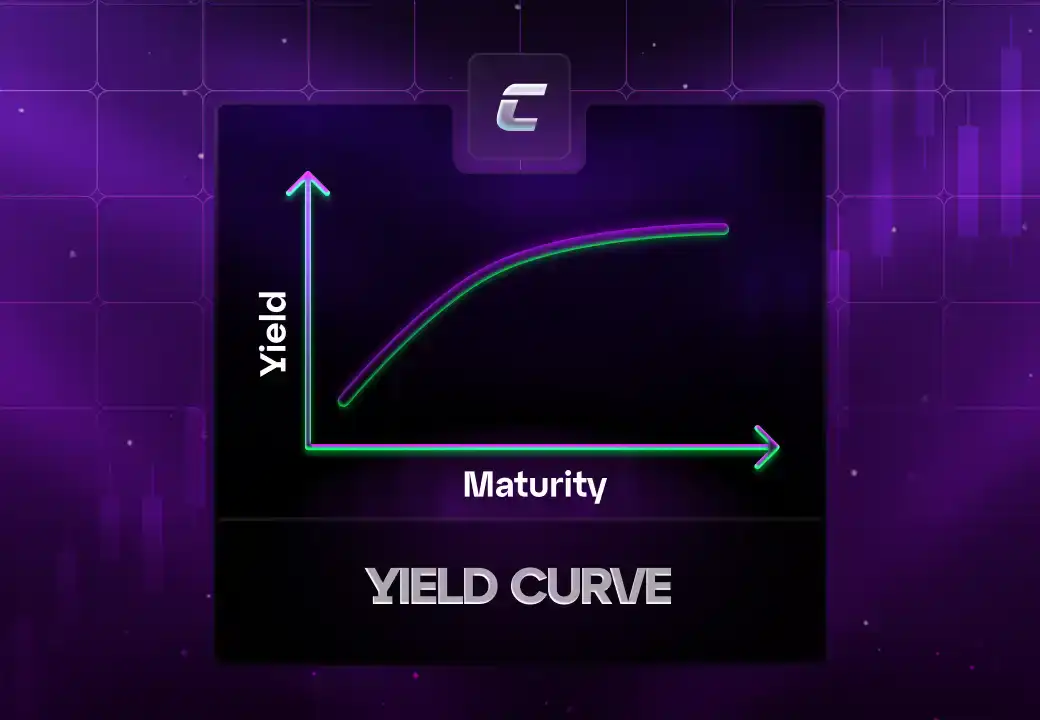

Кривая доходности - это графическое представление, иллюстрирующее зависимость между процентными ставками и сроком погашения долговых ценных бумаг, обычно государственных облигаций. Она играет ключевую роль в отображении настроений инвесторов относительно будущих процентных ставок и экономической активности, служа важным инструментом финансового анализа.

Существуют три основных типа кривых доходности:

- нормальная.

- инвертированная.

- плоская.

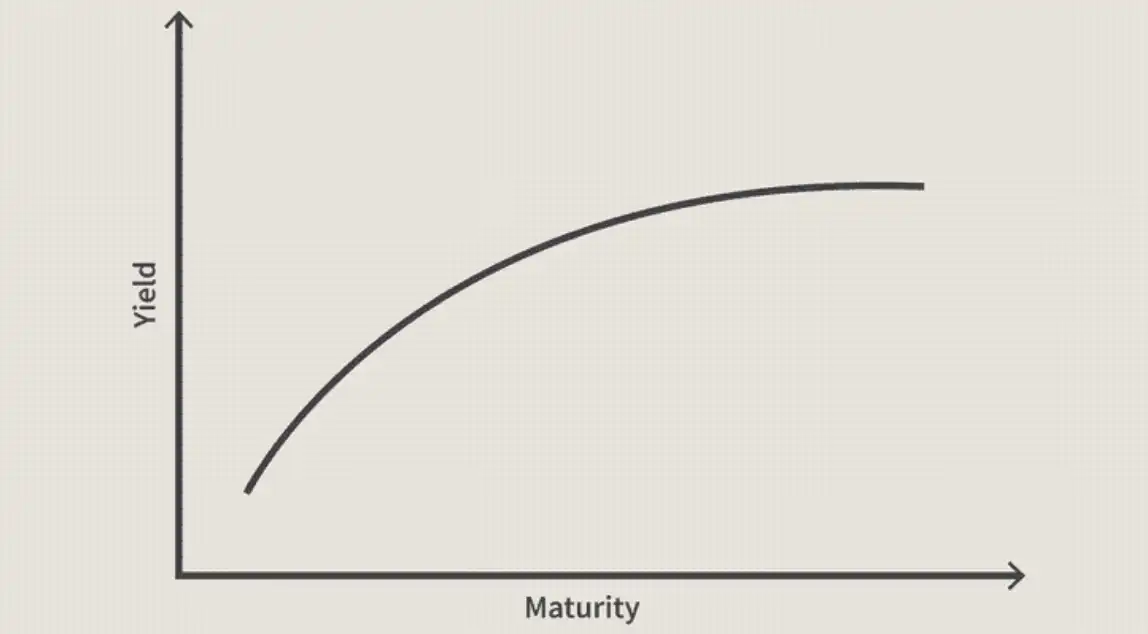

Нормальная кривая доходности имеет восходящий наклон, что указывает на то, что облигации с более длинными сроками имеют более высокие доходности по сравнению с краткосрочными облигациями, отражая ожидания экономического роста.

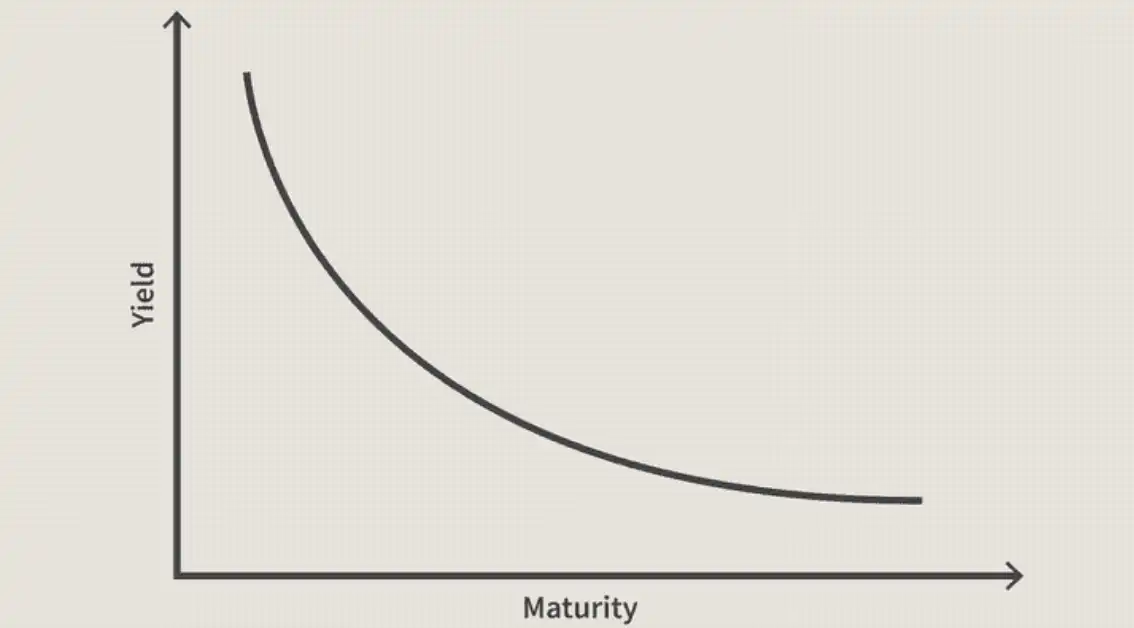

Инвертированная кривая доходности, при которой краткосрочные ставки превышают долгосрочные, часто сигнализирует о надвигающейся рецессии.

Плоская кривая доходности указывает на неопределенность в отношении будущей экономической ситуации.

Нормальная кривая доходности обычно имеет восходящий наклон, отражая более высокие процентные ставки для долгосрочных облигаций. Такая ситуация указывает на здоровую экономику, где инвесторы ожидают роста, что приводит к увеличению спроса на долгосрочные инвестиции. В этом случае облигации с нулевым купоном предоставляют привлекательные возможности для зафиксирования доходности на длительный срок.

Напротив, инвертированная кривая доходности возникает, когда краткосрочные процентные ставки превышают долгосрочные. Это явление обычно сигнализирует о надвигающемся экономическом замедлении или рецессии, поскольку инвесторы предпочитают зафиксировать более высокие доходности на короткие сроки, увеличивая спрос на облигации с нулевым купоном как на безопасное убежище.

Плоская кривая доходности характеризуется незначительной разницей между краткосрочными и долгосрочными процентными ставками, что указывает на неопределенность в экономическом прогнозе. В этот период инвесторы могут искать облигации с нулевым купоном для управления рисками, пока рынок стабилизируется.

Для кредиторов плоская кривая доходности также может указывать на то, что вскоре мы вступим в период низких ожиданий по инфляции. Кредиторы и инвесторы хотят, чтобы доходность долгосрочных инвестиций компенсировала эффект инфляции на их вложения. Однако, когда кривая доходности выравнивается и ожидается низкая инфляция, инвесторы будут менее озабочены влиянием инфляции и будут рассматривать альтернативные затраты долгосрочных инвестиций.

Проще говоря, когда кривая доходности плоская, инвесторы получают одинаковую доходность от краткосрочных и долгосрочных инвестиций. Это может оказать множество эффектов на рынок, включая снижение интереса к долгосрочным инвестициям из-за отсутствия чистой выгоды по сравнению с краткосрочными инвестициями. В таком рынке многие инвесторы будут склоняться к краткосрочным облигациям, избегая долгосрочных облигаций, так как они не несут рисков, связанных с замораживанием финансов в долгосрочных облигациях при одинаковой прибыли и потенциале.

Риск кривой доходности относится к неблагоприятному влиянию изменения процентных ставок на доходность облигаций. Он возникает из-за того, что цены на облигации и процентные ставки имеют обратную взаимосвязь. Цены облигаций на вторичном рынке снижаются при росте рыночных процентных ставок и наоборот.

Например, если кривая доходности облигаций указывает на замедление экономики, инвестор может перевести свои средства в защитные активы, которые традиционно хорошо ведут себя в период рецессии.

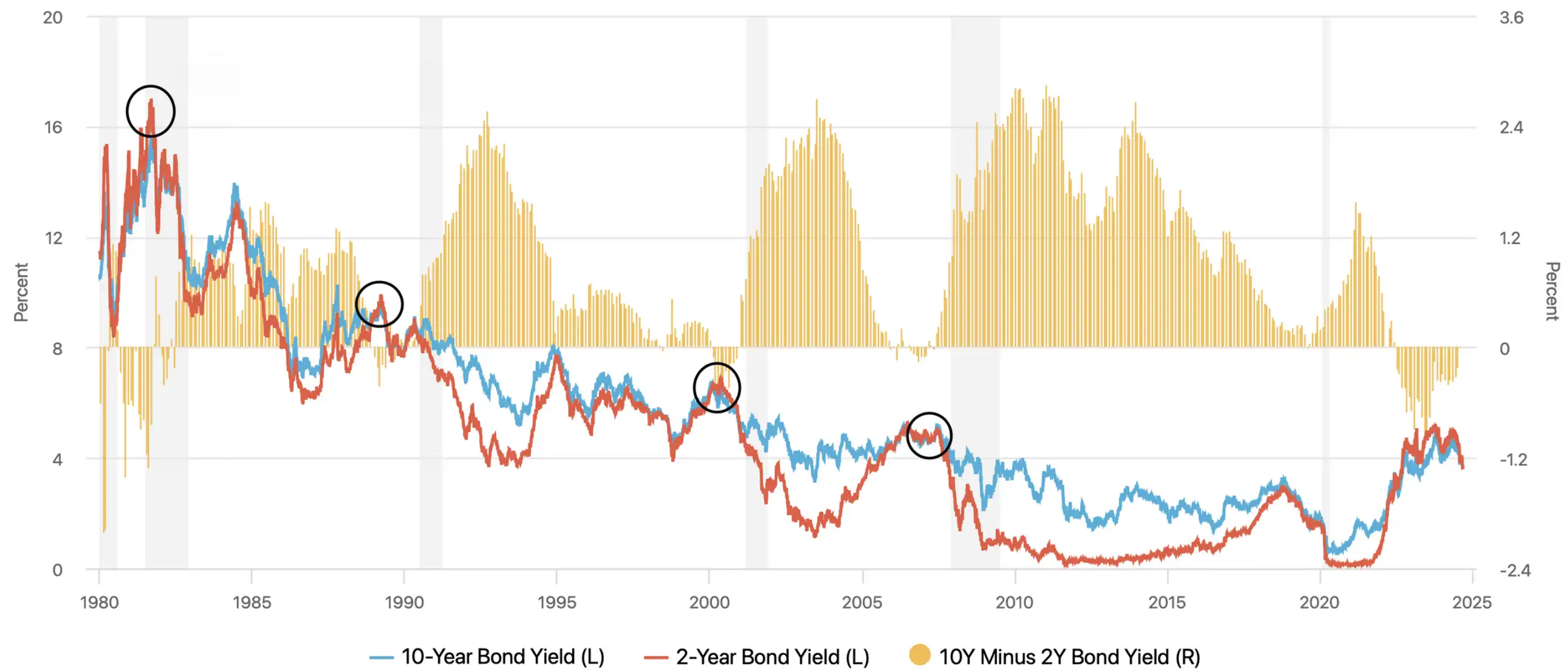

Существует несколько теорий, объясняющих, почему инверсия кривой доходности может указывать на рецессию. Одна теория заключается в том, что она отражает ожидания инвесторов о снижении процентных ставок в будущем. Когда инвесторы ожидают снижения процентных ставок, они покупают облигации с более длинным сроком погашения, которые будут приносить более высокую доходность после снижения процентных ставок. Это приводит к повышению цен на облигации с более длинным сроком погашения и, соответственно, к снижению их доходности.

Другая теория заключается в том, что инверсия кривой доходности отражает ожидания инвесторов о замедлении экономического роста. Когда экономика замедляется, инвесторы требуют более высокую доходность за более высокий риск. Это приводит к повышению доходностей облигаций с более коротким сроком погашения, которые считаются более рискованными, чем облигации с более длинным сроком погашения.

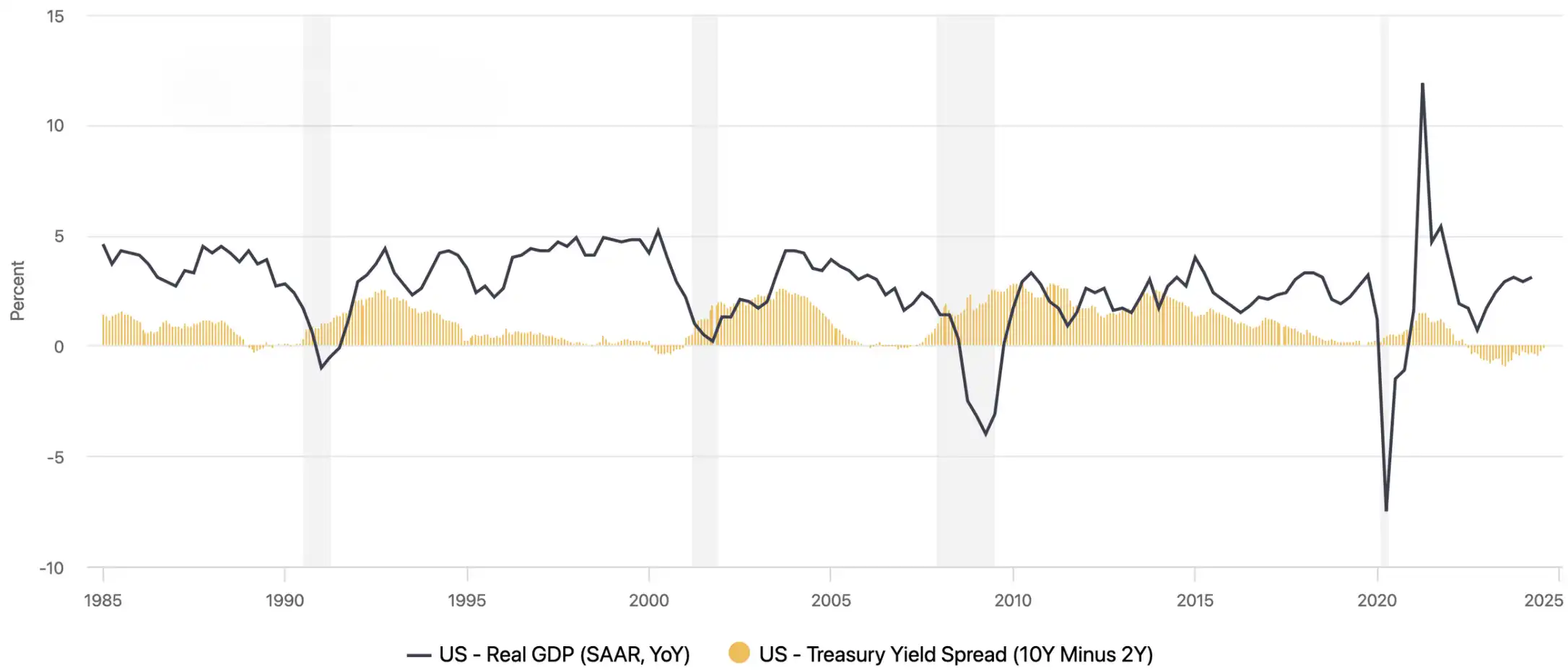

Исторические закономерности

Исторические данные в большинстве случаев подтверждают, что инверсия указывает на потенциальное снижение экономической активности после выхода из нее.

На протяжении истории инверсия кривой доходности часто предшествовала рецессии. Однако важно отметить, что инверсия кривой доходности не является точным индикатором рецессии. В некоторых случаях инверсия кривой доходности не приводила к рецессии, а в других случаях рецессия наступала без инверсии кривой доходности.

Как вы знаете, в текущих реалиях мы тоже находимся в инверсии 10y 2y notes, но будет ли рецессия в этот раз - неизвестно. Данный цикл не похож на предыдущие поэтому никто с точностью не может ответить на этот вопрос.

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!