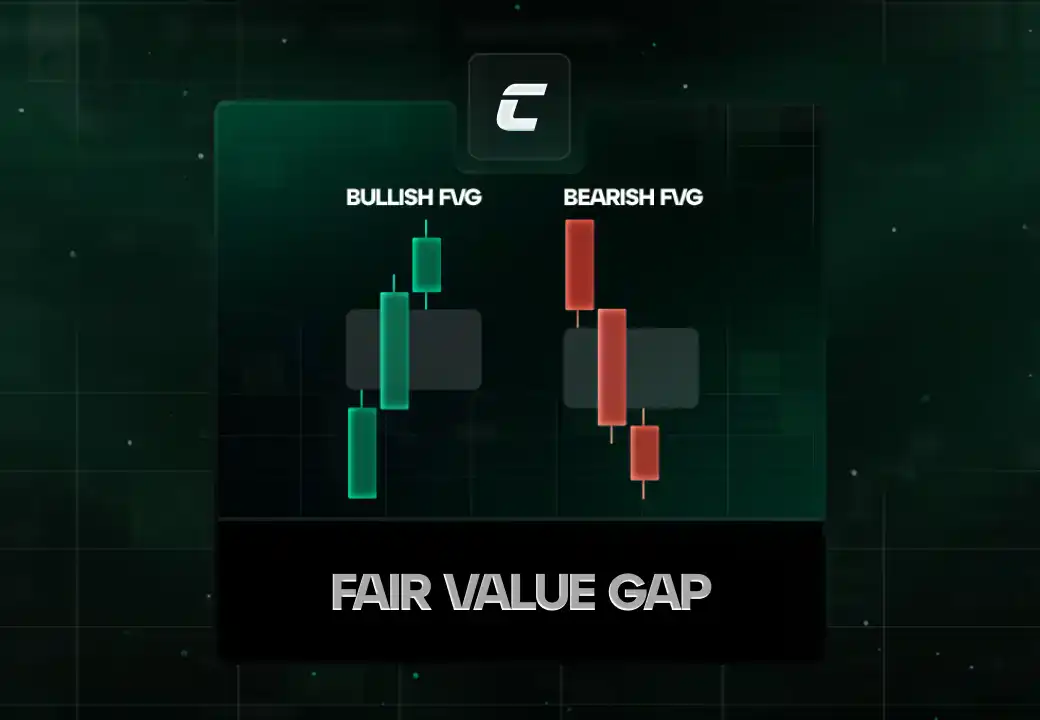

Разновидность: Fair Value Gap (FVG)

В мире финансов и торговли на финансовых рынках стоп-лимитный ордер — это неотъемлемый инструмент, который необходим для успешной стратегии торговли.

Чаще всего у новичков стоп-лимит ордер ассоциируется со словом стоп. Если сравнить стоп ордер и стоп-лимит ордер, кажется что это одно и тоже, но это не совсем так. С помощью стоп-лимитного ордера можно выставить стоп ордер, но это не все возможности, которые он нам дает. Стоп-лимитный ордер предлагает больший контроль и возможность индивидуальной настройки.

Но что это такое? Как и когда его следует использовать? Давайте разберемся.

Что такое лимитный стоп-ордер?

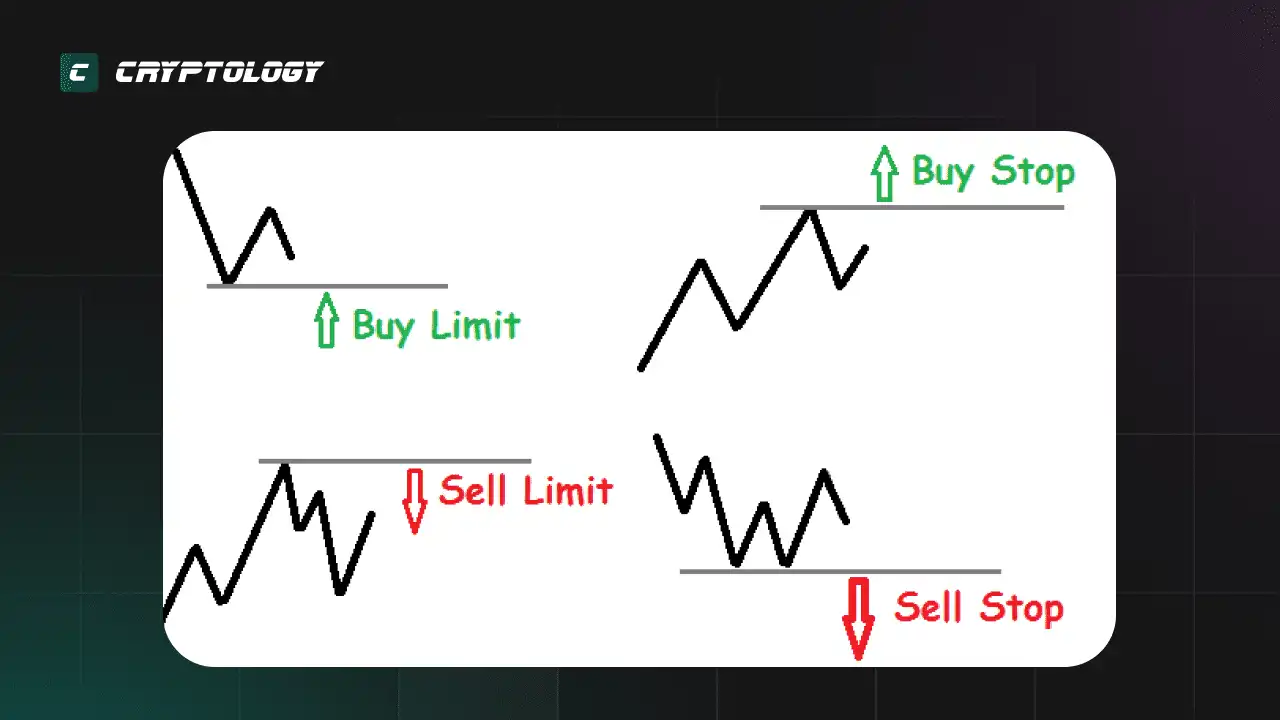

Вкратце, стоп-ордер — это тип ордера, который предполагает покупку или продажу валютной пары (или другого актива), когда его цена достигает указанного уровня, известного как стоп-цена. Это похоже на навигационную систему в вашем автомобиле: когда вы достигаете определенной точки, она подает сигнал.

Лимитный ордер же — это тип ордера, который предназначен для покупки или продажи актива по цене, которая либо лучше, чем текущая рыночная цена, либо соответствует ей. Это словно говорить вашему агенту по недвижимости, что вы готовы купить дом, но только по определенной цене.

Таким образом, лимитный стоп-ордер — это комбинированный инструмент, который начинает действовать как стоп-ордер, когда достигается стоп-цена, и затем превращается в лимитный ордер.

Как работает лимитный стоп-ордер?

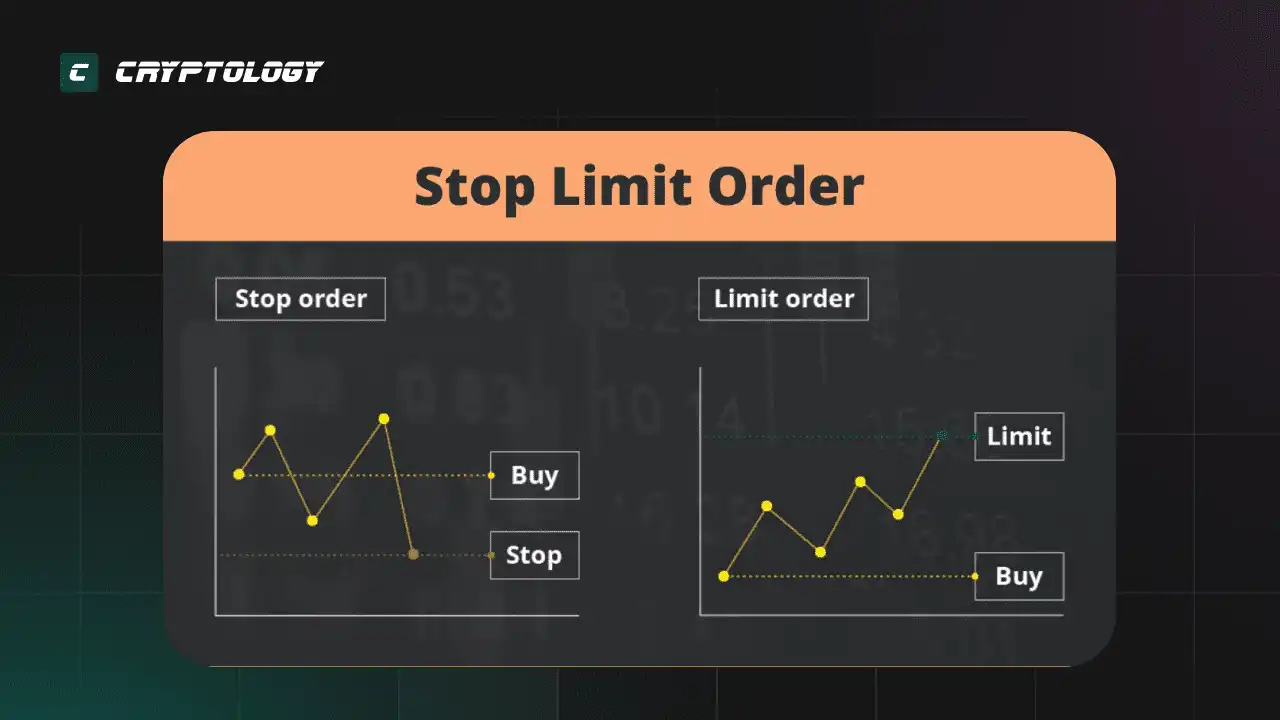

Теперь, когда мы уяснили, что такое стоп-ордер и лимитный ордер, давайте объединим их и узнаем, как работает лимитный стоп-ордер.

Лимитный стоп-ордер начинает свою работу как стоп-ордер. Вы устанавливаете стоп-цену, которая представляет собой цену активации. После того, как рыночная цена достигает или превысит эту стоп-цену, ваш стоп-ордер превращается в лимитный ордер.

В этом состоянии, ваш ордер будет исполнен только по цене, которую вы установили в качестве лимитной цены, или по лучшей цене. Если рынок движется слишком быстро и ваша лимитная цена не может быть исполнена, ваш ордер остается в системе до тех пор, пока не будет достигнута необходимая цена для его исполнения.

Таким образом, лимитный стоп-ордер обеспечивает вам больше контроля над ценой исполнения. Вместо того, чтобы просто выставить стоп-ордер и надеяться на лучшее, лимитный стоп-ордер позволяет вам установить точное значение, по которому вы хотите купить или продать ценную бумагу.

Простыми словами, лимитный стоп-ордер работает следующим образом:

- Вы устанавливаете стоп-цену.

- Вы устанавливаете цену лимитного ордера.

- Когда рынок достигает эту стоп-цену, ваш стоп-ордер превращается в лимитный ордер.

- Этот лимитный ордер затем будет исполнен по вашей лимитной цене или лучше.

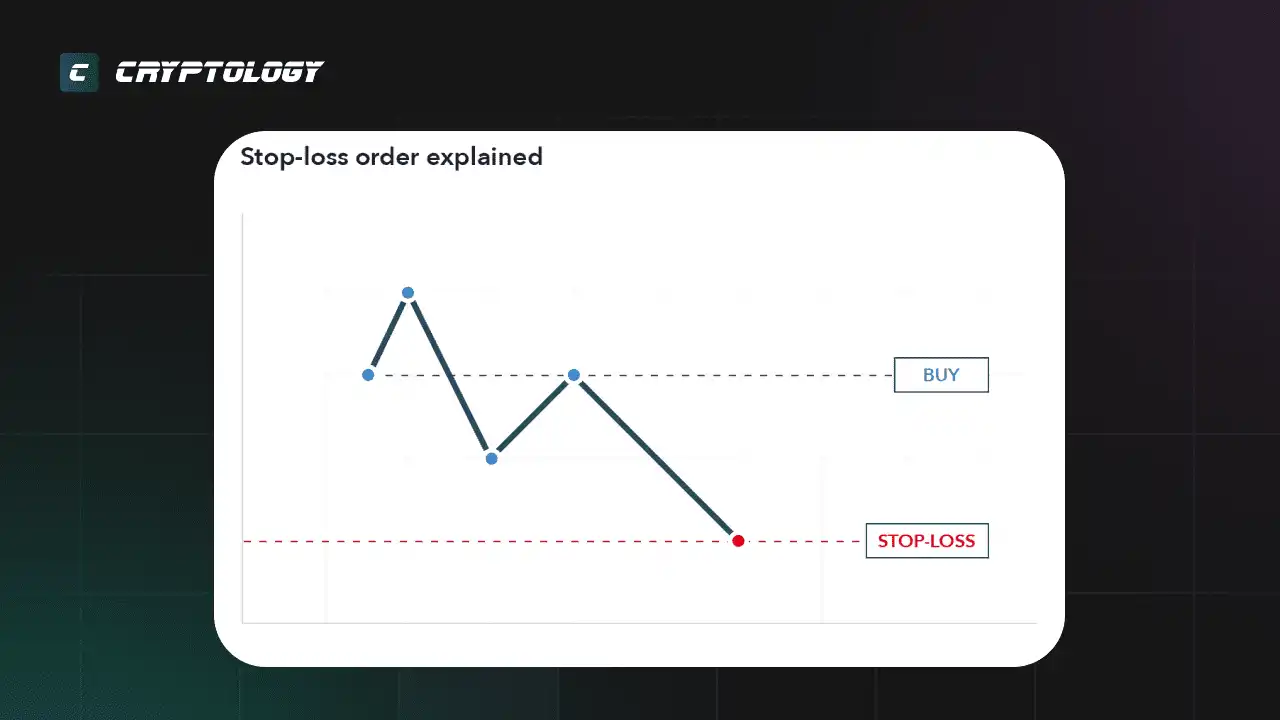

Этот механизм работы делает лимитный стоп-ордер особенно полезным в ситуациях высокой волатильности, когда цены могут быстро изменяться, а обычные стоп-ордеры могут привести к нежелательным сделкам.

Понимание того, как работает лимитный стоп-ордер, является ключевым элементом успешной торговой стратегии. Он может обеспечить вам больше контроля и гибкости в ваших торговых решениях, помочь управлять рисками и защитить вашу потенциальную прибыль.

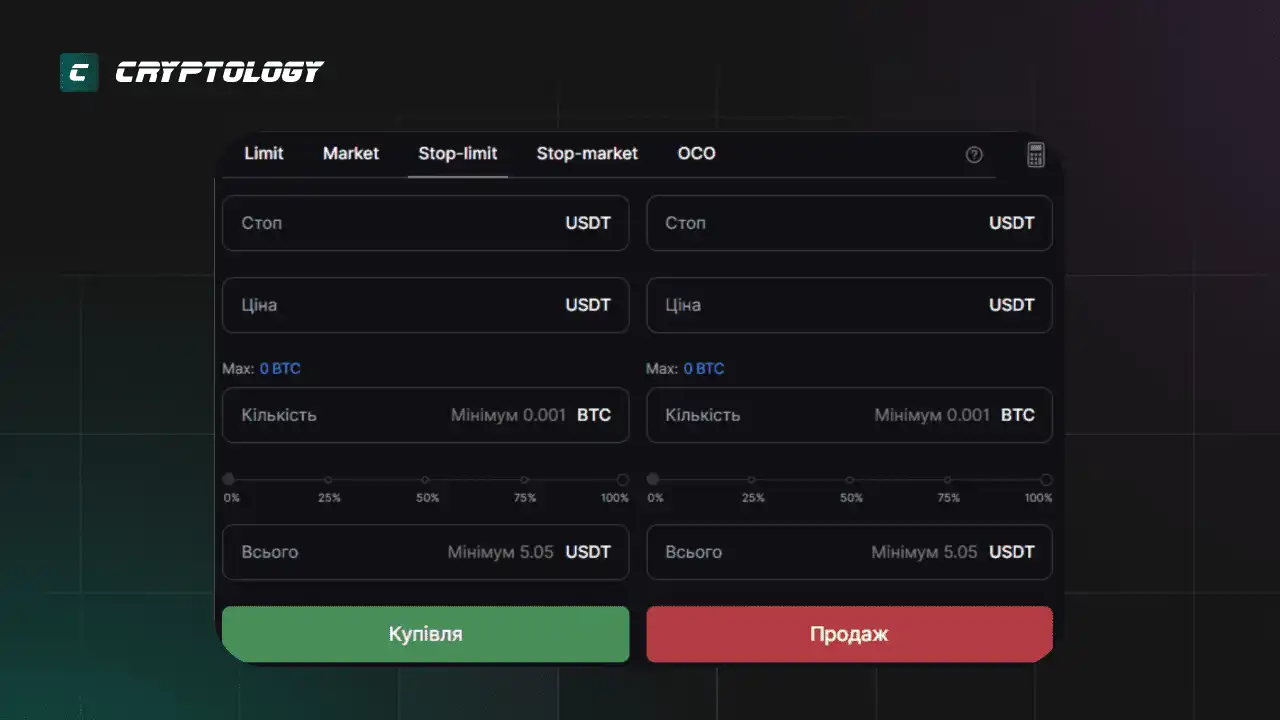

- Stop (Стоп) - это цена активации лимитного стоп-ордера.

- Price (Цена) - это цена лимитного ордера.

- Amount (Количество) - это количество актива, которое вы хотите купить/продать.

Когда использовать стоп-лимитные ордера

Стоп-лимитные ордера несомненно полезны в некоторых ситуациях. В частности, если вы антиципируете, что торгова пара может взлететь или упасть до определенного уровня, но затем изменить свое направление. Или, возможно, вы просто хотите убедиться, что вы будете в состоянии купить или продать актив только при достижении конкретной цены.

Важно понимать, что стоп-лимитный ордер может не выполниться, если цена актива после достижения стоп-цены не достигает лимитной цены.

Преимущества использования лимитного стоп-ордера

- Защита от волатильности: Стоп-лимитный ордер помогает защитить ваши активы от значительных колебаний цен. Это особенно полезно на волатильных рынках, где цены могут резко меняться.

- Гибкость и контроль: Этот тип ордера дает трейдеру больше контроля над условиями сделки. Вы можете определить, при какой цене хотите купить или продать актив, и ордер будет исполнен только при условии, что рынок достигнет этих уровней.

- Автоматизация торговли: Такие ордера позволяют установить условия сделки заранее, что делает процесс торговли менее трудоемким и уменьшает вероятность пропуска важных рыночных моментов.

Недостатки использования лимитного стоп-ордера

Несмотря на множество преимуществ, стоп-лимитный ордер не лишен недостатков:

- Риск невыполнения: В отличие от обычных стоп-ордеров, стоп-лимитные ордеры не гарантируют выполнения. Если цена актива не достигнет указанной лимитной цены после активации стоп-цены, сделка не будет выполнена.

- Сложность: Новичкам может быть сложно понять, как работают стоп-лимитные ордера, и правильно их использовать.

- Потенциальные потери: Если рынок движется в противоположном от ожидаемого направлении и цена актива не достигает лимитной цены, трейдер может потерять возможность купить актив по более низкой цене или продать по более высокой.

Стратегии размещения лимитных стоп-ордеров

Теперь, когда мы проникли в детали того, как работают стоп-лимитные ордера, давайте рассмотрим некоторые стратегии, которые могут помочь вам эффективно их использовать в трейдинге:

- Установите реалистичные цены: Убедитесь, что ваши стоп- и лимитные цены являются достижимыми на текущем рынке. Рынок должен быть способен достигнуть этих цен, чтобы ваш ордер был выполнен.

- Понимайте рынок: Изучите динамику рынка и определите, насколько вероятно, что цена достигнет уровней, которые вы установили. Старайтесь понять, как ваш актив ведет себя в различных рыночных условиях.

- Управление рисками: Важно, чтобы ваши стоп-лимитные ордера соответствовали вашей общей стратегии управления рисками. Устанавливайте ордера так, чтобы минимизировать потери и защитить свои инвестиции.

- Адаптация к изменениям на рынке: Мир финансов постоянно меняется, и ваша стратегия торговли также должна быть гибкой. Не бойтесь корректировать свои стоп-лимитные ордера в ответ на изменения рыночных условий.

Стоп-лимитный ордер: вывод от команды Cryptology KEY

В заключение хочется сказать, что стоп-лимитные ордера являются весомым инструментом для трейдера. Они не только обеспечивают некоторый уровень автоматизации и контроля над вашими сделками, но и позволяют управлять рисками и максимизировать прибыль. Тем не менее, они не лишены недостатков, и требуют аккуратного применения и глубокого понимания рынка.

Помните, на пути к успеху в трейдинге нет места для спешки. Тщательное изучение и понимание инструментов, таких как стоп-лимитные ордера, является неотъемлемой частью этого процесса. Уделите время на подготовку, продолжайте учиться и старайтесь всегда быть на шаг впереди рынка.

Удачи в ваших инвестициях!

Если вы хотите узнать больше о криптовалютах и получить навыки, опыт и инструменты, которые можно сразу применить на криптовалютном рынке, запишитесь на курсы трейдинга в школу трейдинга CRYPTOLOGY.

Что такое стоп-лимитный ордер?

В чём отличие стоп-лимитного ордера от обычного лимитного или стоп ордера?

Есть ли риски, связанные со стоп-лимитными ордерами?

Какие есть альтернативы стоп-лимитному ордеру?

Можно ли отменить стоп-лимитный ордер?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!