Что такое Price Action?

Прайс экшн (англ. Price Action) - это метод анализа движения цен на финансовых рынках без использования индикаторов или других технических средств. Основное внимание уделяется чистому графику, где трейдер анализирует поведение цены на основе паттернов, свечных моделей, уровней поддержки и сопротивления, а также общих рыночных условий. Прайс экшн используется на всех финансовых рынках, включая акции, форекс, криптовалюты, товары и другие активы.

Ценовое действие: объяснение

Ценовое действие основывается на анализе различных форм и паттернов, которые образуют графики цен. Эти паттерны могут дать трейдерам понимание текущего состояния рынка и предоставить намеки на возможное будущее поведение цен. Они также помогают идентифицировать точки входа и выхода, уровни стоп-лосс и тейк-профит.

Существует целый спектр инструментов для построения графиков и настроек графика для анализа ценового действия. Наиболее популярные из них - это график японских свечей. Японские свечи формируют определенные паттерны или модели на графике. Эти модели позволяют прогнозировать возможное дальнейшее движение цен и, соответственно, выбирать оптимальные точки для входа и выхода из сделок.

Основные элементы Price Action

- Цена: главный объект внимания в прайс экшн. Трейдеры анализируют, как изменяется цена актива на определенных уровнях, а также ее динамику.

- Свечные модели - это определенные паттерны, которые образуются из нескольких свечей и сигнализируют о возможных изменениях направления движения цены или продолжения тренда.

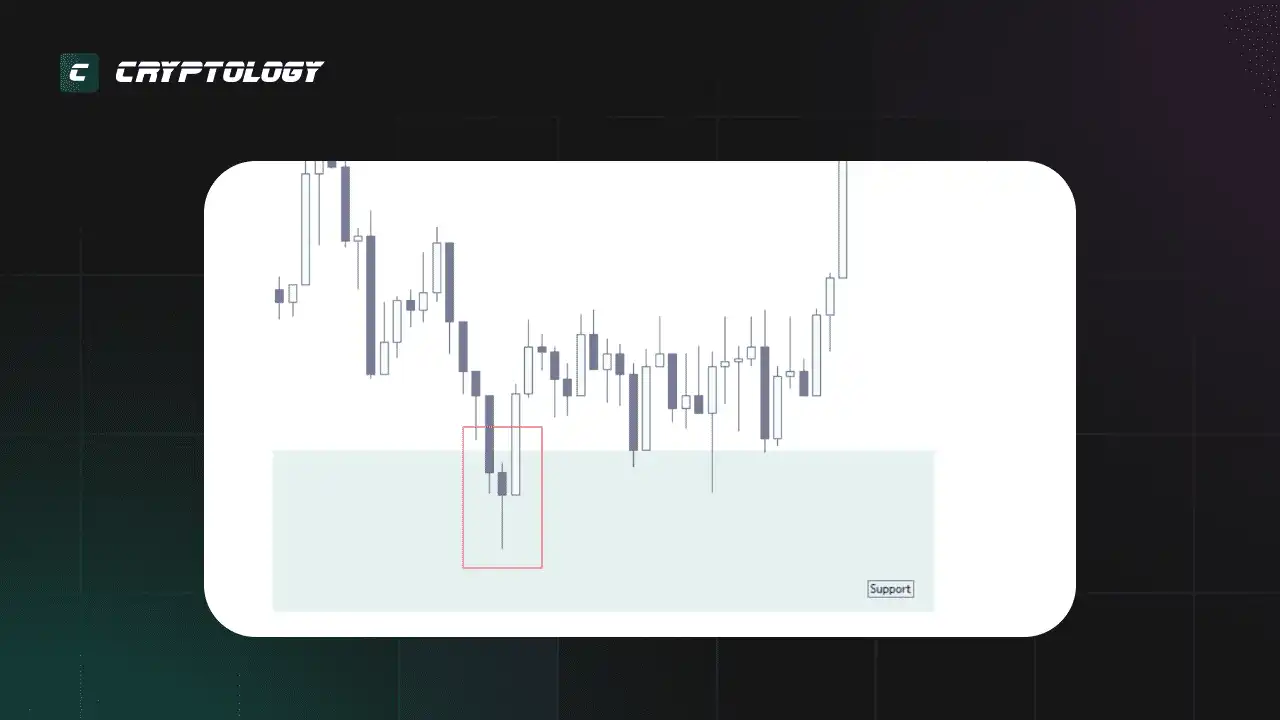

- Уровни поддержки и сопротивления: это ключевые зоны на графике, где цена часто останавливается или разворачивается. Поддержка - это уровень, на котором цена имеет тенденцию останавливать падение, а сопротивление - это уровень, где цена встречает препятствие для дальнейшего роста.

- Тренд - это направление, в котором движется цена. Тренд может быть восходящим, нисходящим или боковым. Трейдеры прайс экшн используют тренды для принятия решений о входе или выходе из сделок.

Как работает Price Action?

Прайс экшн базируется на наблюдении за поведением цены на графике и анализе ее реакций на различные уровни. Например, если цена несколько раз отбивается от определенного уровня поддержки или сопротивления, трейдер может предположить, что этот уровень важен для рынка и будет использовать его для планирования своих сделок.

Основные принципы Price Action

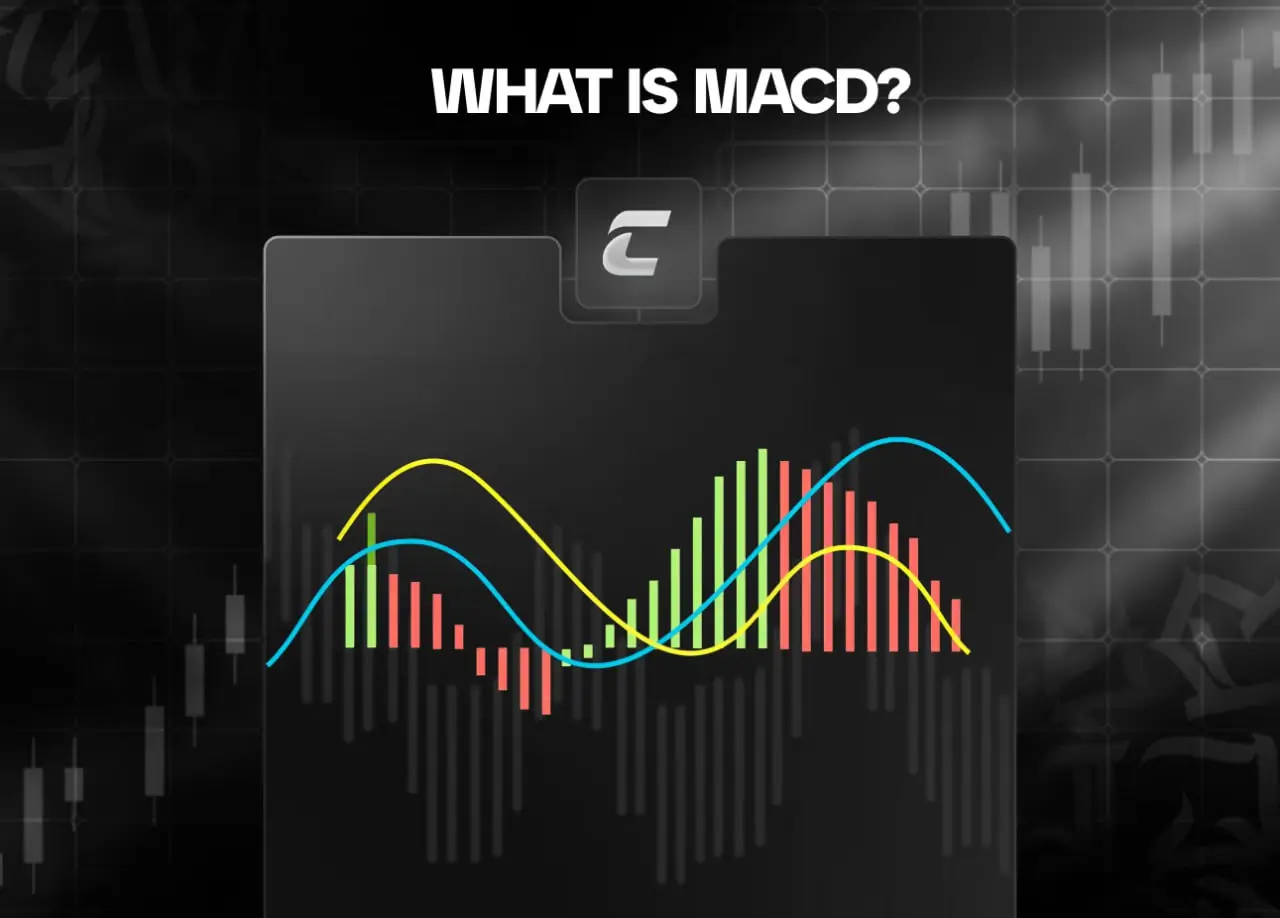

- Анализ чистого графика: трейдеры прайс экшн не используют индикаторы, такие как, например осцилляторы, а работают только с информацией, которую дает им график.

- Вход на основе паттернов: трейдеры ищут специфические свечные модели или паттерны, которые могут сигнализировать о возможных точках входа или выхода из рынка.

- Контекст рынка: прайс экшн также учитывает общие рыночные условия, такие как тренд или боковое движение. Трейдеры анализируют поведение цены в контексте этих условий.

- Уровни поддержки и сопротивления: эти ключевые уровни на графике определяют, где цена может развернуться или продолжить свое движение.

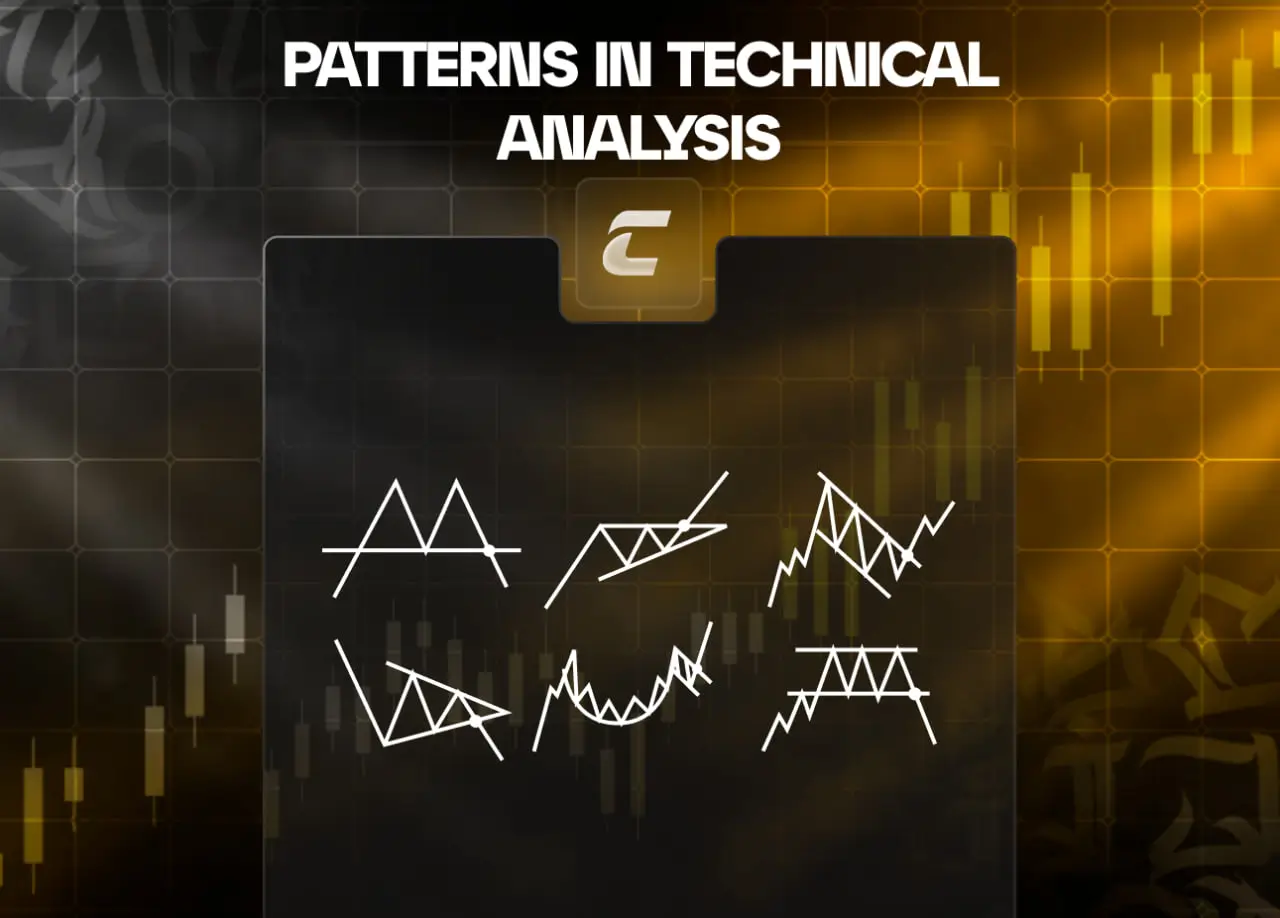

Паттерны Price Action

На финансовых рынках существует множество паттернов Price Action, которые трейдеры активно используют в своих стратегиях. Давайте рассмотрим некоторые из самых популярных:

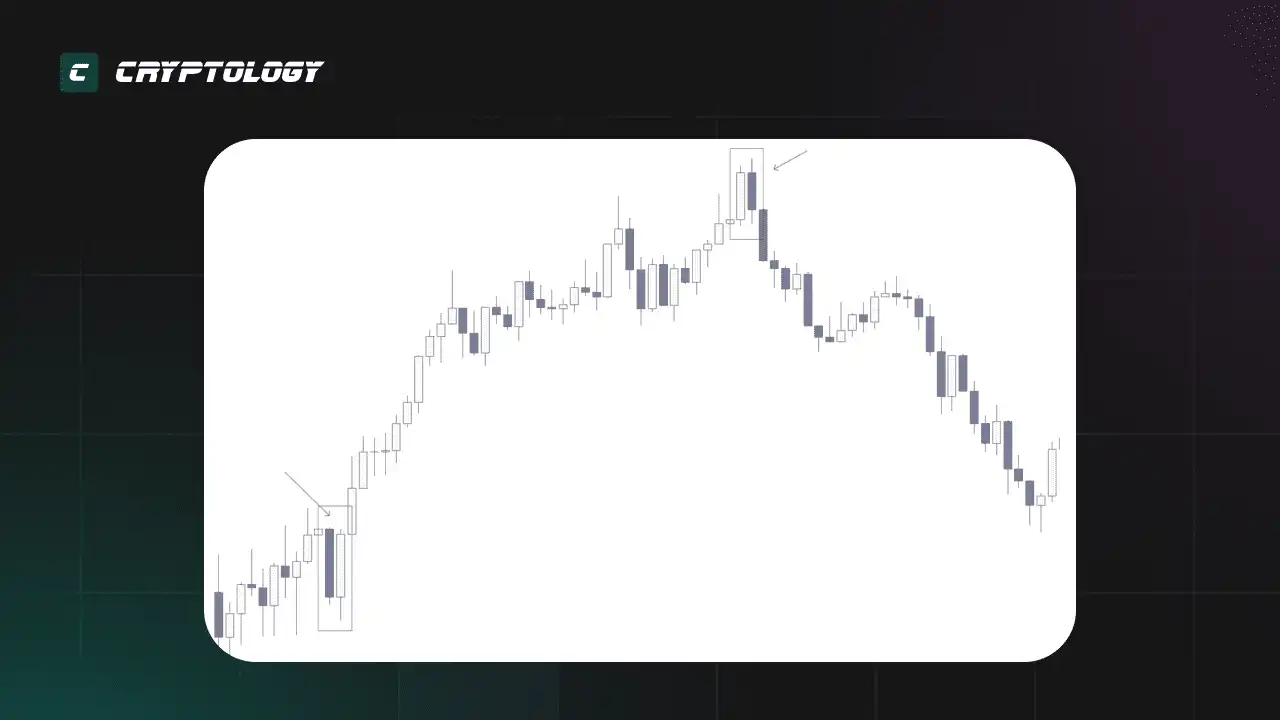

Пиноккио-бар (Pin-bar)

Пиноккио-бар, или Pin-bar, представляет собой паттерн с длинной тенью ("носом"), которая указывает на реакцию цены на важный уровень и может свидетельствовать о возможном развороте. Основная его характеристика - это длинная тень, которая отражает внезапное изменение направления рынка. Например, если на уровне поддержки появляется пин-бар с длинной нижней тенью, это может быть сигналом на потенциальный рост цены.

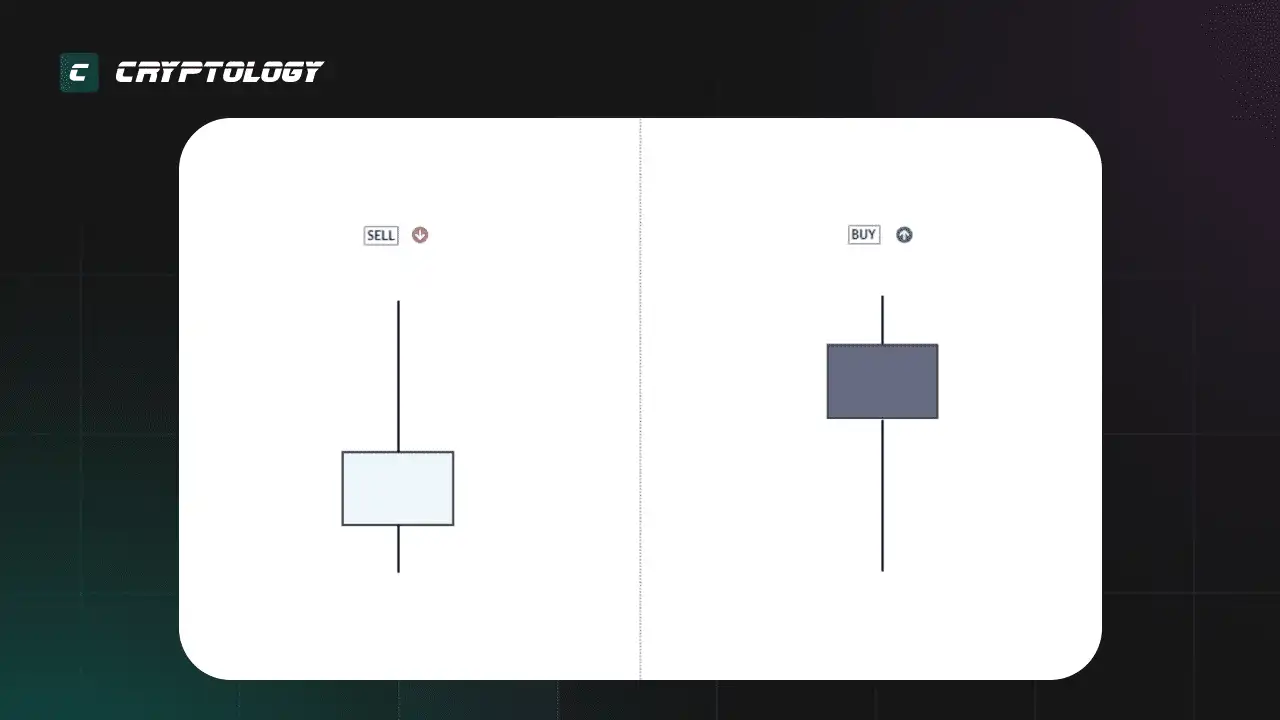

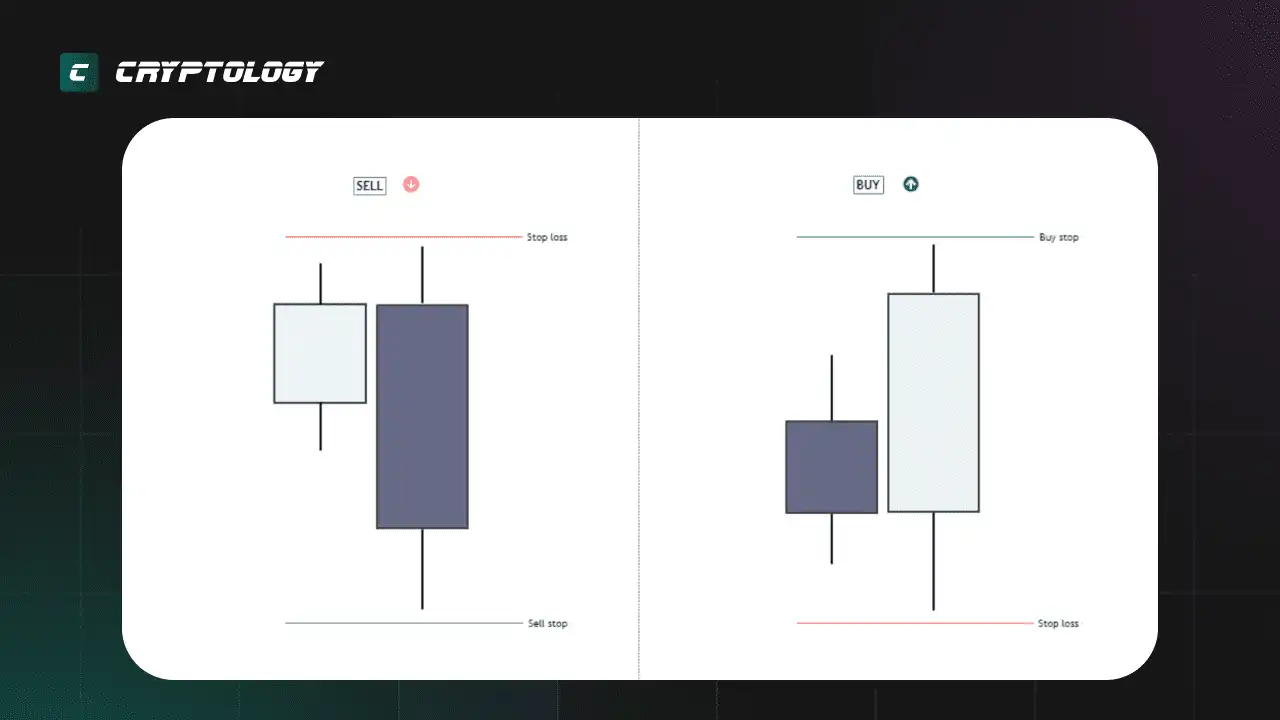

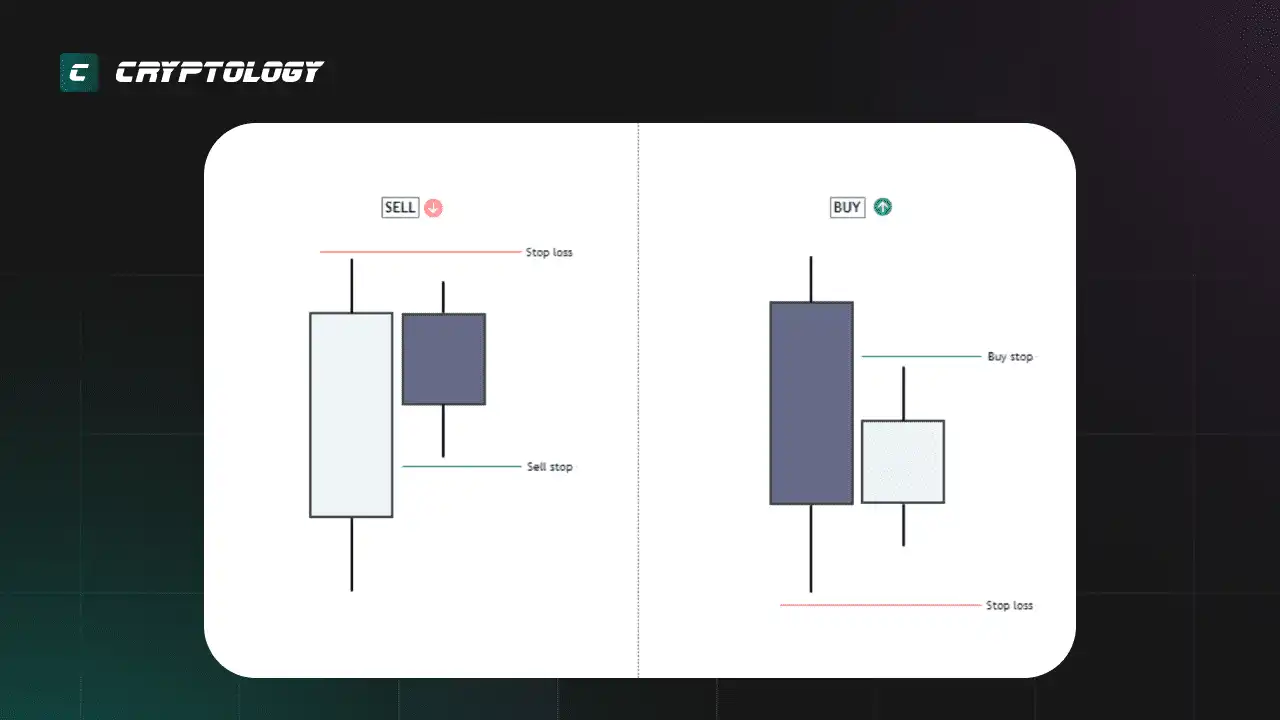

Внешний бар (модель поглощения)

Внешний бар "поглощает" предыдущую свечу, сигнализируя о возможном развороте тренда. В восходящем тренде медвежий внешний бар может указывать на потенциальный спад, особенно если он образуется на уровне сопротивления. Для управления рисками стоп-лосс рекомендуется размещать чуть выше максимума модели.

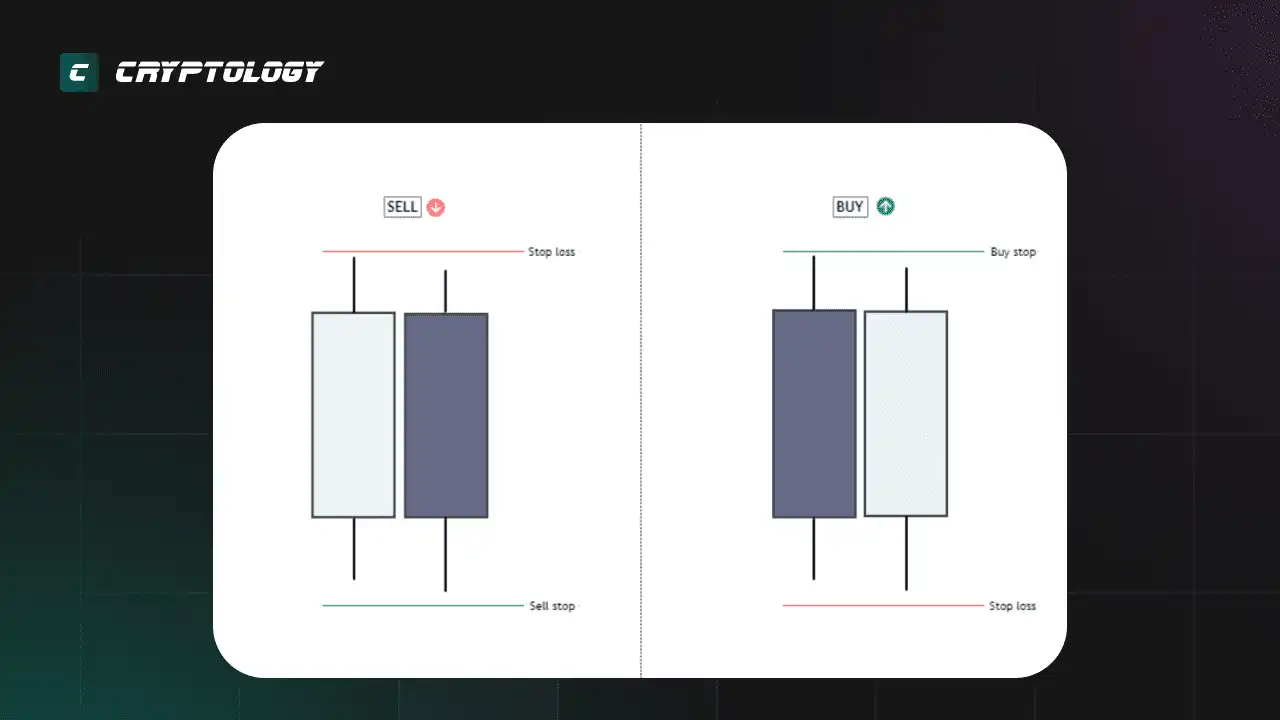

Внутренний бар

Внутренний бар полностью находится внутри диапазона предыдущей свечи, что может свидетельствовать о возможном начале нового тренда после прорыва границ материнского бара. Для снижения рисков стоп-лосс обычно устанавливают за пределами материнской свечи.

Рельсы

Паттерн "рельсы" состоит из двух свечей, напоминающих рельсы на железнодорожном пути. Он свидетельствует о возможном развороте тренда. Например, если в нисходящем тренде появляются "рельсы", это может сигнализировать о потенциальном подъеме, при этом стоп-лосс следует разместить ниже последней свечи.

Примеры торговли по Price Action

Пример с паттерном "Пиноккио-бар"

- Анализ рынка: цена приближается к важному уровню поддержки, где формируется пин-бар с длинной нижней тенью.

- Вход в сделку: открытие длинной позиции после закрытия пин-бара.

- Управление рисками: стоп-лосс устанавливается ниже хвоста пин-бара, а тейк-профит - на ближайшем уровне сопротивления.

- Дальнейшее управление позицией: частичное закрытие позиции на первом уровне прибыли и перенос стоп-лоса в безубыточную зону.

Пример с паттерном "Внешний бар"

- Анализ рынка: цена в восходящем тренде приближается к уровню сопротивления, где формируется медвежий внешний бар.

- Вход в сделку: открытие короткой позиции после подтверждения медвежьего поглощения.

- Управление рисками: стоп-лосс устанавливается чуть выше максимума внешнего бара, а тейк-профит - на следующем уровне поддержки.

Преимущества Price Action

- Простота: прайс экшн не требует использования сложных индикаторов или алгоритмов. Все, что нужно, - это график и умение его анализировать.

- Гибкость: метод можно применять на любом рынке и таймфрейме, от минутных графиков до недельных.

- Актуальность: поскольку прайс экшн работает с текущей ценой, трейдер получает информацию без задержек, которые могут быть при использовании индикаторов.

Недостатки Price Action

- Субъективность: поскольку трейдеры могут по-разному интерпретировать одни и те же паттерны или уровни, прайс экшн не всегда является четким и однозначным.

- Не подходит для новичков: чтобы использовать прайс экшн эффективно, нужен опыт и понимание рыночной структуры. Новичкам может быть трудно правильно интерпретировать рыночные сигналы.

- Отсутствие автоматизации: прайс экшн требует постоянного анализа и не позволяет автоматизировать процесс принятия решений.

Мнение команды Cryptology Key относительно Price Action

Прайс экшн - это мощный и эффективный инструмент для анализа рынков, который позволяет трейдерам принимать решения на основе движения цены и рыночной структуры. Этот метод подходит как для опытных трейдеров, так и для новичков, которые стремятся лучше понять динамику рынка без использования сложных индикаторов. Важно помнить, что успех в прайс экшн зависит от опыта и умения правильно интерпретировать поведение цены, что приходит с практикой и глубинным пониманием рынка.

Что такое Price Action?

Какие основные элементы анализа Price Action?

Свечные модели: паттерны, указывающие на возможный разворот или продолжение тренда.

Уровни поддержки и сопротивления: ключевые зоны, где цена обычно останавливается или разворачивается.

Тренд: направление движения цены, которое может быть восходящим, нисходящим или боковым.

Как работает Price Action?

Какие паттерны используются в Price Action?

Внешний бар (модель поглощения): свеча, которая полностью поглощает предыдущую, указывая на возможный разворот.

Внутренний бар: свеча, находящаяся в пределах предыдущей, что указывает на потенциальный прорыв.

Рельсы: две свечи, напоминающие рельсы на железнодорожном пути, сигнализируя об изменении направления.

Какие преимущества и недостатки имеет Price Action?

Недостатки: субъективность, потребность в опыте, невозможность автоматизации.

Подходит ли Price Action для новичков?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!