Что такое Key Screener

Скринер криптовалют – это инструмент, который помогает трейдерам и инвесторам анализировать и отслеживать рыночные данные, чтобы находить перспективные активы для покупки или продажи. Он предоставляет информацию о ценах, объемах торгов, рыночной капитализации, а также различных технических индикаторах, что позволяет увидеть рыночную картину шире. Такой инструмент существенно упрощает анализ данных и позволяет понять “на каком мы свете”.

Однако большинство скринеров, как правило, сложны в использовании, работают только на одном языке и требуют использования огромного количества дополнительных инструментов, поскольку информация, полученная от них, остается неполной.

Именно по этой причине был создан Key Screener – современная и прокаченная платформа, над которой работали и продолжают работать трейдеры-практики. В отличие от традиционных скринеров, Key Screener предлагает не только интуитивно понятный интерфейс, но и самые мощные и эффективные функции, собранные в одном месте.

Key Screener выводит анализ ончейн-метрик на новый уровень, при этом, не требуя от пользователя опыта в использовании подобных сервисов за плечами, поскольку этот сервис готов научить каждого, как правильно работать и интерпретировать данные. Как именно? Дальше поговорим.

Функционал Key Screener

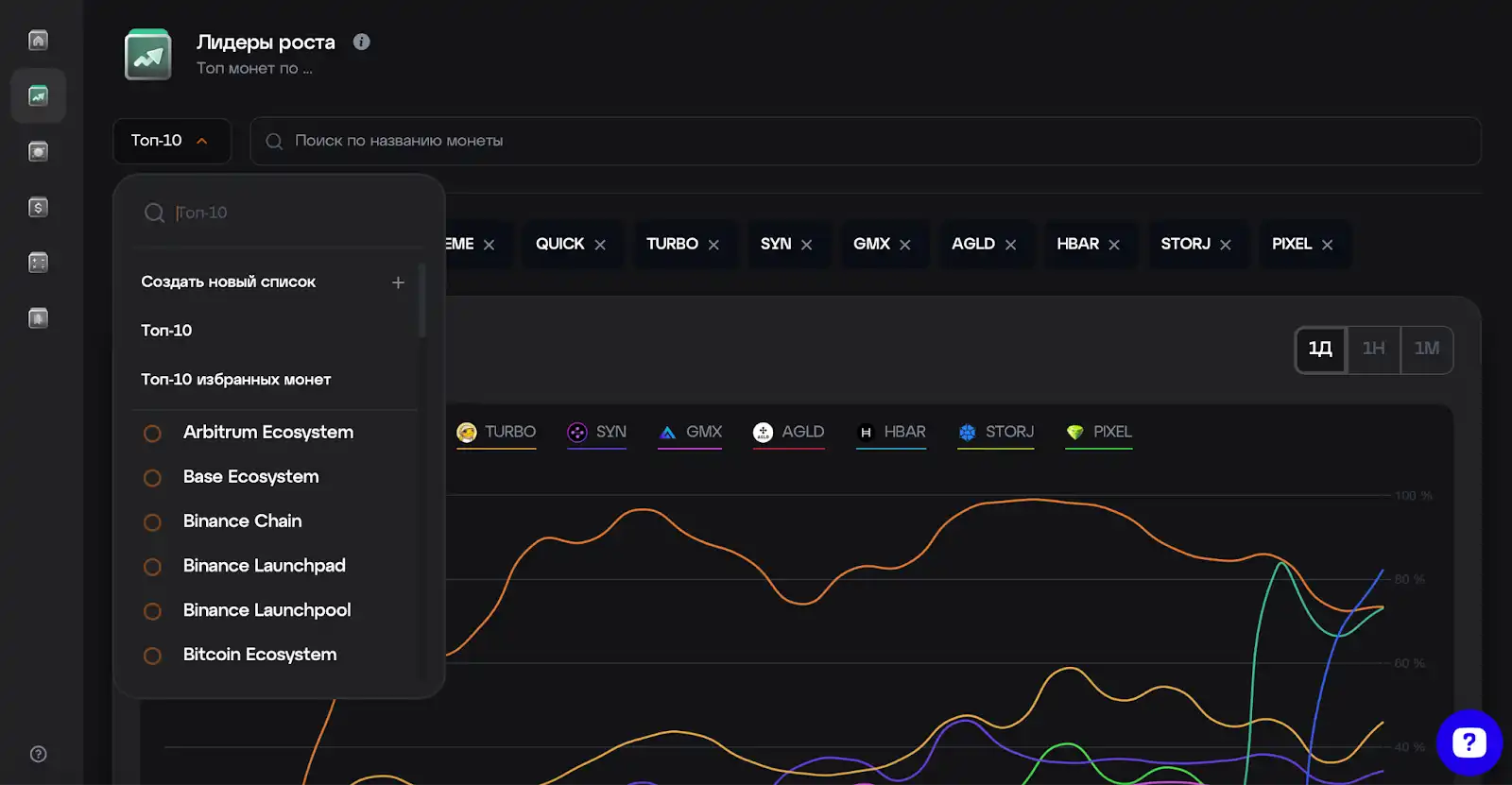

Лидеры роста

Раздел "Лидеры роста" в Key Screener – это инструмент, который помогает пользователям быстро находить криптовалюты, демонстрирующие наибольший рост по выбранным секторам.

Основные возможности раздела:

- Анализ по секторам: пользователь может выбрать один из 46 доступных секторов крипторынка, чтобы анализировать лидеров роста в конкретной отрасли. Это помогает сосредоточиться на тех активах, которые имеют наибольший потенциал в определенных рыночных условиях, и сравнивать их с другими участниками той же категории.

- Формирование собственных списков монет: система позволяет формировать индивидуальные списки, что упрощает управление выбранными активами и позволяет сосредоточиться только на тех активах, которые важны для пользователя.

- Сортировка по типу капитализации: для удобства анализа можно отсортировать топ монет по капитализации, например, крупные, средние или мелкие активы, в зависимости от того, что вас интересует. Это дает возможность учитывать размер рынка монеты и ее ликвидность.

Линейная проекция и ее значение:

В "Лидерах роста" используется уникальная метрика – линейная проекция, которая генерируется на основе топ-10 разных монет по таким показателям, как:

- OI (открытый интерес): показывает количество открытых контрактов на определенный актив, что может указывать на уровень активности и вовлеченности участников рынка.

- CVD (cumulative volume delta): измеряет накопленную разницу между объемом покупок и продаж, позволяя оценить текущие рыночные настроения.

- WAP (weighted average price): средневзвешенная цена актива по объему торгов, показывающая средний уровень цен, по которому происходит торговля.

Эти данные можно сортировать по изменениям за 1 день, 7 дней или 30 дней, что дает возможность отслеживать краткосрочные и долгосрочные тренды.

Как использовать раздел на практике:

- Определение перспективных активов: пользователь может быстро найти активы, которые показывают сильный рост, используя фильтры по секторам и капитализации.

- Отслеживание аномалий: линейная проекция помогает выявлять аномалии в рыночных данных, и принимать решения относительного того или иного актива, или сектора, имея полную картину.

История транзакций

Key Screener позволяет пользователю просматривать историю транзакций для любого интересующего кошелька или определенного токена. Это помогает отслеживать движение средств и анализировать активность, что может быть полезно для оценки рыночных трендов и поведения крупных игроков.

Ключевые метрики Key Screener

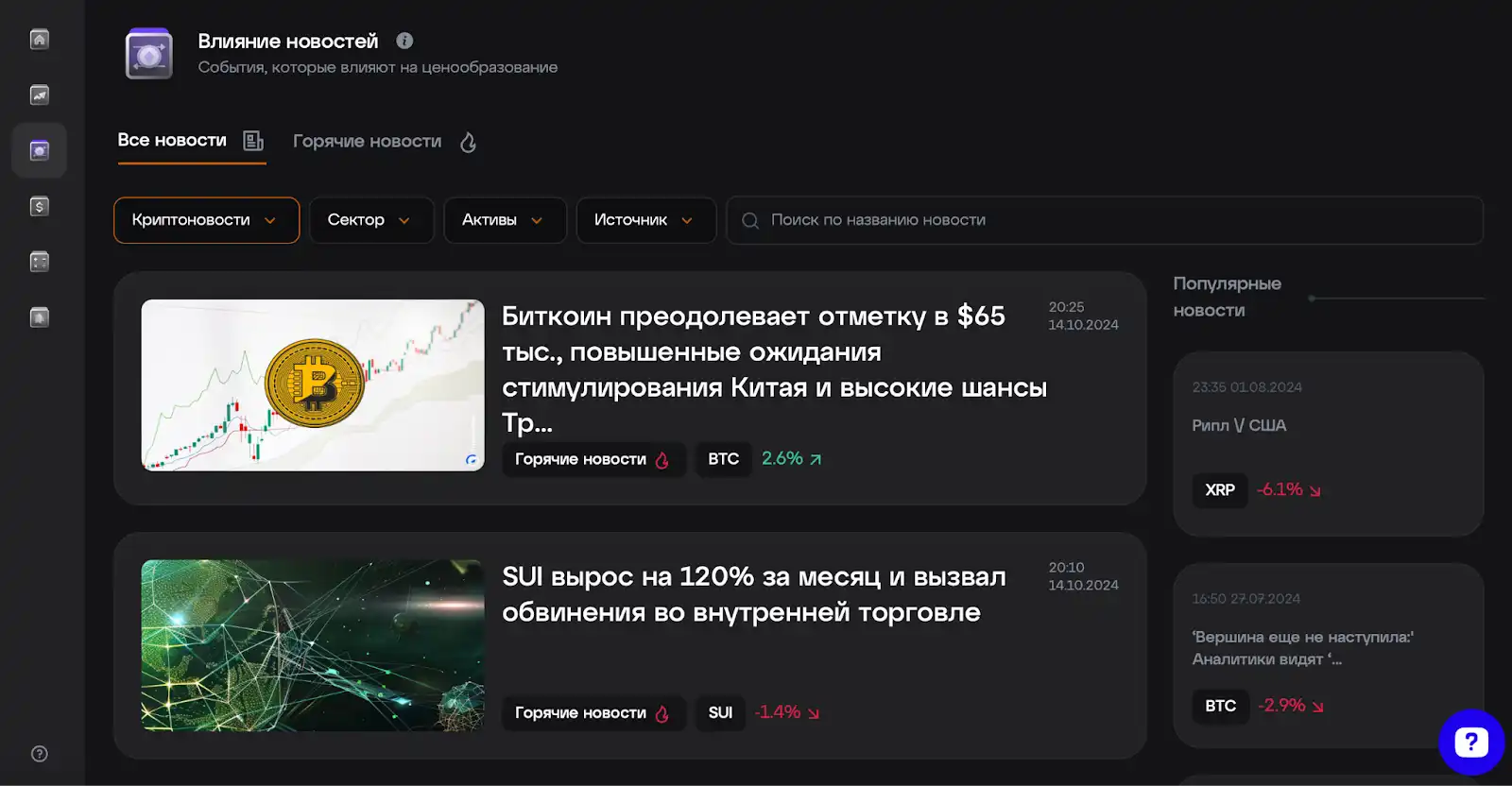

Влияние новостей

Раздел "Влияние новостей" в Key Screener – это инструмент для анализа новостного фона, который помогает пользователям оценивать влияние новостей на рынок криптовалют и отдельно взятых активов. Пользователь получает доступ к актуальным новостям из мира криптовалют, а также макроэкономическим событиям, позволяя быстро находить информацию по конкретным активам, секторам и глобальным экономическим данным.

Но это не просто “новостной портал”, это намного больше.

Основные возможности раздела:

- Анализ новостного фона: Key Screener позволяет изучать публикации и новости в сфере криптовалют и макроэкономики, разделяя информацию на более важные и менее важные данные. Это помогает трейдерам сосредоточиться на наиболее значимых событиях, которые могут оказывать сильное влияние на рынок.

- Поиск новостей: пользователи могут искать новости по конкретным монетам, секторам или макроэкономическим данным, чтобы быстро получать необходимую информацию по интересующим активам или рыночным трендам.

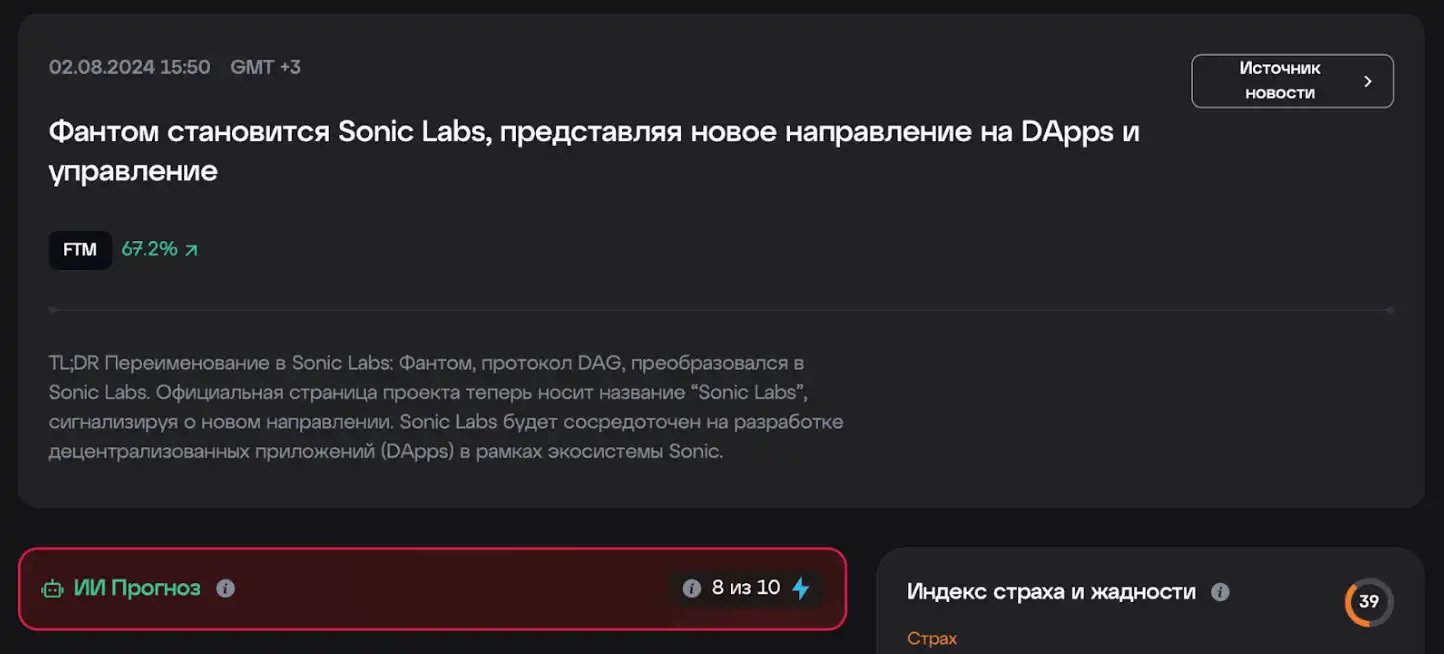

- Оценка новостей с помощью AI: вишенкой на торте станет одна из наиболее уникальных функций этого раздела – встроенный искусственный интеллект (AI), который помогает анализировать контекст новостей и оценивать их влияние на активы. AI присваивает каждой новости рейтинг от 1 до 10, указывающий, насколько сильно она может повлиять на цену.

Рассмотрим один из примеров вместе. На новость, касающуюся актива FTM, вышедшую в свет 02.08.2024, встроенный искусственный интеллект сделал прогноз относительно ее возможного влияния на цену – он оценил эту новость на 8 из 10.

Как результат – снижение стоимости актива на 39.45% в течении следующих 3 дней.

В итоге AI помогает интерпретировать сложные и неоднозначные новости, оценивая их возможное влияние на активы.

Раздел "Влияние новостей" в Key Screener значительно упрощает работу с новостным фоном и делает анализ более точным и оперативным благодаря использованию искусственного интеллекта. Это помогает трейдерам всегда быть в курсе важных событий и быстрее принимать решения на основе актуальных данных и небольшой подсказки от AI.

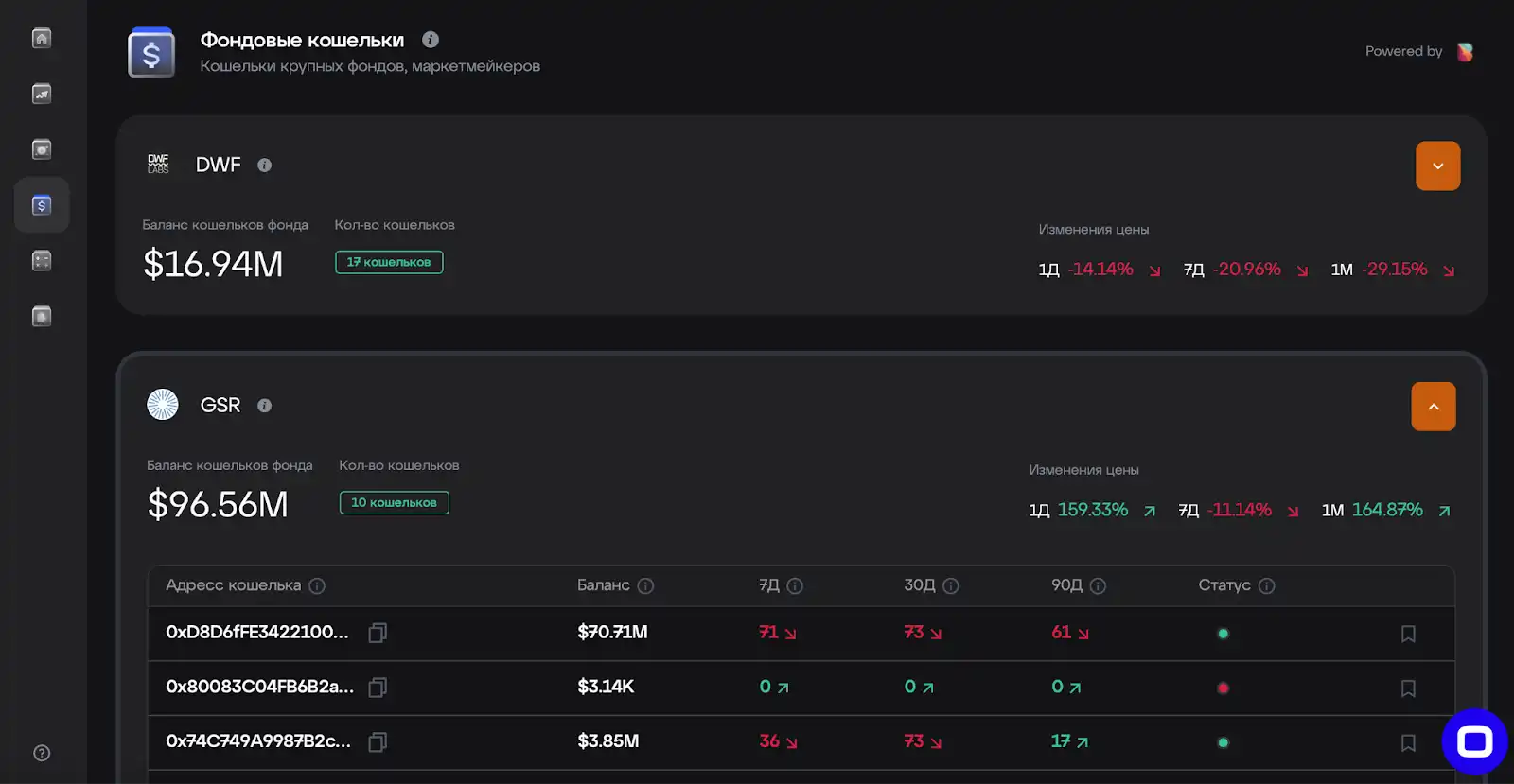

Фондовые кошельки

Раздел "Фондовые кошельки" в Key Screener предоставляет пользователям ценные данные о действиях крупных фондов и маркетмейкеров на рынке криптовалют. Этот инструмент позволяет в режиме реального времени отслеживать, какие активы покупают или продают значимые игроки рынка.

Основные возможности раздела:

- Анализ действий крупных игроков: в этом разделе собраны данные о кошельках крупных фондов и маркетмейкеров. Пользователи могут видеть, какие активы они покупают или продают, и на основе этой информации оценивать текущие рыночные настроения и возможные будущие движения цен. Это дает возможность “подсмотреть” за действиями инвестиционных фондов, которые имеют значительное влияние на рынок.

- Детализированная информация по кошелькам: пользователь получает доступ к полной информации относительно транзакций крупных рыночных игроков с возможностью изучения объема циркулирующих средств за определенный период – 7, 30 или 90 дней. Это дает возможность понять, насколько активны крупные игроки в данный момент и как изменялись их действия на протяжении времени.

- Добавление кошельков в избранное: если пользователь замечает интересный кошелек, его можно добавить в список избранного для удобного дальнейшего отслеживания. Это позволяет быстро возвращаться к мониторингу активности выбранных фондов и получать актуальные обновления о действиях этих кошельков.

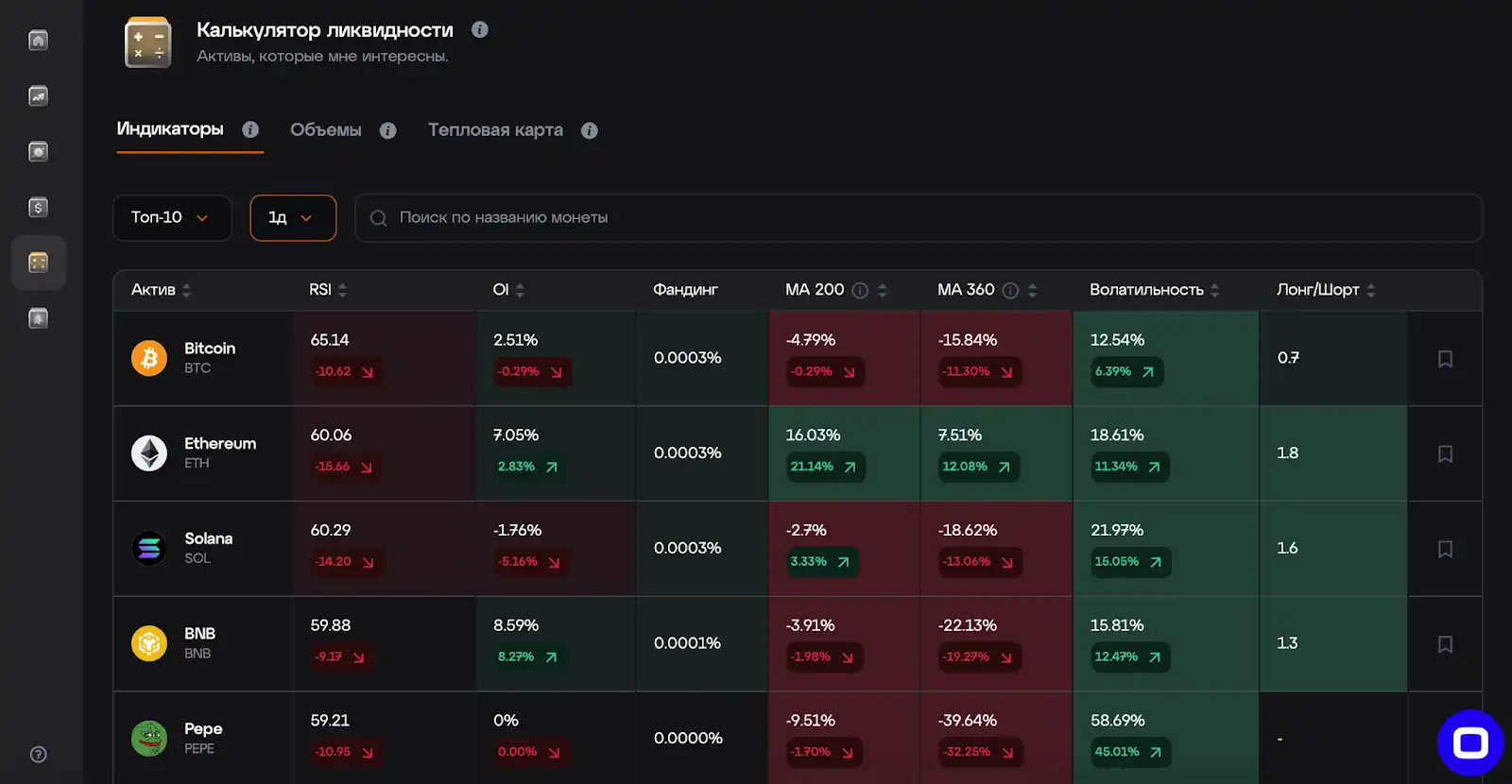

Калькулятор ликвидности

Раздел "Калькулятор ликвидности" в Key Screener – это инструмент для анализа ликвидности и волатильности криптовалют. Он показывает активы, в которых повышаются метрические данные, чтобы лучше сортировать сильные монеты от слабых.

Индикаторы

Пользователь получает полный анализ активов по ключевым индикаторам:

- RSI (индекс относительной силы): помогает определить состояние перекупленности или перепроданности актива. Подробнее про RSI и его возможности тут.

- Открытый интерес (OI): показывает количество открытых контрактов и уровень вовлеченности участников рынка.

- Фандинг: указывает на процентные ставки, которые выплачиваются между участниками маржинальной торговли. Подробнее о том, как фандинг помогает трейдеру в работе вы можете узнать тут.

- MA200 и MA360 (скользящие средние): отражают среднюю цену актива за 200 и 360 дней соответственно, что помогает понять долгосрочные тренды.

- Волатильность: показывает, насколько сильно изменяются цены на актив за определенный период времени.

- Информация о лонгах и шортах: показывает соотношение длинных и коротких позиций на рынке.

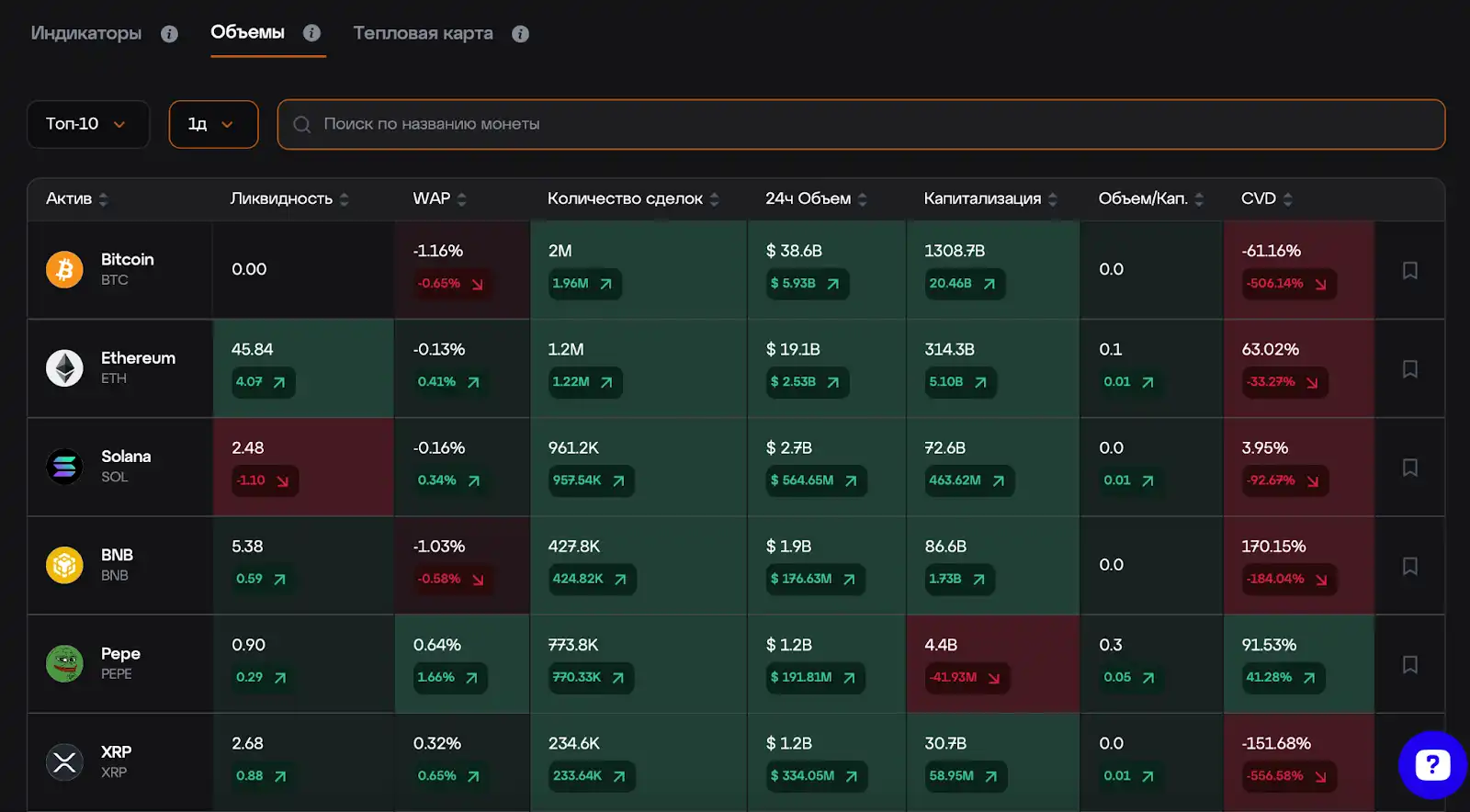

Объемы

Пользователь может изучать данные о ликвидности, Weighted Average Price (WAP), количестве сделок, капитализации, соотношении капитализации к объемам и Cumulative Volume Delta (CVD измеряет накопленную разницу между объемом покупок и продаж и помогает оценить рыночные настроения).

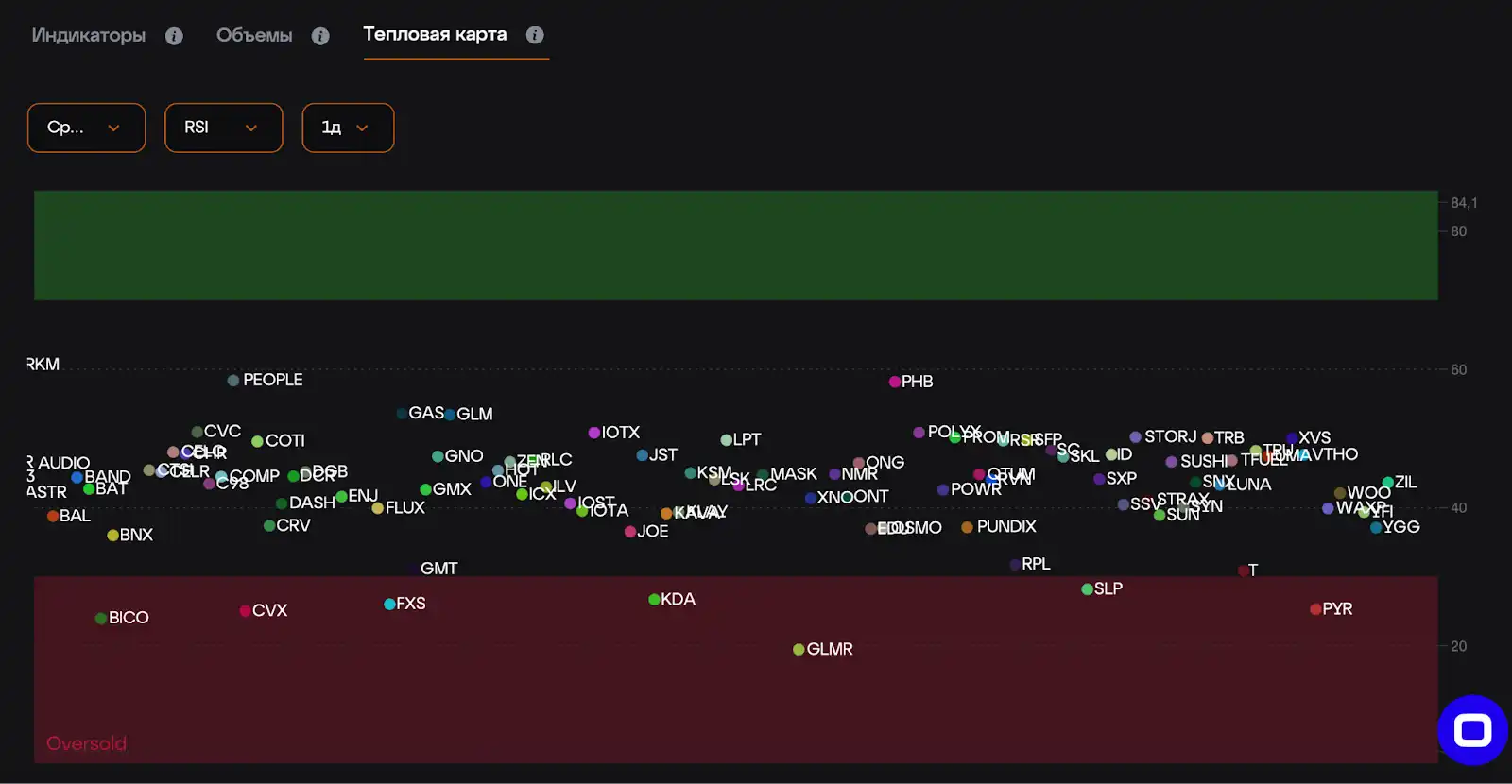

Тепловая карта

Данные могут быть преобразованы в тепловую карту, которая показывает потенциальные текущие фазы альткоинов. Визуально отображается диапазон от слабости до силы, где нижняя часть карты указывает на слабость актива, а верхняя – на его силу. Это помогает быстро оценить, в какой фазе находится актив и какие действия могут быть предприняты.

Сортировка по критериям

Пользователи могут сортировать список активов по таким параметрам, как сектор, открытый интерес, RSI, количество сделок за последние 24 часа, объем торгов за 24 часа и другие показатели. Это дает возможность быстро находить активы, которые соответствуют заданным критериям.

Основная цель данного раздела – показать, как ликвидность и волатильность распределены среди всех активов, торгующихся на Binance за последние 30 дней. Это помогает трейдерам видеть общую картину рынка и принимать решения, основываясь на текущих данных.

Преимущества использования калькулятора ликвидности:

- Экономия времени: калькулятор ликвидности заменяет многочасовое ручное отслеживание данных, предоставляя всю необходимую информацию в одном месте.

- Глубокий анализ рынка: интеграция ключевых метрик и индикаторов позволяет провести комплексный анализ, выявить тренды и оценить состояние рынка.

- Удобная сортировка и визуализация: возможность сортировки по различным критериям и визуальное представление данных в виде тепловой карты упрощает процесс анализа и делает его более наглядным.

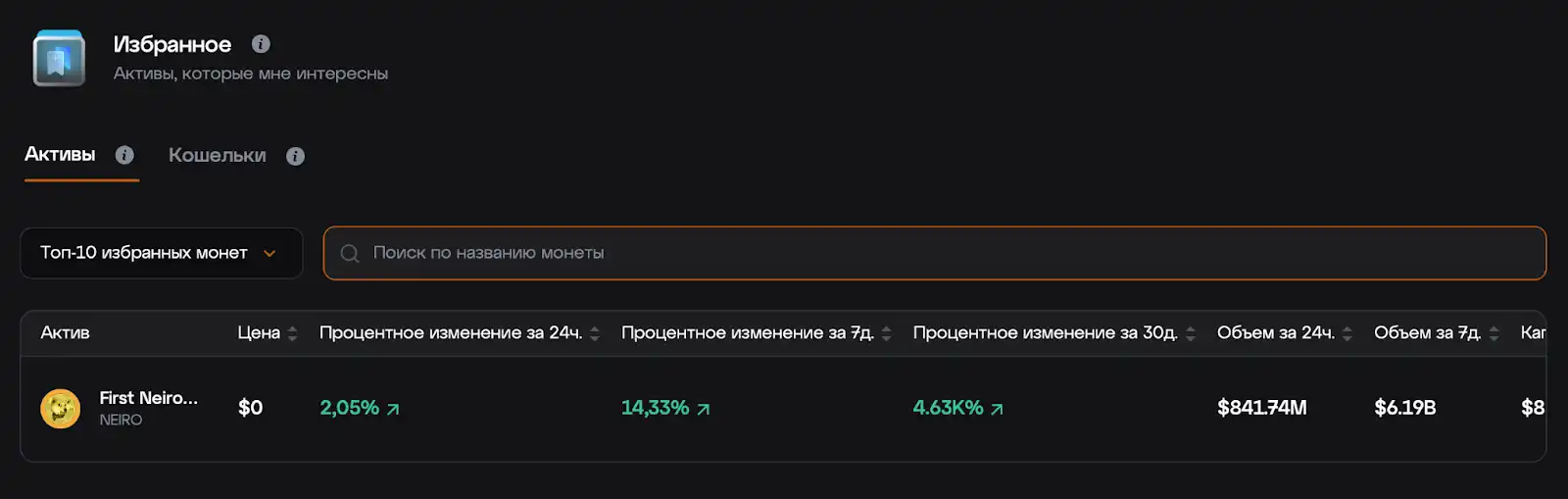

Избранное: вочлист

Раздел "Избранное" в Key Screener – это удобный инструмент для организации и управления списками активов и кошельков, которые представляют интерес для вашей торговли. Он помогает трейдерам систематизировать торговые идеи, следить за важными показателями и быстро ориентироваться в большом количестве данных.

В "Избранном" можно хранить любые активы и кошельки, которые имеют значение для вашей торговой стратегии. Это позволяет сосредоточиться на наблюдении за ключевыми элементами рынка, не отвлекаясь на менее важные данные.

Бесплатный курс по Key Screener от Cryptology Key

Даже если вы не знаете, что такое CVD или WAP, Key Screener готов провести тебе полноценный инструктаж по использованию метрик платформы, который, кстати говоря, будет отличаться в зависимости от твоих предпочтений в торговле. Курс предназначен для трейдеров с разными подходами к торговле и опытом работы с данными.

Курс обучает базовым принципам анализа рыночных данных и использования ключевых метрик, доступных в Key Screener. Это помогает пользователям не только лучше понимать, как интерпретировать показатели, но и как применять их в реальной торговле для принятия решений.

Кроме того, курс адаптируется к предпочтениям пользователя относительно стиля торговли:

- Внутримесячная торговля: для трейдеров, которые предпочитают удерживать позиции на протяжении нескольких недель, курс включает уроки по долгосрочному анализу трендов, изучению скользящих средних (MA200, MA360), анализа волатильности и других индикаторов, подходящих для более длительных временных интервалов.

- Внутренедельная торговля: для тех, кто ориентируется на удержание позиций в пределах одной недели, предусмотрены уроки по анализу открытого интереса, RSI и фандинга. Курс учит, как выявлять изменения рыночных настроений и использовать краткосрочные тренды.

- Внутридневная торговля: для дневных трейдеров курс охватывает методы анализа ликвидности, объемов торгов, WAP, а также интерпретацию быстрых изменений в CVD для выявления краткосрочных рыночных движений.

Курс не ограничивается теоретическими знаниями, а ориентирован на практическое применение. Пользователи учатся применять метрики и индикаторы непосредственно в торговом процессе.

Преимущества прохождения курса:

- Быстрое освоение работы с платформой: курс помогает новичкам быстро освоиться с использованием Key Screener, а более опытным трейдерам — улучшить свои навыки анализа данных.

- Оптимизация торговых стратегий: трейдеры получают знания о том, как использовать ключевые метрики для адаптации своих стратегий под разные рыночные условия.

Преимущества Key Screener

- Все в одном месте: Key Screener объединяет все необходимые для трейдера нового поколения инструменты, избавляя от необходимости использовать несколько платформ. Таким образом процесс сбора информации становится не только более эффективным, но и менее времязатратным.

- Интеграция искусственного интеллекта: встроенный AI помогает анализировать новости и их влияние на рынок, предлагая оценку значимости событий. Не знаете насколько серьезна новость? Спросите AI.

- Реальные данные в режиме реального времени: многие скринер платформы предоставляют информацию с определенной задержкой, а на крипторынке важна каждая минута. Key Screener предоставляет свежие данные в режиме реального времени, позволяя трейдерам оперативно реагировать на изменения.

- Анализ крупных кошельков и маркетмейкеров: пользователи могут видеть действия крупных фондов и маркетмейкеров, отслеживая их покупки и продажи. Это помогает понять, куда движутся "умные деньги" и какие активы могут быть перспективными для торговли. При этом, в отличие от других ончейн-платформ, на которых пользователю нужно провести тщательный ресерч для того, чтобы найти подобную информацию, Key Screener составит список сам за тебя.

- Персонализация: возможность создавать собственные списки избранного, настраивать вочлисты и получать уведомления делает Key Screener удобным инструментом для любой торговой стратегии – от краткосрочной до долгосрочной.

- Обучающий курс по работе с метриками: Key Screener предоставляет трейдерам возможность пройти курс по использованию ключевых метрик, адаптированный под их стиль торговли. Это позволяет быстро освоить работу с платформой и повысить качество своего анализа.

Мнение команды СRYPTOLOGY KEY по использованию Key Screener в работе на рынках

Key Screener – это передовой инструмент для анализа криптовалютного рынка, который объединяет широкий спектр метрик, данных и аналитических возможностей. Он подходит как для новичков, так и для опытных трейдеров, благодаря интуитивно понятному интерфейсу, своим функциям и встроенному обучающему курсу, нацеленному на инструктирование пользователя по использованию платформы.

Key Screener значительно упрощает процесс принятия решений. С его помощью можно экономить время, избегать ошибок, связанных с ручным поиском данных, оптимизировать работу и использовать современные возможности искусственного интеллекта для достижения лучших результатов.

Ни для кого не секрет, что чем раньше вы получаете информацию, тем больше можете с ней сделать и выиграть “фору”. Когда информация общедоступна, никто не может быть на шаг впереди, все идут на одном уровне. Именно поэтому Key Screener является незаменимой платформой для получения преимущества в виде данных: создание собственных вочлистов, помощь от AI и другие функции скринера нацелены именно на такой результат.

Что такое скринер криптовалют?

Что такое Key Screener?

Чем Key Screener отличается от других сервисов?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!