Можно ли совмещать торговлю и основную работу

Что такое AI-агенты в криптовалюте?

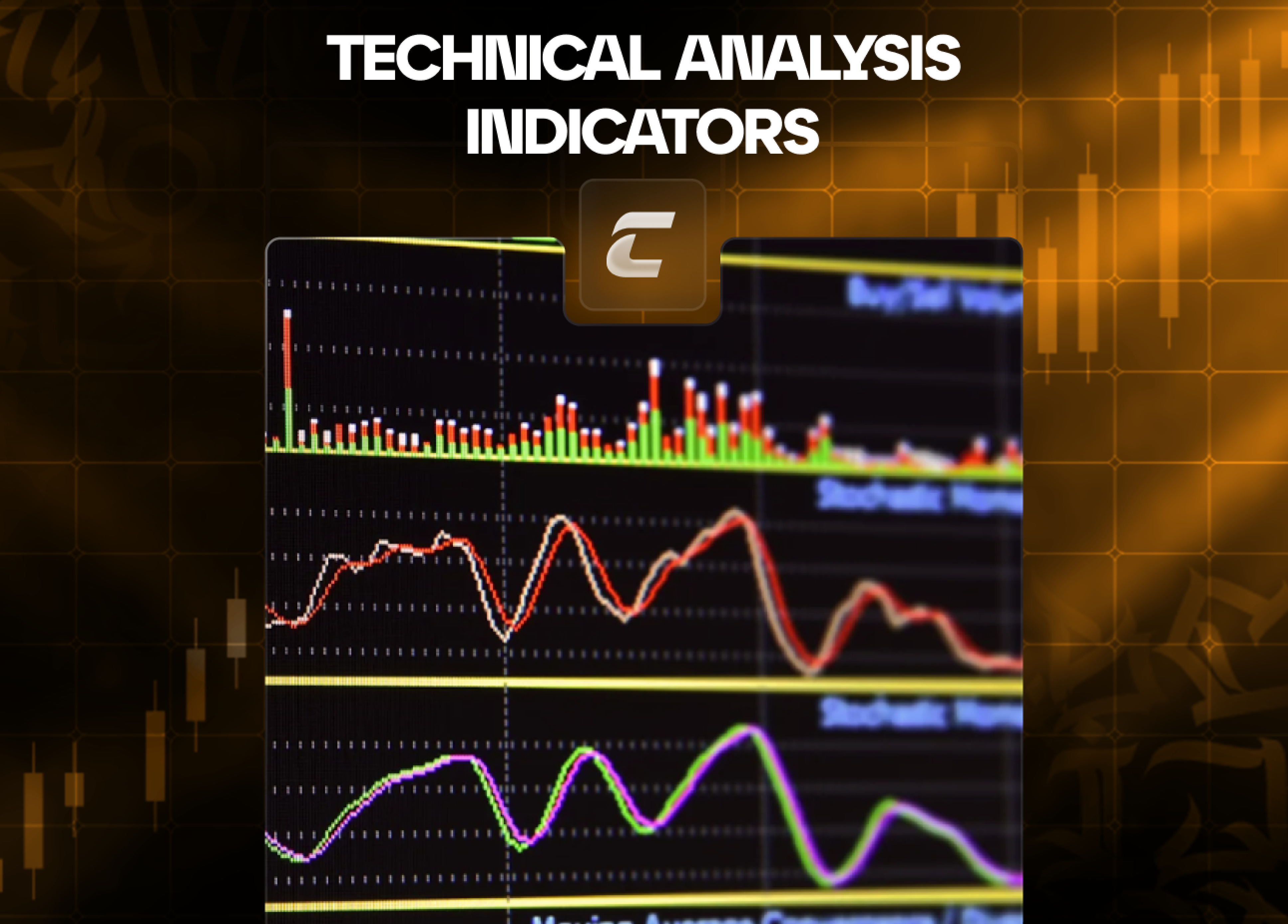

Индикаторы технического анализа: назначение и роль в трейдинге

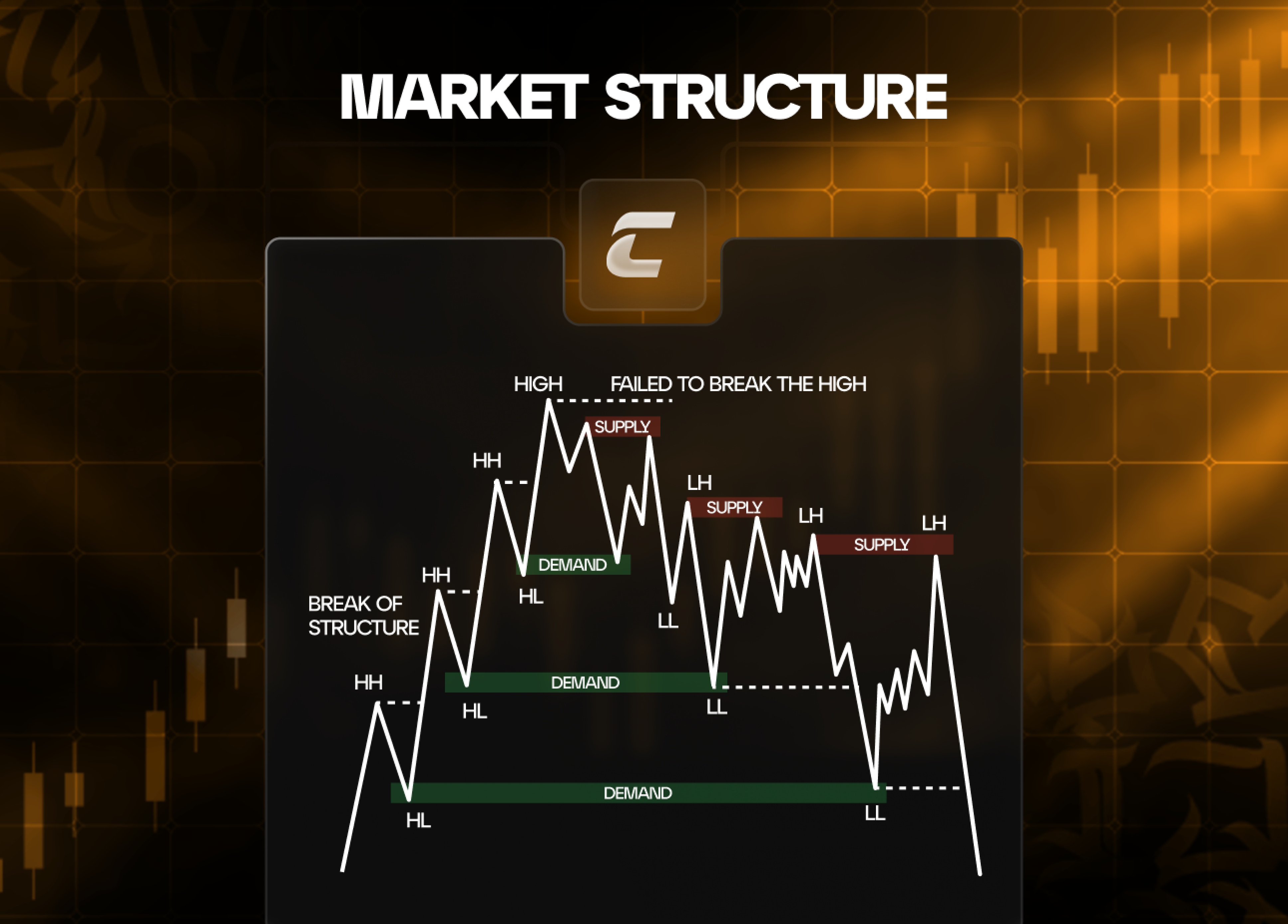

Рыночная структура

Актуальность сектора GameFi

Что такое токены в криптовалюте и чем они отличаются от монет

Публичный ключ в криптовалюте: все, что тебе нужно знать

Что такое бэктест

Дивиденды: от простого к сложному

Кто такие MicroStrategy

Что такое альтсезон?

Что такое японские свечи