Что такое торговый журнал?

Торговый журнал в трейдинге – это инструмент, который играет очень важную роль в развитии и совершенствовании навыков трейдера. Торговый журнал представляет собой детальную запись всех сделок, которые трейдер совершает. В этом журнале фиксируются не только основные параметры каждой торговой операции, такие как дата, время, вид актива, цена входа и выхода и результаты, причины открытия сделки, но и дополнительные заметки и наблюдения, например, текущие рыночные условия, личные ожидания от сделки, эмоциональное состояние и другое.

Цели торгового журнала

Создание торгового журнала – это лишь первый шаг. Ключевое значение имеет умение использовать собранную информацию для улучшения торговых результатов.

Торговый журнал позволяет трейдеру проводить анализ своих торговых решений и стратегий, выявляя успешные и неудачные шаги. Главная функция торгового журнала заключается в аккуратной фиксации всех аспектов торговли трейдера, включая соблюдение установленной торговой стратегии и эмоциональные реакции на процесс торговли. Анализируя информацию из журнала, трейдер может улучшать свои стратегии, избегать повторения ошибок и совершенствовать свои сильные стороны. В первую очередь, торговый журнал служит для документирования всех сделок, что позволяет трейдеру проводить детальный анализ своих торговых решений. Это не только помогает определить, какие стратегии работают лучше всего, но и выявляет часто совершаемые ошибки, чтобы избежать их в будущем.

Другая важная цель журнала – это управление рисками. Записывая размеры позиций, уровни стоп-лоссов и тейк-профиты, трейдер может оценить, насколько эффективно он управляет своими рисками и капиталом.

Торговый журнал также помогает отслеживать эмоциональное состояние трейдера во время торговли, что критически важно для поддержания дисциплины и объективности. Кроме того, журнал способствует непрерывному обучению и самосовершенствованию трейдера. Благодаря журналу становится легче выявлять чрезмерную торговлю и ошибки в анализе рыночных условий. Анализируя свои сделки, трейдеры могут выявить области, требующие улучшения, и разработать планы по их оптимизации.

Преимущества торгового журнала

Главное преимущество торгового журнала – это возможность объективно и имея четкую статистику определить эффективность торговли. Каждая торговая операция должна основываться на веских причинах, которые можно систематизировать. Журнал позволяет трейдеру детально анализировать каждую совершенную сделку: трейдер может выявить, какие инструменты были наиболее доходными, определить, на каких таймфреймах и в каких рыночных условиях он торгует наиболее и наименее успешно с помощью статистических данных.

Другое важное преимущество – улучшение управления рисками. Торговый журнал помогает трейдерам отслеживать и оценивать риски, связанные с каждой торговой операцией, а также общий уровень риска портфеля.

Использование торгового журнала помогает развивать профессионализм трейдера. Он становится не просто инструментом для записи сделок, а ценным ресурсом для обучения, самоанализа и постоянного совершенствования скиллов.

Где вести торговый журнал?

Выбор платформы для ведения записей зависит от того, что для вас более удобно: как правило, трейдеры пользуются сайтами Notion, Google Sheets, Google Docs, Microsoft Excel или Numbers. Кроме того, существуют и специализированные сервисы и приложения, где можно записывать эти данные – на просторах интернета их множество, какие-то платные, какие-то не стоят ничего.

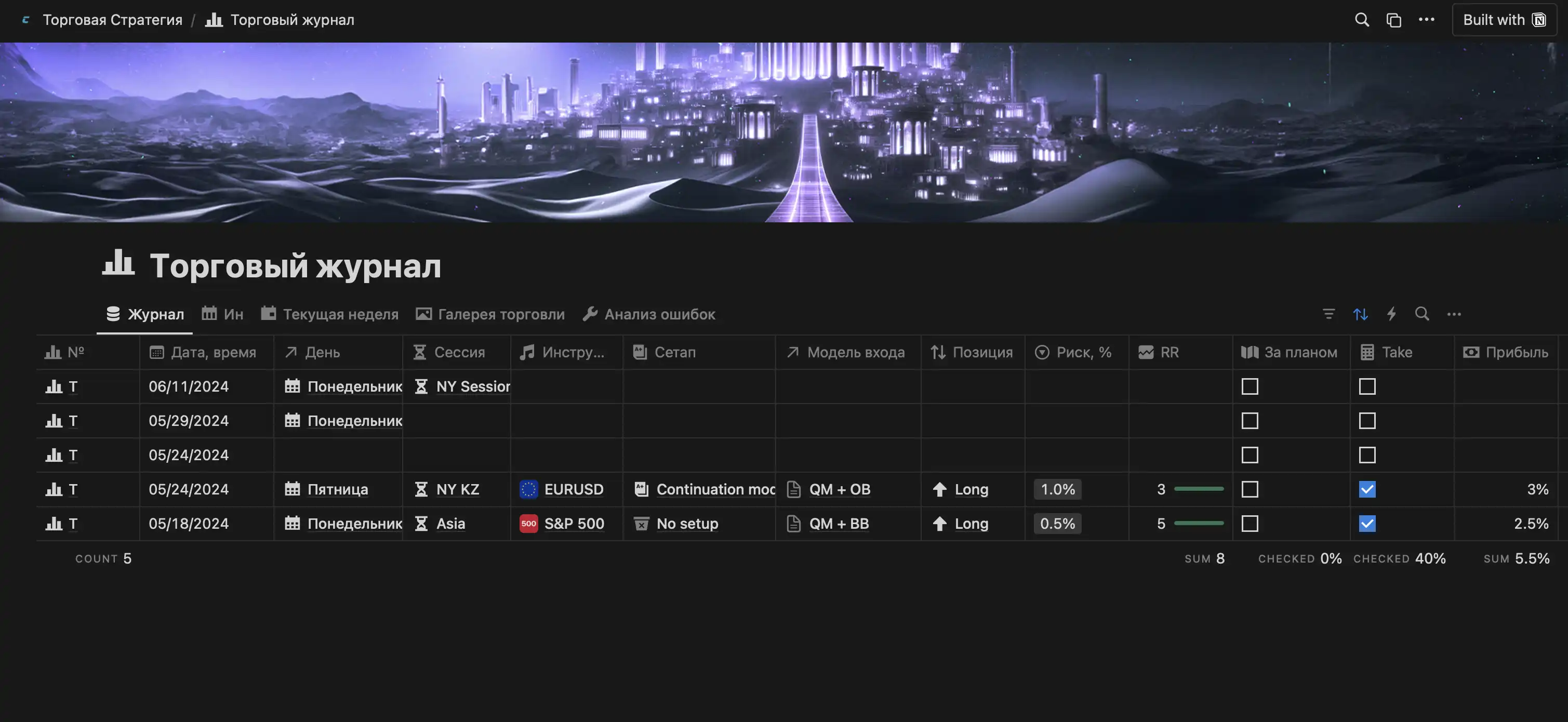

Однако, на самом деле, не так важно какую платформу вы выберете, важно лишь ответственно подойти к заполнению. Как правило, каждый трейдер модифицирует такой журнал под себя, добавляя то, что считает важным, однако есть некоторые обязательные для журнала пункты:

- Торговая пара;

- Даты входа и выхода из позиции;

- Направление позиции (лонг или шорт);

- Причины для входа – сетап;

- Цена входа;

- Цена выхода;

- Размер позиции;

- Стоимость актива;

- Уровень стоп-лосса;

- Риск на сделку;

- Уровни тейк-профита;

- Сумма комиссии;

- Итог сделки – прибыль или убыток;

- Процент прибыли или убытка;

- Комментарий.

В торговый журнал можно включать и дополнительные элементы, такие как таймфреймы, с которых вы открыли позицию, скриншоты графиков, эмоциональное состояние во время сделки, другие комментарии, которые считаются важными для вас. Очень важным, помимо сухих цифр, считается добавление вашего комментария к сделкам.

Шаблон торгового журнала

Для удобства и экономии времени, делимся шаблоном торгового журнала.

Помните, что этот шаблон вы можете взять за основу, добавляя туда те пункты, которые считаете важными для оценки своей работы на рынках. Заполнение торгового журнала не требует большого количества времени, зато оно очень профитно для вашей работы на дистанции, ведь, имея перед своими глазами четкую статистику, трейдер может сделать множество выводов о своей торговой стратегии и работе.

Шаблон по ссылке: https://splashtrd.notion.webp/415358bdd94f43258ad53deac32aabe9?v=850e0842223b4ea2b6a51b3e5c637c9b

Важность торгового журнала: мнение команды CRYPTOLOGY KEY

Ведение торгового журнала не требует много усилий, и при правильном подходе к его использованию, его польза становится очевидной в короткие сроки. Кто-то может сказать, что ему достаточно посмотреть историю сделок на бирже, однако на самом деле это не дает вам полной картины и качественной статистики. Ведение журнала помогает отслеживать все торговые операции полноценно, анализируя при этом не только результаты и сумму комиссий, но и принимаемые решения, стратегии, а также психологические аспекты, которые сопровождают процесс торговли.

Торговый журнал дает возможность более глубокого анализа и оценки собственных действий на рынке. Он позволяет трейдеру отслеживать успешные и неудачные стратегии, что способствует улучшению скиллов. Это не просто способ учета сделок, но и инструмент для самоанализа, помогающий понять свои сильные и слабые стороны в трейдинге.

Кроме того, торговый журнал играет важную роль в развитии дисциплины и последовательности в подходе к торговле, поскольку дисциплинированный трейдер знает, что после входа в позицию, он должен заполнить все поля в своем журнале, а после ее закрытия, он сможет проанализировать сделку. Регулярный просмотр таблицы журнала помогает получить общий обзор портфеля сделок, оценить собственную эффективность и планировать будущие операции.

Использование торговой стратегии и торгового журнала является обязательным и отличает новичка в трейдинге от профессионала. Кроме того, торговый журнал помогает определить трейдеру, какое для него лучшее торговое время, на каких таймфреймах и на каких рынках у него получается торговать успешнее всего.

Что такое торговый журнал?

Зачем нужен торговый журнал?

Где вести торговый журнал?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!