Что такое тест Хауи. Ключевые критерии теста

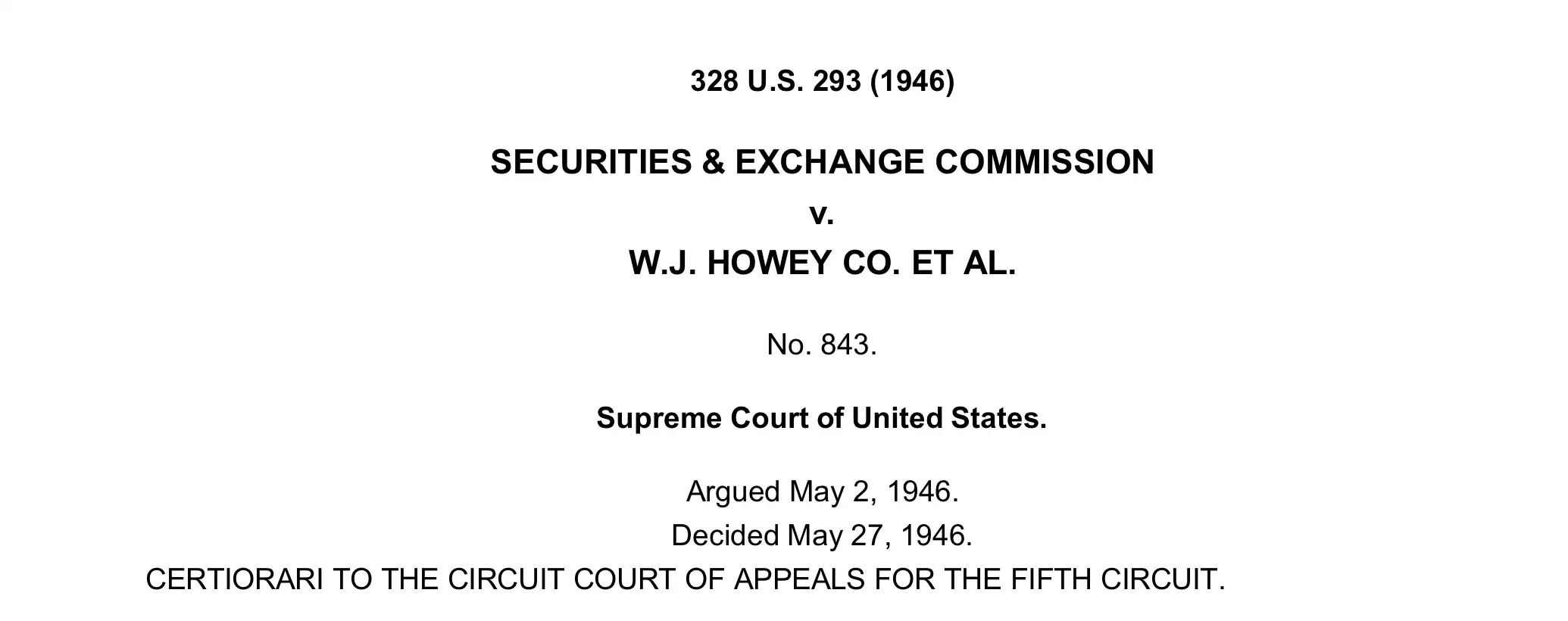

Тест Хауи – это тест с набором критериев, используемых для определения того, является ли актив ценной бумагой. Суть теста: инвестиционный договор возникает, когда вы вкладываете средства в совместное предприятие с разумным ожиданием прибыли, зависящей от усилий других людей. Тест был разработан Верховным судом США в 1946 году в деле SEC против Howey Co.

Ключевые критерии теста Хауи

- Инвестирование. Инвестирование средств в общее предприятие означает, что инвестор должен передать свои деньги в обмен на актив с ожиданиями роста в цене для получения прибыли.

- Общее предприятие. Инвестиции были направлены на общее предприятие: актив является частью проекта или бизнеса, который принадлежит нескольким инвесторам.

- Ожидание прибыли. Инвестор рассчитывает на то, что его инвестиции вырастут в цене и принесут прибыль. Возможны и другие выгоды.

- Прибыль от усилий других. Инвестор получает прибыль усилиями других лиц.

Тест Хауи, или Howey Test, применяется для определения того, является ли определенная сделка или инвестиционный контракт инвестицией в ценные бумаги. Если сделка признается инвестицией в ценные бумаги согласно тесту Хауи, она должна соответствовать требованиям регулирования SEC (Комиссии по ценным бумагам и биржам).

Тест Хауи “не официально” применяется и к криптовалютам и другим цифровым активам. Например, SEC считает, что некоторые криптовалюты, такие как токены ICO, могут квалифицироваться как инвестиционные контракты и, следовательно, должны быть регулируются как ценные бумаги.

Несмотря на четко выделенные критерии теста Хауи, он является сложным и неоднозначным, и в некоторых случаях может быть трудно определить, соответствует ли актив всем четырем критериям теста.

История появления теста Хауи

Тест Хауи был разработан Верховным судом США в 1946 году в деле SEC против Howey Co. Дело было связано с компанией Howey Co., которая продавала паи для выращивания апельсинов инвесторам. Инвесторы платили Howey Co. деньги, а взамен получали паи и право на долю от общей прибыли от выращивания апельсинов. SEC утверждала, что паи Howey Co. являются ценными бумагами, поскольку они отвечают всем четырем критериям теста Хауи:

- Инвестиция денег. Инвесторы вносили деньги в компанию Howey Co.

- Общее предприятие. Инвестиции были направлены на общее предприятие, а именно на выращивание апельсинов.

- Ожидание прибыли. Инвесторы ожидали получить прибыль от своих инвестиций.

- Прибыль от усилий других. Прибыль инвесторов зависела от усилий сотрудников компании Howey Co.

Верховный суд США согласился с SEC и постановил, что паи Howey Co. являются ценными бумагами. Это решение стало основой для теста Хауи, который используется для определения того, является ли актив ценной бумагой: Если тест Хауи признает актив ценной бумагой – это означает, что он подпадает под юрисдикцию законов США "О ценных бумагах" от 1933 года и "Об обмене ценных бумаг" от 1934 года.

Использование теста Хауи на рынках

Если актив соответствует всем четырем критериям теста Howey, то он считается ценной бумагой и подлежит регулированию. На рынках тест Хауи используется в следующих целях:

- Для защиты инвесторов. Тест Хауи помогает защитить инвесторов от мошеннических схем, которые могут маскироваться под ценные бумаги.

- Для обеспечения прозрачности рынка. Тест Хауи помогает обеспечить прозрачность рынка ценных бумаг, поскольку он определяет, какие активы подлежат регулированию.

- Для обеспечения соблюдения законов. Тест Хауи используется регулирующими органами для обеспечения соблюдения законов о ценных бумагах.

На данный момент Тест Howey применяется для регулирования следующих активов на рынках:

- Акции. Акции являются ценными бумагами, поскольку они представляют собой инвестиции денег в общее предприятие, в котором инвесторы ожидают получить прибыль от усилий других лиц.

- Облигации. Облигации являются ценными бумагами, поскольку они представляют собой инвестиции денег в общее предприятие, в котором инвесторы ожидают получить прибыль от процентов, выплачиваемых эмитентом облигаций.

- Депозитарные расписки. Депозитарные расписки являются ценными бумагами, поскольку они представляют собой инвестиции денег в иностранное предприятие.

- Индексы. Индексы могут квалифицироваться как ценные бумаги, поскольку они представляют собой инвестиции денег в портфель активов, который отслеживает определенный рынок или отрасль.

- Фьючерсы и опционы. Фьючерсы и опционы могут квалифицироваться как ценные бумаги, поскольку они представляют собой контракты на покупку или продажу актива в будущем.

- Токены ICO. Некоторые токены ICO могут квалифицироваться как инвестиционные контракты, поскольку они являются инвестициями в общее предприятие, в котором инвесторы планируют получить прибыль от усилий других лиц. Об этом уже не раз говорил глава SEC Гэрри Гэнслер, но на данный момент такие токены официально не признаны ценными бумагами.

Как и почему тест Howey применяется в криптовалютном мире?

Тест Howey часто применяется к криптовалютам и другим цифровым активам. Однако в наибольшей опасности находятся те криптопроекты, которые начинали свой путь с ICO. ICO по мнению SEC могут квалифицироваться как инвестиционные контракты и, следовательно, должны регулироваться как ценные бумаги. В 2017 году SEC выпустила предупреждение о том, что некоторые токены ICO могут быть ценными бумагами. По мнению регуляторов, ICO являются закрытыми продажами узкому кругу лиц. По этой причине токены ICO, которые соответствуют всем четырем критериям теста Хауи, должны быть зарегистрированы в качестве ценных бумаг в соответствии с Законом о ценных бумагах 1933 года. SEC также заявила, что компании, которые продают токены ICO, должны раскрывать информацию о своих проектах и рисках, связанных с инвестициями в токены ICO.SEC представила руководство по применению указанного метода в контексте криптовалют и других активов, основанных на технологии блокчейн: “Термин “ценная бумага” включает “инвестиционный контракт”, равно как и другие инструменты вроде акций, облигаций и передаваемые доли [в капитале компаний]. Цифровой актив должен быть проанализирован для определения того, обладает ли он характеристиками любого продукта, соответствующего определению ценной бумаги в соответствии с федеральным законодательством”, — говорится в документе SEC. Одним из примеров применения теста Хауи к криптовалютам является дело SEC против Ripple.

В декабре 2020 года Комиссия по ценным бумагам и биржам США (SEC) подала иск против компании Ripple Labs, Inc., материнской компании криптовалюты XRP, обвинив компанию в продаже незарегистрированных ценных бумаг. SEC утверждала, что XRP является ценной бумагой, поскольку она соответствует всем четырем критериям теста Хауи:

- Инвестиция денег. Инвесторы вносят деньги в Ripple Labs в обмен на XRP.

- Общее предприятие. XRP используется для оплаты транзакций в сети Ripple.

- Ожидание прибыли. Инвесторы ожидают получить прибыль от роста цен на XRP.

- Прибыль от усилий других. Прибыль инвесторов зависит от усилий Ripple Labs по развитию сети Ripple.

Ripple Labs отрицала обвинения SEC, утверждая, что XRP является платежным средством, а не ценной бумагой. Компания утверждала, что XRP не соответствует всем четырем критериям теста Хауи, поскольку:

- XRP не является инвестицией денег. Инвесторы не вкладывают деньги в Ripple Labs, а используют XRP для оплаты транзакций.

- XRP не является общим предприятием. XRP является платежным средством, а не долей в компании.

- Инвесторы не ожидают получить прибыль от роста цен на XRP. Инвесторы используют XRP для оплаты транзакций, а не для получения прибыли от роста цен.

- Прибыль инвесторов не зависит от усилий других. Прибыль инвесторов зависит от спроса и предложения на XRP, а не от усилий Ripple Labs.

В июле 2023 года судья Аналиса Торрес вынесла решение в пользу Ripple Labs, постановив, что XRP не является ценной бумагой. Распространение XRP через биржи не было рассмотрено как торговля ценными бумагами, так как SEC не смогла четко определить, ожидали ли инвесторы "разумно получить прибыль от предпринимательских или управленческих усилий других".Торрес заявила, что так называемые "программные продажи" составляют менее 1% от общего объема транзакций с токенами компании с 2017 года. “Подавляющее большинство людей, купивших XRP на биржах цифровых активов, вообще не вкладывали деньги в Ripple”, — подчеркнула Торрес. Тем не менее, продажи крупным участникам указывают на то, что они, вероятно, рассчитывали на получение прибыли от вложений в предприятие, что делает XRP подходящим под определение “ценная бумага”. После вынесения решения цена XRP подскочила на 99.93% – с $0,47 до $0,93.

После этого представители Комиссии заявили, что они "продолжат пересматривать решение", после чего подали апелляцию на решение судьи Торрес. А в октябре 2023 года они обратилась к федеральному судье в Нью-Йорке, просив прекратить дело против соучредителя и генерального директора финтех-стартапа Ripple. Представители Ripple ответили на это заявление, назвав его "разгромной капитуляцией правительства". Курс XRP моментально отреагировал, поднявшись более чем на 9.91% за несколько минут до $0,5244. Вероятно, что теперь все последующие подобные дела SEC против криптопроектов будут основываться именно на этом решении, так что можно считать, что XRP дал фору всем криптоактивам, которые “под вопросом”.

Биткоин – это товар или ценная бумага?

В 2022 году суд Нью-Йорка постановил, что BTC является товаром, а не ценной бумагой. Судья Брук Смит согласился с аргументами истцов, что BTC не соответствует всем четырем критериям теста Howey. Важными аргументами для принятия подобного заключения являлось также то, что BTC имеет децентрализованный характер и тот факт, что никто не управляет и не контролирует блокчейном. Во время слушания SEC против Coinbase в январе 2024 года, регулятор заявил, что BTC – единственный актив, котирующийся на Coinbase, который НЕ является “ценной бумагой”.

Решение суда Нью-Йорка имеет важное значение для регулирования криптовалют. Оно устанавливает, что криптовалюты, которые не соответствуют всем четырем критериям теста Хауи, не являются ценными бумагами и не подлежат регулированию SEC. Однако существует теория, согласно которой SEC замечает признаки ценных бумаг в криптовалютах, принцип которых основан на Proof-of-Stake (PoS), об этом ранее говорил Гэри Гэнслер. Дело в том, что такие активы позволяют зарабатывать на стейкинге. Из этого вытекает следующий вопрос: является ли стейкинг сделкой с ценными бумагами? Определение того, является ли стейкинг сделкой с ценными бумагами – спортный вопрос. Комиссия по ценным бумагам и биржам США считает, что некоторые программы стейкинга могут быть сделками с ценными бумагами. SEC утверждает, что программы стекинга могут соответствовать всем четырем критериям теста Хауи, а именно:

- Инвестиция денег. Инвесторы вкладывают деньги в криптовалюту в обмен на право участвовать в стейкинге.

- Общее предприятие. Стейкинг является частью сети блокчейна, которая является общим предприятием.

- Ожидание прибыли. Инвесторы ожидают получить прибыль от роста цен на криптовалюту или от получения вознаграждения за стейкинг.

- Прибыль от усилий других. Прибыль инвесторов зависит от усилий сообщества блокчейна по поддержанию сети.

Однако другие эксперты считают, что стейкинг не является сделкой с ценными бумагами. Они утверждают, что стейкинг не соответствует всем четырем критериям теста Хауи, а именно:

- Стейкинг не является инвестицией денег. Инвесторы не вкладывают деньги в компанию, создавшую криптовалюту, а покупают криптовалюту, которую они могут использовать для стейкинга.

- Стейкинг не является общим предприятием. Стейкер не является акционером компании, создавшей криптовалюту.

- Инвесторы не всегда ожидают получить прибыль от роста цен на криптовалюту. Некоторые инвесторы используют стейкинг для поддержки сети блокчейна, а не для получения прибыли от роста цен.

- Прибыль инвесторов не всегда зависит от усилий других. Прибыль инвесторов может зависеть от спроса и предложения на криптовалюту, а не от усилий сообщества блокчейна.

В 2022 году SEC подала иск против компании Celsius Network, Inc., обвинив компанию в продаже незарегистрированных ценных бумаг в рамках своей программы стейкинга. SEC утверждала, что программа стейкинга Celsius Network соответствует всем четырем критериям теста Хауи. В 2023 году суд Нью-Йорка постановил, что программа стейкинга Celsius Network не является сделкой с ценными бумагами. Судья Брук Смит согласился с аргументами Celsius Network, что программа стейкинга не соответствует всем четырем критериям теста Хауи.

В конечном итоге определение того, является ли стейкинг сделкой с ценными бумагами, будет зависеть от суда. Стейкинг может быть признан сделкой с ценными бумагами, а не сделкой с товарами. Вот несколько факторов, которые могут указывать на то, что стейкинг является сделкой с ценными бумагами:

- Программа стекинга предлагает инвесторам право получать прибыль от роста цен на криптовалюту.

- Программа стекинга предлагает инвесторам право участвовать в управлении сетью блокчейна.

- Программа стекинга предлагается инвесторам на условиях, которые не всегда являются прозрачными или понятными.

Вот несколько факторов, которые могут указывать на то, что стейкинг не является сделкой с ценными бумагами:

- Программа стекинга предлагает инвесторам право получать вознаграждение за обеспечение безопасности сети блокчейна.

- Программа стекинга чаще всего предлагается инвесторам на условиях, которые являются прозрачными и понятными.

Какие токены попадают под категорию ценных бумаг, согласно критериям SEC?

Основной принцип регулирования – "ожидание получения прибыли от усилий третьих лиц". Для примера, инвесторы токена могут зависеть от усилий других, особенно на ранних этапах, если успех проекта связан с разработкой и обслуживанием блокчейна. Прохождение теста Хауи считается успешным, если участники проекта предпринимают шаги для поддержания стоимости монеты, например, создавая дефицит через сжигание токенов. Еще одним признаком ценной бумаги является доля участников проекта в управленческих функциях. Руководствуясь этими критериями, под понятие ценных бумаг могут подпадать практически все токены (особенно ICO и токены управления), а также услуги стейкинга и другие программы заработка.

Ситуация со стейблкоинами

Комиссия по ценным бумагам и биржам США (SEC) считает, что некоторые стейблкоины могут быть ценными бумагами. Давайте разберем стейблкоины, согласно тесту Хауи. SEC утверждает, что стейблкоины могут соответствовать всем четырем критериям теста Хауи:

- Инвестиция денег. Инвесторы вкладывают деньги в стейблкоин в обмен на актив, который имеет потенциал для роста в цене или получения прибыли.

- Общее предприятие. Стейблкоин используется в сети блокчейна, которая является общим предприятием.

- Ожидание прибыли. Инвесторы ожидают получить прибыль от роста цен на стейблкоин или от использования его для оплаты товаров и услуг.

- Прибыль от усилий других. Прибыль инвесторов зависит от усилий сообщества блокчейна по поддержанию сети.

Однако другие эксперты считают, что стейблкоины не являются ценными бумагами. Они утверждают, что стейблкоины не соответствуют всем четырем критериям теста Howey. Разберем стейблкоины по тесту Хауи с другой стороны:

- Стейблкоин не является инвестицией денег. Инвесторы не вкладывают деньги в компанию, создавшую стейблкоин, а покупают актив, который может быть использован для оплаты товаров и услуг.

- Стейблкоин не является общим предприятием. Стейблкоин является средством обмена, а не долей в компании.

- Инвесторы не ожидают получить прибыль от роста цен на стейблкоин. Большая часть инвесторов используют стейблкоины для оплаты товаров и услуг, а не для получения прибыли от роста цен, тем более, что стейблкоин имеет фиксированную цену и должен соответствовать ей на постоянной основе.

- Прибыль инвесторов не всегда зависит от усилий других. Прибыль инвесторов может зависеть от спроса и предложения на стейблкоин, а не от усилий сообщества блокчейна.

В настоящее время SEC не имеет четкого мнения о том, являются ли стейблкоины ценными бумагами. SEC проводила расследования в отношении некоторых стейблкоинов, но не приняла никаких окончательных решений. В 2022 году SEC подала иск против компании Tether, обвинив компанию в продаже незарегистрированных ценных бумаг в рамках своей программы выпуска стейблкоина Tether (USDT). SEC утверждала, что USDT соответствует всем четырем критериям теста Хауи. В 2023 году суд Нью-Йорка постановил, что USDT не является ценной бумагой. Судья Брук Смит согласился с аргументами Tether, что USDT не соответствует всем четырем критериям теста Howey.

Регуляция рынка – это позитив?

Регуляция крипторынка может быть как позитивным, так и негативным фактором. В последнее время про регуляцию ходит много разговоров, давайте рассмотрим ее положительные стороны:

- Защита инвесторов от мошенничества и обмана. Регуляция может помочь защитить инвесторов от мошеннических схем, таких как ICO-скамы и Ponzi-схемы.

- Улучшение прозрачности и подотчетности рынка. Регуляция может помочь повысить прозрачность и подотчетность рынка, что может сделать его более привлекательным для инвесторов.

- Снижение рисков для финансовых систем. Регуляция может помочь снизить риски для финансовых систем, связанные с криптовалютами, такими как риски отмывания денег и финансирования терроризма.

- Поощрение инноваций. Предсказуемый и понятный рынок будет поддерживать развитие, появление новых идей и технологических решений.

- Выгоды для государства. Четкая система регулирования способствует прозрачной налоговой системе: криптоинвесторы смогут платить налоги, благодаря чему эта сфера будет прибыльной для государства и позволит инвесторам работать открыто и прозрачно.

- Легитимность криптовалют в глазах общества. Наша цель – повышение доверия к криптовалютам, и регулирование играет ключевую роль в достижении этой цели.

Теперь рассмотрим отрицательные стороны регулирования:

- Локальный негатив. Регуляторные события на крипторынке могут сопровождаться страхом и продажами, оказывая давление на цены активов.

- Увеличение стоимости транзакций. Регуляция может привести к увеличению стоимости транзакций, поскольку компании будут вынуждены взимать плату за соблюдение требований регулирования.

- Ограничение доступа к рынку. Регуляция может ограничить доступ к рынку для инвесторов из некоторых стран или регионов.

- В некоторых случаях регуляция может снизить уровень волатильности крипторынков. Посмотрев на фондовый рынок, наполненный ценными бумагами, вы никогда не увидите там такой волатильности, как на крипто – это в том числе связано с регуляцией. Кроме того, при введении полного контроля регулятора над крипторынками, рост такой силы, к которой мы привыкли, исключен.

В целом, регулирование крипторынка имеет больше положительных последствий, нежели негативных. По мнению экспертов, регулирование крипторынка является необходимым шагом для его дальнейшего развития. Регулирование поможет защитить инвесторов и сделать рынок более прозрачным и подотчетным. Есть эксперты, которые считают, что регулирование будет иметь негативные последствия для крипторынка. Они утверждают, что регулирование приведет к снижению инноваций и ограничению доступа к рынку. В конечном итоге регулирование является логичным шагом развития для криптовалюты и остановить его невозможно. Конечно, какие-то факторы могут в моменте негативно влиять на рынки, однако в целом это позитивный процесс для рынка.

Что говорит SEC про регуляцию криптовалютного рынка?

Комиссия по ценным бумагам и биржам США (SEC) выступает за регулирование криптовалютного рынка. SEC считает, что регулирование поможет защитить инвесторов от мошенничества и обмана, повысить прозрачность и подотчетность рынка, а также снизить риски для финансовых систем. SEC считает и прямо заявляет, что некоторые криптовалюты являются ценными бумагами. Если криптовалюта является ценной бумагой, то она должна быть зарегистрирована в SEC и соответствовать требованиям Комиссии. Комиссия по ценным бумагам и биржам США также считает, что криптовалютные биржи должны быть зарегистрированы в Комиссии и соответствовать требованиям по борьбе с отмыванием денег. SEC продолжает работать над регулированием криптовалютного рынка. Комиссия планирует принять дополнительные меры по регулированию криптовалютных рынков и компаний, работающих в этой сфере. Вот некоторые конкретные меры регулирования, которые SEC рассматривает:

- Обязательная регистрация криптовалютных бирж в SEC.

- Обязательное раскрытие информации о криптовалютах и криптовалютных биржах.

- Запрет на продажу незарегистрированных криптовалютных ценных бумаг.

- Запрет на торговлю криптовалютами, которые используются для мошенничества или отмывания денег.

SEC также рассматривает возможность создания специального органа, который будет заниматься регулированием криптовалютного рынка. Такой орган мог бы разрабатывать и применять правила для криптовалютных рынков, а также проводить расследования в отношении случаев мошенничества и нарушения правил.

Мнение команды Cryptology Key об эффективности теста Howey

Тест Хауи был разработан в середине прошлого века с целью четко определять какие активы относятся к ценным бумагам. На протяжении десятилетий тест Howey применялся по отношению к фондовому рынку, однако с появлением и распространением криптовалют, SEC начали применять его и к цифровым активам. При попытке использовать тест Хауи во время дела против XRP, Комиссия по ценным бумагам и биржам США потерпела поражение в суде. Во время слушания были вынесены два ключевых момента: распространение среди широкой аудитории не считается инвестиционным контрактом, следовательно, проект не рассматривается как ценная бумага, а также исключительная и закрытая продажа для ограниченного числа инвесторов классифицируется как инвестиционный контракт. Скорее всего, все дальнейшие подобные судебные заседания будут опираться именно на ход этого дела. Дело против XRP было первым случаем попытки применения теста Хауи к криптопроекту, однако точно не последним, ведь еще перед вынесением вердикта по делу против XRP, SEC подали три иска адресованные биржам Coinbase, Binance и Kraken: в исках были представлены целые списки монет, которые по мнению регулятора, являются ценными бумагами. В этот список включены такие проекты, как SOL, ADA, Matic, FIL, SAND, Axie Infinity, Chiliz, Flow, ICP, Near, VGX, Dash, Nexo, Atom, Mana, ALGO, Coti, OMG. Каждый из этих проектов привлек внимание SEC, и тут важно понимать, что если суд вынесет благоприятный вердикт хотя бы по одному из этих криптопроектов, у SEC появится туз в рукаве для будущих дел. Их шансы на победу в последующих судебных спорах с криптопроектами могут возрасти до более чем 90%. Насколько корректно применение теста, созданного для рынка фондовых активов, по отношению к совершенно новому классу цифровых активов – решать не нам, однако в январе 2024 года, во время заседания SEC против Coinbase, судья признал “Закон о ценных бумагах” от 1933 года и тест Хоуи “устаревшими”. Таким образом, можно сделать вывод, что для успешной регуляции, как минимум, все же понадобится трансформация текущих законов под новые современные реалии.

Что такое тест Хауи?

Какие критерии у теста Хауи?

- Инвестиция средств: инвесторы вкладывают свои финансовые ресурсы в определенную компанию.

- Общее предприятие: инвестиции направлены на общий проект.

- Ожидание прибыли: инвесторы рассчитывают на получение прибыли от своих вложений.

- Прибыль от усилий других: финансовый результат для инвесторов зависит от усилий сотрудников и руководства определенной компании.

Как тест применяется к криптовалюте?

Регуляция рынка – это позитив?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!