Понятие альткоинов простыми словами

Альткоин (altcoin) - это криптовалюта, которая является альтернативой биткоину, самой первой и самой известной криптовалюте. Если предположить, что iPhone - это биткоин, то все Android-смартфоны - альткоины.

В настоящее время существуют тысячи альткоинов. Каждый из них имеет свои уникальные особенности, сферы применения и сообщества. Среди популярных альткоинов - Ethereum, Litecoin, Ripple, Bitcoin Cash.

Виды альткоинов

- Монеты платформ - предназначены для использования в качестве платформы для создания децентрализованных приложений (dApps) и смарт-контрактов.

- Монеты конфиденциальности - для повышения конфиденциальности и анонимности транзакций.

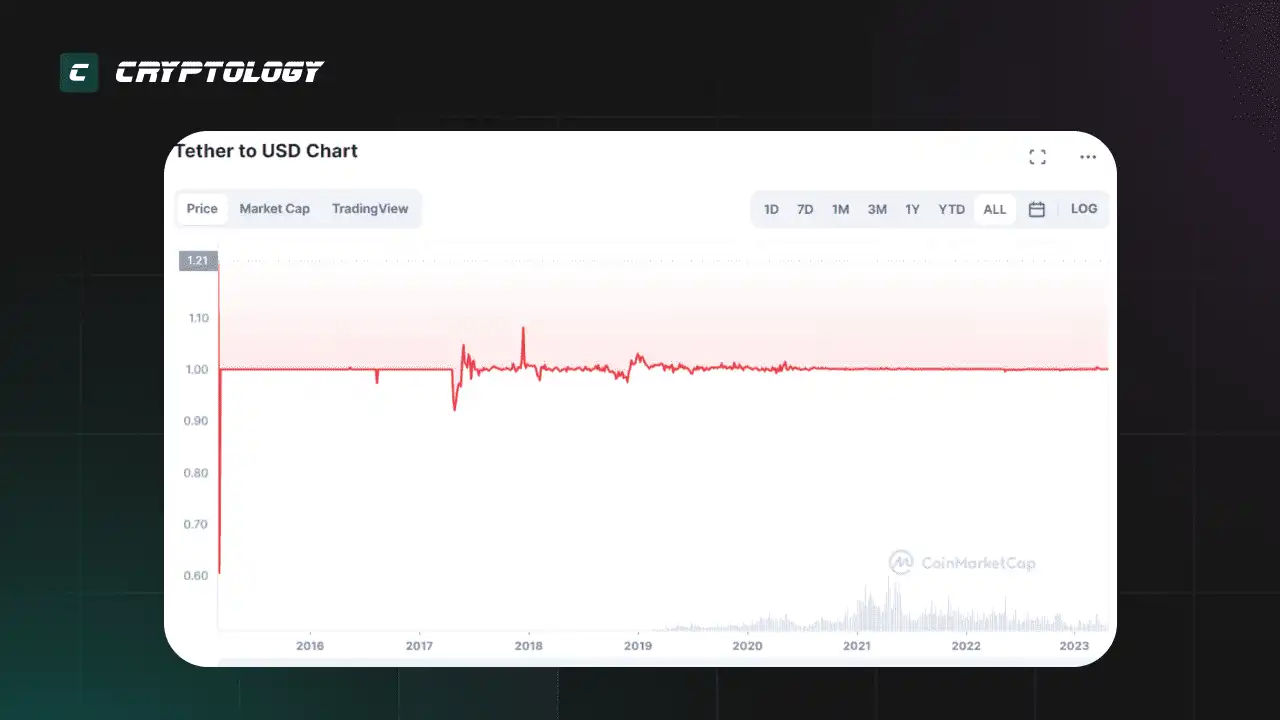

- Стейблкоины - криптовалюты, стоимость которых фиксирована и привязана чаще всего к американскому доллару.

- Утилитарные монеты - используются для оплаты доступа и услуг в определенной экосистеме.

- Платежные монеты - созданы для использования в качестве платежного средства (как в Интернете, так и в реальном мире).

- Токены управления - используются, чтобы заинтересованные стороны в определенной экосистеме блокчейна могли голосовать по ключевым решениям, таким как модернизация сети или изменения в механизме консенсуса.

Стейблкоины

Стейблкоины удобны для инвесторов и трейдеров, которые хотят застраховаться от волатильности других рисков. Они также пригодятся продавцам, которые хотят принимать криптовалютные платежи, не подвергаясь рискам волатильности.

Хотя стейблкоины обладают многими преимуществами, они не лишены определенных рисков. Например, стейблкоины, обеспеченные фиатной валютой, безопасны только в той степени, в какой безопасны банковские счета, на которых хранится базовая валюта.

Используют стейблкоины и обычные пользователи. Наиболее популярный вариант - пересылать друг другу Tether USD (USDT).

Мемкоины

Мемкоины представляют собой разновидность криптовалют, получивших широкое признание в криптовалютной индустрии, особенно в последние годы, благодаря своей вирусной природе и юмористическому происхождению.

Мемкоины, или монеты-мемы, часто создаются в шутку или в качестве тренда в социальных сетях, а не для серьезных инвестиционных целей. Они имеют запоминающиеся названия и символы, отсылающие к популярному событию или явлению, могут быстро завоевать популярность в социальных сетях, таких как Reddit и Twitter.

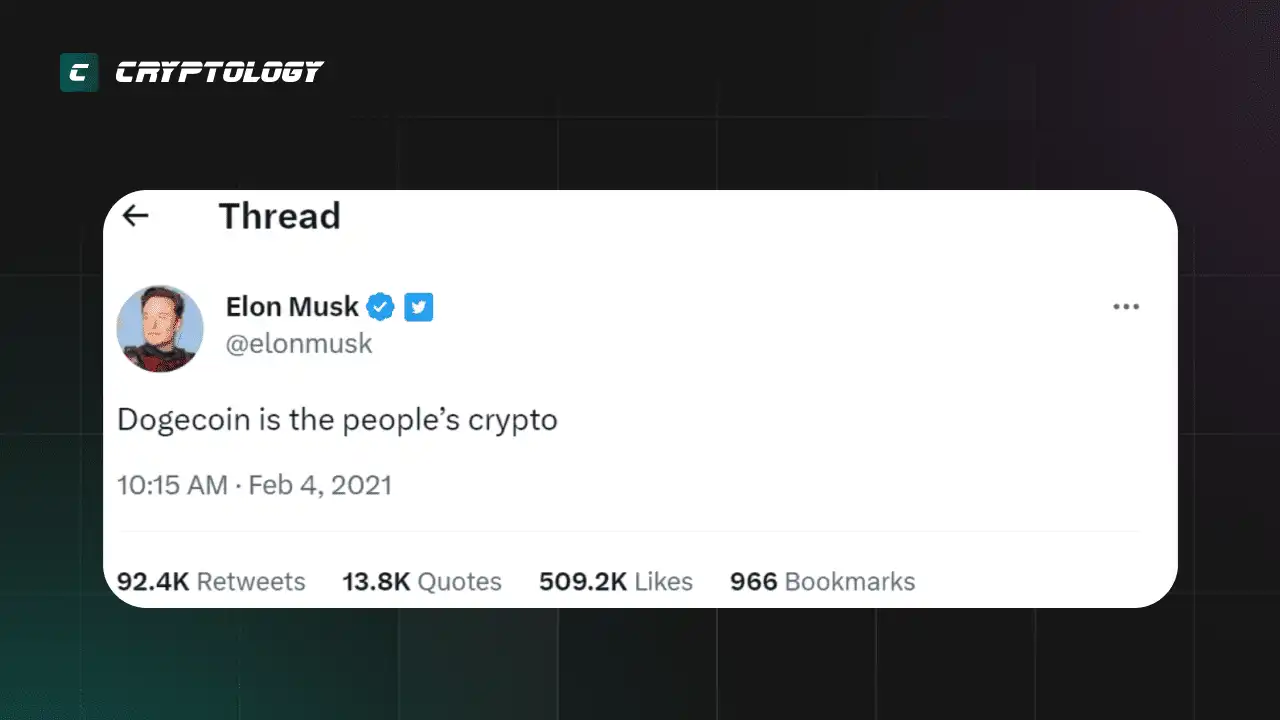

Одной из самых известных монет-мемов является Dogecoin (DOGE), которая была создана в 2013 году как пародия на увлечение биткоином. Несмотря на свое шуточное происхождение, Dogecoin стал вполне легальной криптовалютой с рыночным капиталом в миллиарды долларов и был поддержан такими известными личностями, как Илон Маск.

Утилитарные или служебные токены

Утилитарные токены представляют собой разновидность криптовалюты, которая обеспечивает пользователям доступ к определенному продукту или услуге в рамках экосистемы на основе блокчейна. Они предназначены для использования в качестве платежного средства за функции, которые предоставляет конкретная платформа блокчейн. Их не рассматривают как вариант инвестиций или спекуляций.

Предоставляя доступ к определенной услуге или продукту, утилитарные токены могут стимулировать пользователей к взаимодействию с платформой и способствовать ее росту и развитию.

Примером популярных утилитарных токенов является монета Binance (BNB), которая используется для оплаты торговых сборов и других услуг на бирже Binance.

Токены управления

Токены управления - это тип криптовалюты, которая используется для управления процессом принятия решений в рамках конкретной экосистемы на основе блокчейна. Они позволяют владельцам голосовать по предложениям и принимать решения, которые влияют на направление и развитие проекта.

Токены управления нередко применяются в децентрализованных автономных организациях.

Одним из самых популярных примеров токенов управления является токен MakerDAO (MKR), который используется для управления протоколом MakerDAO - децентрализованной кредитной платформой, позволяющей пользователям брать и давать взаймы криптовалюту без участия централизованного посредника.

Форки

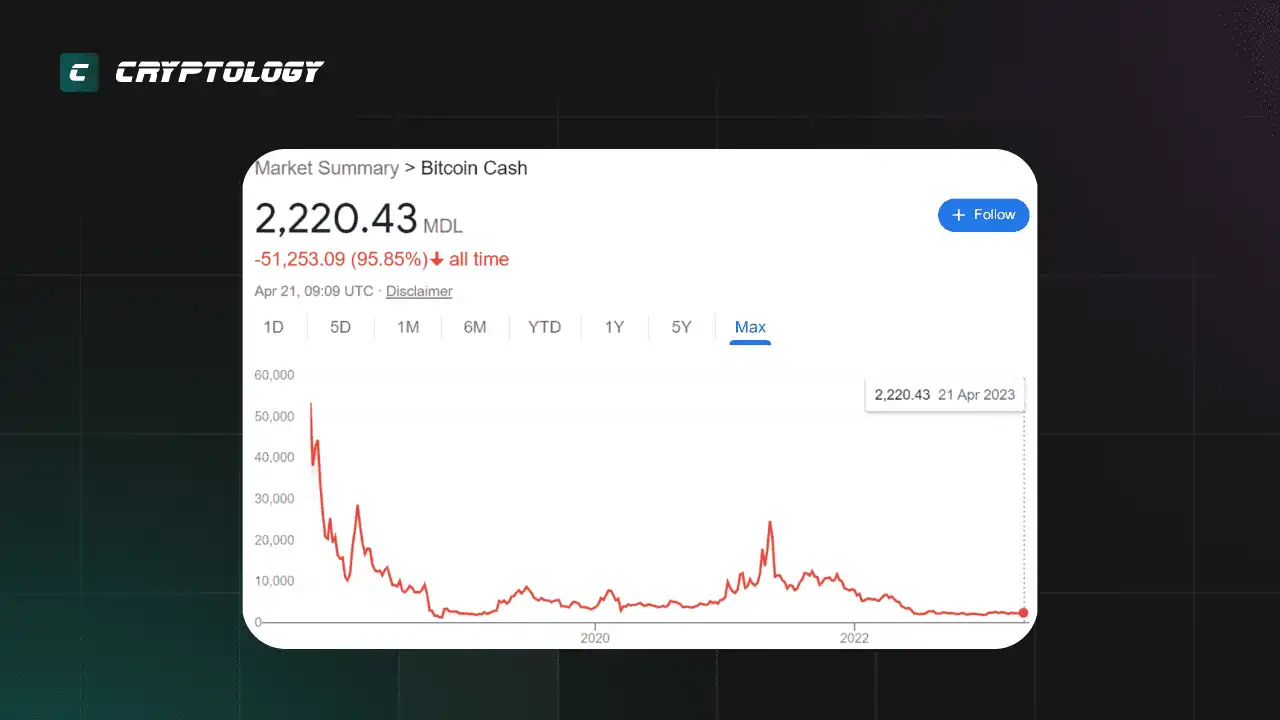

Форки относятся к разработке новой криптовалюты через копирование кода уже существующей криптовалюты и внесения некоторых изменений в протокол. Это часто делается для улучшения исходной криптовалюты или устранения предполагаемых недостатков в ее структуре.

Одним из наиболее известных примеров форка в сфере альткоинов является Bitcoin Cash (BCH). BCH был создан путем форка блокчейна биткоина, чтобы увеличить предельный размер блока с 1 МБ до 8 МБ. Это позволило проводить транзакции быстрее и дешевле.

Токены безопасности

Токены безопасности - это разновидность криптовалюты, которая представляет собой долю в реальном активе. Они предназначены для предоставления инвесторам преимуществ классических ценных бумаг.

На такие токены распространяются нормативные акты, законы о ценных бумагах, которые призваны защитить инвесторов и обеспечить прозрачность финансовых рынков. Это означает, что токены безопасности должны соответствовать требованиям законодательства о знании своих клиентов (KYC) и борьбе с отмыванием денег (AML), а также выпускаться через лицензированные биржи токенов безопасности.

Основные отличия альткоинов от биткоина

- Биткоин был разработан в первую очередь как цифровая валюта, а вот многие альткоины создаются для других целей - обеспечение более быстрых транзакций, повышение конфиденциальности или поддержка децентрализованных решений.

- Биткоин имеет самую большую рыночную капитализацию среди всех криптовалют, занимая около 40-50% всего криптовалютного рынка. Альткоины, как правило, имеют меньшую рыночную капитализацию, некоторым из них с трудом удается получить значительную популярность или широкое распространение. Такая доминация биткоина часто служит барометром для оценки общего настроения на рынке, влияя на инвестиционные решения и стратегии как в отношении самого биткоина, так и альткоинов.

- Биткоин принимается все большим числом продавцов, многие альткоины не получают значительного распространения.

Альткоин: преимущества и недостатки

Преимущества альткоинов

- Альткоины предоставляют возможность диверсифицировать свои криптовалютные портфели, снижая их подверженность какой-либо одной конкретной криптовалюте. Это может помочь снизить риск и улучшить общие показатели портфеля.

- Многие альткоины предлагают уникальные функции и возможности, которых нет у биткоина, например, более быстрые транзакции, повышенная защита данных или возможность поддержки децентрализованных приложений.

- Некоторые альткоины имеют более низкие комиссии за транзакции, чем биткоин, что делает их более экономически выгодным вариантом для пользователей, которые хотят отправлять и получать криптовалюту.

Недостатки альткоинов

- Альткоины часто обладают невысокой ликвидностью, небольшой пользовательской базой и менее развитой технологией. Все это способствует большей волатильности и более высокому риску.

- Альткоины имеют менее широкое распространение и признание, чем Биткоин, что ограничивает их полезность и ценность.

- С учетом большого количества различных альткоинов инвесторам может быть сложно ориентироваться на рынке и выбирать лучшие варианты. Это приводит к путанице и необходимости тратить время на анализ, особенно для начинающих инвесторов.

- Поскольку криптовалютный рынок продолжает расти и развиваться, возрастает риск вмешательства регулирующих органов. Альткоины могут быть особенно уязвимы для регулятивного контроля, что может повлиять на их ценность и жизнеспособность в качестве инвестиций.

Перспективы инвестиций в альткоины: мнение экспертов Cryptology KEY

Инвестиции в альткоины - это высокий риск. Несмотря на потенциал роста, они часто приводят к потерям. Всегда надо стремиться выбирать альткоины, которые имеют реальную ценность и созданы для решения реальных проблем.

Но все же, именно альткоины, а не хорошо всем известные и распространенные монеты открывают для инвесторов особые перспективы. Альткоины могут принести сотни и тысячи процентов годовых, их можно сравнивать с penny stocks (мусорные акции), благодаря которым небольшой начальный депозит можно разогнать до миллионов долларов.

А вот Биткоин, Эфириум и другие ТОП-10 монеты - это уже своего рода консервативные вложения, как Apple, Microsoft и IBM.

Альткоины поэтому - высокий риск, но и потенциал высокого дохода.

Если вы хотите узнать больше об альткоинах и получить навыки, опыт и инструменты, которые можно сразу применить на криптовалютном рынке - запишитесь на курсы трейдинга в академию трейдинга CRYPTOLOGY KEY.

Что такое альткоины?

Какие альткоины наиболее популярны?

Зачем нужны альткоины?

Как купить альткоины?

Как хранить альткоины?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!