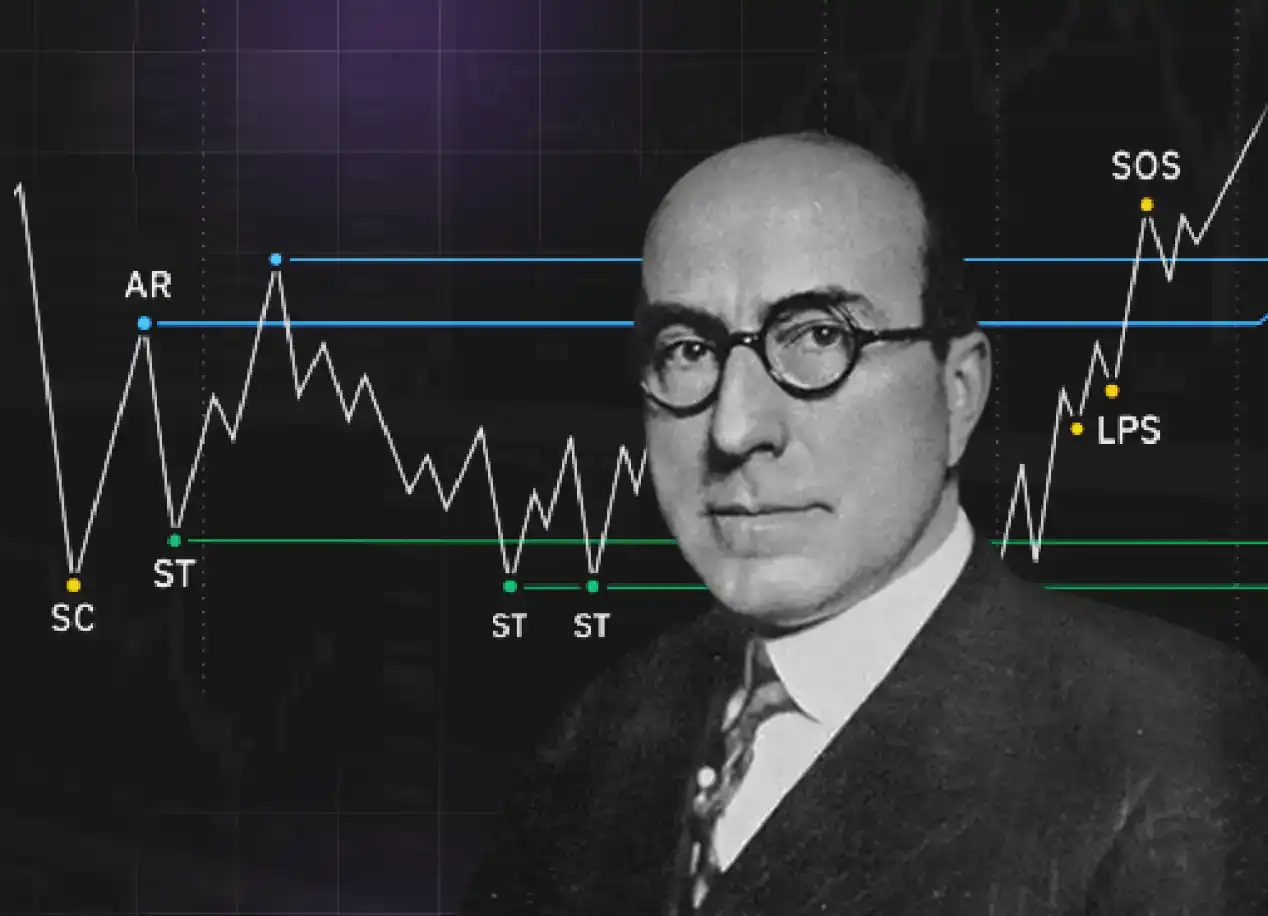

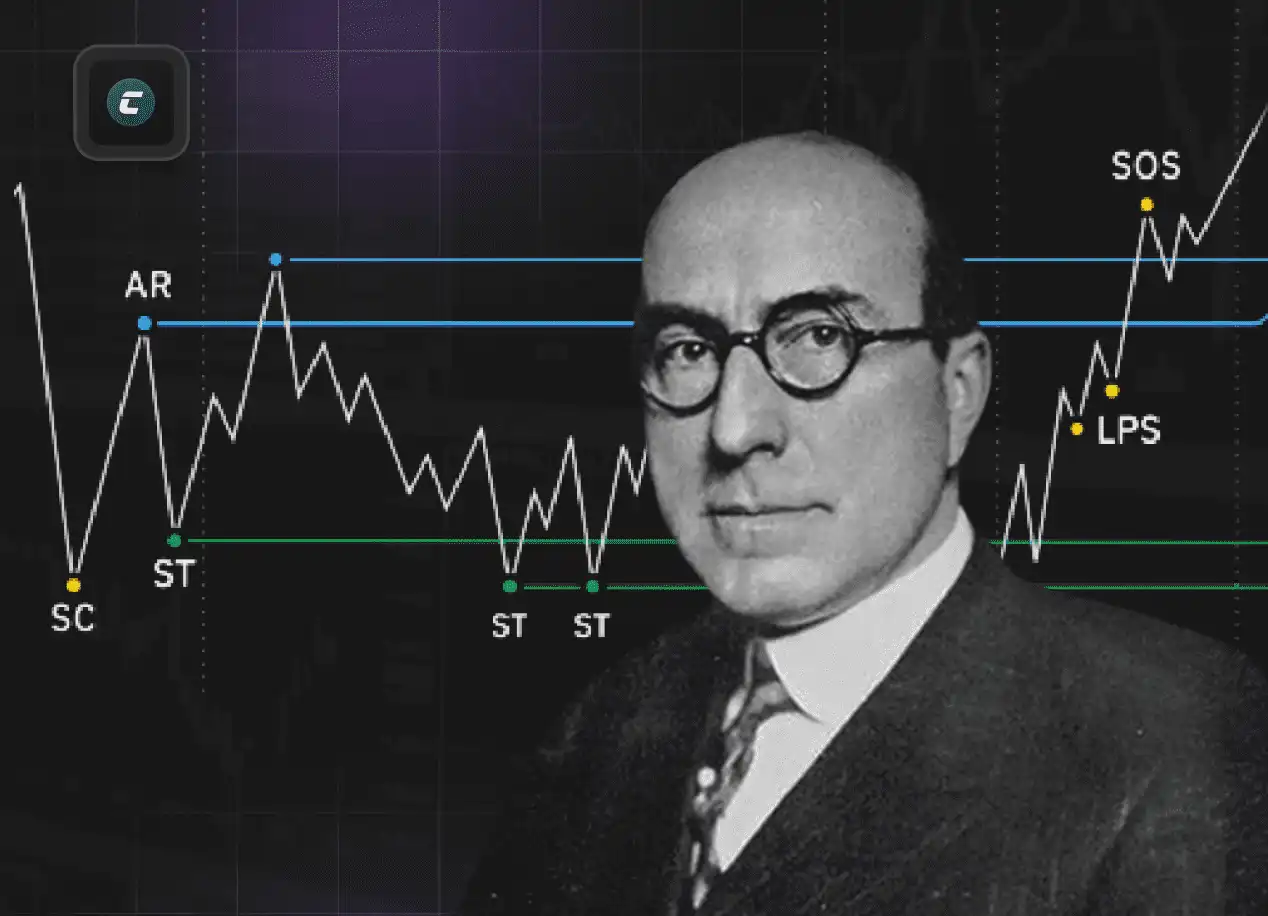

Когда речь идет о торговле на рынке, невозможно обойтись без упоминания Ричарда Вайкоффа — легенды трейдинга и создателя метода Вайкоффа. Его идеи о движении рынка и принципах торговли считаются одними из наиболее эффективных и проверенных временем.

Метод Вайкоффа - это один из самых популярных и эффективных подходов к анализу циклов на рынках. С его помощью можно определить фазу рынка и точнее прогнозировать будущие движения цены.

Ричард Демиль Вайкофф

Ричард Демиль Вайкофф был одним из наиболее влиятельных трейдеров начала 20 века. Он был не только успешным инвестором, но и педагогом, активно обучая других секретам рынка. Вайкофф был убежден, что для успешной торговли необходимо понимать мотивацию крупных участников и использовать эту информацию в свою пользу.

Пятиэтапный подход к рынку

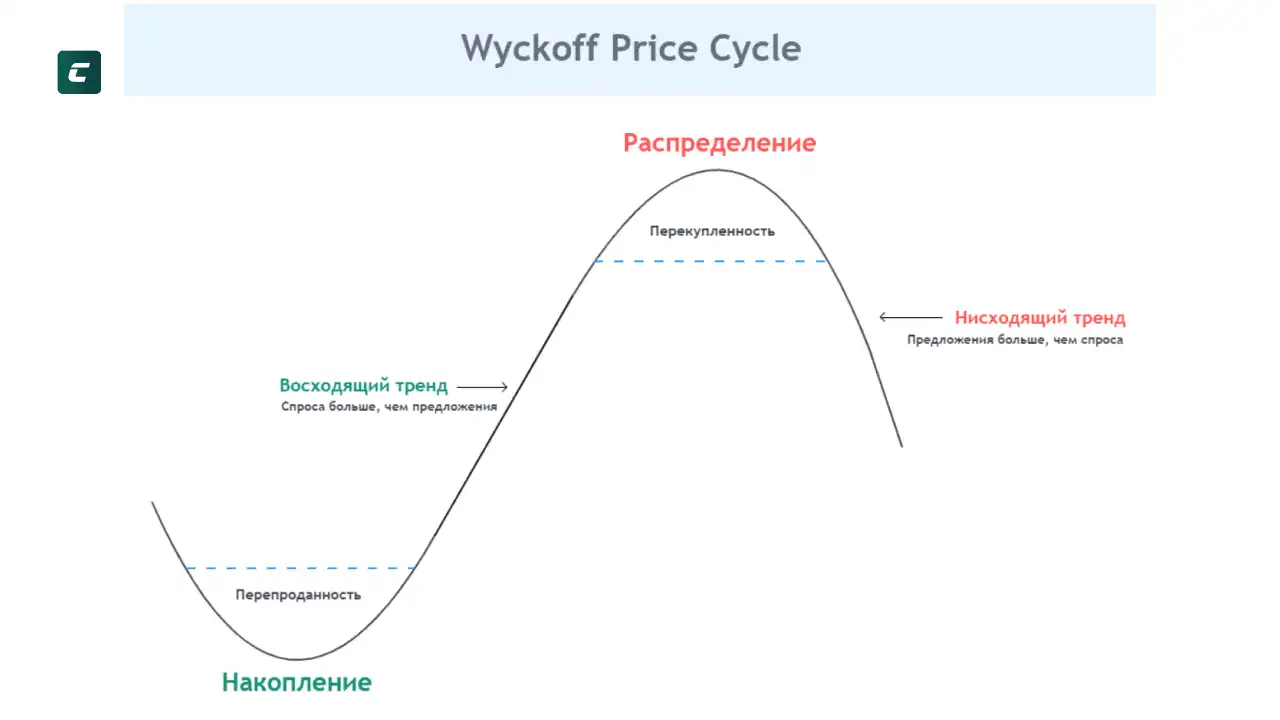

В методе Вайкоффа выделяется пять этапов, которые отражают разные фазы рыночного цикла:

- Накопление: Этап, когда "умные деньги" начинают активно покупать, говорит о том, что рынок достиг дна.

- Восходящий тренд: Период, когда активы растут в цене.

- Распределение: Время, когда крупные игроки начинают продавать активы, веря, что рынок достиг своего пика.

- Нисходящий тренд: Когда цены активов идут вниз.

- Консолидация: Рынок замедляется и многие трейдеры ожидают развития событий.

Исходя из этого Вайкофф выделяет основные шаги в анализе:

- Важно определить, есть ли в рынке крупный игрок, если да, то какие его цели?

- Для более эффективного анализа желательно выбирать те активы, где уже видны полноценные циклы, это поможет лучше определить текущий и будущий тренд.

- Выбирать сильные активы, которые имеют потенциал, технологию, фундаментал и другие факторы, которые могут помочь активу.

- Акцентировать больше внимания на тех активах, которые смогут показать более динамическое движение. С этим могут помочь объёмы.

- Важно вовремя войти в сделку. Понимание циклов и прогнозирование будущего поможет.

Ценовой цикл Вайкоффа (Wyckoff)

Чтобы понять суть ценового цикла Вайкоффа, необходимо погрузиться в динамику рынка и его фазы. Этот цикл основан на предположении о том, что крупные институциональные участники или "умные деньги" могут манипулировать рынком в свою пользу.

Накопление

На этапе накопления крупные участники начинают аккумулировать активы. Этот процесс может занять длительное время. Цена актива зачастую остается в определенных рамках, формируя так называемые "торговые диапазоны". Этот диапазон становится своеобразной "базой", с которой начнется будущий восходящий тренд. На графиках это выглядит как длительный период без значительных колебаний в цене.

Восходящий тренд

После завершения фазы накопления начинается восходящий тренд. "Умные деньги" уже вошли в рынок, и теперь розничные инвесторы и трейдеры начинают активнее покупать активы, замечая рост. Это ускоряет движение цен вверх.

Распределение

На этапе распределения крупные игроки начинают продажу активов. Они делают это постепенно, чтобы не вызвать паники на рынке. Таким образом, аналогично фазе накопления, формируется торговый диапазон, но уже на вершине тренда.

Нисходящий тренд

После завершения распределения начинается нисходящий тренд. Как правило, этот этап развивается быстрее, чем восходящий тренд, так как паника и страх распространяются быстрее, чем оптимизм. "Умные деньги" уже вышли из рынка, а розничные инвесторы и трейдеры пытаются минимизировать убытки.

Консолидация

После нисходящего тренда рынок входит в фазу консолидации. Здесь цены могут колебаться в узком диапазоне, пока рынок не определится с новым направлением.

Понимание ценового цикла Вайкоффа дает трейдерам и инвесторам уникальное преимущество. Оно позволяет предвидеть будущие движения рынка, анализируя текущую фазу и действия крупных участников.

Тест оценки актива на покупку

Существует ряд тестов с вопросами, на которые нужно ответить перед покупкой. Правильно поставленные вопросы помогают лучше оценить актив и его цикл, вот некоторые вопросы:

- Удовлетворяет ли вас соотношение риска к прибыли? Минимальный рекомендуемый показатель 1 к 3, что означает потенциальную потерю одного доллара с возможностью заработать три.

- Можно ли утверждать, что прошлый нисходящий тренд закончился?

- Завершил ли актив все фазы прошлого цикла? Была ли фаза финальных продаж с повторным тестом?

- Есть ли наличие увеличивающихся объёмов при росте/снижении?

- Актив реагирует на рост рынка сильнее, чем большинство других инструментов?

Законы рынка Ричарда Вайкоффа

Закон предложения и спроса: Это основная движущая сила любого рынка.

Спрос > Предложение = Цена растет

Спрос < Предложение = Цена падает

Спрос = Предложение = Отсутствие значительного изменения цены, низкая волатильность.

Эти законы работают и применяются на всех рынках, не только в методе Вайкоффа.

Закон причины и следствия: Для каждого движения на рынке существует причина.

Внутри торгового диапазона создается причина для дальнейшего развития ценового движения, поэтому нам важно правильно определить, какая фаза сейчас реализуется. Фазы Вайкоффа дают больше понимания о том, как действует рядовой инвестор и крупные участники. Крупный капитал набирает позицию в момент потери надежды мелких инвесторов, покупая все их активы. Далее происходит рост и крупный игрок начинает распродавать свой актив по ценам выше тем же инвесторам, которые вернулись увидев рост.

Закон усилия и результата: Результаты на рынке часто коррелируют с усилиями, затраченными на их достижение.

Ход цены должен быть подтвержден объемом.

Если цена легко идет вверх, но объемы не подтверждают силу движения, скорее всего это манипулятивное движения для последующих продаж. Если цена легко идет вниз, но объемы не подтверждают силу движения (низкие объемы), скорее всего это манипулятивное движение для последующих покупок.

Анализ торговых диапазонов

Торговые диапазоны играют ключевую роль в методе Вайкоффа. Вайкофф верил, что анализ диапазонов, в которых торгуется актив, может дать глубокое понимание текущей фазы рынка

Фазы формирования в диапазоне

Определение фаз формирования рынка — ключевой момент в методологии Вайкоффа. Эти фазы позволяют трейдерам прогнозировать будущие движения рынка на основе текущего состояния.

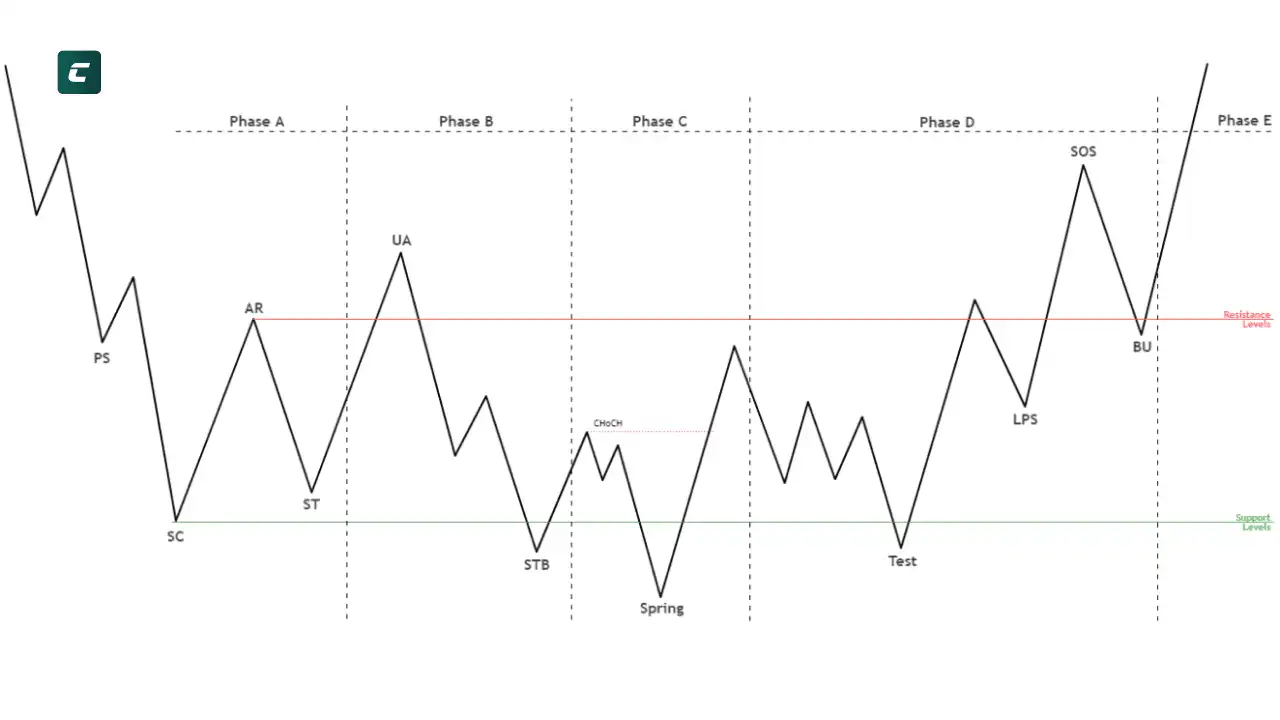

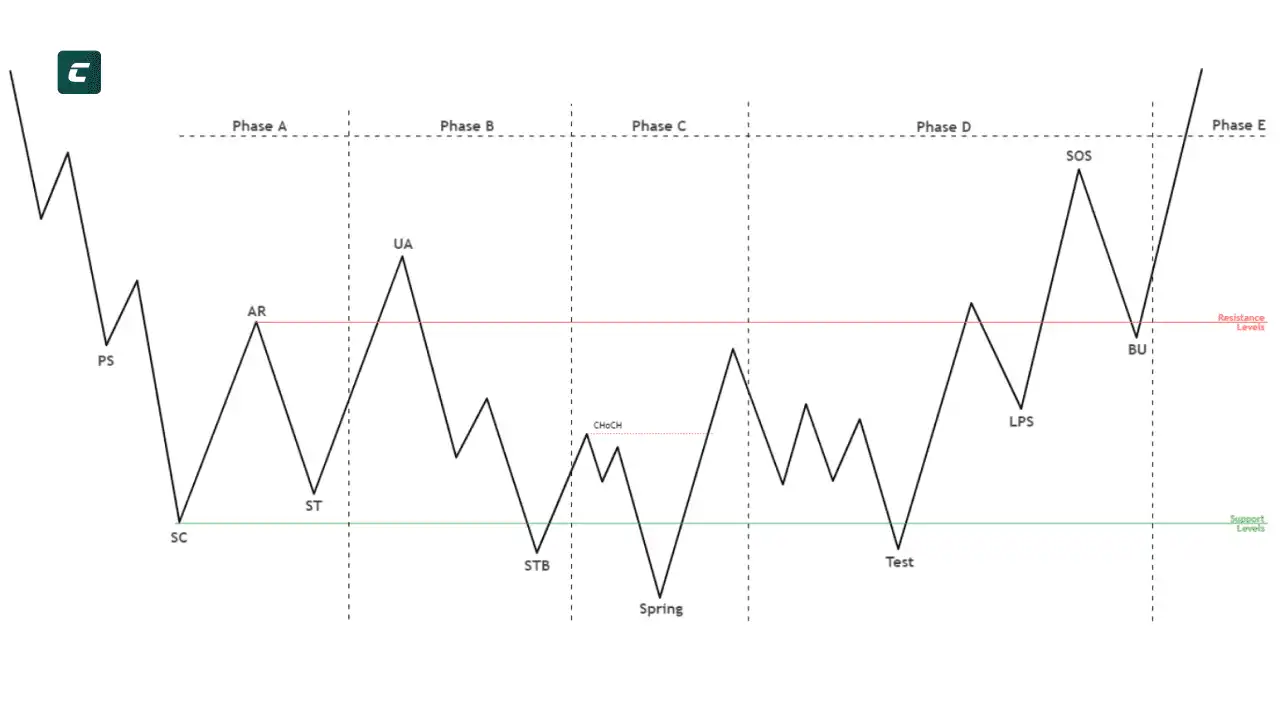

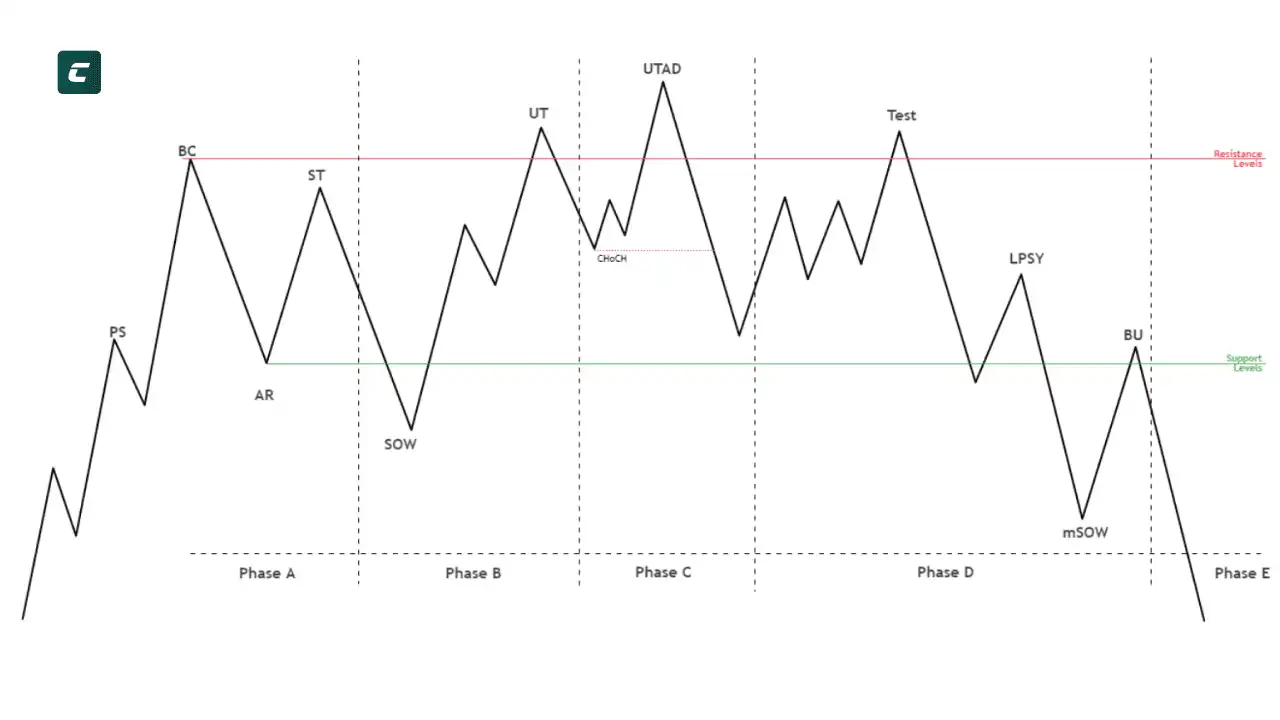

Phase А: (PS + SC + AR + ST) Конец предыдущего тренда.

Phase В: (UA + STB) Построение потенциального движения.

Phase С: (Spring) Тестирование предыдущего экстремума.

Phase D: (LPS + SOS + BU) Подтверждение нового тренда.

Phase E: Выход за рамки диапазона.

Схемы Вайкоффа

Схемы или шаблоны, которые Вайкофф разработал, представляют собой конкретные модели поведения цен, которые обычно появляются на разных этапах рыночного цикла. Они включают в себя различные паттерны, такие как "признаки силы" и "признаки слабости".

Аббревиатуры фаз по Вайкоффу

PS (Preliminary support/supply - предварительная остановка цены в аккумуляции или дистрибуции) - первая попытка остановить трендовое движение перед началом консолидации, зачастую поддержка или сопротивление терпит неудачи в этой фазе.

SC / BC (Selling/Buying climax - кульминация продаж/покупок) – первый признак интереса покупателя в аккумуляции и продавца в дистрибуции, происходит на увеличенных объемах. Создается трейдерами, способными инициировать изменение цен.

AR (Automatic rally / automatic reaction) – резкое импульсное движение после кульминации покупок/продаж, обычно показывает границы торгового диапазона (боковика), в котором будет происходить набор или распределение актива. Переход от рынка, который контролируется одной из сторон к рынку в состоянии равновесия.

ST (Secondary test) – проверка на прочность намерения покупателя или продавца в кульминации покупок (SC) или продаж (BC). После ST мы можем сказать, что нисходящий или восходящий тренд был остановлен и мы перешли в состояние консолидации, где крупный игрок готов набирать/распределять свои позиции.

UA (Upthrust action - признак силы) / mSOW ( minor Sign of Weakness - предварительный признак слабости) – не всегда появляется на графике, движение с целью снятия ликвидности с AR (верхней или нижней границы боковика).

STB / UT (Secondary test B / Upthrust - повторный тест) – снятие ликвидности с SC / BC, если не происходит слома локальной структуры, то в последствии можем увидеть Spring / Utad для сбора последней ликвидности.

Spring / UTAD (Springboard/Upthrust after distribution - последняя манипуляция крупного игрока) – выполняется с целью высадки всех лишних игроков с рынка и заключительного набора позиции крупным игроком. Как следствие происходит выход из консолидации и истинное движение вверх или вниз.

Test - тестирование Spring / Utad. Возможность для агрессивного входа в рынок после локального слома структуры.

SOW / SOS (Sign of weakness/Sign of strength) – выход цены за пределы боковика, данное движение является подтверждением нашей схематики аккумуляции/дистрибуции.

LPS / LPSY (Last point of support/last point of supply - последняя точка поддержки/сопротивления) – возможность консервативно зайти в сделку после выхода цены из консолидации.

BU (back-up) – импульсное движение для последнего набора позиции перед трендовым движением.

Основные правила:

- Никогда не торгуйте против основного тренда.

- Определите текущую фазу рынка перед принятием решения о торговле.

- Используйте объем для подтверждения движения цены.

Аккумуляция

Аккумуляция — это фаза, когда "умные деньги" начинают активно входить на рынок. Трейдеры должны быть внимательны к признакам аккумуляции, таким как увеличение объема при росте цен.

Схематический пример

- Любая аккумуляция формируется после нисходящего движения.

- Остановка трендового движения (формирование точек SС, AR, ST).

- В аккумуляции нас всегда будет интересовать работа с ликвидностью снизу (это наличие STB и Spring).

- Снижение уровня волатильности и объема по мере развития диапазона.

- После финальной манипуляции важным аспектом является наличие смены характера (choch), наличие повышенных объемов и начало зарождения восходящего тренда.

- Аккумуляция может считаться завершенной и подтвержденной после того, как цена выходит за пределы боковика и формируется SOS.

Графический пример

Дистрибуция

На этапе дистрибуции "умные деньги" начинают выходить из рынка. Это может привести к резкому падению цен. Главное для трейдера — увидеть признаки дистрибуции заранее.

Схематическое изображение

- Любая дистрибуция формируется после восходящего движения.

- Остановка трендового движения (формирование точек BC, AR, ST).

- В дистрибуции нас всегда будет интересовать работа с ликвидностью сверху (это наличие UT и UTAD).

- Увеличение уровня волатильности и объема по мере развития диапазона.

- После финальной манипуляции важным аспектом является наличие смены характера (choch), наличие повышенных объемов и начало зарождения нисходящего тренда.

- Дистрибуция может считаться завершенной и подтвержденной после того, как цена выходит за пределы боковика и формируется MSOW.

Важность объемов и их анализ в методе Вайкоффа: экспертное мнение команды Cryptology KEY

Анализ объёмов помогает определить силу или слабость актива. Рост без объёмов может сигнализировать про манипулятивность движения, рост в сопровождении с объёмами говорит о силе.

Действительно ли этот метод работает?

Метод Вайкоффа хорошо ложится под новые реалии рынка. Несмотря на то, что методу более ста лет, он хорош и применим. Законы, циклы и фазы рынков остались такими же. Естественно, что рынок стал динамичнее и изменился за последнее время, но и мы не стоим на месте, адаптируясь сами и адаптируя используемые инструменты под реалии, но основы остались теми же. Суть рынков осталась, что позволяет и дальше использовать этот метод в комбинации с другими инструментами.

Можно ли использовать метод Вайкоффа на крипторынке?

В интернете можно найти много споров на эту тему. Да, крипторынок волатильнее и моложе, нежели классические рынки, но в этом есть и ряд плюсов, благодаря которым активы могут лучше поддаваться методу Вайкоффа, который уже не раз доказал свою работоспособность на рынке криптовалют. Важно учесть, что крипторынок не стоит на месте, сюда приходит всё больше институциональных инвесторов и капитала с традиционных рынков, что влияет на его динамику. Регуляторные действия также приведут к изменениям. Общая капитализация постепенно растёт и это еще один аргумент за то, что рынок будет лучше поддаваться анализу.

Применение метода Wyckoff в торговле на крипторынке

Чем ликвиднее актив, тем лучше работает метод. Анализировать малокапитализированные активы может быть напрасной тратой времени, так как они плохо поддаются анализу. Рыночные циклы всегда уникальны и неповторны, но в них всегда есть конкретные стадии, которые также применимы тут, на крипторынке.

Заключение

Метод Вайкоффа остается одним из самых эффективных инструментов для понимания рыночных циклов и прогнозирования будущих движений цен. Хотя метод был разработан более ста лет назад, его принципы остаются актуальными и сегодня. Для успешного применения этой методики требуется понимание основных принципов и тщательный анализ рынка.

Примечание: Это лишь верхушка айсберга методики Вайкоффа. Глубокое понимание требует детального изучения и практики.

Если вы хотите узнать больше о криптовалютах и получить навыки, опыт и инструменты, которые можно сразу применить на криптовалютном рынке, запишитесь на курсы трейдинга в школу трейдинга CRYPTOLOGY KEY.

Что такое метод Вайкоффа?

Как торговал Вайкофф?

Что такое Композитный человек Вайкоффа?

Что такое фаза накопления по Вайкоффу?

Что такое цикл распределения Вайкоффа?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!