Что такое скам-проекты

Скам-проекты в криптовалюте – это мошеннические проекты, созданные для того, чтобы обманом завладеть деньгами инвесторов. Их главная цель – привлечь внимание людей и убедить их вложить деньги в проект, который на самом деле не существует или не имеет реальной ценности.

Наиболее распространенным скам-проектами в криптовалюте являются: фальшивые ICO, монеты «пустышки», псевдо-инвестиционные проекты, схемы Понци (пирамиды), пиратские монеты.

Как работают скам-проекты

Как правило, мошенники искусственно поднимают цену своего проекта, таким образом манипулируя ожиданиями людей и играя на их жадности. Инвесторы начинают нести деньги в проект, поскольку ожидают от него экспоненциальный рост, а после запуска разработчик исчезает с рынка, унося средства инвесторов. Когда обман раскрывается, пользователи массово избавляются от активов, происходит Panic sale и цена рушится, опускаясь до нуля. Кто-то успевает продать активы и забрать хоть что-то, а кто-то из-за нехватки ликвидности теряет все свои средства.

Рассмотрим подробнее все виды таких проектов:

- Фальшивые ICO. Это проекты, которые проводят первичное предложение монет (ICO), чтобы собрать деньги у инвесторов. Однако эти проекты являются мошенничеством, и инвесторы не получают никаких реальных активов взамен на свои средства.

- Монеты-пустышки. Это криптовалюты, которые не имеют реальной ценности или применения. Они часто создаются мошенниками для того, чтобы обманом заставить инвесторов купить их.

- Псевдо-инвестиционные проекты. Это проекты, которые обещают инвесторам высокую доходность за короткий период времени. Однако эти проекты часто являются мошенничеством, и инвесторы в конечном итоге теряют свои деньги.

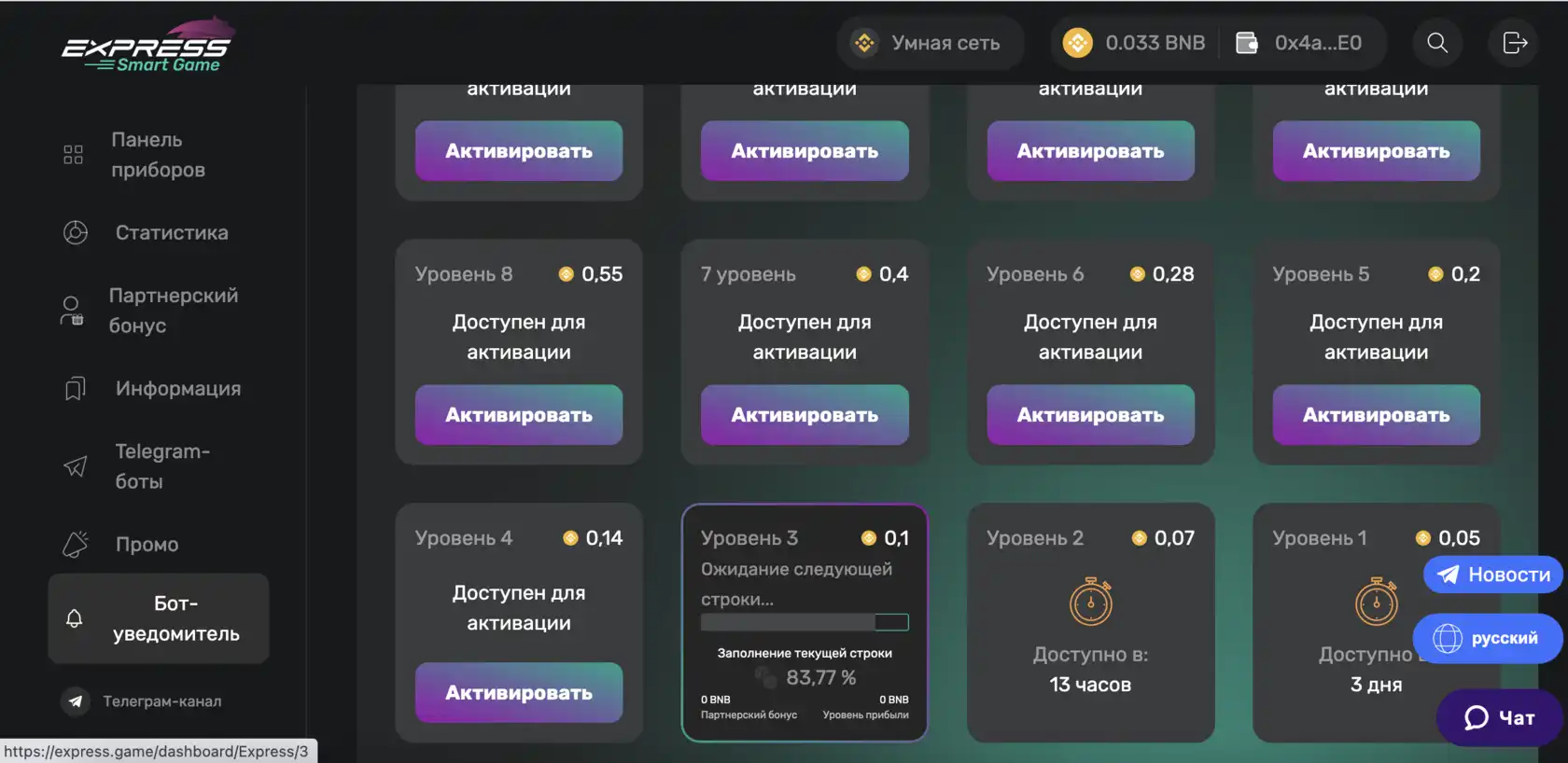

- Схемы Понци. Еще один вид проектов, которые обещают высокую доходность за короткий период времени. Эта доходность достигается за счет денег, полученных от новых инвесторов, а не за счет реальных инвестиций. Схема Понци работает следующим образом: мошенник создает инвестиционный проект, который обещает инвесторам высокую доходность, далее происходит привлечение новых инвесторов. Мошенник использует деньги новых инвесторов, чтобы выплатить доход предыдущим инвесторам. Схема Понци работает до тех пор, пока мошенник может привлекать новых инвесторов. Как только поток новых инвесторов иссякает, схема рушится, и инвесторы теряют свои деньги.

Одним из самых известных проектов, основанных на схеме Понци является МММ, который был создан в 1992 году, а потерпел крах в 1997. Примером криптовалютных проектов такого типа является Express Game – он функционировал в 2022 году.

Какие риски несет инвестирование в скам-проекты

Пиратские монеты. Это криптовалюты, которые создаются на основе уже существующего проекта. Они часто используются для того, чтобы обманом заставить инвесторов продать свои активы в существующем проекте и инвестировать в пиратскую монету. Такие монеты можно сравнить с фишинговыми веб-сайтами.

Кроме этого, существуют также случаи, когда мошенники покупают уже существующий токен с низкой ликвидностью, поднимают вокруг него хайп, после чего инвесторы закупают его себе в портфель, а мошенники "разгружаются" с помощью новых инвесторов, продавая токен гораздо дороже, чем купили его изначально.

Еще одним распространенным способом мошенничества является невозможность продать токен после его покупки: инвесторы покупают токен, однако продать его не могут, даже если цена на него растет. В этот момент мошенники удаляются с той ликвидностью, которую занесли инвесторы. Известным примером таких махинаций является токен Squid, которые появился на рынке после выхода сериала "Squid Game". Мошенники создали ажиотаж вокруг монеты, поклонники сериала начали закупаться, цена выросла на 310000%, однако когда инвесторы захотели продать токен, сделать это не получилось. После того как люди начали понимать, что это скам-токен, цена монеты обрушилась.

Чтобы избежать попадания на уловки скам-проектов в криптовалюте, важно проводить тщательный анализ любого проекта, прежде чем инвестировать в него.

Потеря всех инвестиций - наиболее распространенный риск, связанный с инвестированием в скам-проекты. Мошенники часто используют сложные финансовые схемы, чтобы обмануть инвесторов, и в конечном итоге инвесторы теряют все свои деньги.

Конечно, инвесторы могут понять в определенный момент, что токен, в который они инвестировали, является скамом, однако, как правило, это происходит, когда цена на него начинает снижаться. Даже если инвесторам удастся вернуть часть своих денег, они все равно несут финансовые убытки.

Кроме финансовой стороны данного вопроса нельзя умалять и психологические последствия для человека. Потеря денег может иметь серьезные психологические последствия для инвесторов. Они могут испытывать чувство разочарования, гнева и даже депрессии.

Скам-проекты обычно не обеспечивают инвесторов надлежащей правовой защитой, из-за чего, даже если человек захочет как-то вернуть свои потерянные средства, у него не получится. Биржа FTX, которая потерпела крах в 2022 году, потихоньку возвращает средства пострадавшим, поскольку в любом случае предполагает правовую защиту пользователей. В скам проектах такого не предусмотрено.

Основные признаки скам-проектов

Слишком «сладкие» условия – один из главных признаков скама. Обещания высокой доходности за короткий период времени – один из самых распространенных признаков мошенничества. Мошенники часто обещают инвесторам высокую доходность, чтобы привлечь их внимание. Однако эти обещания часто нереалистичны и невыполнимы.

Кроме этого, признаком обмана также является отсутствие прозрачности. Мошенники часто не предоставляют инвесторам никакой информации о своих проектах. Они могут иметь непрозрачный веб-сайт или не предоставлять никакой информации о своей команде разработчиков. Если вы не можете найти никакой информации о команде проекта или она является анонимной – смело ставьте красный флаг проекту.

Маркетинг – это хорошо, но агрессивные маркетинговые кампании – страшно. Мошенники часто используют агрессивную маркетинговую кампанию, чтобы привлечь внимание инвесторов. Они могут использовать социальные сети, рекламу, лидеров мнений и другие методы, чтобы распространять информацию о своем проекте. Подобное поведение часто является красным флагом, на который следует обратить внимание перед инвестированием.

Примером может служить игра IguVerse и ее агрессивное продвижение. Для продвижения были задействованы социальные сети, блогеры, Pop Up реклама, нативная реклама и много других маркетинговых инструментов. Этот криптовалютный проект заявил о своем революционном подходе к индустрии игр и развлечений, но со временем возникли проблемы. Ограничения на вывод средств, недостаток игр и недовольство качеством приложений стали серьезными проблемами. Инвесторы заметили неправомерное поведение команды проекта. Несмотря на продолжающееся привлечение инвестиций и проведение ICO, стало ясно, что проект лишен реальной ценности. Команда не выполняет свои обещания и не соблюдает обязательства перед инвесторами.

Если вы видите какой-либо из этих признаков, важно провести тщательный анализ проекта, прежде чем инвестировать в него.

Инструменты для проверки токена. Проверка безопасности смарт-контрактов

Если вы решили инвестировать в проект, очень важным является проведение детального ресерча с целью избежания мошенничества. Существует множество инструментов для проверки токенов, которые могут помочь инвесторам оценить безопасность и надежность проекта.

Мошенники часто применяют тактику FOMO (страх упущенной возможности), когда продвигают свои проекты. Анонсы в соцсетях ясно демонстрируют, что у пользователя нет времени на раздумья – нужно быстро вложить средства, иначе будет поздно. Однако вкладывать деньги, не проведя исследования, является очень рискованным. Для того, чтобы не попасть в ловушку, следует выделить время и изучить все доступные детали проекта.

В первую очередь нужно проверить команду, которая создала проект. Команда проекта является одним из важнейших факторов, которые следует учитывать при принятии решения об инвестировании: опытная и квалифицированная команда с хорошей репутацией является признаком того, что проект имеет хорошие шансы на успех. Разработчики скам-токенов, в свою очередь, предпочитают оставаться анонимными, осознавая, что они совершают преступление, и разглашение информации о себе может привести к их аресту. Если вы заинтересованы новым проектом, но не можете найти данные о разработчиках в социальных сетях или на сайте – будьте осторожны.

Конечно, факт анонимности не гарантирует, что проект незаконный, однако это точно является красным флагом. Большинство компаний делают упор на свою репутацию и раскрывают личности всех участников команды, так как без этой информации они не могут даже залиститься на крупных биржах. Открытая команда является репутационным моментом, который вызывает доверие со стороны пользователей.

После того, как вы изучили команду, следует обратить внимание на White Paper проекта. White Paper (белая книга) – это документ, который описывает проект, его цели и потенциальные преимущества. White Paper является важным источником информации для инвесторов. Если в проекте нет White Paper – это еще один красный флаг. Обычно мошенники не тратят время на White Paper. В то же время, наличие White Paper само по себе все еще не гарантирует честность создателей. Следует тщательно изучить этот документ. Например, если White Paper состоит исключительно из обещаний высоких доходов и прогнозов роста монеты – это красный флаг. Кроме этого, обратите внимание на то, как написан документ – несвязный и плохо структурированный текст должен быть для вас предупреждением. Противоречивая или неясная информация также может свидетельствовать о фиктивности проекта.

Если вы видите, что с White Paper что-то не так, важно провести дополнительные исследования, прежде чем инвестировать в него.

После этого шага следует изучить рекламу. Мошенники, как правило, активно продвигают свои продукты среди популярных блогеров и в социальных сетях. Важно помнить, что блогеры размещают рекламу за вознаграждение, и не все из них обеспокоены своей репутацией.

Перед вложением денег в проект, проверьте социальные сети, связанные с ним. Обратите внимание на дату создания групп или каналов. Если монета новая, а новостная лента полна обещаний "легких" денег, это может быть признаком мошенничества – красный флаг. Кроме того, даже если вы нашли информацию о проекте на платных ресурсах – это не является 100% уверенностью в добросовестности проекта, поскольку в таких группах часто закрыты комментарии, а как только проект скамится, информация о нем удаляется. Никогда не верьте слепо в рекламу подобных инвестиционных активов, даже если информацию вы нашли у своего любимого блогера.

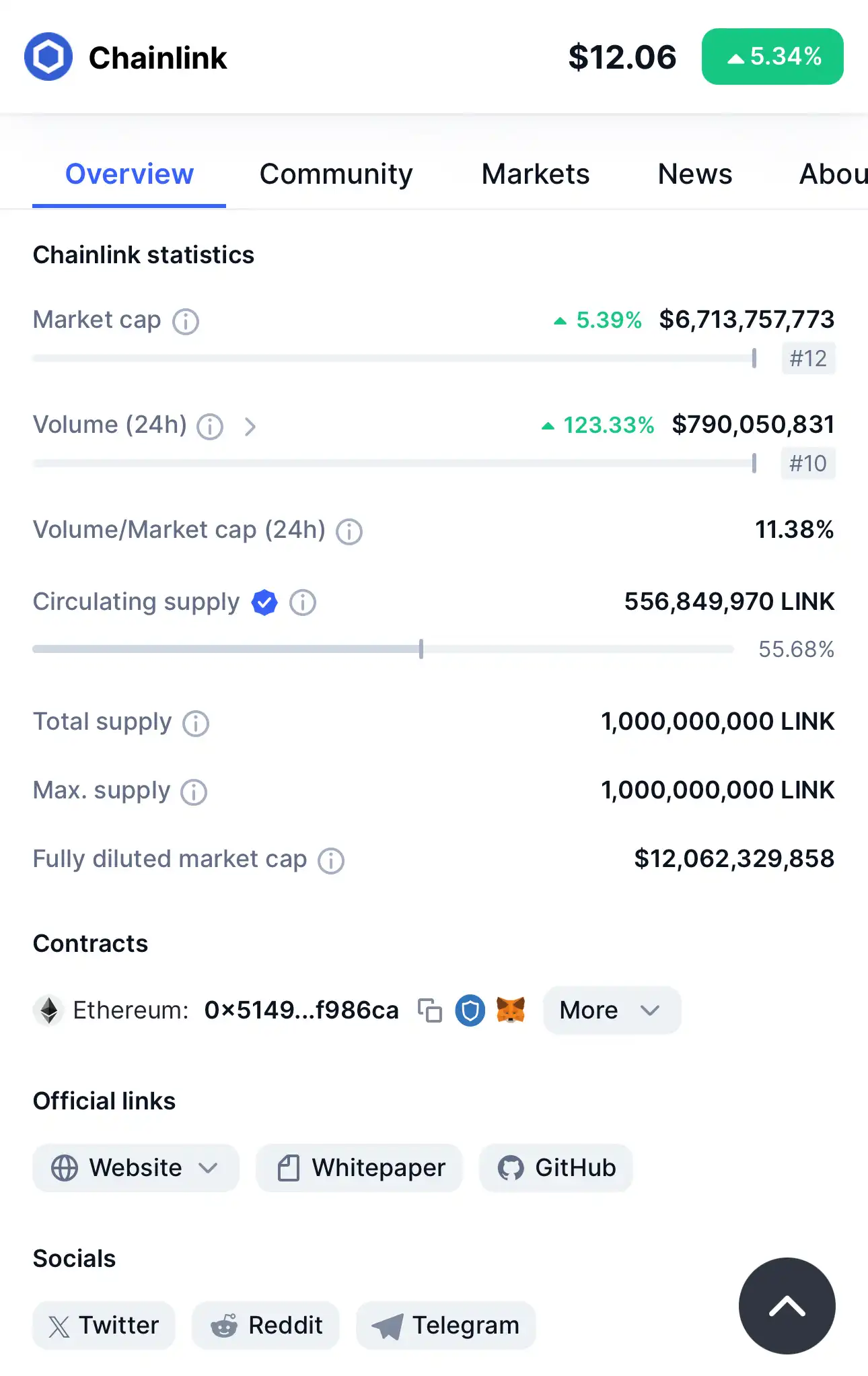

Далее обратите внимание на то, размещен ли токена на coinmarketcap.com и coingecko.com. На этих площадках, как правило, можно найти всю самую важную информацию об активе: ее капитализацию, общее предложение, ссылки на веб сайт и White Paper, список бирж, на которых торгуется токен, данные по аудиту. Если проект чистый, то вам будет доступна эта информация.

Конечно, эти шаги следует совершать в комплексе – не только изучить White Paper или проанализировать график торгов, чтобы сделать окончательный вывод. Вернемся к Squid: у проекта была ясная техническая документация, но на сайте обнаружились орфографические ошибки – несерьезный подход – красный флаг.

Можно также изучить отзывы пользователей на различных площадках: если комментаторы проекта высказываются в большей мере негативно, то это может быть еще одним красным флагом.

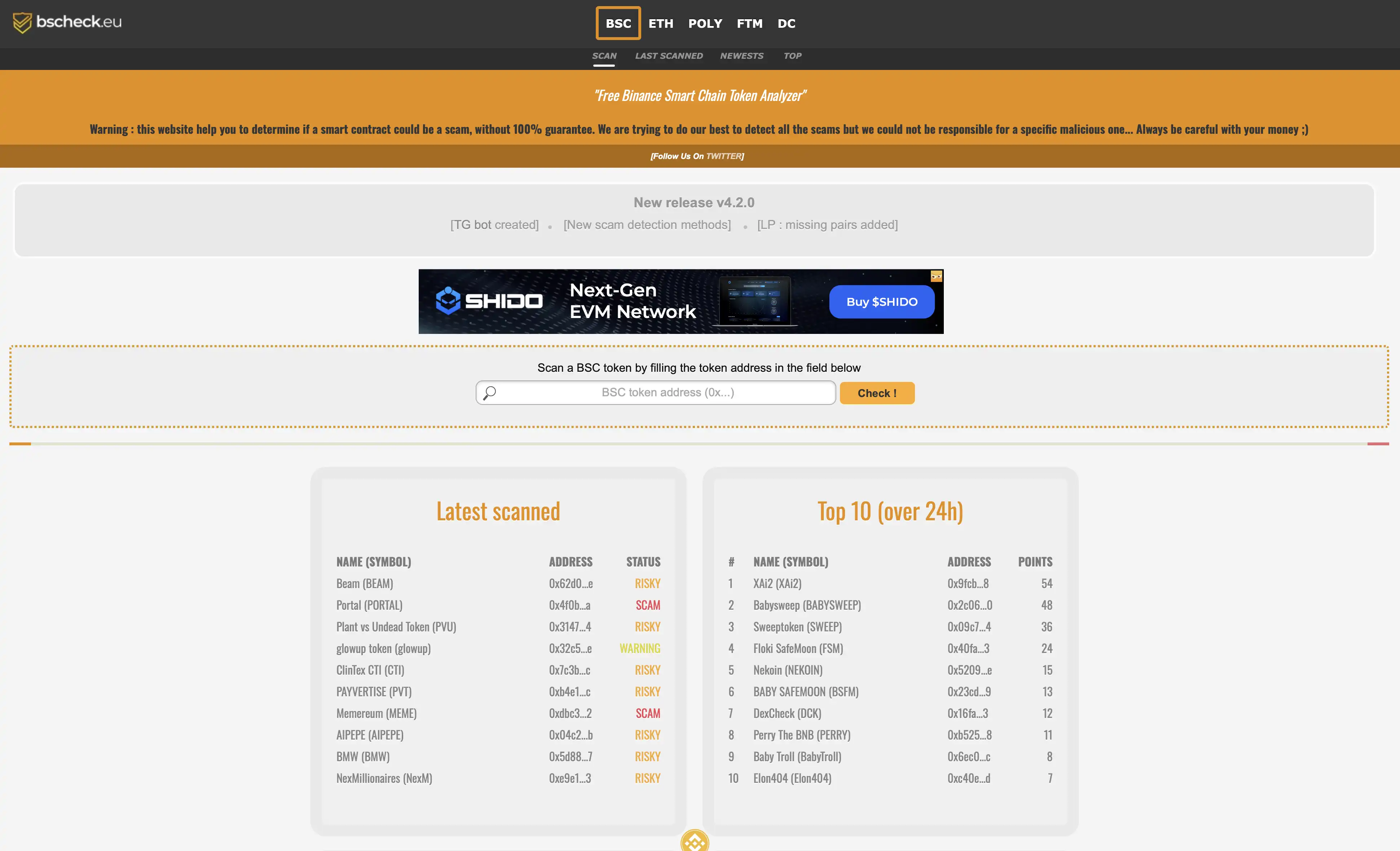

Кроме анализа фундаментальных данных проекта, следует изучить смарт-контракт. Например, платформа Bscheck.eu проводит анализ смарт-контрактов на предмет мошенничества. Здесь можно проверить токены в сетях Ethereum, BSC, Polygon и других, получив информацию о крупнейших держателях токена, кошельках разработчика, уровне ликвидности проекта и многом другом.

Изучение ликвидности проекта является крайне важным при его анализе, поскольку ликвидность определяет, насколько быстро и легко пользователь может осуществить торговлю токеном.

Следовательно, токены с высоким объемом торгов считаются наиболее ликвидными. Эти данные доступны на всех биржах и платформах отслеживания токенов. Если ликвидность мала и постоянно убывает, это может быть сигналом мошеннического проекта.

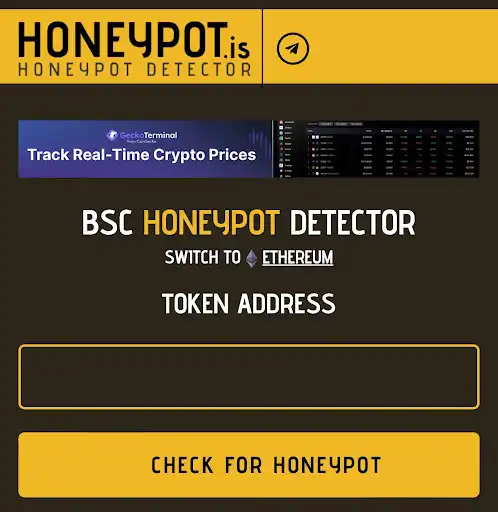

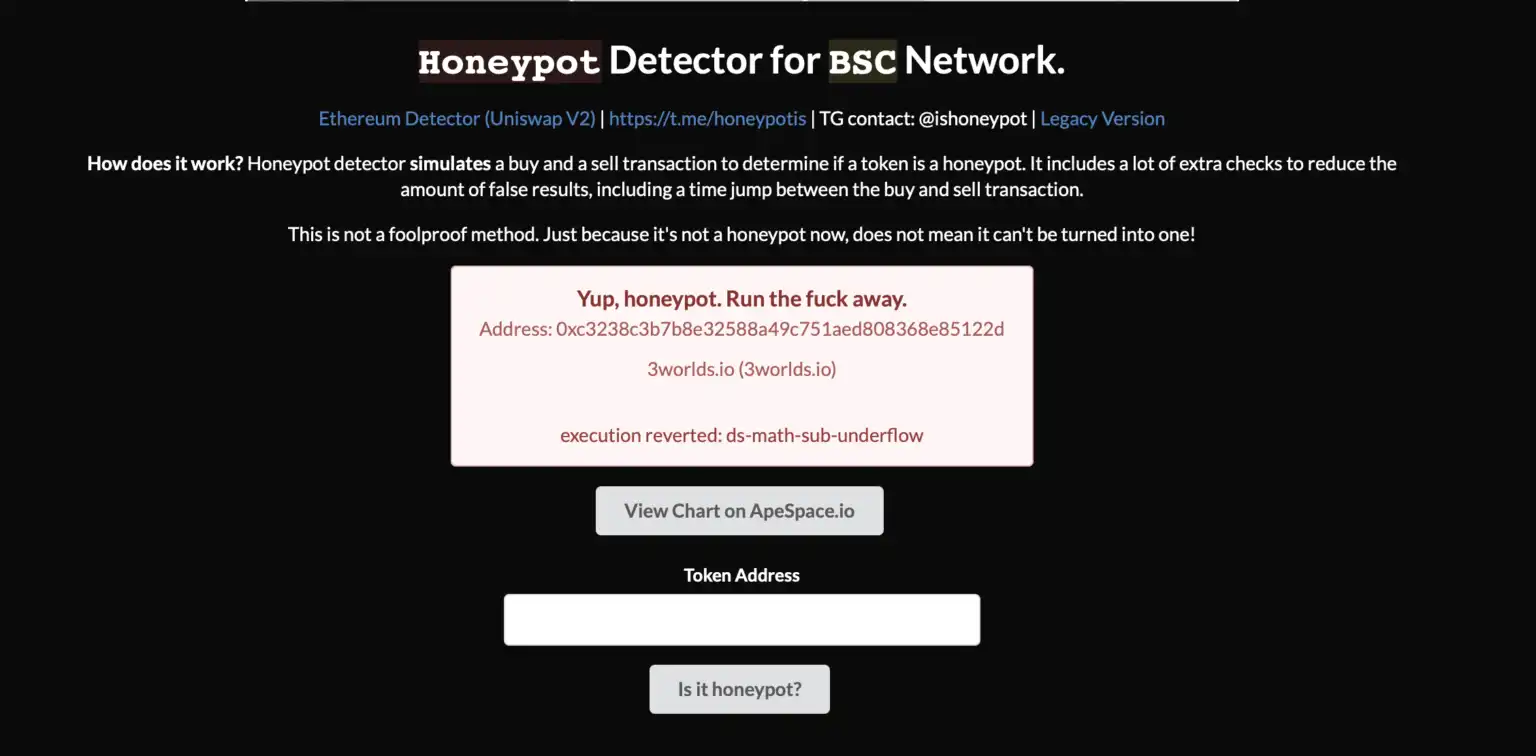

Существует платформа Honeypot.is, которая проводит имитацию транзакций покупки и продажи токенов для выявления потенциальных скам-проектов.

Этот инструмент ориентирован на токены в сети BSC. Вам нужно просто ввести адрес токена в соответствующее поле на сайте и выполнить проверку. Если результат отмечен красным или оранжевым, проект стоит внимательно пересмотреть. Зелёная метка, вероятно, указывает на отсутствие скама.

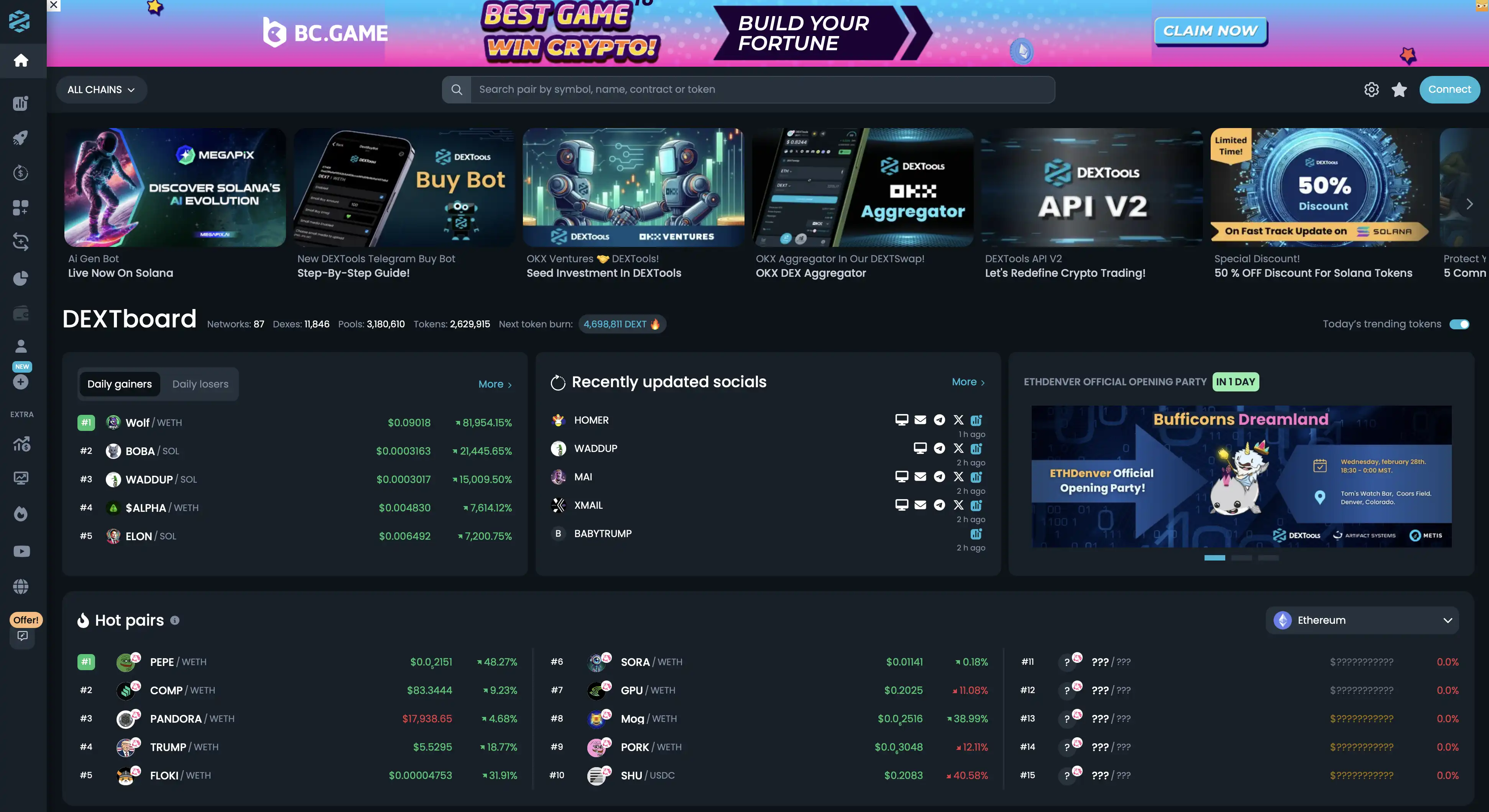

Для проверки транзакций токена также можно использовать площадку DEXtools, которая дает возможность пользователям отслеживать рынки в реальном времени, а также мониторить транзакции с тем или иным токеном.

Существует проект, созданный Dapp Radar, под названием GitHub. Это своеобразный черный список, в который внесены адреса смарт-контрактов, которые уже были определены как мошенничество.

Вышеперечисленные способы следует использовать в комплексе, поскольку только такой подход позволит вам сделать правдивые выводы относительно того или иного актива. Важно понимать, что ни один из них не гарантирует того, что токен не окажется мошенничеством по итогу, однако только такой подход позволит вам увидеть целостную картину по активу, после чего принимать инвестиционные решения.

Как не попасться на скам-токены: советы команды CRYPTOLOGY KEY

В криптомире возможностей хоть отбавляй и с каждым днем их становится все больше, однако существует и обратная сторона медали – скам-проекты. Мошенничество, к сожалению, не является редкостью в криптовалюте и за ее пределами. Для того, чтобы не попасться на удочку таких проектов, важно тщательно подходить к процессу инвестирования.

Прежде всего, необходимо провести всестороннее исследование проекта, в который вы планируете инвестировать. Это включает в себя анализ команды, стоящей за проектом: узнайте об их прошлом опыте и репутации в криптосфере. Наличие опытных и уважаемых членов в команде может служить хорошим индикатором надежности проекта. Далее, обратите внимание на whitepaper проекта – это документ, в котором должна быть раскрыта полная информация о целях, стратегии, технологии и токеномике проекта. Тщательный анализ whitepaper может помочь понять, насколько осуществимы и реальны заявленные цели проекта. Не забывайте также следить за активностью проекта в социальных сетях и на форумах. Активное участие в сообществе и регулярное обновление информации могут свидетельствовать о серьезности намерений команды. Однако следует помнить, что высокая активность в соцсетях сама по себе не гарантирует успех. Кроме того, тщательно изучите токеномику проекта. Вопросы, на которые стоит обратить внимание: как распределяются токены, каковы механизмы их обращения, есть ли риски инфляции и каков общий объем эмиссии.

Для проведения ресерча мы рекомендуем обращаться к следующим платформам: coinmarketcap.com, coingecko.com, Bscheck.eu, Honeypot.is, DEXtools, DefiLlama, GitHub.

Кроме того, обязательно изучите веб-сайт проекта: оцените, насколько качественно он сделан, нет ли там ошибок и несостыковок. Несоответствия или недостаточная прозрачность в этих аспектах – красный флаг для инвестирования. Если в ходе вашего исследования вы обнаружите несоответствия или что-то покажется вам подозрительным, лучше отказаться от инвестирования в такой проект. Помните о принципе "доверяй, но проверяй". Ваша бдительность и тщательно проведенный ресерч проекта могут спасти вас от потери средств.

Что такое скам-проекты?

Какие наиболее распространенные виды скам-проектов в криптовалюте?

Какие признаки у скам-проектов?

Что такое скам-токен?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!