Что такое фандинг и как он работает

Фандинг — это комиссия, которую платят трейдеры с открытыми позициями для устранений расхождений между ценами на актив торгуемый на фьючерсном и спотовом рынках.

Фандинг в трейдинге — это механизм финансирования, позволяющий трейдерам использовать капитал инвесторов для увеличения своих торговых операций. Эта модель работает на принципе партнёрства: трейдер управляет средствами, предоставленными инвесторами, а взамен делится с ними частью своей прибыли. Фандинг предоставляет трейдерам возможность участвовать в более крупных сделках, чем позволяли бы их собственные средства, увеличивая потенциальную доходность при успешных операциях. Взаимодействие между инвесторами и трейдерами обычно регулируется через специализированные платформы, которые обеспечивают прозрачность сделок и защиту сторон. Ключевым моментом является выбор надёжных партнёров и чёткое определение условий сотрудничества, включая распределение прибыли и управление рисками.

Зачем нужен фандинг?

Финансирование (Funding) внедрено биржами для того, чтобы не было серьезных расхождений между ценами на актива торгуемого на фьючерсном и спотовом рынке — для урегулирования спроса и предложения между этими рынками.

Теперь копнем чуть глубже: существует два вида фьючерсных контрактов — срочные и бессрочные. Особенность срочных контрактов состоит в том, что они имеют дату экспирации: открытая позиция будет закрыта автоматически в назначенный день. Ваша позиция никак не может повлиять на рыночное равновесие, поскольку до момента закрытия контракта, его стоимость может отличаться от текущей стоимости базового актива (того, что вы видите на споте), но по мере приближения к завершению срока контракта она снова приближается к реальной рыночной цене актива.

Бессрочные фьючерсы можно удерживать сколько угодно — на то они и бессрочные. Вы должно быть замечали, что цена актива на фьючерсных рынках отличается от спотовой, при чем отклоняться она может в обе стороны на определенное количество пунктов. Для избежания серьезного расхождения цен на рынках, биржи внедряют в свою работу механизм фандинга. Благодаря фандингу поддерживается баланс между рынками, благодаря чему они становятся привлекательнее для торговли.

Положительный и отрицательный фандинг

Когда ставка финансирования положительна, это означает, что цена фьючерсного контракта выше, чем цена на спотовом рынке. В этом случае биржа взимает процент с трейдеров, торгующих на повышение (Long) и передает его трейдерам, торгующим на понижение (Short). То есть те, кто держит длинные позиции, платят дополнительные средства держателям коротких позиций.

В случае отрицательной ставки финансирования цена фьючерсного контракта ниже цены спотового рынка. Биржа взимает процент с коротких позиций и передает его держателям длинных позиций.

Таким образом биржа стимулирует держателей тех или иных позиций закрывать текущие и менять направление торговли, поскольку работа в первоначальном направлении становится менее выгодной.

Пример расчета фандинга

В основном расчет фандинга происходит каждые 8 часов (в 4:00 (+15сек) 12:00 (+15 сек) и 20:00 (+15сек) UTC). При этом на некоторых биржах есть правило: в случае сильного роста процесс фандинга может проводиться чаще. В момент перерасчета происходит перераспределение средств, при котором у одних трейдеров списываются деньги, а другим начисляются. Размер списания варьируется и зависит от открытых позиций и расхождения котировок.

Существует формула, по которой рассчитывается фандинг: X = Y * Z. Где: X — сумма финансирования; Y — номинальная стоимость позиций; Z — ставка финансирования.

Важно помнить, что формула расчета фандинга может отличаться в зависимости от биржи.

Номинальная стоимость позиций

Чтобы определить номинальную стоимость активов, нужно умножить цену маркировки на размер контракта.

Номинальная стоимость позиций рассчитывается по такой формуле: Y = A + B Где: Y — номинальная стоимость позиций; A — цена маркировки; B — размер контракта.

Цена маркировки представляет собой справедливую стоимость контракта, которая применяется при ликвидации позиции или расчете нереализованной прибыли и убытков (PNL).

Размер контракта определяет количество зарезервированных активов для определенного фьючерсного контракта. Например, это может быть 1 BTC, 10 ETH и так далее, в зависимости от конкретных условий контракта.

Ставка финансирования

Ставка финансирования на фьючерсном рынке включает в себя две составляющие:

- Процентную ставку

- Премию (премиум-индекс).

Зачастую процентная ставка зафиксирована в размере 0,03% в день, что составляет 0,01% за каждые 8 часов.

Премия изменяется каждые 8 часов и играет ключевую роль в управлении цен между рынками:

- Между стоимостью бессрочного фьючерса и базовым активом.

- Между стоимостью фьючерса и ценой маркировки.

Высокий разрыв между этими показателями приводит к увеличению премии. С другой стороны, снижение премии указывает на низкий разрыв между стоимостью.

Как рассчитывается премиум-индекс?

Премиум-индекс рассчитывается для каждого контракта, учитывая два фактора:

- Индекс цен, отражающий средний курс спотового рынка на крупных биржах.

- Воздействие номинала маржи (IMN), который представляет номинальный размер позиции, доступный для торговли с маржой в размере 200 USDT.

Как заработать на фандинге?

Трейдеры могут зарабатывать на фандинг ставках используя стратегию дельта-нейтральности. Стратегия основана на разнице между ценой самого актива и деривативов. Суть стратегии в том, чтобы открыть и закрыть позиции в нужный момент для получения финансирования.

Использование фандинга в анализе рынка

Наблюдение за показателем ставки при анализе рынка может помочь трейдерам заработать.

Положительная ставка:

Если перерасчет ставки случится уже скоро (через 5, 10, 30, 60 минут), то трейдеру, который собирается открывать длинную позицию, следует подождать, чтобы избежать оплаты финансирования за короткий интервал.

Если трейдер намеревается открыть короткую позицию, то более выгодно сделать это в конце периода, чтобы сразу получить вознаграждение за финансирование.

Отрицательная ставка:

Для трейдеров, которые хотят открыть лонг позиции, целесообразным будет сделать это в конце периода.

Для шорт трейдеров более предпочтительными являются позиции, открытые в начале периода.

Фандинг ставки показывают общее настроение на рынке: высокие положительные ставки указывают на силу быков, в то время как отрицательные — на силу медведей.

Если ставка финансирования находится в положительной зоне, то цена контракта превышает стоимость актива на споте, разумно рассматривать возможность открытия короткой позиции.

Если ставка финансирования находится в отрицательной зоне, то цена контракта ниже рыночной стоимости на спотовом рынке - выгодно рассматривать возможность открытия длинной позиции.

Фандинг и Арбитраж

Еще одним интересным способом заработать на фандинг ставках является арбитраж.

Эта стратегия включает в себя одновременную торговлю разницами в ставках на нескольких платформах.

Пример:

На одной платформе финансирование BTC составляет 0,06%, в то время, как на другой — - 0,03%. Этим можно воспользоваться для заработка: ставки выплачиваются каждые 8 часов, то есть каждые 8 часов длинные позиции будут выплачивать комиссию за финансирование коротким позициям на первой бирже, и наоборот — на второй.

При выделении 20000$ на такой вид заработка, вы можете открыть две позиции на разных биржах по 10000$ на каждой.

При положительной ставке финансирования трейдер решает открыть короткую позицию на первой бирже на $ 10,000. Без использования кредитного плеча его доход за день будет равен: ($ 10,000 x 0,06%) x 3 = $ 18. Помните, что при использовании кредитного плеча этот доход увеличится.

Хеджирование

Сперва нужно будет открыть две вкладки — спотовый и фьючерсный рынок. Для хеджирования cвоих позиций трейдер может открыть противоположные позиции на двух рынках.

Трейдер покупает BTC на рынке споте и одновременно продает бессрочный фьючерс на него. Таким образом, он достигает нейтральной позиции: если цены растут, прибыль приносит спотовая позиция, в то время, как на фьючерсах он получает убыток. Если же цены идут вниз, то спотовая позиция становится убыточной, в то время как фьючерсная — прибыльной. Таким образом одна позиция компенсирует другую.

Пример:

У вас есть 11100$, вы покупаете BTC на 10000$ на споте, и продаете BTC на 1100$ с кредитным плечом 10х. Ставка финансирования составляет 0,06 % и остается на этом уровне при ее перерасчете.

Считаем прибыль:

- Без плеча (1100$ x 0,06 %) x 3 = 1.98$

- С плечом 10х — 19.8$

Где найти фандинг на популярных биржах

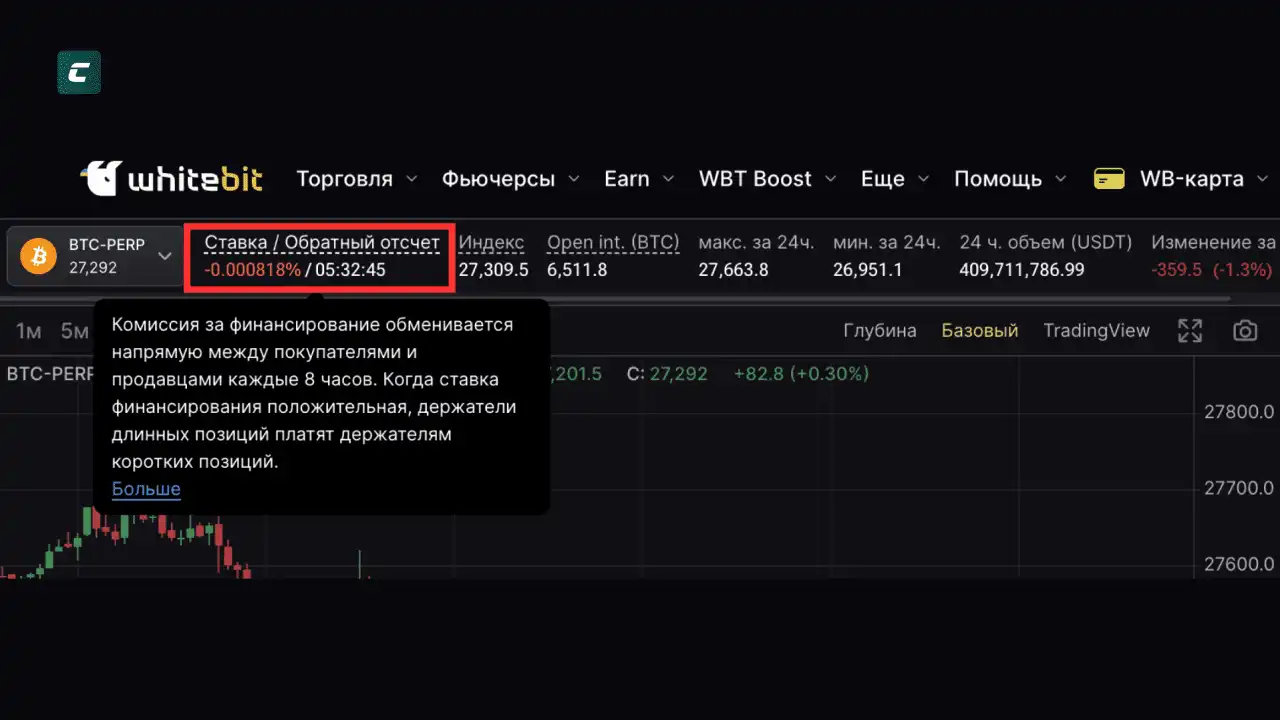

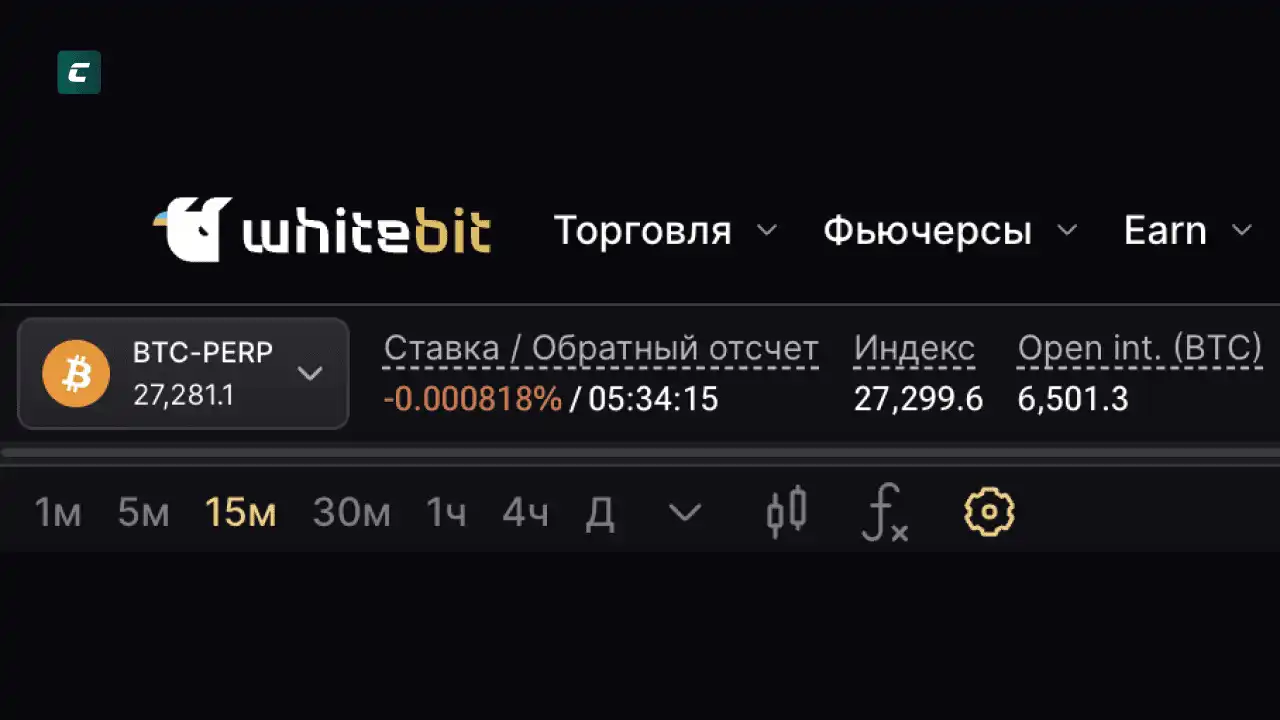

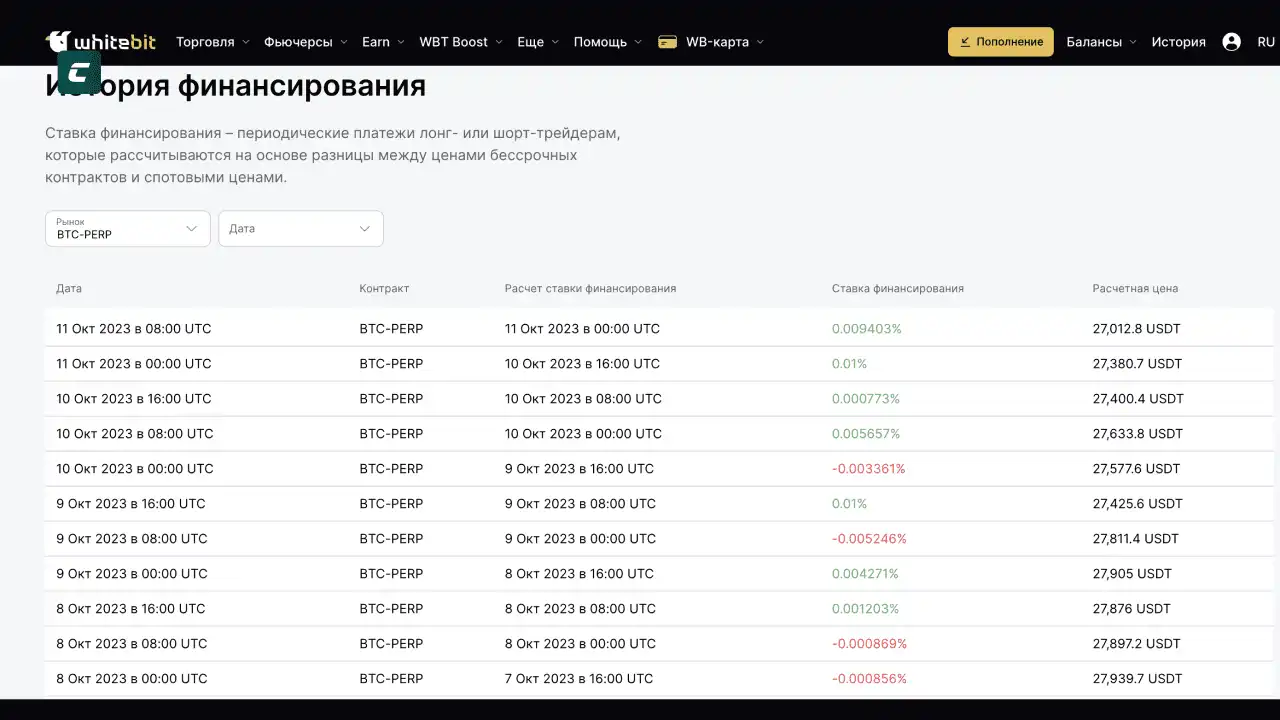

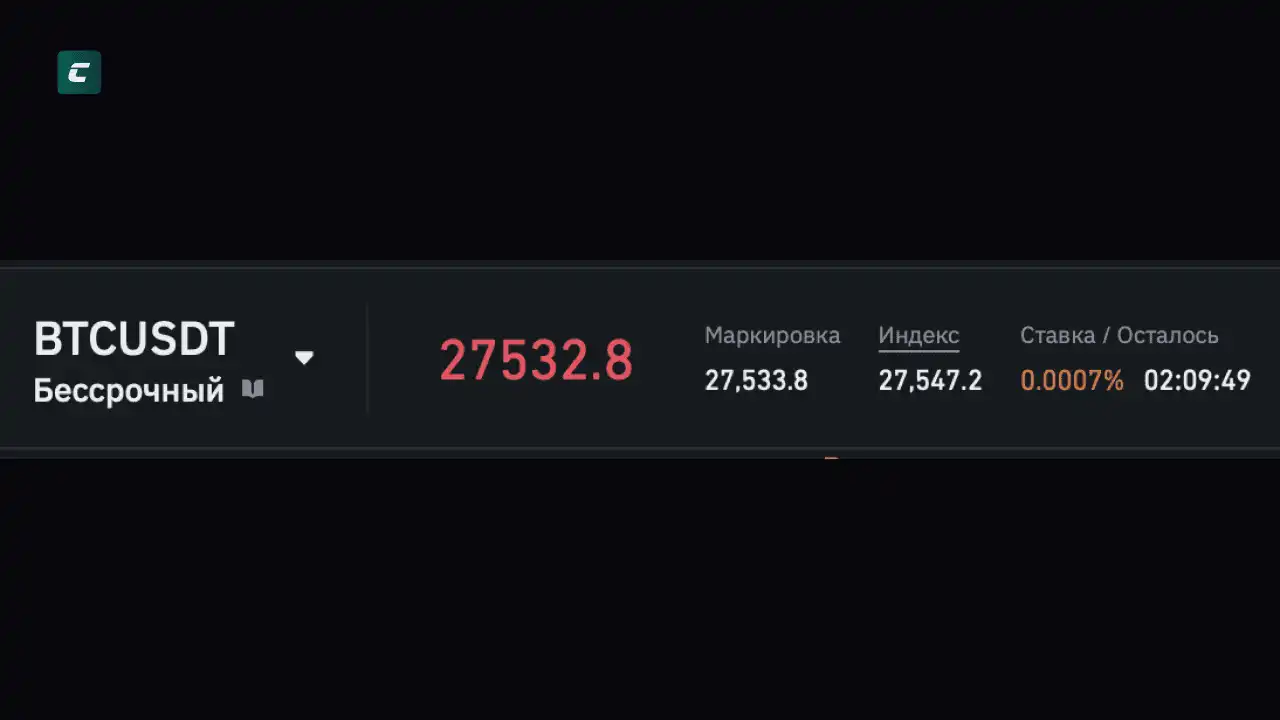

Биржа WhiteBIT: перейдя на фьючерсный терминал, вы увидите надпись “Ставка/Зворотній відлік” — здесь вы увидите ставку, а также информацию о количестве времени до ее перерасчета. При этом, если вы нажмете на эту надпись, то вас отправит на страницу, где вы увидите историю смены ставок по тому или иному активу.

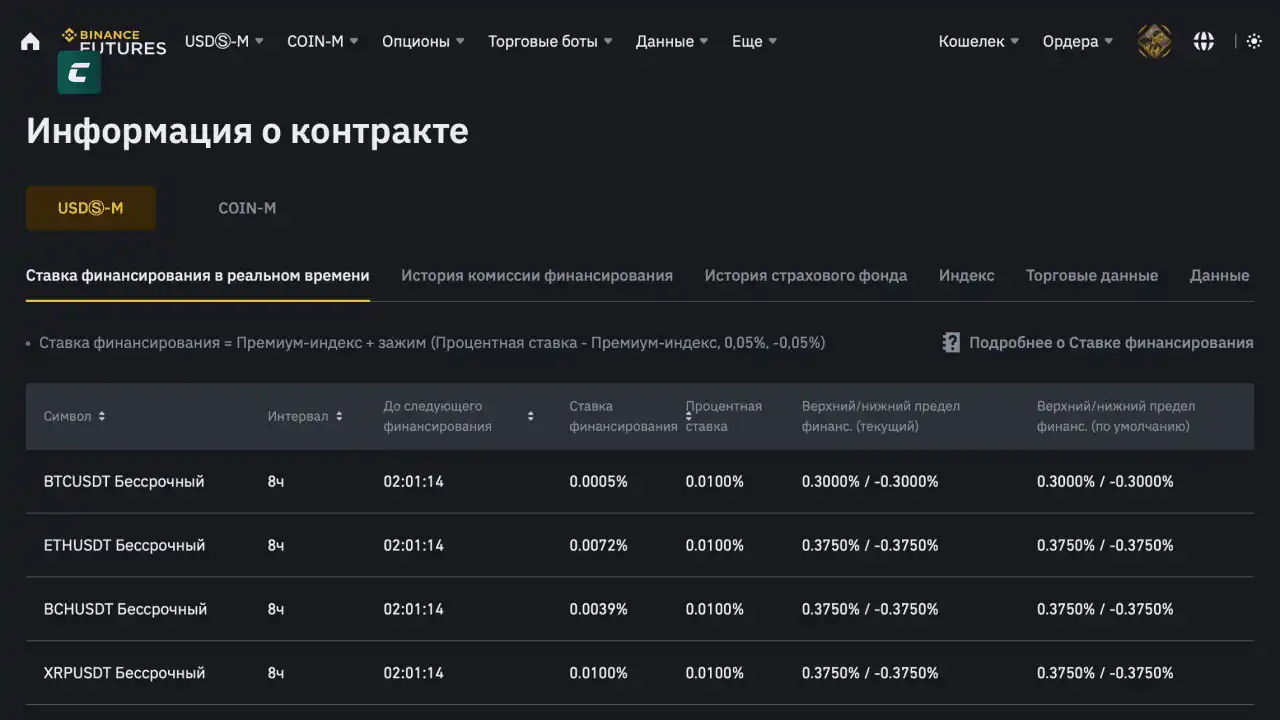

Биржа Binance: когда вы переходите на фьючерсные рынки на бирже Binance, в верхней части терминала вы можете увидеть надпись “Ставка/Осталось.” — именно здесь вы можете увидеть текущую ставку и количество времени до ее обновления.

Здесь вы также можете найти вкладку-информационную панель, на которой вы можете изучить актуальные ставки и их периодичность по активам.

Биржа Kucoin: перейдя на торговлю деривативами вы также увидите надпись “Ставка финансирования” вверху терминала.

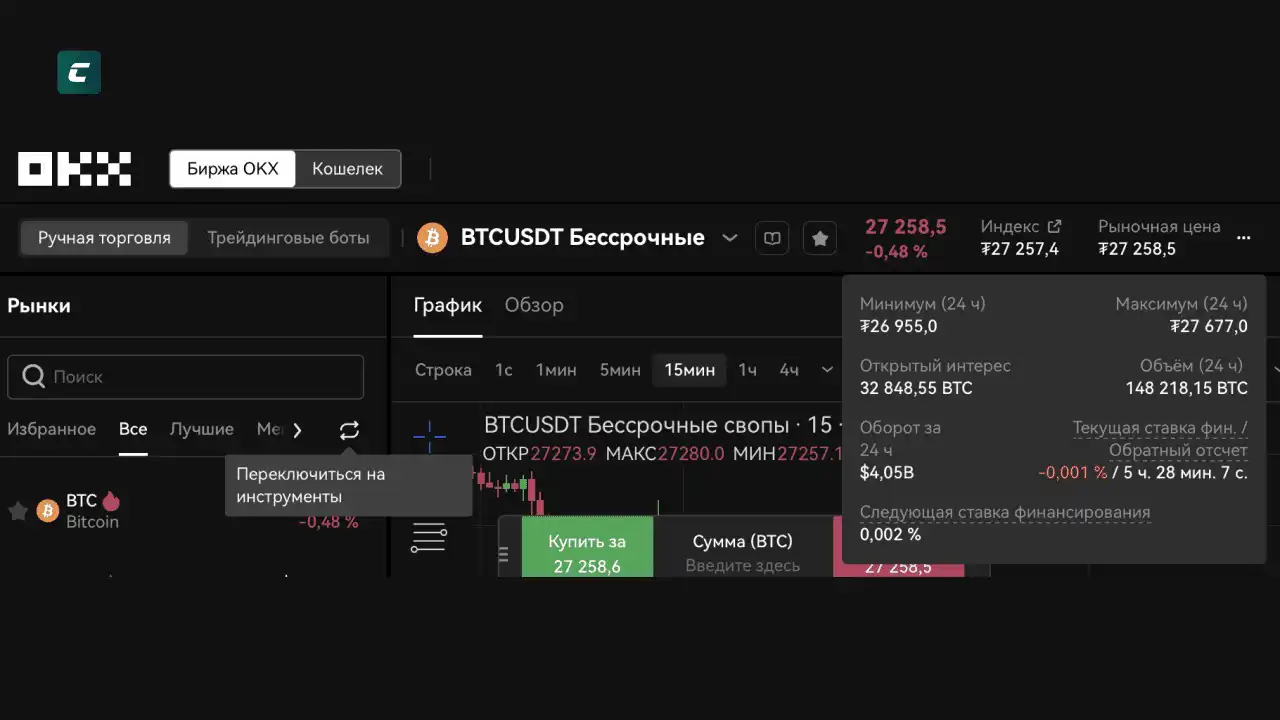

Биржа OKX: перейдя на торговлю бессрочными контрактами, вам нужно будет нажать на три точки вверху терминала, после этого вы увидите текущую ставку и время до ее обновления.

Советы по использованию Фандинга от команды Cryptology KEY

Фандинг - это достаточно эффективный инструмент для определения настроений на рынке, который в синхронизации с другими инструментами и анализом графика может помочь определить будущее движение цены с большей долей вероятности.

Как это работает? Объяснение логики фандинга. Положительный фандинг означает, что цена актива на спотовом рынке ниже, чем на фьючерсном рынке. Если на рынке сейчас большинство сделок открыты в лонг, то для нас это означает то, что на рынке сейчас намного больше потенциальных продавцов, что может оказать давление на котировки, ведь закрытие позиции на повышение - это продажа, а закрытие позиции на понижение - это покупка.

Аналогично и в обратную сторону, если в таблице фандинга доминирует негативный показатель, то мы можем предполагать, что на рынке сейчас больше открытых шортовых позиций, нежели лонговых = на рынке больше потенциальных покупателей, чем продавцов, ведь закрытие шортовой позиции - это покупка.

Как использовать фандинг в трейдинге? Вариаций использования фандинга есть много и каждый трейдер использует инструмент по-своему. В разных рыночных ситуациях фандинг может давать разные сигналы, о которых будем говорить далее.

Фандинг имеет три статуса:

- Нейтральный - 0,01 белого цвета.

- Положительный - больше 0,01 красного цвета.

- Негативный - меньше 0,01 зеленого цвета. Чем выше/ниже значения, тем ярче цвет индикатора.

В таблице фандинга мы видим наиболее ликвидные биржи и все торгуемые на них фьючерсные активы. Для более эффективного использования фандинга рекомендуется обращать внимание на все активы вместе - такой способ будет точнее сигнализировать о текущем состоянии рынка. Также, важно учесть, что фандинг может опаздывать и в моменте давать ложные сигналы.

На скриншоте выше мы видим пример, когда рынок с большей долей вероятности находится в состоянии перекупленности. Так как большинство значений нейтральны или положительны - для нас это сигнал того, что рынок вероятнее всего пойдет вниз.

В данном случае таблица фандинга сверкает зеленым, намекая на потенциальное движение вверх. Но всё ли так очевидно и просто? Разберем эту ситуацию на графике:

Что мы знаем? Цена на протяжении почти двух недель находится в боковом движении с негативным фандингом, который намекает на возможное восходящее движение, но это не сигнал на лонг по текущим ценам. Внизу мы видим скопление ликвидности в виде равных минимумов. Зная о том, что сейчас для нас лонг в приоритете, нам нужно найти вход в сделку. Наблюдая скопление ликвидности внизу мы можем ожидать манипулятивное снятие пула ликвидности с целью упрощения будущего истинного движения, после чего можем ожидать сильную реакцию, так как в приоритете у нас именно восходящее движение.

Видим, что цена сперва пошла вниз, сняв внутреннюю ликвидность, после чего достаточно быстро развернулась, выйдя вверх с полным поглощением всего нисходящего движения.

Фандинг продолжал быть негативным в момент нисходящего движения и после, намекая на возможный рост. Зная, что на протяжении длительного периода фандинг был негативным и продолжает быть таким во время и после нисходящего движения, которое сняло ключевую внутреннюю ликвидность, можно было сделать предположение, что главной целью нисходящего движения было снятие ликвидности.

Что делать, если один актив сигнализирует о шорте, а все остальные о лонге? Приоритет мы отдаём общей картине, но локально для интрадей торговли можно обращать внимание на выбранные вами активы без общего состояния рынка. Не забывайте, что фандинг может опаздывать и достаточно быстро менять свои значения.

Также, важно отметить то, что фандинг может “разгрузиться” во время бокового движения или малой волатильности на рынках, быстро нивелируя состояние перекупленности или перепроданности, поэтому при его использовании нужно постоянно актуализировать данные.

Вывод

Фандинг - действенный инструмент, но мы не можем открывать сделки только основываясь на нём, ведь цена нередко может продолжать движение против показателей. Фандинг - это дополнительный инструмент для анализа, который работает и может помочь трейдеру, но для его использования нужен опыт и применение других видов анализа.

Что такое фандинг?

Какой бывает фандинг?

Положительный фандинг означает, что цена фьючерсного контракта превышает цену на этот же актив на спотовом рынке. В таком случае биржа взимает процент с держателей длинных позиций и передает его держателям коротких позиций.

Отрицательный фандинг означает, что цена фьючерсного контракта ниже цены актива на спотовом рынке. Биржа взимает процент с держателей коротких позиций и отдает его держателям длинных позиций.

Где найти фандинг на бирже?

Как работает фандинг в трейдинге?

Зачем нужен фандинг?

Как часто происходит фандинг?

Влияет ли фандинг на прибыльность трейдинга?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!