Майнинг – это основной способ, с помощью которого криптовалюты создаются и функционируют. Как работает майнинг? Что за этим стоит? В этой статье мы рассмотрим все эти вопросы и дадим на них ответы.

Суть работы майнинга

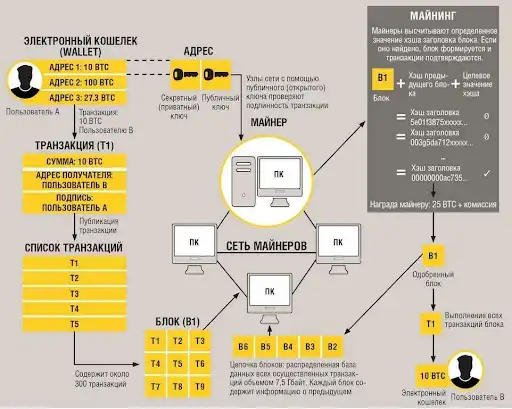

Майнинг криптовалют – это процесс, при котором участники криптовалютной сети выполняют вычислительные задачи, чтобы подтверждать и обрабатывать транзакции, а также создавать новые блоки в блокчейне. Проведем аналогию: представьте себе очень большую бухгалтерскую книжку, к которой имеют доступ тысячи людей. Задача майнера – добавить в эту книгу новые записи, за что майнер и получит вознаграждение. Эти записи добавляются путем решения сложных математических задач с помощью определенного оборудования. Эта книжка является блокчейном, а новые добавляемые записи – блоками. Отсюда и название – блокчейн – то есть, цепочка блоков.

Награда за каждый добытый “блок” составляет 6.25 BTC. Найти точную статистику о том, сколько блоков добывается в день сложно, но самая популярная цифра, которую можно обнаружить в интернете – 144 блока в день – что равняется 900 новым BTC каждый день. Тут важно обозначить, что это суммарные цифры по всему миру, то есть все майнеры в мире каждый день добывают в среднем 900 новых BTC, добавляя в среднем около 144 новых блоков. Первый майнинговый узел, который успешно проверит свой блок и добавит его в блокчейн, получит награду за блок (6.25 BTC).

Основные компоненты майнинга криптовалют:

- Транзакции. Майнеры собирают все новые транзакции в сети и помещают их в блоки, зачастую этими транзакциями являются стандартные переводы криптовалюты с одного кошелька на другой.

- Доказательство работы (Proof of Work, PoW). Это алгоритм, который используется в процессе майнинга, и требует от майнеров решать сложные математические задачи (не самостоятельно, конечно же), чтобы создать новый блок и добавить его к блокчейну. Первый майнер, решивший задачу, получает право создать блок и получает награду за свои усилия.

- Блокчейн. Блокчейн представляет собой децентрализованную базу данных, содержащую все транзакции и блоки, созданные в сети. Он является открытым и неизменным, что делает его надежным и устойчивым к манипуляциям.

- Награды. Майнеры, решившие задачу майнинга, получают вознаграждение за создание блока. Это вознаграждение обычно состоит из вновь созданных криптовалютных токенов и комиссий за обработку транзакций.

Несмотря на привлекательность в виде вознаграждения, майнинг криптовалют требует значительных вычислительных мощностей и дорогостоящего оборудования, а также энергозатрат. Тем не менее, это важный процесс, обеспечивающий децентрализацию и безопасность криптовалютных сетей. Майнинг также позволяет подтверждать транзакции в сети, внося записи в блокчейн и предотвращая трату одной и той же криптовалюты более одного раза.

Как работает майнинг криптовалют?

Майнинг основан на принципах децентрализации и безопасности, и включает в себя работу специализированных участников, называемых майнерами. Эти участники, при помощи майнинг оборудования, выполняют ряд важных задач, которые делают майнинг возможным и эффективным.

Шаг 1. Хеширование транзакций

Шаг 1 в процессе майнинга криптовалюты – это хеширование транзакций. Когда пользователь отправляет криптовалюту другому участнику сети, эта транзакция записывается в пул ожидающих обработки транзакций. В этом пуле собираются все новые транзакции, ожидающие подтверждения.

Для того чтобы добавить транзакции в новый блок, майнеры должны сначала собрать их вместе и создать хеш транзакций. Хеш – это уникальная строка данных, полученная из содержания транзакций путем применения к ним криптографической функции. Этот хеш будет уникальным для каждой комбинации транзакций и служит для обеспечения целостности данных.

Задача майнера – создать хеш блока, который включает в себя хеш транзакций предыдущего блока в цепи (кроме первого блока, называемого "генезис-блоком"). Чтобы создать правильный хеш, майнеры должны решить математическую задачу, которая требует значительной вычислительной мощности и времени. Этот процесс называется "доказательством работы" (Proof of Work) и обеспечивает безопасность и надежность сети.

Шаг 2. Создание дерева Меркла

На втором этапе майнинга криптовалюты создается дерево Меркла. Дерево Меркла – это структура данных, которая позволяет майнерам эффективно организовать и хешировать большое количество транзакций, собранных в блок.

Для создания дерева Меркла оборудование для майнинга берет хеши всех транзакций в блоке и попарно комбинируют их. Затем оно берет хеши результатов первого уровня и снова комбинирует их, создавая хеши для второго уровня. Этот процесс повторяется до тех пор, пока не будет создан единый хеш, называемый "корнем Меркла", который представляет собой уникальное значение для всех транзакций в блоке.

Дерево Меркла играет важную роль в обеспечении целостности данных в блоке. Если даже одна транзакция внутри блока изменится, это приведет к изменению хеша корня Меркла, что сразу будет заметно всем участникам сети. Таким образом, дерево Меркла обеспечивает безопасность и надежность транзакций в блокчейне.

Шаг 3. Поиск действительного заголовка блока (хеш-блока)

Третий шаг в процессе майнинга криптовалюты – это поиск действительного заголовка блока, "хеш-блока". Этот шаг представляет собой ключевую часть доказательства работы (Proof of Work), которое используется для создания нового блока в блокчейне.

Для поиска действительного заголовка блока, майнеры берут некоторые элементы данных из предыдущего блока, включая хеш транзакций и хеш корня Меркла. Затем они добавляют к этим данным случайное число, называемое "нонсом" (nonce, одноразовое число), и вычисляют хеш от всей этой комбинации. Цель – найти такой нонс, при котором результат хеша соответствует определенному условию, например, начинается с определенного числа нулей.

Поскольку поиск подходящего нонса является процессом случайного подбора, майнеры должны многократно повторять этот процесс, изменяя нонс до тех пор, пока не удовлетворят условия. Первый майнер, найдя подходящий нонс, объявляет создание нового блока и добавляет его к блокчейну. За это майнер получает награду в виде новых криптовалютных токенов и комиссий за транзакции.

Шаг 4. Трансляция извлеченного блока

Четвертый шаг в процессе майнинга криптовалюты – это трансляция извлеченного блока в сеть криптовалюты. После того как майнер успешно найдет действительный заголовок блока (хеш-блока), он должен сообщить об этом всем участникам сети.

Майнер создает новый блок, который содержит собранные им транзакции, корень Меркла и найденный заголовок блока. Затем этот блок транслируется в сеть, где другие участники могут его проверить и добавить к своим копиям блокчейна.

Важно отметить, что другие участники сети, называемые узлами, также проверяют валидность блока, включая правильность хеша и корректность транзакций. Если блок проходит проверку, он становится частью общей цепи блоков, и транзакции в нем считаются подтвержденными.

Таким образом, этот шаг обеспечивает децентрализацию и безопасность криптовалютной сети, так как блоки проверяются и одобряются всеми участниками, и никакой центральный орган не контролирует процесс создания новых блоков.

Что делать, если одновременно добываются два блока?

Когда два или более майнера одновременно завершают майнинг и извлекают новые блоки в криптовалютной сети, возникает ситуация, известная как "гонка за блоком" или "состояние конфликта". Это может произойти из-за разницы во времени между созданием блоков и их распространением по сети. В этой ситуации сеть должна решить, какой из двух блоков будет считаться основным и добавляться к блокчейну, а какой второстепенным или же "сиротским" блоком.

Чтобы разрешить эту ситуацию, обычно используют следующие механизмы:

- Доказательство работы (PoW). В большинстве криптовалют, таких как Bitcoin, майнеры продолжают работу над созданием новых блоков и расширяют блокчейн. Блок, который первым получает большинство вычислительной мощности сети, становится основным блоком. То есть, блок, выполнивший больше работы и становится основным.

- Длительность доверия. В некоторых случаях майнеры и узлы могут "доверять" блоку после некоторой задержки, чтобы убедиться, что нет более длинной цепи блоков. Это позволяет избежать сбоя в сети из-за недостаточной синхронизации.

- Автоматический выбор. Некоторые сети используют механизм автоматического выбора блока, который определяет, какой блок следует добавить к блокчейну на основе определенных правил.

Главная цель в такой ситуации – поддержать единство сети и избежать разветвления блокчейна. Как только один блок становится основным, остальные узлы сети должны отклонить второстепенный (сиротский) блок и продолжать работу с единым блокчейном.

Что такое сложность майнинга?

Сложность майнинга – это числовой параметр, используемый для регулирования уровня сложности вычислений, необходимых для создания новых блоков. Этот параметр регулируется автоматически с целью поддержания среднего времени между созданием блоков на стабильном уровне. Сложность майнинга зависит от количества майнеров и общей вычислительной мощности их оборудования: чем больше майнеров, тем сложнее добыча и наоборот.

Основные аспекты сложности майнинга:

- Автоматическая регулировка. Сложность майнинга автоматически адаптируется к общей вычислительной мощности сети. Если майнеры работают очень быстро и блоки создаются слишком часто, сложность увеличивается, чтобы замедлить процесс. Если вычислительная мощность снижается, сложность уменьшается, чтобы поддержать стабильный интервал между блоками.

- Цель сложности. Цель сложности – это числовой параметр, который определяет, насколько низко должен быть хеш блока (доказательство работы), чтобы считать блок действительным. Чем ниже цель, тем выше сложность майнинга.

- Средний интервал времени. Сложность настраивается таким образом, чтобы обеспечивать средний интервал времени между созданием блоков. В случае с Bitcoin, этот интервал составляет около 10 минут.

Сложность майнинга является важным аспектом децентрализованных криптовалютных сетей, так как она управляет тем, сколько вычислительной мощности требуется для создания блоков. Это также помогает предотвратить взломы и атаки на сеть, так как взломщику пришлось бы контролировать более 51% всей вычислительной мощности сети.

Что такое Хешрейт

Хешрейт – это единица измерения вычислительной мощности оборудования, которое используется для майнинга криптовалют. Чем выше хешрейт, тем больше операций хеширования может выполнить оборудование в единицу времени.

Проще говоря, хешрейт – это скорость, с которой оборудование может решать криптографические задачи. Эти задачи связаны с созданием новых блоков в блокчейне, которые содержат транзакции и другие данные. Хешрейт измеряется в хешах в секунду (H/s). Один хеш – это результат вычисления, который представляет собой уникальную строку символов.

Например, хешрейт в 100 MH/s означает, что оборудование может выполнить 100 миллионов хешей в секунду. Хешрейт важен для майнинга, потому что он определяет, насколько быстро майнер может найти новый блок. Майнеры, которые имеют более высокий хешрейт, имеют больше шансов найти новый блок и получить вознаграждение в виде криптовалюты.

По состоянию на 15.02.2024 скорость хэширования Биткоина составляет 600 Эх/с. Это означает, что в секунду происходит 600 квинтиллионов хэшей в секунду.

Виды майнинга криптовалют

Существует несколько разнообразных методов майнинга криптовалют, каждый из которых предоставляет участникам разные способы участия в процессе создания новых блоков и обеспечения безопасности криптовалютных сетей. Разнообразие методов майнинга отражает различия в алгоритмах конкретных криптовалют и подходах к обеспечению децентрализации и безопасности. Рассмотрим основные типы майнинга, которые позволяют участникам внести свой вклад в криптовалютные сети.

CPU майнинг

CPU-майнинг (майнинг с использованием процессора) был одним из первых методов создания новых блоков в криптовалютных сетях, таких как Bitcoin. В начале развития криптовалют, процессоры (CPU) были основным инструментом для майнинга.

CPU-майнинг был относительно простым и доступным для широкой аудитории, и пользователи могли запускать специализированные программы на своих компьютерах для выполнения вычислительных задач и создания новых блоков. Однако с течением времени и увеличением вычислительной мощности в сети, CPU-майнинг стал неэффективным. Процессоры не могли конкурировать с более мощными устройствами, такими как графические процессоры (GPU) и асик-майнеры.

С течением времени CPU-майнинг стал использоваться редко, и большинство майнеров перешли на более эффективные методы. Однако с использованием CPU всё еще можно добывать крипту, только вот эффективность данного способа уступает альтернативам. В определенных случаях это может быть выгодным для тех, у кого есть доступ к большой сети компьютеров или кластерам серверов.

GPU майнинг

Графические процессоры (GPU) представляют собой мощные устройства, способные выполнять параллельные вычисления, что делает их идеальными для решения сложных математических задач, связанных с майнингом криптовалют.

Основным преимуществом GPU-майнинга является его способность обрабатывать большие объемы вычислений, что позволяет майнерам участвовать в создании новых блоков и получать вознаграждение за это. Многие криптовалюты используют алгоритмы, которые оптимизированы для работы с GPU, что делает этот метод майнинга очень популярным и более эффективным.

Однако стоит отметить, что с ростом популярности GPU-майнинга, увеличилась конкуренция, и для успешного майнинга стали требоваться более мощные и специализированные GPU. Это привело к развитию майнинга с применением более специализированных устройств, таких как асик-майнеры.

ASIC майнинг

ASIC-майнинг (майнинг с использованием специализированных интегральных схем) – это метод создания новых блоков в криптовалютных сетях, который использует высокоспециализированные майнинговые устройства, называемые асиками. Асик-майнеры спроектированы исключительно для выполнения определенных вычислительных задач, связанных с майнингом, что делает их гораздо более эффективными и мощными по сравнению с центральными процессорами (CPU) и графическими процессорами (GPU).

Преимущества ASIC-майнинга:

- Высокая производительность. Асик-майнеры способны обрабатывать огромные объемы вычислений, что позволяет им создавать новые блоки быстро и эффективно.

- Экономичность. Они потребляют гораздо меньше электроэнергии по сравнению с CPU и GPU, что делает их экономически выгодными для крупных майнинговых ферм.

- Специализация. Асики оптимизированы для работы с определенными алгоритмами майнинга, что делает их идеальными для добычи конкретных криптовалют.

Однако у ASIC-майнинга есть и недостатки: высокая стоимость и ограничение на использование только для определенных криптовалют, которые поддерживают соответствующие алгоритмы майнинга. Из-за ограниченного доступа к асик-майнерам, майнингу грозит централизация.

FGPA майнинг

FPGA-майнинг – это процесс добычи криптовалюты с использованием программируемых логических интегральных схем (FPGA). FPGA – это тип микросхем, которые можно программировать для выполнения различных задач. В контексте майнинга криптовалюты FPGA можно запрограммировать для выполнения алгоритма хеширования, используемого для добычи криптовалюты.

Одним из основных преимуществ FPGA-майнинга является его гибкость. FPGA можно перепрограммировать для добычи различных криптовалют, в то время как GPU и ASIC, например, обычно предназначены для добычи одной конкретной криптовалюты. Это означает, что FPGA-майнеры могут быть более гибкими и адаптироваться к изменениям в рынке криптовалют.

Другим преимуществом FPGA-майнинга является его энергоэффективность. FPGA обычно потребляют меньше энергии, чем GPU или ASIC. Это может привести к снижению затрат на майнинг и снижению воздействия майнинга на окружающую среду.

Однако FPGA-майнинг также имеет недостатки. Одним из основных недостатков является его сложность. Кроме того, FPGA-майнеры дороже чем GPU или ASIC.

FPGA-майнинг – это эффективный и гибкий метод добычи криптовалюты. Однако он дороже и сложнее с технической точки зрения.

Облачный майнинг

Можно ли майнить без оборудования? Для этого существует облачный майнинг – это процесс добычи криптовалюты с использованием удаленного центра обработки данных. Этот тип майнинга позволяет пользователям добывать биткоин или альтернативные криптовалюты без необходимости закупать и настраивать дорогостоящее оборудование.

Облачный майнинг работает следующим образом:

- Пользователь заключает договор с облачным майнинговым сервисом.

- Сервис предоставляет пользователю доступ к вычислительной мощности своих ферм.

- Пользователь использует эту вычислительную мощность для добычи криптовалюты.

Облачный майнинг имеет ряд преимуществ по сравнению с традиционным майнингом:

- Удобство. Пользователи не нуждаются в покупке и обслуживании оборудования для майнинга.

- Доступность. Облачный майнинг доступен для пользователей из любой точки мира, главное –- наличие интернета.

- Безопасность. Облачные майнинговые сервисы обычно обеспечивают высокий уровень безопасности.

Однако облачный майнинг также имеет ряд недостатков:

- Стоимость. Облачный майнинг может быть более дорогим, чем традиционный майнинг.

- Риск. Пользователи облачного майнинга не имеют контроля над оборудованием и процессом майнинга.

Майнинг-пулы

Майнинг-пулы (или майнинговые пулы) – это кооперативные группы или организации майнеров, которые объединяют свои вычислительные ресурсы, чтобы увеличить свои шансы на создание новых блоков и получение вознаграждения. Основная идея майнинг-пулов заключается в том, чтобы майнеры могли работать вместе, а не конкурировать друг с другом.

Преимущества майнинг-пулов включают в себя:

- Увеличение вероятности нахождения блоков. Пулы объединяют вычислительную мощность множества майнеров, что повышает шансы на создание новых блоков и получение награды.

- Равномерное распределение доходов. В майнинг-пулах доходы распределяются между участниками пропорционально их вычислительной мощности и вкладу, обеспечивая более стабильный доход.

- Уменьшение волатильности. Работая в пуле, майнеры могут избежать значительной волатильности, связанной с сольным майнингом, где выплаты могут быть нерегулярными.

У майнинг пулов есть недостатки: такие, как комиссии, которые они взимают с майнеров, и потеря некоторой степени децентрализации, так как контроль над процессом майнинга частично передается пулу.

Тем не менее, майнинг-пулы остаются популярным выбором для большинства индивидуальных майнеров, особенно в случае криптовалют с высокой сложностью майнинга.

Соло майнинг

Соло-майнинг – это процесс добычи криптовалюты без участия пула майнеров. В этом случае майнер самостоятельно выполняет все расчёты, необходимые для поиска нового блока в блокчейне.

У соло майнинга есть преимущества. Во-первых, майнер получает все вознаграждения за найденный блок, а не только свою долю, как в случае с пулом. Во-вторых, майнер имеет полный контроль над своим оборудованием и процессом майнинга.

Тем не менее, вероятность найти новый блок в одиночку очень мала. Кроме того, майнер несет полную ответственность за все расходы, связанные с майнингом, такие как электроэнергия и обслуживание оборудования.

Плюсы и минусы майнинга

Преимущества майнинга:

- Возможность получить вознаграждение. Майнинг – это способ заработать, добывая криптовалюту. Все просто: добыли крипту, продали, получили прибыль.

- Потенциал роста. Сам процесс майнинга обеспечивает потенциал к росту цены выбранной для майнинга крипты. Но в то же время майнинг не дает гарантий на то, что цена будет всегда только подниматься.

- Поддержание экосистемы. Помимо материальной награды, майнеры также получают и некое моральное вознаграждение, поддерживая любимый проект и помогая ему расти.

Недостатки майнинга:

- Высокая стоимость. Майнинг требует дорогостоящего оборудования. Стоимость майнинга может быть выше, чем потенциальная прибыль.

- Энергопотребление. Майнинг потребляет огромное количество электроэнергии. Помимо непомерных счетов за электричество, это также создает нагрузку на электросети, требуя большего от электростанций, которые, в свою очередь, могут вредить окружающей среде (например, если речь идет о ТЭЦ).

- Технические сложности. Майнинг – это сложный процесс. Покупка оборудования, его сборка в одну систему, настройка и подключение необходимых программ - все это требует определенных знаний и навыков.

- Технические отходы. Оборудование для майнинга обычно служит не очень долго, после чего просто выкидывается, ведь для обычной работы оно не годится ввиду почти 100% изношенности. Это создает огромные технические свалки с видеокартами, процессорами и другим оборудованием, используемым для майнинга. Особенно остро эта проблема стоит в Китае и некоторых других странах Азии.

Что такое “атака 51%” и как от нее защититься

Чтобы рассказать об атаке 51%, для начала следует немного рассказать о блокчейне. В абсолютном большинстве случаев, изменения в блокчейн вносятся только после получения более 50% “голосов”. “Голосовать”, в зависимости от конкретной экосистемы, могут как те, кто держит больше всего определенных монет или токенов (наиболее характерно для систем Proof-of-Stake), так и те, в чьих руках наибольшая вычислительная мощность (наиболее характерно для систем Proof-of-Work). За редким исключением, голосовать могут и другие члены экосистемы, например, валидаторы, делегаты или хранители.

Таким образом, если в руках одного человека или группы лиц оказывается более 51% “голосов”, они могут сделать с блокчейном практически что угодно. Например, за считанные минуты вывести все доступные монеты или токены на какой-то кошелек. После этого монеты обычно “отмывались” через Tornado Cash (который, к счастью, был заблокирован в конце 2022), анонимные биржи или похожие сервисы. Одним из ярчайших примеров подобной схемы взлома является “Группа Лазаря” – группа хакеров, работающая на правительство Северной Кореи. Они часто использовали “атаку 51%”. Точная сумма украденных ими денег неизвестна, но эксперты сходятся во мнении, что речь идет о “миллиардах долларов”.

Есть несколько способов защиты от атаки 51%:

- Децентрализация. Это довольно логично – чем больше “голосов” необходимо для успешного “голосования”, тем сложнее взломать такую систему. Также возможно внедрение своего рода “запрета” на держание слишком больших “голосов” в чьих-то руках, чтобы количество тех, кто может голосовать, было как можно большим.

- Отказ от голосования. Как бы это ни звучало, но децентрализованные криптовалюты зачастую очень централизованные. Происходит это из-за того, что “голосовать” обычно могут только те, в чьих руках больше всего монет или вычислительной мощности. Отказ от подобной системы в пользу чего-то более “демократического” или просто более надежно защищенного может также быть решением.

В общем и целом, если подобная атака на систему возможна – то надежной защиты от нее просто не существует. Ведь даже если система сама по себе защищена от внешних вмешательств, то те, кто имеет права “голоса” – обычные люди, и они могут ошибаться и становиться жертвами взлома.

Важное про майнинг: мнение экспертов Cryptology Key

Майнинг криптовалют – это первый способ добычи криптовалюты. Кроме того, майнеры отвечают за безопасность криптовалют, обеспечивая проверку транзакций и создание новых блоков. Майнеры проверяют транзакции и создают новые блоки, которые добавляются в блокчейн. Майнинг также помогает децентрализовать криптовалюты. Если бы майнинг контролировался одной организацией, то эта организация могла бы контролировать сеть и манипулировать ею. Однако майнинг также потребляет большое количество электроэнергии, которая чаще всего вырабатывается на основе ископаемого топлива. Это приводит к увеличению выбросов парниковых газов и загрязнению окружающей среды. Именно из-за большого потребления электроэнергии сейчас майнинг отходит на второй план в сфере добычи криптовалюты и обеспечения ее безопасности и децентрализации.

Большинство новых криптопроектов строятся на алгоритме консенсуса PoS (Proof-of-Stake), где добыча новых монет, безопасность и работоспособность блокчейна обеспечивается с помощью процесса стейкинга. Стейкинг в свою очередь не требует особого оборудования и большого энергопотребления, как майнинг. По этой причине некоторые проекты даже начинают переходить с PoW на PoS, например, Ethereum ранее работал на алгоритме PoW (Proof-of-Work), а в 2022 году перешел на PoS: теперь майнеры не могут добывать ETH с помощью майнинга, а работоспособность блокчейна и новые монеты обеспечивает стейкинг. Тем не менее, BTC, например, добывается исключительно с помощью майнинга. Интересно, что именно не экологичность добычи BTC повлияла на то, что компания Tesla перестала принимать платежи в этой монете. Кроме этого, экологические проблемы, возникающие из-за майнинга, привели к запрету майнинга BTC в Китае в июне 2021 года. Китай был крупнейшим центром майнинга BTC в мире, на его долю приходилось около 65% глобальной вычислительной мощности. Запрет майнинга в Китае привел к резкому снижению энергопотребления майнинга BTC и снижению выбросов парниковых газов. По оценкам, майнинг Bitcoin потребляет столько же электроэнергии, сколько потребляет вся страна Швеция.

Начинать заниматься майнингом сейчас не так рентабельно, как было ранее, поскольку для того, чтобы выйти в ноль и отработать вложенные деньги в оборудование и энергопотребление, могут потребоваться годы. Большинство майнеров ранее предпочитали добывать ETH, поскольку это было наиболее выгодно. Сейчас ETH можно добывать с помощью стейкинга, как и многие другие проекты. По этой причине большинство криптоэнтузиастов отдают предпочтение стейкингу – он более рентабелен, не требует вложений и дополнительного оборудования.

Что такое майнинг?

Какие криптовалюты можно майнить?

Можно ли майнить криптовалюту на обычном компьютере?

Как работает майнинг?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!