Что такое доминация биткоина и почему так важно следить за этим показателем?

Доминация биткоина - это ключевой показатель, который привлекает внимание многих инвесторов и участников криптовалютного рынка. Этот показатель олицетворяет долю рыночной капитализации биткоина относительно общей капитализации всех криптовалют. Понимание доминации биткоина имеет большое значение для инвесторов и трейдеров, поскольку оно может дать представление о том, как биткоин влияет на весь рынок криптовалют и какие тенденции можно ожидать в будущем. В этой статье мы рассмотрим, почему важно следить за доминацией биткоина и как этот показатель может улучшить ваши результаты в трейдинге и инвестировании.

Что такое доминация BTC?

Доминация биткоина, обозначаемая на графиках как BTC.D (Bitcoin Dominance) - это индекс, который измеряет долю рыночной капитализации биткоина относительно общей рыночной капитализации всех криптовалют,показатель выражается в процентах.

История этого термина связана с развитием криптовалютного рынка и ростом альтернативных криптовалют, называемых альткоинами. В начале криптовалютной эры биткоин был единственной криптовалютой, и его доминация составляла 100% рыночной капитализации криптовалют. Однако с течением времени появились новые криптовалюты, такие как Эфириум (Ethereum), Риппл (Ripple), Лайткоин (Litecoin) и многие другие.

С появлением альткоинов рынок начал диверсифицироваться, и инвесторы стали обращать внимание не только на биткоин, но и на другие криптовалюты. Это привело к снижению доли биткоина в общей капитализации рынка. Для отслеживания этой доли и был введен показатель BTC.D.

Почему доминация BTC важна?

Доминация биткоина важна по нескольким причинам:

- Отражает разницу в интересе криптовалютного сообщества к биткоину и альткоинам.

- Позволяет инвесторам и трейдерам оценить, насколько стабильно биткоин удерживает свою позицию на рынке. Это также позволяет локально оценить, кто сильнее, а кто слабее и то, насколько сейчас BTC сильнее или слабее по отношению к альткоинам.

- Помогает прогнозировать тенденции на рынке криптовалют и оценивать, интересны ли сейчас альткоины конкурентоспособны и перспективны для покупок. С помощью доминации нельзя определить, какие альткоины перспективны.

Важно понимать, что доминация биткоина - это лишь один из многих факторов, влияющих на динамику криптовалютного рынка, и он должен рассматриваться в синхронизации с другими инструментами и аналазом графиков. Все же этот показатель остается важным инструментом для анализа и принятия решений в мире криптовалют.

Что влияет на доминацию биткоина?

Рассмотрим, какие факторы влияют на доминацию биткоина и формируют этот важный показатель на криптовалютном рынке.

Цена биткоина

Цена биткоина играет ключевую роль в определении доминации BTC и вот почему:

- Лидерство по капитализации. Биткоин, как первая и наиболее известная криптовалюта, имеет самую высокую рыночную капитализацию среди всех криптовалют. Когда цена биткоина растет, его рыночная капитализация также увеличивается, что ведет к увеличению доли биткоина в общей капитализации рынка криптовалют.

- Психологический эффект. Цена биткоина часто становится новостью, что привлекает внимание массовой аудитории и усиливает интерес к криптовалютам в целом. Это также может способствовать увеличению доли биткоина на рынке.

- Восприятие стабильности. Биткоин часто рассматривается как более стабильная криптовалюта по сравнению с многими альтернативными криптовалютами. Поэтому, когда цена биткоина растет, инвесторы могут предпочитать его, чтобы избежать более высокой волатильности, что может способствовать увеличению его доминации.

- Инвестиционные стратегии. Высокая цена биткоина может влиять на инвестиционные стратегии, такие как диверсификация активов в портфеле. Инвесторы могут увеличивать свою экспозицию к биткоину, чтобы воспользоваться ростом цены, что также увеличивает его долю на рынке.

- Инвестиционный интерес. Высокая цена биткоина может привлечь больше инвесторов и трейдеров на рынок криптовалют. Это может вызвать увеличение спроса на биткоин и его долю в рыночной капитализации.

Важно отметить, что цена биткоина не единственный фактор, влияющий на его доминацию. Этот показатель также подвержен влиянию других факторов, таких как технические инновации, регуляторные изменения и общая динамика рынка криптовалют.

Цена альткоинов

Цены альткоинов имеют существенное воздействие на доминацию биткоина и общую динамику рынка криптовалют. Вот несколько ключевых моментов, объясняющих, как цена альткоина влияет на криптовалютный рынок:

- Конкуренция с биткоином. Цена альткоинов часто конкурирует с ценой биткоина за внимание и инвестиции инвесторов. Если цена альткоинов растет быстрее, чем цена биткоина, инвесторы могут склоняться к альткоинам, что может снижать долю биткоина в рыночной капитализации.

- Альтернативные инвестиции. Повышение цены альткоинов может привлечь инвесторов, ищущих альтернативные возможности для инвестирования. Это может означать, что инвесторы будут выходить из биткоина в пользу альткоинов, что также влияет на доминацию биткоина.

- Инновации и технологический прогресс. Некоторые альткоины предлагают уникальные технологические решения и преимущества, которые могут привлекать внимание инвесторов и пользователей. Повышение интереса к этим инновациям может способствовать росту цены альткоинов.

- Волатильность. Цены альткоинов часто более волатильны, чем цена биткоина. Это может предоставлять трейдерам и спекулянтам больше возможностей для прибыльной торговли альткоинами, что также влияет на их цены и доминацию.

- Реакция на новости и события. События, такие как анонсы новых проектов, изменения в законодательстве или крупные инвестиции, могут значительно влиять на цены альткоинов. Инвесторы следят за такими новостями и реагируют на них.

Почему важно следить за доминацией биткоина?

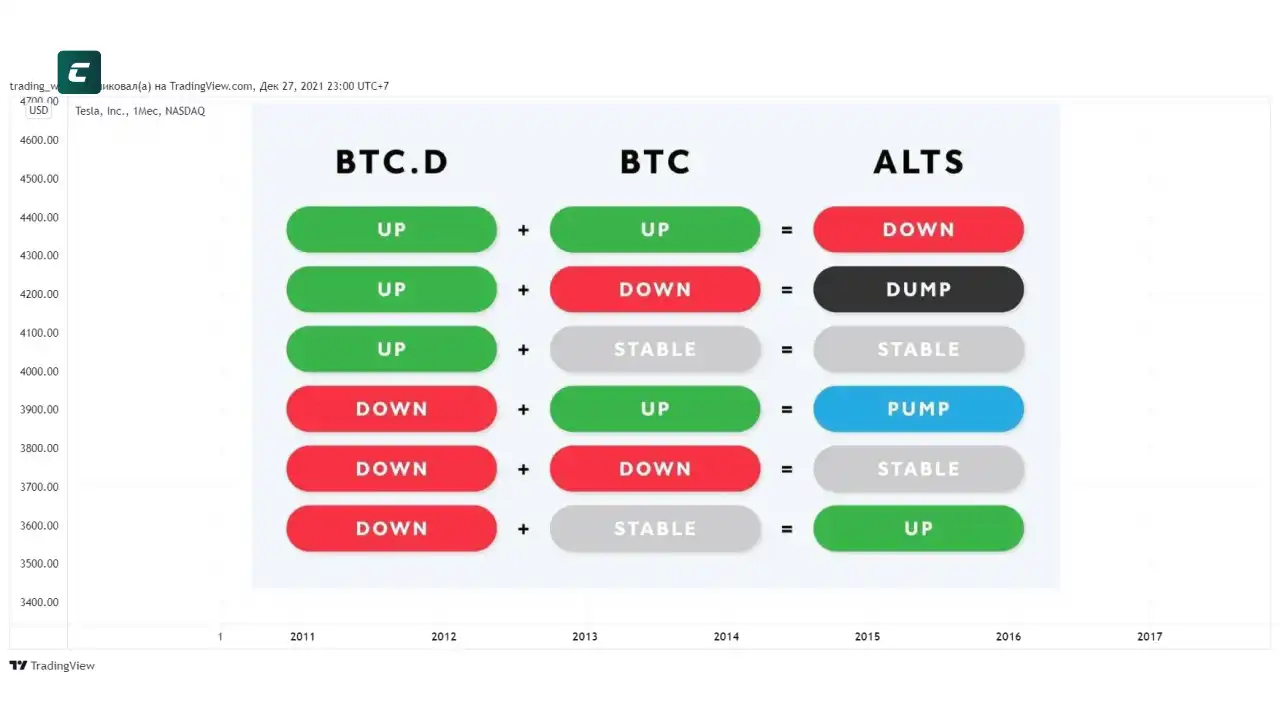

Этот показатель олицетворяет важную роль биткоина в цифровой экосистеме и имеет непосредственное влияние на динамику рынка криптовалют. Поэтому следить за доминацией биткоина является неотъемлемой частью анализа рынка и принятия инвестиционных решений.Индекс доминации в купе с ценой на сам биткоин может подсказать о том, павильное ли сейчас время, чтобы вкладываться в альткоины. Это позволяет вам более точно управлять своими рисками и диверсифицировать ваш портфель. Вот как это работает:

- Доминация BTC вверх + Цена BTC вверх = цена альткоинов вниз (дамп).

- Доминация BTC вверх + Цена BTC вниз = цена альткоинов вниз (дамп).

- Доминация BTC вверх + Боковое движение BTC = боковое движение цены альткоинов, зачастую альтокоины немного слабее в такие моменты.

- Доминация BTC вниз + Цена BTC вверх = цена альткоинов вверх (памп).

- Доминация BTC вниз + Цена BTC вниз = боковое движение цены альткоинов, зачастую альткоины следуют за BTC в такие моменты. Некоторые могут показывать локальную силу.

- Доминация BTC вниз + Боковое движение BTC = цена альткоинов вверх (памп).

Индекс доминирования на других рынках

Индексы доминирования также могут использоваться для анализа секторов на фондовом рынке. Например, в индексе S&P 500 можно выделить секторы, такие как технологии, здравоохранение, энергетика и другие, и измерить их долю в общей рыночной капитализации индекса. Это позволяет инвесторам оценить, какие секторы наиболее значимы и какие могут влиять на общую динамику рынка.

Можно ли анализировать индекс доминации биткоина?

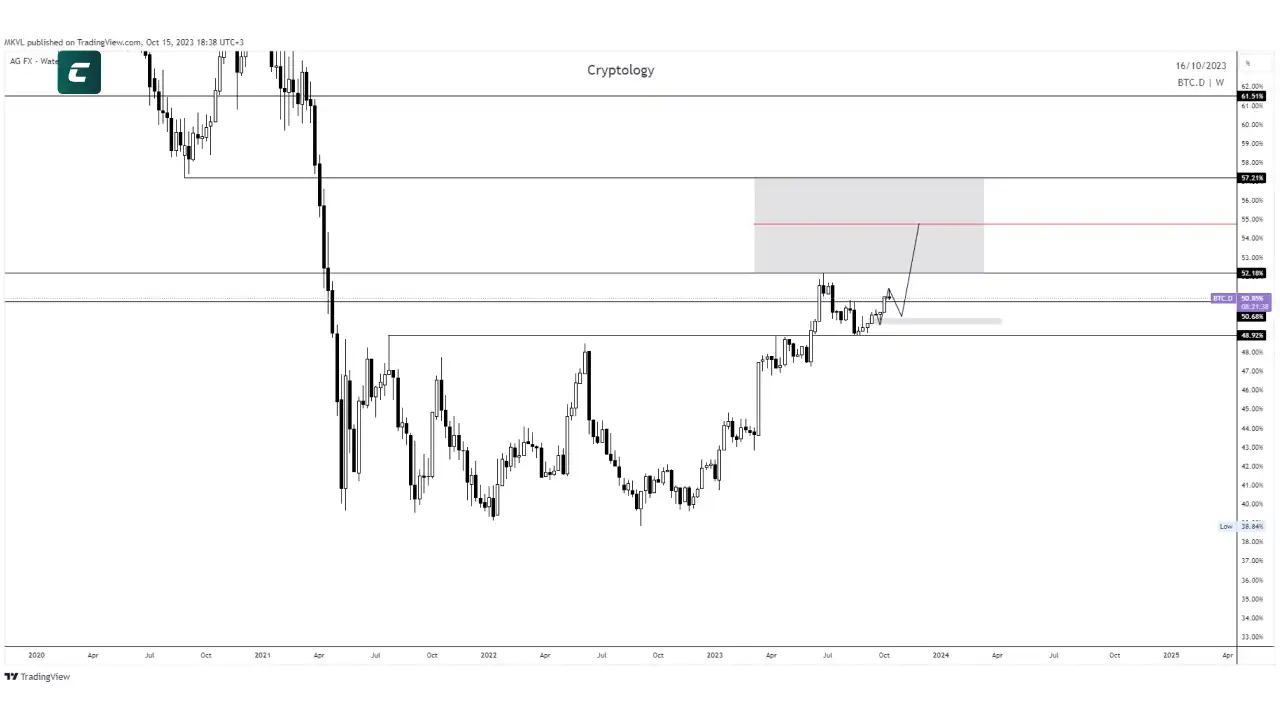

Да, график доминации биткоина поддается анализу, что помогает трейдерам и инвесторам. График доминации помогает правильно определить текущие тенденции на рынке чтобы работать эффективнее, ведь мы должны подстраиваться под рынок, а не он под нас. График доминации может дать много пользы как краткосрочной, так и долгосрочной. Например, график доминации биткоина может указывать на слабость альткоинов по отношению к биткоину, что говорит нам о том, что момент для покупок ещё не настал, а для трейдеров это сигнал, что по алькоинам приоритетнее позиции на понижение, а по биткоину на повышение. Ниже будет практический пример анализа графика доминации.

Стоит ли полагаться на индекс доминации биткоина при торговле: мнение команды Cryptology KEY

Индекс доминации биткоина является важным элементом при анализе криптовалютного рынка. Он действительно важен и несет в себе много полезной и применимой информации как краткосрочно, так и долгосрочно.

Его можно анализировать и применять в своей торговле, ведь при правильном анализе вы можете получить ряд преимуществ, но нельзя полагаться только на этот индекс, так как он будет полезен только в синхронизации с другими инструментами и качественным анализом графиков.

Кстати, в наших еженедельных разборах рынков мы постоянно анализируем данный индекс и даём свои выводы - это и есть качественный пример применения анализа доминации в трейдинге.

Что такое доминация биткоина?

Зачем нужно отслеживать доминацию биткоина?

Какие факторы могут влиять на доминацию биткоина?

- Изменения в цене биткоина.

- Внимание СМИ и новостные события, связанные с биткоином.

- Развитие других криптовалютных проектов (альткоины) и их привлекательность для инвесторов.

- Решения и изменения в протоколе биткоина (например, обновления или хардфорки).

Как доминация биткоина влияет на другие криптовалюты?

Как отслеживать доминацию Bitcoin?

Тогда расскажи друзьям – пусть тоже прокачивают свои навыки. Поделиться можно легко с помощью кнопок внизу или просто скопировав ссылку. Мы будем рады твоим отметкам в соц. сетях!

Поделиться

Подписывайся на нашу email-рассылку и получай свежие аналитические обзоры, новости, инсайты и приглашения на прямые эфиры прямо в свой почтовый ящик. Никакого спама — только ценная информация для трейдеров!