Последние статьи

Что такое валютные резервы и зачем они нужны стране

Криптоимперия семьи Трампа

Как Web3 меняет рынок труда

Что такое криптоэквайринг и как он работает

Скины из CS2 - выгодные альтернативные инвестиции?

Хеш транзакции: что это, как проверить и избежать рисков

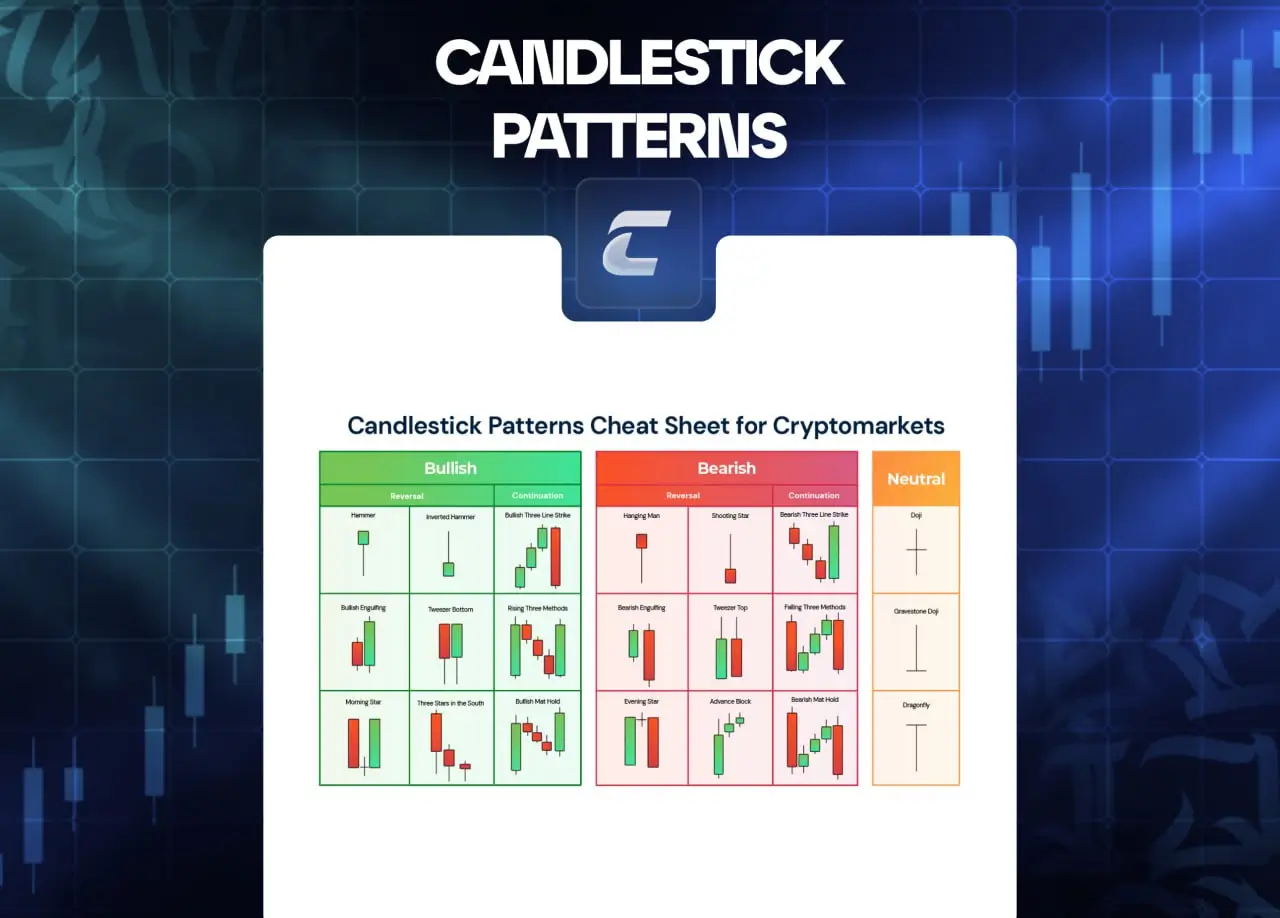

Свечные паттерны: основы и стратегии использования в трейдинге

Отзыв студента: Павел об обучении в Cryptology Key

Что такое TronScan и как им пользоваться

Что такое кросс-курс

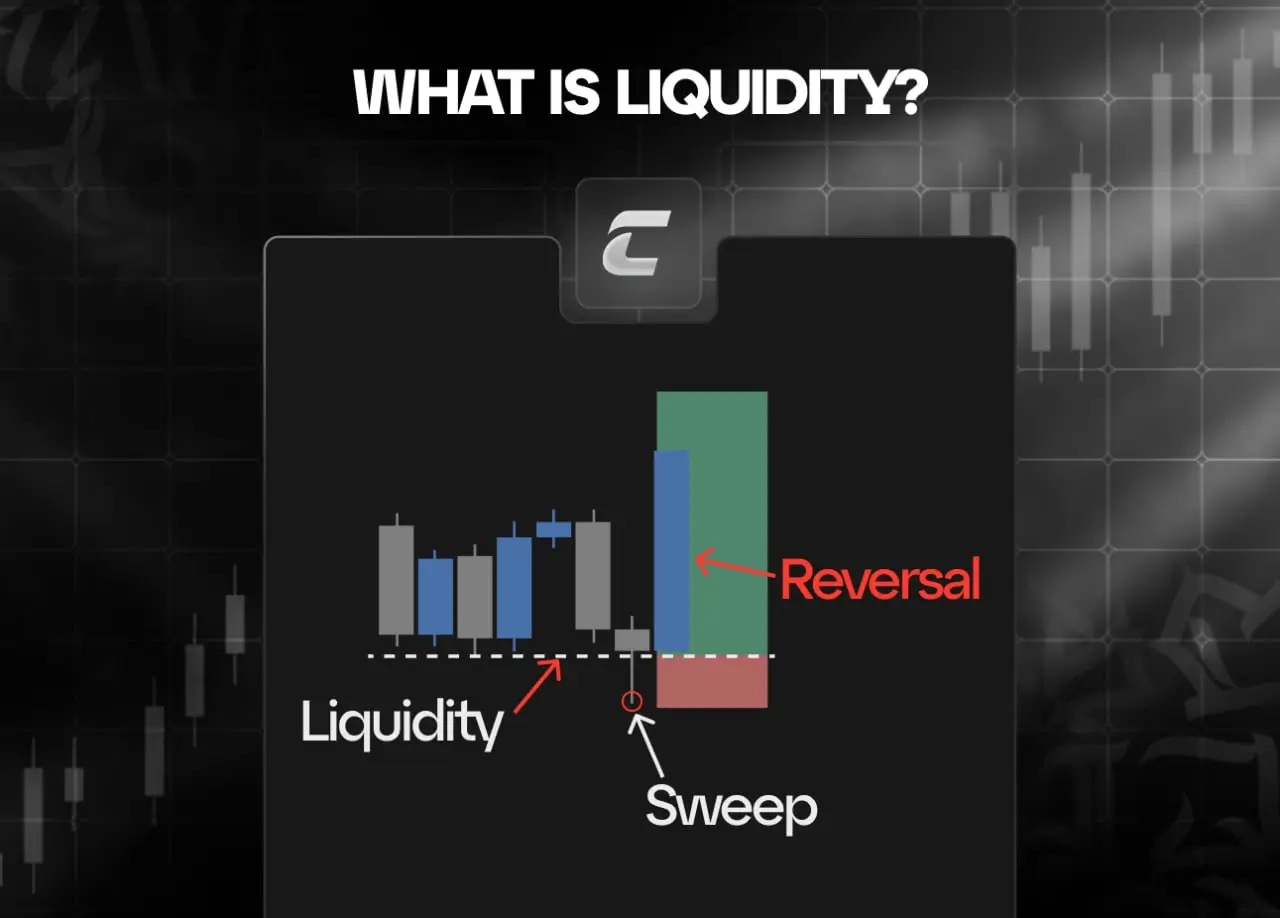

Что такое ликвидность в трейдинге

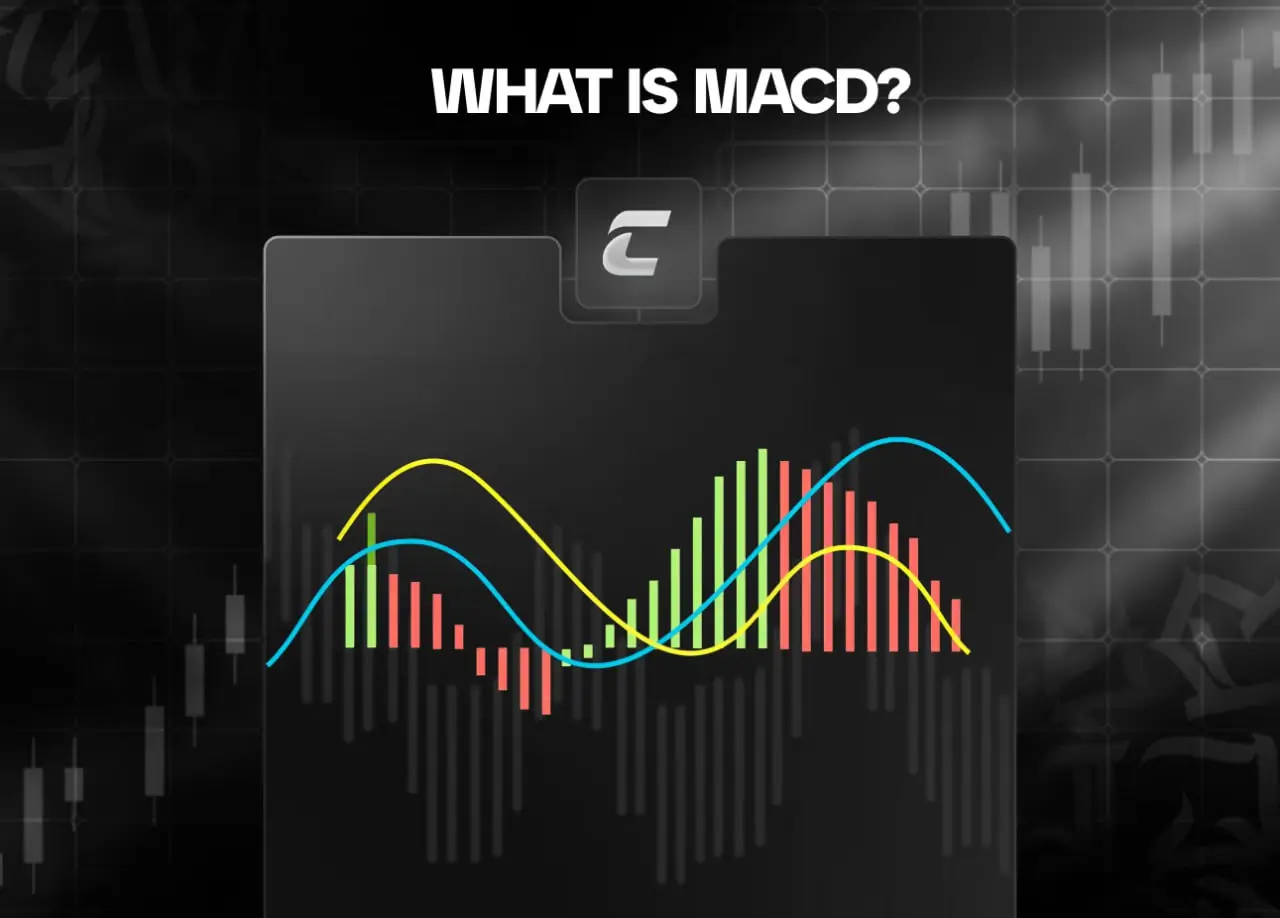

Что такое MACD